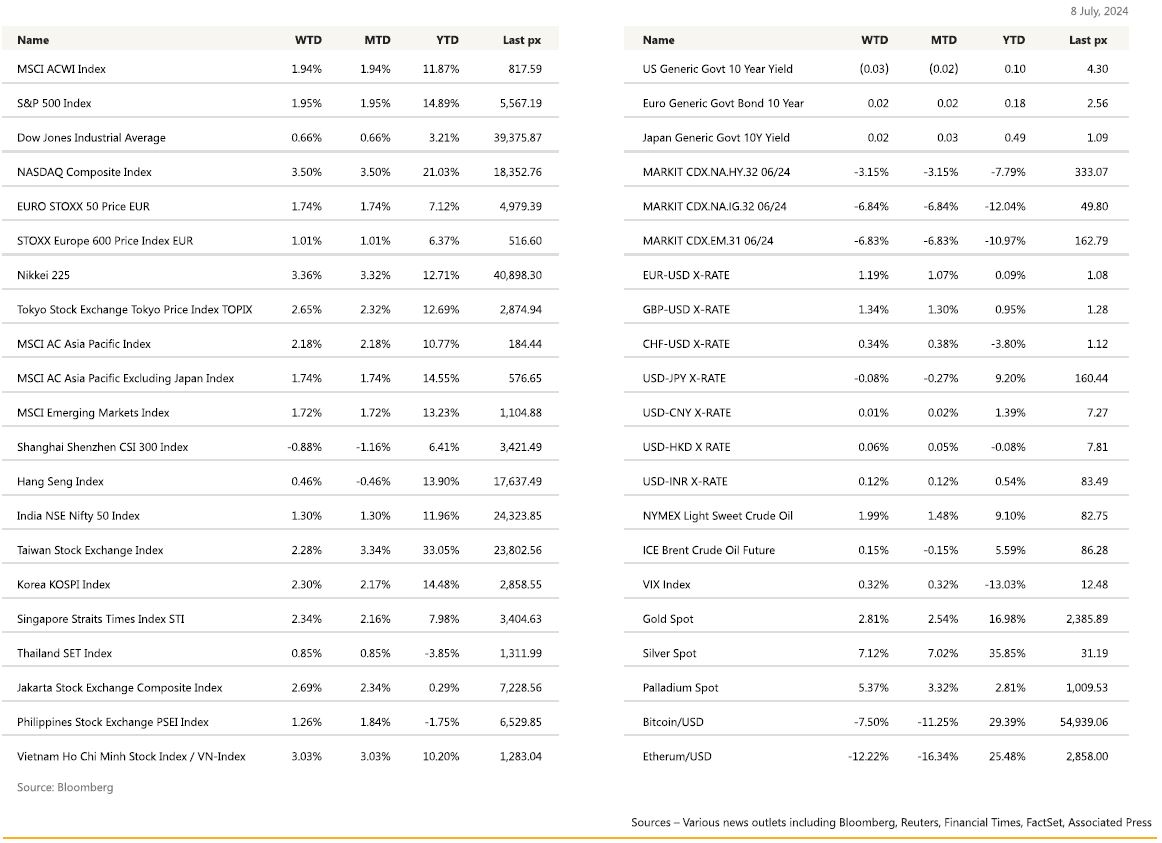

KEY MARKET MOVES

MACRO OVERVIEW

US

On Monday June ISM Manufacturing printed at 48.5 lower than the consensus at 49.1. May JOLTS surprisingly rebounded by around 220K job Vs the revised April data.

On Wednesday, June PMI Services printed a touch higher than expected at 55.3 but on the same day we witnessed a huge drop of the June ISM Services Index, printing at 48.8 Vs 52.7 expected and 53.8 the previous Month. It is important to note that the rebound the previous Month seemed a bit weird has the index has been trending steadily lower for roughly the past two years and the May rebound was surprising. Coming back on the details of the June data that was published last Wednesday, prices paid were a touch lower than consensus, but employment component printed at 46.1 Vs 49.5 expected and new orders component printed at 47.3 Vs 53.6 expected and 54.1 the previous Month. Also last Wednesday, June ADP employment was weaker, Initial Jobless claims and continuing claims printed higher than expected, May factory orders were much weaker, printing at -0.50% Vs +0.20% expected. To summarize, all these data are showing a weakening US economy and job market, 10Years yield went down by close to 10bps over the day while the S&P500 gained 0.50%, supported, as usual, by the dynamic of lower rates supporting valuations. We believe we will continue to see weak ISM Services prints in the next couple Months, US equity should at some points consider that worsening data will be hurting corporate profits moving forward.

