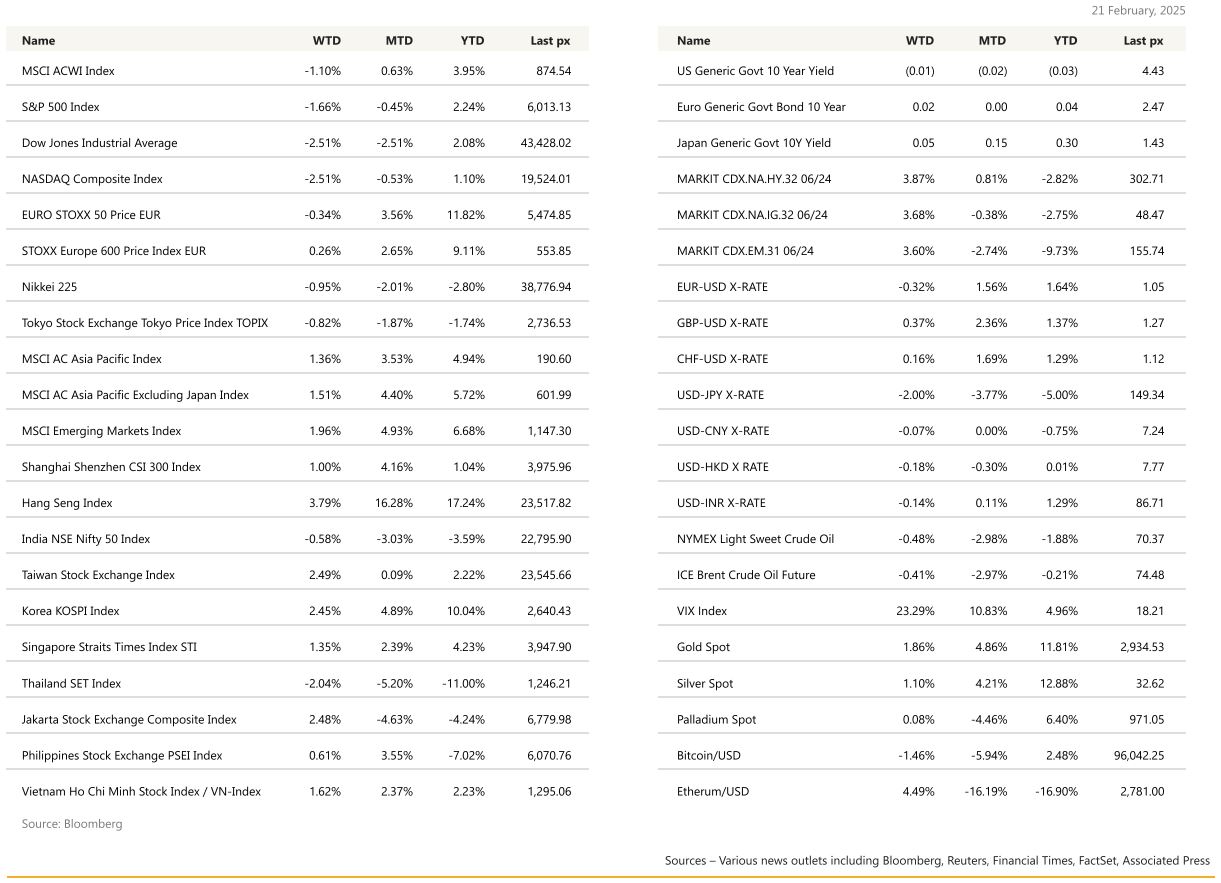

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Friday night’s performance pushed all 3 major US indices lower for the shortened week. US stocks saw their biggest daily drop in more than two months and posted their third weekly loss in the past four, as traders took profits in the high-flying technology shares. Stocks slumped after a batch of weaker than expected economic reports on the US economy were released. PMI Data showed that business activity expanded at the slowest pace since September 2023. Manufacturing PMI was better than expected at 51.6 but both services and composite underwhelmed at 49.7 and 50.4 from 52.9 and 52.7 previously, respectively. The Uni. Of Mich. final survey of inflation expectations jumped to the highest reading since November 2023 at 4.3% and 3.5% for the 1 Yr and 5-10 Yrs respectively. Uncertainty pertaining to tariffs implications could add to the list of reasons for the Fed to keep rates elevated. Adding to the risk off sentiment, St. Louis Fed President Alberto Musalem said policy should remain “modestly restrictive” until it’s clear inflation is on course for the central bank’s 2% target, and that he sees increased risks that progress may stall or even reverse. Atlanta Fed President Bostic also said officials should be patient when evaluating how Trump’s policies may affect the economy, noting some approaches could add to inflation while others could spark investment. Positive sentiment across the pond with a potential end to the Russia-Ukraine conflict reportedly saw flows returning to Europe at the US’ expense. After hitting a fresh all-time high on Wednesday, the S&P 500 retreated as Walmart’s warning of slower sales growth sparked worries that consumer spending was stalling. The last Fed minutes showed that officials expressed their confidence in maintaining steady interest rates amidst persistent inflation and economic policy uncertainty. “Many participants noted that the committee could maintain the policy rate at a restrictive level if the economy remained robust and inflation remained elevated.” The recent US government buyout programme from DOGE, offering some federal employees around eight months’ salary to resign voluntarily, introduces an additional layer of complexity to labour market data. It should be noted that the BLS counts jobs rather than individuals in its Establishment Survey, which produces the widely followed “nonfarm payrolls” number. If a person holds two jobs, they are counted twice. Federal employees accepting buyouts will continue receiving pay and benefits for a deferred period while remaining free to seek other employment. If many of these individuals take new jobs while still technically on the government payroll, payroll figures could be artificially inflated. The UST10 year yield fell to 4.43% whilst the VIX spiked to 18.21.

