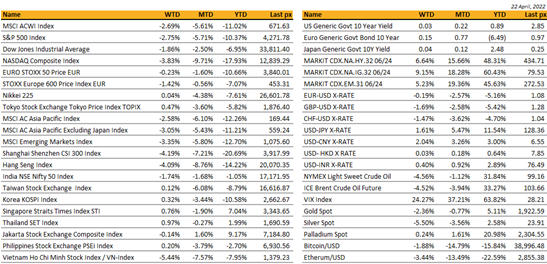

Key market moves

Source: Bloomberg

Macro Overview

Americas:

US markets fell to its lowest points in more than month as fears of a more aggressive Fed tightening soured sentiment. 10-year UST yields are higher by 7 bps for the week, with the 2 years up some 24 bps. The Nasdaq took the brunt of the fall, declining 3.83% for the week.

An overall solid earnings reports from some big wicks earlier in the week failed to turn around the selloff following hawkish Fed-speak. Tesla, which has over a $1 trl market cap posted a record Q1 profit despite supply-chain issues. Netflix on the other hand, sank following reported losses in its customers for the first time in a decade.

Although nothing really new was said by the Fed, the mere mention of a 50 bps hike was enough to send shivers down markets. Fed chief Powell outlined a possible path that could include 2 or 3 more rate increases of 50 bps each and pretty much virtually sealing a 50 bps hike in May. A less hawkish Fed member Mester sees neutral at 2.5% by year-end, well below the street’s expectations. SF president Mary Daly said there wasn’t a high probability of inflation getting to 2% by year end (??) and Chicago’s Evans opined “there’s more alignment on getting monetary policy to a neutral, slightly restrictive stance”. Both are non-voters at the Fed Reserve. The week also saw the release of the Beige Book which indicated further expansion at a moderate pace with stronger underlying.

An important week of data releases await us with US GDP, Personal Consumption and the Fed’s closely watched PCE Deflator.

We remain constructive amidst this volatility with a focus on commodities and consumer staples defensives.

Cryptos remain vulnerable pivoting about BTC $40000 and ETH $3k as risk sentiment remain on its backfoot.

Europe / Middle East (EMEA):

Equity markets ended the week mostly lower, with STOXX Europe 600 down 1.42%, though the DAX and the CAC outperformed versus the broader market.

This week’s equity downdraft coincided with a huge selloff in bond markets amid another sharp re-pricing on rate hikes by central banks. Three 25bp hikes are now priced in by year-end. All benchmark bonds in the Eurozone are now yielding more than zero for the first time since 2014 with the 10-yr Bund yield approaching 1%. Global equities saw $17.5B of outflows in week-ended 20-Apr, of which $2.9B left Europe, marking the 10th week of outflows. Basic Resources, Health Care, Financial Services and Travel & Leisure were the biggest sector decliners.

As the Q1 reporting season gets underway in Europe, Stoxx 600 companies are expected to report a rise of 24.7% in profit, up from the 14.6% growth rate expected at the start of the year, but still a much lower pace compared to 2021. The focus will be very much on pricing power, margins and demand, putting the spotlight on companies’ ability to pass on higher costs to consumers. Luxury goods are seen as resilient to inflationary pressures given their pricing power. LVMH last week said it would continue to raise prices despite geopolitical tensions and lockdowns in China.

April flash Eurozone manufacturing PMI marked a15-month low at 55.3 vs prior 56.5, but the services PMI was at 8-month high of 57.7 vs prior 55.6. Overall, the PMI composite output Index at a 7-month high of 55.8 vs prior month at 54.9. Growth accelerated in April as the rebounding service sector, benefitting from loosened Covid-19 restrictions, helped offset the near stalling of manufacturing output. Hiring also picked up and business expectations for the year ahead lifted from March’s 17-month low, albeit with confidence remaining subdued.

A string of disappointing UK economic data releases last week stoked fresh concerns about a sharp re-pricing of the country’s outlook. Sterling slumped to its lowest since November 2020 after PMIs for both UK services and the whole economy fell to a three-month low in April, while consumer confidence sank to its lowest since the GFC and retail sales fell more sharply than expected in March. The IMF named the UK as the one country in the developed world expected to face the worst inflation shock over the next two years. The Fund expects the UK economy will be around 1% smaller in both 2022 and 2023.

Emmanuel Macron secured a second term as French President with a ~58% versus ~42% vote margin. Macron is the first incumbent to win a second term since Jacques Chirac two decades ago. The outcome is likely to be well received by markets, as it should mean continuity on economic and foreign policy. Still, the margin of victory is much narrower than the last presidential vote in 2017 when Macron won by more than 30 points.

Wheat prices tested 2007-2008 highs in March, but have since declined substantially. Only corn prices remain poised to post fresh all-time highs. Analysts suggest that the food crisis may move to background until all key grains threaten previous peaks once more, which might happen if the Ukraine war drags on.

Asia:

Asia markets closed in the red last week, MSCI Asia Ex japan index was down 3%. Shanghai was the worst performer, down 4.19% for the week. This was despite China’s securities watchdog on Thursday urging institutional investors to buy more domestic shares in a bid to stabilize a market hit by the nation’s Covid-Zero strategy. Sentiment has taken a hit after the authorities delivered a smaller- than-expected cut to lenders’ required reserve ratio last week and the central bank refrained from injecting liquidity through lower lending rates.

