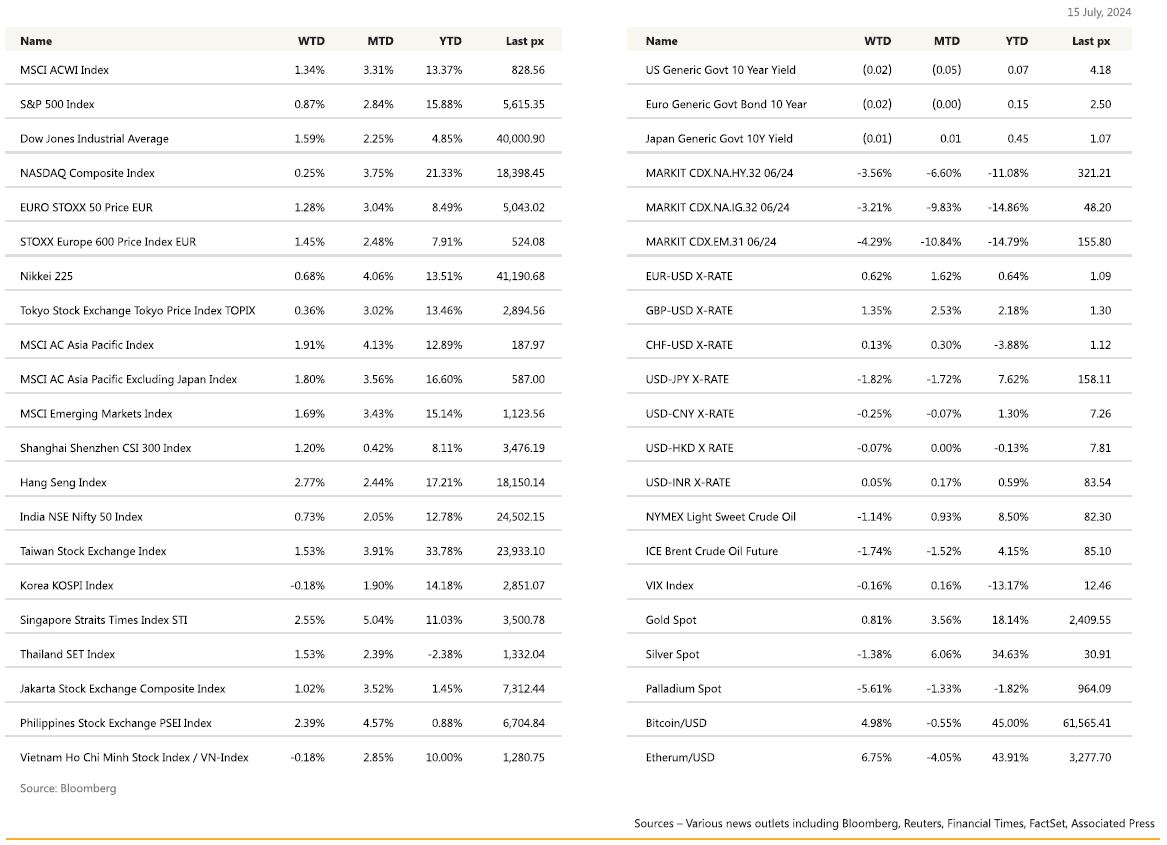

KEY MARKET MOVES

MACRO OVERVIEW

US

US equities finished higher on Friday. Cyclicals were among the best performers. Treasuries were firmer across the curve with the 2Y yield finishing near 4.45%. Dollar index was down 0.4%, adding to yesterday’s 0.6% drop. Gold finished little changed. Bitcoin futures were up 0.9%.

In terms of data, the core CPI inflation rose just 0.065% in June, lower than expectations. This was the smallest monthly increase since January 2021. Rent inflation slowed more than expected, with OER rising just 0.28% mom. Lead indicators have been pointing to a slowdown in rental inflation, leading us to expect that most of June’s disinflation will eventually prove persistent. Supercore service prices declined for a secondconsecutive month, with the weakness led by the travel-related components. Initial jobless claims edged down to 222k for the week ending 6 July. Continuing claims also moved lower to 1852k for the week ending 29 June. A slowdown in the pace of net hiring suggests labor markets are moderating gradually, while layoffs remain subdued.