This week will see the release of GDP data, Personal Consumption, Spending and Income as well as the Fed’s preferred inflation measure, the PCE on Friday. MoM core PCE is expected to increase to 0.3% in January whilst the YoY core is expected to fall to 2.6% from 2.8% previously.

Europe

European equity markets ended on Friday mixed. Chemicals, Food & Beverage, and Construction & Materials led, Energy and Media lagged.

The euro area composite PMI was stable at 50.2, below consensus expectation of 50.5, only narrowly above the 50 noexpansion thresholds. Sequentially, the improvement in manufacturing output (+1.6pt to 48.7) was offset by a softening in services activity (-0.6pt to 50.7). Geographically, activity showed signs of improvement in Germany but remained the weakest in France. The flash consumer confidence increased by 0.6%pt to -13.6%pt. This marks consecutive monthly increases following signs of weakness at the end of 2024. January HICP inflation was unrevised from the flash in the final data releases for France and Italy, together with the final prints for Germany and Spain.

Over in the UK, the payroll measure of jobs rose 21k in January following a couple of declines, with December revised to show a smaller drop of 14k. Headline CPI to 3.0% y/y, from 2.5%, with steps up also in core and services. The uptick was driven by an unwind of airfare weakness, VAT on private sector school fees, core goods and food (notably meat prices). The February flash composite PMI was broadly unchanged at 50.6, with the level, in our view, remaining consistent with muted private sector demand in Q1. January retail sales volumes grew at a robust 1.7% m/m, although this was driven by a very large increase in the oftenvolatile food component.

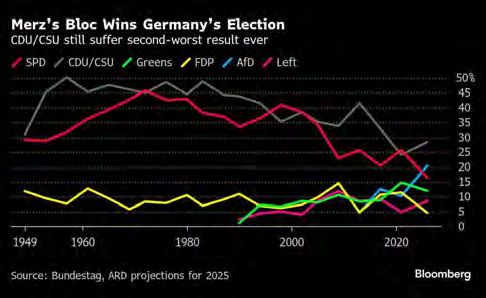

Germany’s centre-right Christian Democratic Union (CDU) led by Friedrich Merz won the election, with early results putting his bloc in the lead. This election was held seven months ahead of schedule after the collapse of Chancellor Olaf Scholz’s unpopular and long-troubled three-party coalition. The CDU-CSU won 28.5% of votes, with the far-right AfD in second place with 20% and Scholz’s Social Democratic Party coming in third with 16.5%, according to ZDF exit polls data. But the 2025 vote to elect 639 members to the Bundestag, the lower house of parliament, did yield a first in Germany’s postwar history. There were other historic firsts on Sunday night. With a turnout of more than 83 percent, the 2025 elections had the highest turnout in a country known for its high voter turnout rates where Chancellor Olaf Scholz’s centre-left Social Democratic Party (SPD), for the first time in history, is no longer one of the two major political forces.

