KEY MARKET MOVES

MACRO OVERVIEW

Global

US markets fell for the shortened week after a 2-week upstreak as good news spelt bad news, that a strong US economy will prompt the Fed to keep rates higher for longer. Bond traders have been ratcheting up bets that the Federal Reserve isn’t done with its interest-rate hikes just yet. With the economy defying gloomy forecasts and energy prices rising, economists are forecasting the biggest monthly jump in 14 months — and the swaps market is pricing in risk that it will come in even higher than expected. Brent oil climbed above $90 a barrel – a 9-month high and was on track for a small weekly gain after supply curbs from OPEC+ leaders Saudi Arabia and Russia were extended for the rest of the year. Growing tensions between US and China added to the risk off sentiment with China banning the use of Apple’s i-phones in government and state owned businesses and the US probing a made in China chip housed within Huawei’s latest smartphone.

Applications for US unemployment benefits fell to the lowest since February fanning speculation the Fed could turn hawkish again after pausing later this month. Another data point supporting this narrative was the services industry, which expanded more than expected in August. On the positive side, signs of a cooling labor market stoked optimism that the Fed may be done, with futures traders seeing a roughly 50% chance that it will raise rates one more time in November after holding steady at the Sept. 19-20 meeting.

Apart from CPI on Wednesday, we will have retail sales, industrial production and PPI to cap the week’s releases. Headline CPI YoY is expected to accelerate to 3.6% from 3.2% whilst the monthly core CPI is expected to come in unchanged at 0.2%. No Fedspeak this week as the blackout period starts for the next FOMC meet.

In investments, we recommend floaters and shorter duration (BBB+ ~ 5.5% yield, duration 2.6 years) over longer duration for the moment, as long dated yields continue to hold up. Resilient data and talks of growth sustainability and new issues add to LTyield volatility.

Asia

China and Hong Kong started the week strong up 1.4% for Shenzen and up 2.5% for HangSeng index on Monday. In Hong Kong, the mainland property index surged by 8% on the back of the slew of property sector related support announced. But the rally was short lived.

Asian equities ended lower last week. More losses for the Hang Seng, which is now in the red for the week despite the property sector rally we saw at the start of the week; mainland stocks also lower. (CSI -1.36%, HSI -0.98%) Japan too was lower (NKY -0.32%), Australia dragged down by commodity stocks post China’s trade data (ASX 300 -1.7%). India broke to four-week highs to close +1.98%. Vietnam and Philippines were the other benchmarks to show a gain, up 1.42% and 0.68% respectively for the week.

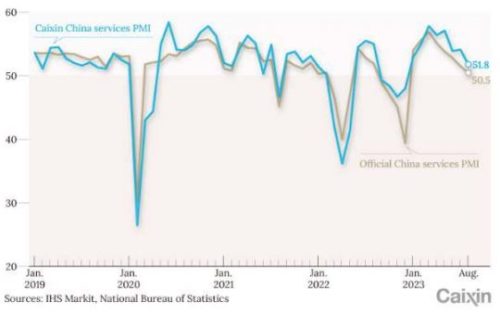

Some data points out of Asia in the last week – Caixin China General Services Business Activity Index, which provides an independent snapshot of operating conditions in services industries such as retail and travel, dropped to 51.8, the lowest this year in China.

Japan household spending shrunk by most in 2.5 years amid sharp fall in housing category.

India PMI dipped a little but still at expansive 60.9. Singapore’s retail sales growth increased slightly from last month’s two-year low.

Expansion in China’s Services Activity Weakens

Headline inflation in Emerging Asia appear to be rising again as higher food and energy costs push August CPI readings higher to give regional central banks fresh headaches amid slowing economic growth.

Taiwan latest to post seven-month high y/y headline inflation of 2.3% from July’s 1.9%, above central bank target range.

Follows higher headline inflation readings in Indonesia (3.3% from 3.1% y/y), Philippines (5.3% from 4.7%), South Korea (3.4% from 2.3%), Thailand (0.9% from 0.4%), Vietnam (3.0% from 2.1%). Core inflation remains on downward trajectory in all these countries giving central banks, governments time to address headline inflation with fiscal measures, economists say.

Japan’s core inflation is following the path of G10 peers, and if that persists, it could soon be a lot higher than the BoJ forecasts. G10 central banks have also tended to start hiking when core inflation was 2%pt above their target, where Japan is now. The RBA kept policy on hold as expected in September and retained its hawkish bias. DB still expects two more 25bp hikes in November and December this year. Data will need to rebound from the soft tone of the past month to justify those hikes, but already there is evidence that could happen as early as the next monthly CPI print.