After the soft CPI data, markets now price in a September cut with roughly 90% probability, and more than 6 cuts are priced cumulatively by the end of the year. this not only affects US yields, but has also supported assets sensitive to USD liquidity conditions globally. The JPY appreciated sharply following the US CPI release. The June PPI report Friday was also consistent with disinflation, came in at 2.6% annually and 0.2% mom, ahead of expectations. A 0.6% increase in the price of services accounted for the rise in the PPI. Services rose 0.3% in May. They were boosted by a 1.9% surge in margins or trade services.

July’s prelim consumer sentiment report printed at 66.0, below consensus 67.0 and June’s mom reading of 68.2. Continued consumers perceived substantial uncertainty in trajectory of economy with most recent presidential debate.

The attempted assassination of former President Donald Trump at a rally in Pennsylvania on Saturday has left one attendee and the gunman dead. Trump was grazed by a bullet and treated at a local hospital, but released late Saturday night. The 20-year-old kitchen worker who shot at Donald Trump was shot dead at the scene and the FBI has not identified any motive. Attention has turned to political fallout as Trump’s odds of wining tightened further. Shooting also prompted questions around how it affects Biden’s campaign strategy.

Europe

The Europe Stoxx 600 index ended Friday up 0.97%, with a third consecutive positive session taking it to its highest level since June 12.

In the euro area, the June Indeed wage growth tracker for June sharply accelerated to 4.2% yoy, from 3.5% in May. Italy was the primary driver of the strength, as were Spain and the Netherlands to a lesser extent, with France slowing and Germany sidestepping. This series tends to lead to ECB’s negotiated wage growth series by around 9 months.

Ultimately, this should not affect the ECB’s decision this Thursday, We expect the ECB to leave rates unchanged in July. Recent ECBspeak has underscored the need for more time and more data before rates can be cut again. Markets are pricing almost nothing for July (1bp of cuts), reflecting the view that July does not appear to be live. Around 45bp of cuts are priced by end-2024, which appears fair considering ECBspeak is torn between one and two more cuts this year.

Moreover, Lagarde said during Sintra that while the ECB did not need services inflation to print at 2%, it did need to see corporate profits absorb wage increases.

This week, we will see the Q2 results of the ECB’s Bank Lending Survey and the EA Industrial Production tomorrow. Most importantly is the ECB Governing Council meeting on Thursday.

In the UK, May’s GDP outturn completed a string of positive UK growth prints over the past 5 months, with output rising by 0.4% mom, notably stronger than the 0.2% consensus had been expecting. All major elements of output rose in May, from manufacturing at 0.4% mom to construction, up nearly 2% mom and more than offsetting the large decline in the previous month, and services at 0.3% mom.

This highlighted a strong recovery from the mild recession at -0.4% in H2 last year. GDP has risen by 1.5% between December 2023 and May this year. It has all been due to services. It was up 1.8% over that period. The stand-out sub-sectors include transport/storage, admin/support at +4.4% since December, Professional/scientific/tech growing at 3.7% since December but output now over 14% higher than in January 2020.

In France, after a period of silence, President Macron finally gave his thought on the political situation following the elections in a letter to French citizens. He will wait for the National Assembly to convene on 18 July. That same day, the Assembly will elect its President. On 19 and 20 July, other important posts of the Assembly will also be filled. The belonging of the President of the National Assembly will be key in determining the PM.

This week, we will see the inflation data in the UK. The June headline, core, services and core goods CPI.

Asia

Asian markets were all in the green last week. MSCI Asia Ex Japan was higher by 1.8%. Singapore’s FSSTI index and Hong Kong’s Hang Seng index led Asian markets, up 2.55% and 2.77% respectively.