This week will be crucial for data releases. On the activity front, we will be watching the January money and credit data (Thu), and the Q4 final GDP releases for Germany and France (Tue and Fri). On the inflation front, we will be following the EA January final HICP release (Mon) and the February flash prints for Spain (Thu), Germany, Italy and France (Fri). On 25 February, the ECB will also release its EA indicator of negotiated wages for Q4 and on 28 February we will see the EU ECB 3Yr CPI expectations.

Asia

Asian markets closed higher in general last week with the Hang Seng Index leading gains in Asia, up 3.79%, taking YTD gains to 17.24%. The highest amongst Asian equity markets. Strong results from Alibaba following through from recent positive headlines on the company helped boost sentiment around Chinese Tech names. Alibaba’s shares rose 14.6% Friday to hit highest level since Nov-2021!

In contrast, the Indian stock market ended lower last week, marking the second consecutive weekly fall. A combination of negative factors such as relentless FII selling, falling rupee, expensive valuations and the US threat of reciprocating tariff levies continue to drive investors away from Indian equities.

China’s President Xi Jinping met with top business tycoons at a forum last week, signalling a potential shift towards a more supportive stance on the private sector after years of crackdowns. In his speech, Xi emphasized promoting healthy development in the private sector, while reinforcing the importance of both the public and non-public sectors in China’s economy. He assured that businesses of all ownership types would have equal opportunities and legal protections. Notable attendees included leaders from Alibaba, Huawei, BYD, Xiaomi, and others, though CEOs from Baidu and ByteDance were absent. Reports of upcoming legal changes to further support the private sector were released following the meeting, aiming to boost confidence among entrepreneurs and investors. China faces a confidence problem, not a money supply one, so measures that build confidence among entrepreneurs, businesspeople, and investors such as government support for tech and private sector are seen as drivers for growth. Goldman Sachs is the latest broker that raised MSCI China index target on optimism over its technological advancements.

PBOC Governor Pan Gongsheng said in a speech in Saudi Arabia on Sunday that a steady yuan has contributed to stability of global financial markets and economy, adding yuan has largely stabled while many currencies have depreciated recently against dollar. Reiterated PBOC will adopt macro-prudential policies in times of exchange rate overshooting to keep yuan basically stable at adaptive and equilibrium level. Pan also said authorities are focusing more on consumption as economy was previously mainly driven by investment.

Seoul has announced it’s suspending new downloads of the China-based AI chatbot DeepSeek until South Korean authorities can guarantee it’s complying with local data protection laws.

Other data from Asia:

- Japan Q4 GDP notably beats expectations as companies boosted investment and net exports improved. Japan has asked Washington for exemption from Trump’s reciprocal trade tariffs. Singapore’s key exports in January fell more than estimates, led by drop in non-electronic exports. Thailand Q4 GDP grew less than expected in Q4 and brought whole-year growth to 2.5% y/y, slower than estimates. Indonesia’s trade surplus in January bigger than forecast amid surprisingly weak imports.

- The Reserve Bank of Australia has cut its key rate by 25bps to 4.1% for the first time since 2020, noting inflation has eased but still expressing caution about the outlook. Thailand PM Paetongtarn says her government will push for 3.5% growth in 2025 and will seek to work closer with central bank to support small businesses. Singapore unveiled expansionary budget ramping up spending to address cost-of-living issues amid looming election.

GeoPolitics

Europe: European countries clashed over sending troops to Ukraine and failed to come up with a united strategy forward.

Germany, Italy, Poland and Spain expressed a reluctance to dispatch peacekeeping forces to the war-torn country, hours after Britain offered to put “boots on the ground”. France proposed a “reassurance force” that would be stationed behind, not on, a future ceasefire line in Ukraine. But in blunt remarks following the summit, German Chancellor Olaf Scholz called a discussion about troop deployments “highly inappropriate” given the war was still being waged. UK Prime Minister Sir Keir Starmer said he was “prepared to consider committing British forces on the ground alongside others if there is a lasting peace agreement”.

