- Singapore

A brief recap of the market’s past week, by Bordier Singapore

Our website uses cookies to improve the overall user experience. By continuing, you are agreeing to our Data Protection, to our Disclaimer and use of cookies on the site.

|

You are using an insecure Internet browser Navigateur internet non sécurisé |

||

|

We have noticed that you are using Internet Explorer which is an outdated and insecure Internet browser. Please use one of the browsers below for a safe and optimal experience on our website.

Nous avons remarqué que vous utilisez Internet Explorer, qui est un navigateur internet obsolète et non sécurisé. Nous vous recommandons d’utiliser à la place l’un des navigateurs ci-dessous pour une expérience sûre et optimale sur notre site.

|

||

| Edge | Firefox | Chrome |

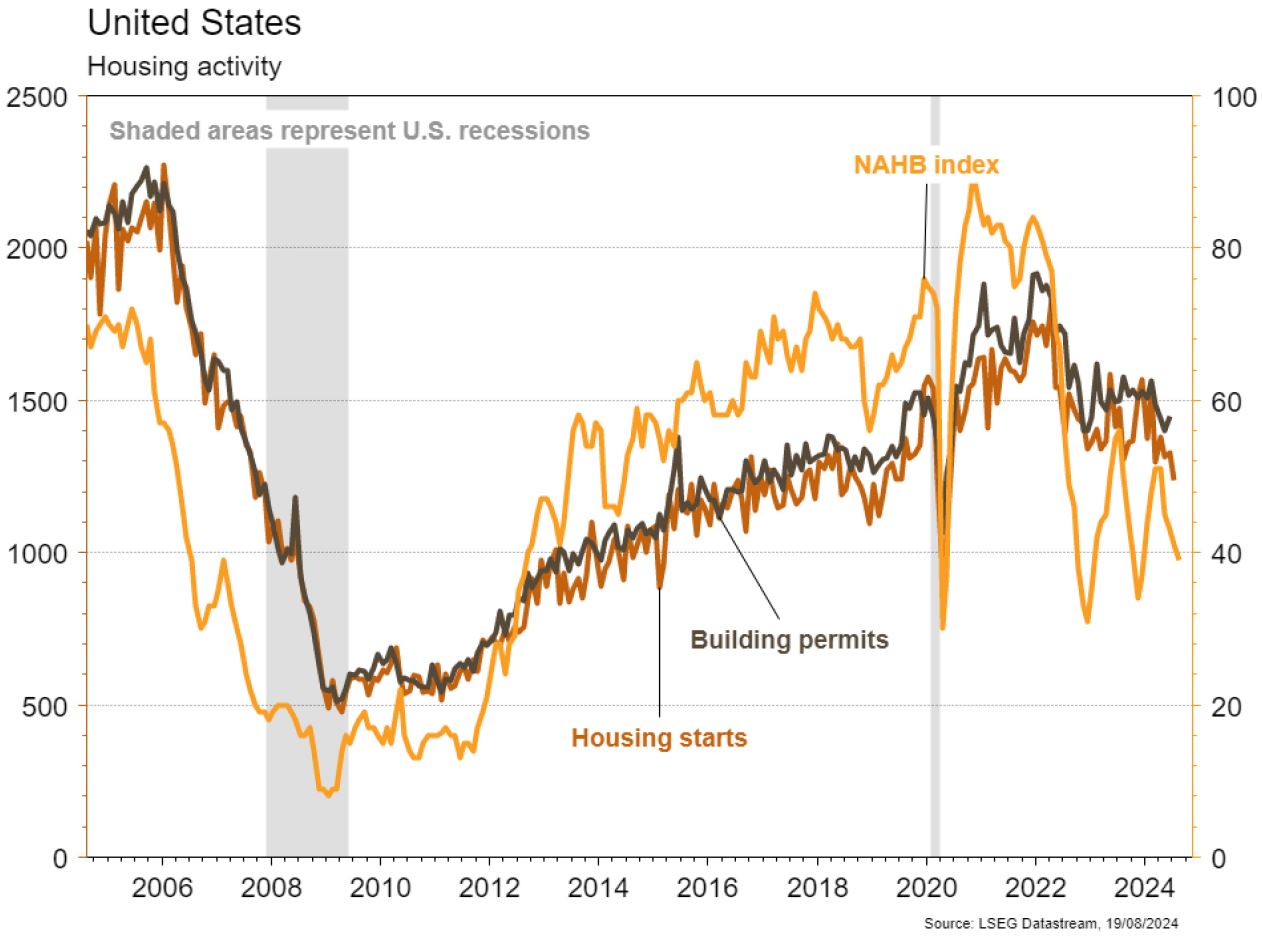

Statistics published in the United States were mixed. Among the pleasant surprises: retail sales in July (+1% m/m vs +0.3% expected) and the recovery in household confidence (Univ. of Michigan) from 66.4 to 67.8. Price growth was in line with expectations in July (+0.2% m/m; +2.9% y/y). Disappointments mounted in the real estate sector: homebuilder’s confidence fell from 41 to 39 in August, as did housing starts (-6.8% m/m) and building permits (-4% m/m). Industrial production disappointed in July (-0.6% m/m vs -0.3% m/m expected). Industrial production also declined in the Eurozone in June (-0.1% m/m; -3.9% y/y). In China, retail sales beat expectations in July (+2.7% y/y vs. +2.6% y/y expected), but not industrial production (+5.1% y/y vs. +5.2% y/y expected) or investments (+3.6% y/y vs. +3.9% y/y).

