France 2025 “Liberty, Equality, .. Fiscality”

A brief reminder of the major events that marked France in 2024 (apart from the Summer Olympic Games) :

A succession of 4 different Prime Ministers and an Assembly fractured into three irreconcilable blocs leading to political instability unprecedented since the 1950s. The largest slippage in the budget deficit outside periods of crisis (6.10% of GDP) with, as a result, the launch of an excessive deficit procedure by the European Commission. Two lowering of the sovereign rating and two negative outlooks. The absence in January of a budget for the current year is also unprecedented. A clear underperformance of French financial assets and 10Years OAT (French Government Bond) yield now higher than Greece. An accumulation of recessive or pre-recessive signals accentuating the upward trend in business failures. 2024 was an awful vintage year.

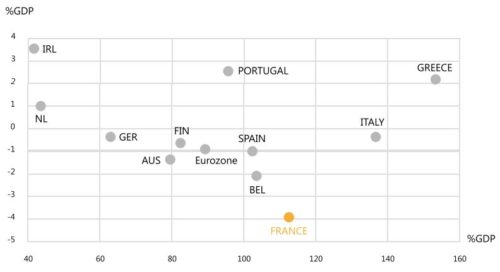

France is now in the worst budgetary situation of all countries in the euro zone. Not only is the public debt high, but more serious for its long-term sustainability, primary expenditure (excluding interest charges) is not covered by tax revenues. This has been going on for 23 years. No other country can boast such market complacency, which is why other governments at least strive to balance their primary budgets. The political situation is very fragile. As for the current budget debate, it has only demonstrated the tax obsession (always more taxes) of almost all political parties. This cannot last. That France has degraded public finances is nothing new. Since the euro was created 25 years ago, the French public deficit has been “excessive”, in other words greater than 3% of GDP, for 20 years (left graph). It has long been thought that other countries were in a worse situation, not having the same capacity to raise taxes.

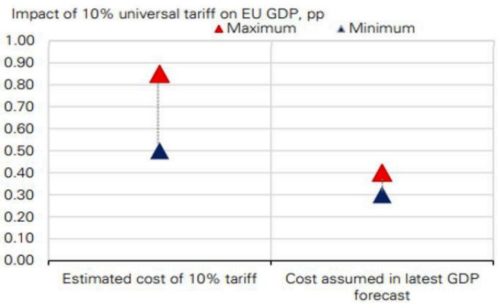

During the European sovereign crises of around ten years ago, France was in an intermediate position between the low-indebted countries of the north and the highly indebted countries of the periphery. The French bond risk premium had certainly jumped, reaching a peak of 190bps compared to Germany in 2011, but the market had never closed. As they said at the time, France traveled first-class with a second-class ticket. What is new is that all the other over-indebted countries have since made consolidation efforts (sometimes interrupted or delayed by the shock of the pandemic) while France has done nothing to cure its budgetary incontinence. On the contrary, it leaks everywhere. The year 2024 is exemplary as it reveals so many failures. Tax revenues overestimated to epic proportions and spending that continues to slide. Other countries, like France, have debt ratios exceeding 100% of GDP, but at least they do not at the same time have gigantic and chronic primary deficits. France is out of the norm here (right graph). When the debt refinancing rate exceeds the GDP growth rate, a country cannot stabilize its debt if it does not cover its expenses excluding interest charges with its tax revenues. Until now, the French risk premium has been increasing but remains quite low (≈80bps Vs 10Y Bund) despite its surge since last June. However, a little more political stress, disinflation, and a faltering recovery, all the elements would come together for the markets to reassess the French budgetary risk and put its sovereign rating & cost of financing under further stress.

Figure 1 : Excessive government deficit (>3% GDP) since the creation of the euro (1999-2024)

Figure 2 : Eurozone: government debt (x-axis) vs cyclicallyadjusted primary balance (y-axis) in 2024

In the preamble to the hundreds of pages of the French draft budget for 2025, there is an unintentionally comical sentence from the two ministers concerned: “There will be neither austerity cure nor tax bludgeoning”. As a result, compulsory deductions, already close to a world record, should rise by almost one point to 46.6% of GDP. The presentation of the budget is such that taxes account for a third of the budgetary adjustment. The rest would come from a slowdown (let’s not talk about cuts) in spending. The High Council of Public Finances has another analysis which judges that tax increases make 70% of the adjustment.

It is obvious that the current political situation prevents a credible medium-term budgetary adjustment plan from being constructed. When the previous government (Barnier) presented a plan to the European Commission a few weeks ago predicting that the deficit would be reduced from 6.1% of GDP this year to 3% in 2029, it fooled no one. We have already noted that the official presentation of the efforts divided into one third increasing taxes and two thirds reducing spending was fallacious. The High Council of Public Finances rather assessed the sharing in inverse proportions. But this opinion was before the start of the budget discussion by parliamentarians. Whether in committees or in plenary assembly, the deputies have multiplied the proposals to aggravate the fiscal blow, also striving to reduce the rare efforts in insubstantial expenditure (for example, the deindexation of retirement pensions).

Having no majority in the Assembly, the Prime Minister had two paths to try to pass the budget. Option 1: wait for the legal review period to expire in the Assembly and, in the absence of agreement, apply the budget by ordinance. This would undoubtedly have provoked a subsequent vote of confidence but at least France would have approached 2025 with a “real” budget. Option 2 (the one that was chosen by Prime Minister Barnier): hold the government accountable by exposing itself to an immediate motion of censure. On December 4, the National Rally joined the parties of the left bloc to support this motion. This atypical assembly forming an absolute majority of 313 votes (out of 589) brought down the government after only 91 days of activity.