Thailand is likely to ease visa rules for Chinese and Indian travellers and allow longer stays for visitors from all nations as new Prime Minister Srettha Thavisin looks for ways to boost tourism revenue to nearly $100 billion next year. The new stimulus measures are likely to be announced after the first cabinet meeting which is to take place in early-Sep 23.

- We expect AOT (airport), ERW (hotels) , SPA (wellness centres) and CENTEL (hotel) to benefit the most from the potential visa exemption for Chinese tourists.

GEOPOLITICS

Chinese banks have extended billions of dollars to Russian peers as financial institutions in the west pulled back operations in the country amid its invasion of Ukraine. Data showed China’s exposure to Russia’s banking sector quadrupled in 14 months to end of Mar-23, as Beijing moved to promote renminbi as an alternative to dollar. Chinese currency now accounts for 16% of Russia’s export payments, as compared with less than 1% preinvasion. “The crisis in Ukraine has sounded the alarm for mankind, and similar tragedies must not be staged in Asia,” Chinese Foreign Minister Wang Yi said on Saturday in a video address at a think tank conference hosted by the Foreign Policy Community of Indonesia in Jakarta. “We must promote regional security through dialogue and cooperation and oppose seeking absolute security at the expense of other countries,” RT reported.

A new Huawei phone runs on an unexpectedly advanced chip. China has been barred by sanctions from accessing the latest semiconductor technology, but its own industry is making chip breakthroughs. The new Kirin 9000s chip in Huawei’s latest phone uses an advanced 7-nanometer processor fabricated in China by the country’s top chipmaker, Semiconductor Manufacturing International Corp. (SMIC).

China seeks to broaden ban on iPhones in sensitive departments to state agencies and firms. Several agencies have begun instructing staff not to bring iPhones to work, affirming some earlier media reports. Restrictions likely to extend to state-owned enterprises in a far broader reach. Likely be a culmination of a years long effort to restrict foreign technology use in sensitive environments amid Beijing’s selfreliance push. Still unclear how extensive the ban will be though article says it may vary depending on agency or company

Apple likely to take hit if move materializes as China contributes 20% of its revenue and hosts majority of global iPhone manufacturing, which CEO Tim Cook calls relationship with China “symbiotic”.

President Joe Biden insisted Sunday at the G20, he does not want to “contain” China, as the two powers face deepening divisions on trade, security and rights. “One of the things that is going on now is China is beginning to change some of the rules of the game, in terms of trade and other issues,” Biden told a news conference. Biden insisted the United States is not seeking to box China in, but rather to establish clear ground rules for relations.

G20 able to reach consensus on a joint communique after softening language regarding Ukraine. The closing G20 statement denounced using force for territorial gain but made no mention of Russian aggression, prompting criticism from Ukraine. The US, EU and other western allies had agreed to remove condemnation of Russian president Vladimir Putin’s war against Ukraine from the meeting’s communique, in exchange for pledges from all 20 states — including Russia and China — to respect territorial integrity and work towards a “just peace” for Kyiv. Russia’s Foreign Minister Sergei Lavrov has praised a joint declaration by G20 leaders. Russia had not expected consensus and agreement on the wording was “a step in the right direction”, said Mr Lavrov. Chinese President Xi Jinping skipped the G20 as Beijing and Delhi tussle over territorial and other issues. Biden said he had met the No.2 person in China, Chinese Premier Li Qiang

CREDIT/ TREASURIES

The US Treasury curve inverted further during the short last week, 2years yield was up 12bps, 5years up 9bps, 10years up 6bps & 30years up 2bps. US IG lost 0.30% over the week, US HY lost 0.60% and leverage loans gained 0.20%. IG credit spread were unchanged and HY credit spread widened by 7bps.

Prices Paid rebounded from 56.8 to 58.9. Employment rebounded from 50.7 to 54.7 & New Orders rebounded from 55.0 to 57.5), it added to the sense that the US economy might be in better shape than feared. The data initially led markets to increase the prospects of another hike from the Fed this year, but this more than reversed during the course of the day as a risk-off rates rally took hold and US equity Index finished the day in the red. It is interesting to note the market reaction when compared to the August US Manufacturing & Services PMI’s released on the 23rd of August, which printed lower than expectations. On that day, equity index went up (bad news is good news or in other words, FED cutting sooner than what was expected before the PMI’s prints) and interest rates, short & long, went down. So basically, our observation is that when we get stronger leading indicators bonds rally, and when we get weaker leading indicators, bonds rally as well.

We had a couple of Fed speaker end of last week :

- Goolsbee said it is possible to get on the ‘golden path’ and that monetary policy is working, while he added that overall inflation is above where they want it and there are risks.