A study by the Anbi Observatory of Water Resources confirms the conclusions of the CNR - Italy's National Research Council: Sicily is drying up and has lost 16 million m3 of water resources in the space of a year. The institute estimates that, if water collection and storage infrastructures are not improved, over 70% of the island is at risk of desertification, already palpable in the south.

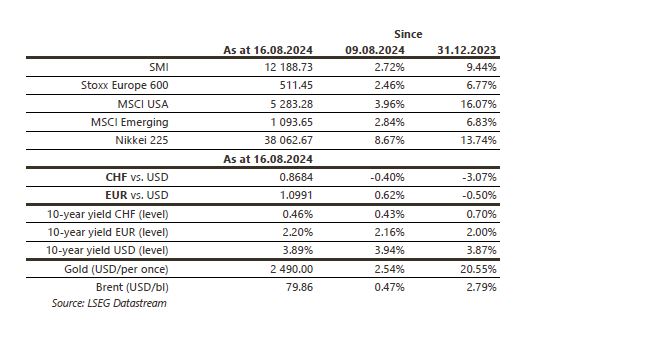

Equity markets are attempting a rebound, rising strongly (US: +4.0%; Europe: +2.5%; emerging markets: +2.8% and Japan: +8.7%!) and are already approaching their July highs. Sovereign 10-year yields have regained a degree of stability (USD: -5bp; EUR & CHF: +2/+3bp), while investors are on the lookout for news from the central bankers meeting in Jackson Hole this week. The dollar index depreciates by 0.7% and pushes gold (+2.5%) to a new all-time high. Coming up this week: manufacturing and services PMIs, Fed "minutes", new and existing home sales in the U.S.; manufacturing and services PMIs and household confidence in the eurozone; 1- and 5-year loan rates in China.

Coming up this week: foreign trade/exports in watches in July (OFDF) and Q2 labor market (OFS). The following companies are due to release H1 results: Gurit, Metall Zug, Medartis, PSP Swiss Property, Huber+Suhner, DocMorris, Alcon (T2), Orior, Sensirion, Feintool, Implenia, Aluflexpack, BKW, SoftwareONE, Alcon, BCV, Siegfried, Zug Estates, Kudelski, SPS, Swiss Re, Alpiq and Valartis.

VESTAS has been removed from our Core Holdings list. The group has issued a warning on its 2024 results due to a major provision linked to cost inflation on its services order book. Management’s credibility has been damaged, and we expect the stock price to remain capped in the short term.

Automotive sector: in its new forecast for August 2024, S&P Global Mobility projects world production at 88.8 million vehicles, a decline of 1.9% y/y, including a 5% y/y drop in the 3rd quarter. S&P has also revised downwards its projections for 2025 and 2026. A return to pre-Covid levels is not yet in sight.

Pharmaceutical sector: CMS (Centers for Medicare & Medicaid Services) has announced the list of negotiated price reductions for the first ten drugs selected under the new IRA legislation for Medicare price negotiation. Reductions range from 38% to 79% vs gross price, but appear more moderate when net prices are taken into account (post-discounts already in place, which average 50%). The announcement is in line with expectations and reassuring for our Core Holdings stocks concerned: AstraZeneca (for Farxiga – heart failure/type II diabetes), Novo Nordisk (NovoLog – insulin) and Merck & Co (Januvia – type II diabetes).

Volatility in US rates continued last week on the back of subdued macroeconomic figures, with PPI on a downward trajectory and CPI in line with consensus, while retail sales and jobless claims surprised positively. This reinforced the risk-on movement begun the previous week and the tightening of credit spreads, with IG down 8bps and high yield down 22bps, while the US 10-year sovereign was down 5bps on the week.

Stock markets

The indices are back at about the same level as before the correction, thanks to good quarterly results, and the question of a “bear trap” may arise. All eyes will be on the Jackson Hole meeting in the hope of learning more about a possible rate cut in September. Caution remains the watchword.

Currencies

The $ is being dragged down against the major currencies this morning by expectation of a September rate cut, and by a sharp rise in the JPY overnight ($/JPY 148-145.22). We anticipate a wait-and-see market this week, focused on the Jackson Hole meeting. The €/$ is up to €/$ 1.1043, a test of the 1.1139 res. is possible, the 1.0943 sup. remains valid. $/CHF corrects to 0.8640, sup. 0.8500 res. 0.8876. CHF strengthens to €/CHF 0.9543, sup. 0.9414 res. 0.9692. The £ rebounds to £/$ 1.2960 sup. 1.2779 res. 1.3000. Gold reaches all-time high at $2509/oz, sup. 2432.

This document has been issued for information purposes and is exclusively supplied by Bordier & Cie SCmA in the framework of an existing contractual relationship with the recipient of this document. The views and opinions contained in it are those of Bordier & Cie SCmA. Its contents may not be reproduced or redistributed by unauthorized persons. The user will be held liable for any unauthorized reproduction or circulation of this document, which may give rise to legal proceedings. All the information contained in it is provided for information only and should in no way be taken as investment, legal or tax advice provided to third parties. Furthermore, it is emphasized that the provisions of our legal information page are fully applicable to this document and namely provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier Bank does namely not provide any investment services or advice to “US persons” as defined by the Securities and Exchange Commission rules. Furthermore, the information on our website – including the present document – is by no mean directed to such persons or entities.

"*" indicates required fields

insights

© 2024 Bordier & Cie

Please select your location and language below. If your location is not listed please select "International".