This is the record for brevity of a French government since 1958, the start of the Fifth Republic. As a result, no budget could be adopted before the end of the year. To avoid the discontinuity of state services, the resigning government presented a “special law”, adopted on December 18, which authorizes the state to levy taxes (following the same scales as in 2024), to issue debt to finance the State and social security and to open certain credits by decree. On December 13, the president appointed a new Prime Minister in the person of François Bayrou. He has supported Macron since 2017 (not without some friction) and chairs a centrist party which has 34 deputies (12% of the total).

In this political-budgetary saga, the French economy continues to be subject to extreme uncertainty, which is likely to postpone certain spending or hiring decisions. The absence of a state budget exposes taxpayers to an increase in tax pressure (tax brackets not being reassessed), puts an end to certain tax credits, freezes the budgets of ministries and communities , suspends support measures initially included in the finance law. The renewal of the 2024 budget does not lead to an automatic consolidation of public finances. The Court of Auditors instead estimates that this would maintain the public deficit at around 6% of GDP, but based on some other estimates, on its current slope, the deficit could go towards 7% of GDP, unheard of outside of a recession. In a column published on December 18, all employers’ organizations, and all unions (except the CGT) are concerned about the risk of an economic and social crisis, a sign that the feedback from the field regarding employment is bad.

Monthly household survey (closed on November 18), the anticipated unemployment index strongly accentuates the rise observed in recent months; it has been at the highest level since spring 2021. In November, the number of business failures recorded by the Banque de France (BdF) continued to rise (+18% year-on-year) and exceeded the average for pre-pandemic years. The Banque de France survey of businesses (closed on December 4, before the fall of Barnier’s government) shows that uncertainty is increasing in all sectors and is at its highest for two years in industrial sector (at the time, we were in the middle of an energy crisis). Investment spending has been in continuous decline for 13 quarters for households (real estate market crisis) and for 4 quarters for businesses. The BdF estimates that real GDP stagnated in Q4 2024. The INSEE survey (closed on December 16) records a further decline in the business climate which is now at the lowest of the year and 6% below the long-term average. This is typically the level observed in the past at the dawn of recession phases.

To give a positive note to this dark panorama, two things. First, inflation continues to fall. In November, it was at 1.3% over one year (1.5% for underlying inflation). Secondly, there is a timid awakening of bank credit. New credit flows for Real estate purchases have picked up since the spring (+10% over one year, but -32% over two years).

Upcoming meeting

The Prime Minister plans to deliver his policy speech on January 14 when the parliamentary session resumes. Should follow the presentation of a new finance bill, based in part on that of his predecessor Michel Barnier, with the ambition of having it adopted around mid-February. Mr. Bayrou was evasive on the deficit target for 2025 and on adjustments affecting taxes and spending. No one anymore believes that the deficit will be reduced to 5% of GDP in 2025. To ensure the neutrality of certain opposition parties, the Prime Minister also intends to re-examine the pension reform and promises to modify the voting method. by introducing a large dose of proportionality

Conclusion

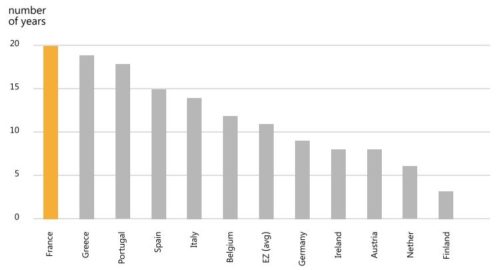

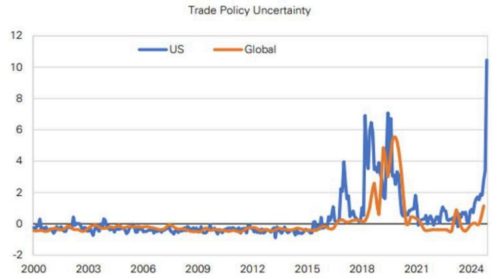

As fiscal uncertainty and political instability continue, with little hope of a lasting resolution in the near term, the real economy weakens, not all at once, but gradually. Investment spending is falling, employment in the private sector has stagnated since the spring and hiring prospects are deteriorating. There is no traction to be expected from external demand.. With the constant uncertainty about the survival of the government, coupled with a still restrictive Monetary Policy from the ECB (the European Central Bank has been too slow to cut interest rates to help the Eurozone’s stagnating economies, and many economists have warned that the central bank had “fallen behind the curve” and was out of sync with economic fundamentals), adding to that the uncertainties of Trump 2.0 policies and US tariffs threaten to amplify Europe’s structural competitiveness problem and keep the economy on this side of the Atlantic in low-growth mode (see charts below), France presents all the symptoms of an economy entering recession. 10years OAT paying only 80bps over Bund, even though Germany has their own issues, does not look like a bargain to me. Some potential technical short term spread compression could happen but the long-term picture looks bleak.

Figure 3: Tariff warning – US trade policy uncertainty has already jumped to levels above Trump 1.0

Figure 4: The impact of US tariffs on European GDP

spending. No one anymore believes that the deficit will be reduced to 5% of GDP in 2025. To ensure the neutrality of certain opposition parties, the Prime Minister also intends to re-examine the pension reform and promises to modify the voting method. by introducing a large dose of proportionality.

Disclaimer The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that: (i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. (ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and (iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.