China’s economic growth slowed to 4.7% year on year in Q2, marked by decelerations in industrial output, retail sales, and fixed-asset investment in June. The growth was slower than the 5.3% year-on-year GDP increase in the first quarter of this year. China’s consumer prices rose by 0.2% in June, year on year, missing expectations. Core CPI, which strips out more volatile food and energy prices, rose by 0.6% year on year in June, slightly slower than the 0.7% increase in the first six months of the year. The PBoC has kept the 1-year MLF interest rate unchanged at 2.5%, as expected.

Bank of Korea held rates steady at 3.5% as widely expected last week, and said it would weigh timing of rate cut but needed more evidence inflation was returning to target. Rate frozen for 12th consecutive meeting. BOK is cognizant of rising household debt that in June saw new loans increase for a third month on new mortgage issue while broader economy remained supported by buoyant exports. Governor Rhee said hold decision was unanimous although two members said they would consider rate cut within next three months. Taiwan’s central bank has moved to quash talk of an interest cut, saying it has no plans to cut rates despite sharp drawdown in bank liquidity over past month. Comments from bank comes as June exports rose 23.5% yoy to $39.9B versus consensus expectations of 10.3%. Finance ministry said AI, high-performance computing responsible for surge with shipments to US growing 74% y/y; those to China rose 7.3% following contraction in May

Malaysia said it is near a deal with Singapore to develop Southeast Asia’s first cross-border special economic zone, which the countries hope will lure new investment and spur growth.

Bank Negara Malaysia (BNM) kept its policy rate unchanged. The monetary policy committee (MPC) decided to maintain the overnight policy rate (OPR) at 3%, unchanged since May 2023. Headline inflation in Malaysia was 2% year on year in May, up from 1.8% in April. Core inflation was 1.9% year on year in May, the same as the previous month.

GeoPolitics

China – Ukraine: Chinese President Xi Jinping repeated his call for a ceasefire in Ukraine during a surprise meeting with visiting Hungarian PM Victor Orban. Xi said priority now should be a deescalation as quickly as possible while Orban, whose country took EU presidency on 1-Jul, lauded China for displaying firmness and stability. However Xi’s comments are unlikely to do much to stop the fighting while Orban’s visit to Moscow a few days ago drew sharp response from rest of EU (Bloomberg). ‘

Europe – China: Germany said on July 11th it will phase out the use of components from Chinese telecom giants Huawei and ZTE in its 5G networks by 2026 due to national security concerns. The ministry said that 5G networks form part of Germany’s “critical infrastructure” and are important for the functioning of sectors ranging from health to transport and energy. After the UK in the summer of 2020, Sweden became the second country in Europe and the first in the EU to explicitly ban Huawei from almost all of the network infrastructure needed to run its 5G mobile network.

Ukraine has urged NATO allies to lift restrictions on its use of long-range weapons against targets in Russia, saying that would be a “game-changer” in its war with Moscow, while China slammed NATO criticism of its support for Russia as biased and malicious. Near the end of the summit on Thursday, United States President Joe Biden mistakenly referred to Ukrainian President Volodymyr Zelenskyy as “President Putin”, before correcting himself, in a mix-up likely to add fuel to calls for him to quit the 2024 presidential race. In a press conference shortly after, Biden made another verbal slip, referring to Vice President Kamala Harris as “Vice President Trump”.

US – The U.S. Republican National Convention begins today in Milwaukee, with Donald Trump expected to accept the party’s nomination this week. This event follows an assassination attempt on the former president during a rally in Pennsylvania on Saturday. Leaders of the world’s largest and most influential companies, including Jeff Bezos, Mark Zuckerberg, and Elon Musk, have voiced concerns that political violence in the U.S. is undermining democracy. The incident had notable financial repercussions as well, with Bitcoin surging past $60,000 over the weekend in response to the turmoil.