Lastly on Friday, June NFP printed at 206K, higher than expected, but there was a substantial downward revision of the previous Month, from 272K to 218K. Private payroll printed at 136K, lower than consensus at 160K. Unemployment rate increased from 4.00% to 4.10%. Labor force participation printed at 62.6%, in line with consensus and one tenth of one percent higher than previous Month. Average hourly earnings MoM & YoY printed in line with consensus at respectively +0.30% & 3.90%, but down 1 tenth MoM & 2 tenths YoY when compared to previous Month.

To conclude, some of the leading indicators are showing signs that the US economy is slowing and that the job market deceleration process is on its way. On top of that, inflation normalization process also continues, we should have more evidence of that with the June CPI & PPI announcements this week. All these elements should probably give comfort to the FED to start normalizing their Monetary policy, maybe not during their end of July meeting in view of what has been communicated during their June’s Meeting, but most probably during their quarterly meeting which will be happening mid- September.

Europe

European market finished mostly lower on Friday. Utilities, real estate and technology the best performers, while energy and banks lag.

Within the Euro Area, data released in the past few weeks suggest that growth is slowing. Industrial Production surprised to the downside, dropping 2.5% mom in May, with the contraction broad-based and with expansion only in nondurable consumer goods and energy production. Euro area retail sales marginally increased in May but was weaker than expected at 0.1% where Bloomberg was at +0.2%. EA headline inflation eased 0.1pp to 2.5% yoy in June, driven by energy and food, alcohol and tobacco. At the same time, core was a little stronger and held steady at 2.9% yoy due to core goods not deflating as fast as anticipated while services inflation remained elevated.

After the second round of election, France’s left-wing New Popular Front coalition on Sunday unexpectedly led the votes, clinching the largest number of seats but falling short of an absolute majority in a parliamentary run-off vote. The leftwing New Popular Front won 182 seats while President Emmanuel’s ensemble party won 163 seats and the Far right Nationally Rally which won the first round of elections slumped to third place with 143 seats. None of the party have accrued the necessary absolute majority of 289 seats to rule alone, suggesting a hung parliament. Prime Minister Gabriel Attal, part of Macron’s Ensemble party, on Sunday stated his intentions to step down after the election results. Euro slid as much as 0.4% in early trading.

In the UK, the general election turned out largely as expected with the Labour winning a comfortable majority, currently with 412 seats compared to just 121 seats for the Conservatives, 71 for the Liberal Democrats and just 9 for SNP and 4 for Reform UK. The big swing was due to the collapse of the Conservatives and the rise of Reform. It was the lowest number of seats for Conservatives’ 190 year history. Most of the Conservative votes was lost to Reform However, despite its high vote share at 15%, Reform only won 4 seats, coming second in more than 100 constituencies.

In last week’s data, within the June PMI release, although the headline composite and services indices were revised up (52.3 from 51.7 and 52.1 from 51.1 respectively), the prices components were revised down across input and output prices. In services, the bounce in output prices signaled by June flash data is now much more muted in the final release as the index was revised down 0.9pt to 56.1. The Bank of England Decision Maker Panel have pointed to ongoing disinflation with the firms’ expectations for CPI inflation 1 year ahead eased further from 2.9% in May to 2.8% in June.

This week, the KPMG/REC report will shed some light on the labour market, while monthly GDP for May could show expansion. After the election blackout, MPC speakers are back and we can look out for signs of who is open to an August cut.

Asia

Asia was up last week. MSCI Asia ex Japan, closed the week higher +1.74%. TOPIX joined Nikkei reaching record high as Japan stocks continue to rally. The yen collapsed to a 38-year low just days before the stock-index record was achieved, the event was seen as broadly significant and greatly concerning, in terms of inflation, monetary policy and economic growth. The return of the Japanese currency to levels not seen since 1986 was thought of as a hit to the credibility of the central bank and as a big problem for the country as a whole. Nikkei was up 3.36% for the week, taking YTD gains to +12.7%.

Analysts are also predicting earnings growth of 35% over the next two financial years — from April 2024 to March 2026 — as well as topline growth of 4% per year.

PMIs: Taiwan and South Korean PMIs rose to two-year high. China Caixin services PMI came in at 51.8 vs consensus 51.2 and official manufacturing PMI 49.5 vs consensus 49.5. The HSBC final India Manufacturing Purchasing Managers’ Index (PMI), compiled by S&P Global, rose to 58.3 in June. The survey showed that inflationary pressures remained elevated as cost prices increased at a marginally slower pace from May.

CPIs: Tokyo core CPI firmer than expected amid acceleration in services inflation; industrial production was also stronger than expected with autos among the main drivers. Indonesia’s inflation eased to lowest level in nine months in June. June CPI decelerated to 2.5% YoY below expectations and May’s 2.8% yoy. Core inflation came in at 1.9%oya, in-line with expectations. South Korea’s inflation came in at 2.4% for June, missing expectations by economists polled by Reuters who predicted an inflation rate of 2.7%. Thailand reported a month-on- month drop in inflation in June to 0.62 %, compared to 1.54% in May. The June inflation was driven by food and non-alcoholic beverages, which rose 0.48%.