US- India: US gas exports are the most likely beneficiaries of a pledge by Donald Trump and Narendra Modi to make India a leading buyer of American energy. The US is the world’s largest LNG exporter, and already accounted for about a fifth of India’s supplies in 2024. But the leaders’ commitment, which came after Trump called India a “tariff king” and “big abuser” and threatened reciprocal tariffs, has the potential to expand the market for US suppliers, experts say. International Energy Agency said India’s natural gas consumption would increase by nearly 60 per cent by 2030, with LNG imports set to more than double in the same period

US – Ukraine: The White House and Ukraine have made significant progress toward reaching an agreement that would provide the U.S. with access to Ukraine’s rare earth minerals and tighten the long-term relationship between Kyiv and Washington. Rare earth elements are a set of 17 elements that are essential to many kinds of consumer technology, including cellphones, hard drives and electric and hybrid vehicles. Trump’s national security adviser also expressed confidence Friday that Zelenskyy would eventually accept a deal letting the U.S. access his country’s rare earth minerals.

US- Russia -Saudi Arabia: Russia wants Ukraine to hold immediate elections as part of deal. Putin questioned Zelenskyy’s legitimacy after his term expired in May 2024, but Kyiv has said it can only hold an election after the fighting stops and martial law is lifted. Donald Trump appeared to blame Ukraine for the war with Russia and signalled Kyiv should hold elections, in his first public remarks. US has also signalled openness to relieve some sanctions on Russia as part of possible Ukraine deal.

A side note – Even though the discussion in Ryad was probably focussing on the future of Ukraine and improving relationship with Russia, the three parties (US, Saudi Arabia & Russia) present at this conference account for roughly 42% of world oil production.

President Zelensky has reiterated he won t accept a deal Ukraine didn t negotiate.

US – Japan: Japan’s Trade Minister Yoji Muto plans to visit the US in March and will seek exemptions from Trump administration. Muto is arranging meetings with newly confirmed US Commerce Secretary Howard Lutnick, Energy Secretary Chris Wright and other top officials also to discuss plans to buy more American natural gas and Nippon Steel’s stranded bid to acquire US Steel, according to the report.

Vietnam – China: Vietnam’s parliament on Wednesday (Feb 19) approved plans for an US$8 billion rail link from its largest northern port city to the border with China, boosting links between the two communist-ruled countries and making trade easier.

The new rail line will run through some of Vietnam’s key manufacturing hubs, home to Samsung, Foxconn, Pegatron and other global giants, many of whom rely on a regular flow of components from China. Vietnam said a feasibility study for the Haiphong-Lao Cai railway will begin this year and it wants the line finished by 2030.

Credit/Treasuries

USTs rallied after an unexpected fall in the Services PMI alongside downward revisions to the University of Michigan Consumer Sentiment survey. Flight-to-quality bids accelerate the rally. The US treasury curve bull flattened with the 2y: -6bps, 10y: -4.5bps and 10 yr: -2bps. In addition, FOMC minutes highlighted some Fed interest in pausing or slowing balance sheet runoff until debt ceiling is lifted, while Treasury Secretary Bessent said US a long way off from boosting longerterm debt sales, citing hurdles such as still elevated inflation and Fed’s QT program, all providing support for Treasuries. Credit spreads in US IG and HY rose 5 and 11 bps respectively.

FX

DXY USD Index fell 0.09% to close the week at 106.61. Growth worries back in play last Friday following softer February flash PMIs.

S&P Global Manufacturing PMI edged up to 51.6 (C: 51.4; P: 51.2), moving further into expansion. However, the Services PMI unexpectedly fell to 49.7 (C: 53.0; P: 52.9) in February. Michigan consumer sentiment fell 3.1pts from the preliminary read to 64.7, with both current and expected conditions weaker. Sentiment now at lowest level since late 2023.