Credit / Treasuries

US Treasury curve bull steepened as some market participants became increasingly confident in more imminent rate cuts due to soft US inflation data. UST 2 years fell 15 bps to 4.4514, 10 years fell 10 bps to 4.1829 and 30 years fell 8 bps to 4.3959. Over the course of the week, 2s20s steepened an additional 7bp. UST 10 years yield might test the key psychological level of 4.00, given that it closed below 4.20 (support level) on a weekly basis. Both US IG and HY continued to tighten given the risk on sentiment with imminent rate cut, with both spread falling more than 3%.

FX

DXY USD Index fell 0.75% to 104.093 due to weak inflation data and dovish Fed Chair Powell testimony.

June US CPI surprises to the downside substantially and showed broad-based deceleration, with Core CPI increasing just 0.06% m/m (C: 0.2%; P: 0.2%), the slowest monthly pace since January 2021. PPI data was stronger than expected, with beats to headline PPI and core PPI (ex-food and energy) which rose 0.2% m/m (C: 0.1%) and 0.4% m/m (C: 0.2%) respectively, coupled with upward revisions to the May values. Core PPI (ex-food, energy, and trade) was flat over the month. However, the underlying details painted a different picture, as components that feed into PCE such as airfares and financial services were noticeably soft. Chair Powell continued to emphasize the dualsided risks of the policy rate, between labor and inflation. He reiterated that the Fed does not need inflation to be below 2% before cutting rates, while also suggesting that the neutral interest rate has risen.

EURUSD rose 0.62% to 1.0907, while GBPUSD rose 1.35% to 1.2988 due to weaker USD. UK GDP rebounds and surpasses consensus expectations, growing 0.4% m/m in May (C: 0.2%; P: 0.0%). providing a robust and healthy view of economic momentum. In addition, BoE Chief Economist Pill delivered a hawkish message, arguing that inflation remains persistent in the UK. As a result, EURGBP fell 0.72% to 0.8397 since August as robust risk sentiment and rate differentials boost GBP.

USDJPY fell 1.82% to 157.83 due to weak USD. USDJPY fell from 161.60 to a low of 157.40 after the soft USD inflation data, indicating possible Japan MoF intervention. Media reports reports that the BoJ conducted a “rate check on JPY against EUR”, and that “Japan likely spent $22bn on yen intervention Last Thursday” given that the expected change in BoJ’s current account balance seemed to diverge from money market broker forecasts. Data wise, Japan Headline PPI rose 0.2% m/m in June (C: 0.4%; P: 0.7%), with y/y at 2.9% (P: 2.4%). Core Machine orders fell 3.2% (C: 0.8%, P: -2.9%).

AUDNZD rose 0.96% to 1.1087, its highest level since Nov 2022. RBNZ maintains its policy rate at its July meeting but tones down its hawkish stance noting that declining activity “may indicate that tight monetary policy is feeding through to domestic demand more strongly than expected.

Oil & commodities

Oil future fell last week, with WTI falling 1.14% to 82.21 and Brent falling 1.74% to 85.03, as Hurricane Beryl seemed to do little damage to enemy facilities. This was despite according to the weekly ETA crude oil inventories fell by 3.44mn barrels for the week ending July 5, which was more than expected, while refineries operated at the highest utilization rates since the end of May.

Gold rose 0.81% to 2411.43 due to weak USD, break key resistance level of 2400. Market is now pricing the full first rate cut to be in September, compared November a week ago. US Treasury yields fell across all tenors, with 2 years and 10 years falling 15 to 10 basis points respectively.

Economic News This Week

-

Monday – CH Money Supply/GDP/Indust. Pdtn/Retail Sales, NZ Hse Sales, EU Indust. Ptdn, CA Mfg Sales, US Empir Mfg

-

Tuesday – JP Tertiary Industry Index, EU Zew Exp., CA CPI, US Retail Sales

-

Wednesday – NZ CPI, UK CPI/RPI, EU CPI, US Mortg. App/Bulding Permits/Housing Starts/Indust. Pdtn

-

Thursday – AU Employ., UK Employ./Average Weekly Earning, EU ECB Rate Decision, US Initial Jobless Claims/Leading Index

-

Friday – UK Gfk Cons. Confid., JP CPI, UK Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.