- Logan said it could be appropriate to skip an interest rate increase in September, but skipping does not imply stopping rate hikes, while she noted that there is work left to do to get to sufficiently restrictive policy and is not yet convinced that they have extinguished excess inflation.

- Williams said the Fed is focused on its dual mandate and inflation is moving in the right direction, as well as noted that there is still more data to come before the next FOMC meeting. Furthermore, Williams stated that policy is in a good place and is data dependent, while he added that policy is restrictive, but the question is whether it is sufficiently restrictive.

- Bostic said there is still work to do to get inflation back to 2%, while he added the US economy is still working through pandemic dynamics and consumer strength has kept economic pain at bay.

Monetary policymakers have now entered their pre-FOMC communication blackout period.

This week will be busy with some very important macro data announcements 10 days before 21st of September FOMC Meeting. We will have this week the August CPI, August Retail Sales (July Retail Sales were especially strong, increasing by 1% MoM), we will have the August PPI, the September Empire Manufacturing Index as well as August Industrial Production, and finally September University of Michigan Sentiment Index). August headline CPI is expected to rebound supported by higher energy price, for instance gasoline prices, in average rebounded MoM by around 7% in the US.

FX

DXY USD Index rose 0.82% to close the week at 105.09 (above key resistance level), as UST yields continue to rise amid the busiest session for high-grade corporate issuance for the month of Sept and in addition, likely due to a reflection of diminished global growth expectations (global PMIs came in below preliminary in August). Data wise, US initial jobless claims came in at 216k (C: 233k; P: 29k) and an upward revision to 2Q23 unit labor costs to 2.2% qoq. ISM services level came in at 54.5, above consensus. The Fed will now enter a blackout period (no communication from Fed members) till 21Sep where we will have the FOMC rate decision. This week, we will have the US CPI/PPI, retail sales and Michigan Sentiment data.

EURUSD fell 0.74% to close the week at 1.07 due to weak European PMIs. Final PMI (both Mfg and Svcs) in August came in below preliminary. EU retail sales came in -1.0%, above consensus, while GDP 2Q Final came in at 0.1% (C: 0.3%, P: 0.3%). We have the ECB rate decision this Thursday, where we expect ECB to hold rates. This may cause further downside on EURUSD, where we may test the key psychological level at 1.05.

GBPUSD fell 0.97% to close the week at 1.2468 (below key support level) due to dovish comments from BoE Governor Bailey, who expects rates are near the top of the cycle and a marked decline in CPI in upcoming months. He suggested the BoE may be close to its terminal rate, while overtightening – and a possible recession – would cause a risk to the BoE’s CPI goal. The next immediate support level on GBPUSD is at 1.243, which is the 200 days MA.

USDJPY rose 1.10% to close the week at 147.83 due to higher UST yields. Japan MOF minister verbally intervened, who suggested that any options to address excessive moves in the FX market should not be ruled out. Data wise, JP real household consumption expenditures fell 5.0% yoy in July (C: -2.5%; P: -4.2%). Outlays fell 2.7% mom in July as consumers reduced consumption across broad goods and services amid higher inflation. 2Q23 Real GDP was revised down to 4.8% qoq SAAR (C: 5.6%; Preliminary: 6.0%).

Oil & Commodity

Bloomberg Commodity Index fell 0.60% due to lower gold price and base metal, despite the rally in oil prices. WTI and Brent rose 2.29% and 2.37%, closing the week at 87.51 and 90.65 respectively, after both Saudi Arabia and Russia extend oil production cutbacks through the end of the year. Saudi Arabia has announced that it is to extend its 1 million barrels per day (bpd) cut in oil production through to year-end, continuing its output at around 9mbpd into the final quarter of 2023. Russia also said it will also extend its 300k bpd reduction of exports until the end of December 2023 and will likewise review the measure on a monthly basis. As a sign of how close the two countries are aligned, Saudi Arabia and Russia announced the cuts in coordinated statements. Gold price fell 1.08% to 1919.08 due to higher US real yields. Immediate support on gold price at 1900.

ECO

Monday – JP Machine Tool Orders, NO CPù

Tuesday – AU Cons. Confid./ Biz Confid., UK Unemploy. Rate, NO GDP, EU Zew, US Small Biz OptimÒ

Wednesday – NZ Food Prices, JP PPI, UK Indust. Pdtn/ Mfg Pdtn/ Trade Balance, EU Indust. Pdtn, US Mortg. App./ CPù

Thursday – JP Core Machine Orders/ Indust. Pdtn, AU Unemploy. Rate, SW CPI, EU ECB Rate Decision, US Retail Sales/ PPI/ Initial Jobless ClaimÑ

Friday – CH LFR/ Indust. Pdtn/ Retail Sales, EU Trade Balance, US Empire Mfg/ Indust. Pdtn/ Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.