European Currencies performed mixed against USD, with EURUSD -0.32% to 1.0458, GBPUSD +0.37% at 1.2632, USDCHF -0.17% to 0.8983. EUR fell due to disappointing France composite PMI which falls to the lowest level since September 2023. Eurozone preliminary Composite PMI remained at 50.2 in February (C: 50.5; P: 50.2) as the Manufacturing PMI rose to 47.3 (C: 47.0; P: 46.6), and the Services PMI edged down to 50.7 (C: 51.5; P: 51.3). On the positive note, EU trade commissioner cites positive momentum in US trade talks, notes potential deal to cut car tariffs. GBP outperformed following robust macro data. UK employment, average weekly earnings and retail sales all beat consensus. Preliminary composite PMI fell driven by below consensus manufacturing PMI, even as services PMI edged slightly above consensus.

Antipodean Currencies rose against USD, with AUDUSD +0.08% to 0.6352 and NZDUSD +0.3% to 0.5742, despite RBA and RBNZ both lowering cash rate, in line with consensus. RBA cuts rates by 25 bps but warned that further monetary easing still hinged on more downside in inflation. RBA flagged that it would retain a restrictive policy due to the strength of the jobs market and an uncertain global economic outlook. AU wages missed consensus, but employment beats expectations, confirming continued tightness in the labor market as participation and employment to population ratios reach record highs. RBNZ cuts rates by 50 bps but Governor Orr signals that future rate cuts will be in smaller, 25bp increments, in April and May.

USDJPY fell 2% to close the week at 149.27, below the key support level of 150, driven by tighter US-JP interest rate differential, with yield on 10yr JGBs touching a fresh 15 year high of 1.46 following robust Japan Macro data. Japan GDP beat consensus, +2.8% qoq saar in Q4 (C: 1.1%), while Q3 was also revised up to 1.7% from 1.2%. Japan’s inflation accelerated to hit a 2yr high, rising +4.0% yoy in January from +3.6% in the prior month. Core CPI also rose more than expected, reaching 3.2% yoy, a one-and-a-half-year high and a tenth above consensus but with core-core in-line. BOJ Governor Kazuo Ueda signalled that the central bank stands ready to increase government bond buying if long-term interest rates rise sharply, reiterating the BOJ’s long-standing commitment to supporting stable markets.

USDCAD rose 0.3% to 1.4224 despite a beat on Canada core CPI. Headline in line with consensus, +0.1%mom in January, but underlying measures stronger. Trimmed mean +2.7% yoy (C: 2.6%). Median +2.7% yoy (C: 2.5%) and 0.1ppt upward revision to month prior. A 25bp cut at the BoC s upcoming March meeting is ~50% priced. BoC Governor Macklem says trade escalations with the US would result in severe economic impact and could wipe out growth over two years. Absent of tariffs, Macklem noted that Canada’s economy is “on a better footing”, inflation is back at target, and rates have come down “substantially”. However, he acknowledged that trade uncertainty is “already causing harm”.

Oil & Commodity

WTI crude and Brent crude oil futures rose to an intra-week high of 73.25 and 77.15 respectively following conflicting reports as to whether OPEC+ is considering a delay to monthly oil supply increases scheduled to begin in April. However, all the gains were pared back last Friday amid concerns around US consumer demand, inflationary pressures, and a potential new virus. WTI crude and Brent crude oil futures eventually closed the week, -0.48% and -0.41% to 70.4 and 74.43 respectively.

Gold rose 1.86% to close the week at 2936.05 as US Treasury yields fell across the curve. In addition, growing concerns and uncertainty surrounding tariffs and federal government policies continue to support gold price. Support level at 2880/2830, while resistance level at 2970/3000.

Economic News This Week

- Monday – NZ Retail Sales, EU CPI, US Dallas Mfg Act

- Tuesday – JP Machine Tool Orders, US Cons. Confid./ Richmond Fed Mfg

- Wednesday – AU CPI, US MBA Mortg. App./New Home Sales

- Thursday – SZ GDP, EU Cons/Econ./Indust./Svc Confid., US GDP/ Personal Cons./ Durable Goods/ Initial Jobess Claims/ Pending Home Sales

- Friday – JP Tokyo CPI/ Retail Sales/ Indust. Pdtn, SW GDP/ Retail Sales, EU ECB 3Yr CPI Exp., CA GDP, US Personal Income/ Personal Spending/ PCE Index

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.