GeoPolitics

Israel – Palestine: Israel is preparing to test an experimental model for running postwar Gaza, by creating a series of “bubbles” that are designed to be Hamas-free. The pilot scheme will soon be launched in the northern Gaza neighbourhoods of Atatra. Under the scheme, the Israeli military would funnel aid from the nearby Western Erez crossing to vetted local Palestinians, who would distribute the aid and gradually expand their responsibilities to take over civilian governance in the area. Israeli forces, at least for an initial phase, would ensure security.

Israel – Iran: An adviser to Iran’s supreme leader has warned that if Israel launches an all-out offensive against Hizbollah, it would risk triggering a regional war in which Tehran and the “axis of resistance” would support the Lebanese militant movement with “all means”.

US- China: The Biden administration has revoked eight licenses this year that had allowed some companies to ship goods to Chinese telecoms equipment giant Huawei. The details shed new light on measures the Biden administration is taking to thwart Huawei, as the company has started to rebound despite Washington’s efforts to cripple it on national security grounds. Huawei has denied it is a security risk.

India – Russia: Media reports suggest that Modi will visit Russia in the second week of July. This trip will rankle many Western observers. Since the Ukraine war began, India’s purchase of cheap oil from Russia has been seen as profiting from troubles in the heart of Europe.

Credit / Treasuries

The US Treasury curve flattened over the short week with the 2 & 5years yields down 15bps, 10years yield dropped by 12bps & 30yield lost 9bps. US IG credit spreads tightened by 3bps while US HY credit spreads were tighter by 5bps.

The combination of lower interest rates & tighter credit spread help fixed income assets to achieve positive performances last week, with US IG up 1.90% & US HY up 0.90%. Leverage loans were flat over the week.

FX

DXY USD Index fell 0.94% to 104.875, as worse than expected US macro data points towards 2 rate cut in 2024.

June nonfarm payrolls rose 206k (C: 190k, P: 272k), but May was revised downwards to 218K from 272k) and April to 108k from 165k. Unemployment rate ticked up to 4.1%. US June ISM services fell to 4 years low of 48.8 (C: 52.7), while ISM manufacturing fell to 48.5 (C: 49.1). Both prices paid index continue to fall. Chair Powell commented that “inflation now shows signs of resuming its disinflationary trend,” though still arguing for more data, adding that risks are now coming into better balance. He argued that additional data is needed to understand that the levels they are currently seeing are a “true reading of underlying inflation.”

EURUSD rose 1.19% to 1.084, driven by USD weakness and surveys released for the French Election indicating a hung parliament last week. The election result showed that the left wing has won the most seats with 182 seats, with National Rally slumping into third place with 143 seats. This meant that France is plunged into political limbo, with no party reaching an absolute majority. Lagarde continued to stress the importance of being data-dependent, which pushes back against a July ECB cut. However, she did acknowledge that the ECB does not need services inflation to be at 2% to cut rates. Eurozone headline CPI fell to 2.5% (C: 2.5%; P: 2.6%), Unemployment Rate remained at 6.4% (C: 6.4%).

GBPUSD rose 1.34% to 1.2815, driven by USD weakness. In the UK election, The Labour Party won a landslide victory, dramatically reshaping the political landscape after the Conservatives imploded following 14 years of rule that became defined by turmoil. However, this has no impact on GBP, as it is all priced in by the market.

USDJPY fell 0.08% to 160.75, despite USD weakening and slump in US Treasury yields, with the 2 and 10 years falling 15 and 11.77 bps respectively. Data wise, BoJ Tankan Survey for June shows solid results, with improvement in large manufacturing business conditions.

Oil & commodities

Oil future rose with WTI +1.99% to 83.16 and Brent +0.15% to 86.54 as it continued their upward momentum amid continued geopolitical risk, supply concerns, and weather-related risks, as the strongest-ever June hurricane intensifies, which may indicate a serious hurricane season to come.

Gold rose 2.81% to 2392.16, as Investors positioned for Fed Rate cuts given the deterioration in US macro data with disinflation showing. We have the US CI number this week, which show validate the disinflation trend. In addition, Gold price is supported with the fall in US Treasury yields.

Economic News This Week

-

Monday – JP BoP Curr. Acc., EU Sentix Inv. Confid., US NY Fed 1-Yr Inflat. Exp.

-

Tuesday – AU Cons. Confid./ Biz Confid., JP Machine Tool, US Small Biz. Optim.

-

Wednesday – JP PPI, CH CPI/PPI, NZ RBNZ OCR, Norway CPI, US MBA Mortg. App./Wholesale Inv.

-

Thursday – NZ Food Prices, JP Core Machine Orders, UK Indust. Pdtn/Mfg Pdtn/ Trade Balance, US CPI/Initial Jobless Claims

-

Friday – JP Indust. Pdtn, SW CPI, US PPI/ Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.