Last week it was also reported that China doubled down on its friendship with Russia. The two nations would increase “strategic coordination,” China’s vice foreign minister said, despite the ongoing war in Ukraine.

The People’s Bank of China set a weaker-than-expected currency fixing as Covid-led lockdowns intensified risks for the world’s second-largest economy. The PBOC set the reference rate for the onshore yuan at 6.3996 per dollar, weaker than the average estimate of 6.3895 per dollar. China’s central bank on Monday announced 23 measures to boost growth after the nation reported its biggest decline in consumer spending and worst unemployment rate since the early months of the pandemic

Foreign investors ditched a record $18bn worth of renminbi-denominated debt last month, with selling accelerating as soaring US bond yields dulled the allure of holding Chinese debt. Expectations of rate rises from the Federal Reserve as it combats surging inflation have pushed up the 10-year US Treasury yield to 2.9% this week, while anticipated easing by the People’s Bank of China has kept the Chinese 10-year yield anchored at about 2.8% in recent sessions.

The Bank of Japan offered to buy an unlimited amount of 10-year government bonds at 0.25% for the first time this month. The BOJ conducted similar operations at the end of March in a bid to rein in a rise in yield.

The leader of the Solomon Islands announced Wednesday that his country signed a security agreement with China just days before a top American official was due to visit the Pacific nation. The Solomon Islands sits in a strategic but politically volatile part of the world. The Solomon Islands has had a security deal with Australia since 2003, when Canberra began a 14-year peace mission in response to ethnic riots. When unrest erupted in the capital Honiara late last year, Australia, New Zealand and Papua New Guinea sent forces to support local police at the request of the Solomon Islands. But soon after, China sent police to train local riot control forces for the first time.

Indonesia’s central bank kept its benchmark interest rate unchanged to support the economy’s flagging recovery, while working with the government to manage price pressures. Bank Indonesia held the seven-day reverse repurchase rate at a record low 3.5% last week. The rupiah, which has been among the least volatile currencies in Asia, strengthened 0.1% against the dollar after the rate decision. The currency has weakened 0.6% so far this year. The central bank lowered the economy’s growth forecast this year to a range of 4.5%-5.3%. The bank maintained its 2%-4% inflation outlook for the year.

Britain and India want a free trade agreement by October. Prime ministers Boris Johnson and Narendra Modi pledged cooperation on defense and business deals during a meeting Friday.

Sri Lanka requested an emergency bailout from the IMF. The country owes more than $35 billion in foreign debt. More tough economic times in general are ahead, the IMF said, as it cut its global GDP growth forecast to 3.6%.

Beijing, a city of more than 20 million people, has locked down dozens of residential compounds and told inhabitants of the eastern district of Chaoyang to be tested three times this week after dozens of infections were found over the weekend. The flareup comes as Shanghai reported a record number of fatalities and imposed stricter rules to try and stamp out infections. China has repeatedly defended Covid Zero, saying the policy saves lives and keeps the economy going, even as the strategy increasingly darkens the country’s growth outlook and threatens to disrupt global supply chains. Authorities have started to enact nine actions announced last week, including installing fences in some neighborhoods over the weekend to seal buildings where positive cases have been found. It’s sparked renewed frustration among residents already locked down for weeks and unable to reliably access food or medical care.

COMPANIES

Didi Global slumped over 18% after claiming that the company will hold an extraordinary general meeting on May 23 to vote on its delisting plans in the country.

Streaming stocks were rocked late Tuesday after Netflix Inc. reported its first customer decline in more than a decade. Netflix said there are more than 100 million households that use its service and don’t pay for it, on top of its 221.6 million subscribers. The Company will explore the best way to offer advertising over the next couple of years and crack down on password sharing. By nudging customers to pay — and inserting advertising — Netflix begins to resemble the cable TV replaced. Netflix lost close to 40% of its market value, a decline of almost $60bn on Wednesday.

Tesla’s adjusted earnings per share beat estimates, rising 246.2% compared to the year-ago quarter. Revenue also came in above analyst forecasts, rising 80.5% year over year. Tesla said that it recently began deliveries of the Model Y from its new factory in Austin, Texas. Production at its new Gigafactory Berlin-Brandenburg began last month. Tesla produced 305,407 vehicles in Q1, a dramatic 69.4% increase from the year-ago.

Twitter is reexamining Elon Musk’s bid. The social media company is taking the offer more seriously after Musk said he’s got the funds for it, The Wall Street Journal reported.

Novavax has published the first clinical data for a combined Covid-19 and flu vaccine. The trial, conducted in Australia, studied the combined shot in almost 650 people aged 50 to 70. An initial analysis found that their immune responses were similar to that for Novavax’s standalone Covid-19 vaccine and its flu vaccine candidate.

Indian scooter startup Ola Electric issued a recall. The SoftBank-backed company called back nearly 1,500 electric scooters after a vehicle caught on fire.

FX/ COMMODITIES

USD continues its upward trend, rising 0.72% to 101.22, as Fed Chair Powell confirms that a 50 bps rate hike is on the table for May meeting, and hinting that it is appropriate to move a little more quickly and the idea of front end loading. OIS is pricing 50 bps rate hikes in May, June, July and September.

USDJPY rose 1.61% to 128.50 alongside a speech by BoJ Governor Kuroda which says “The Bank of Japan should persistently continue with the current aggressive money easing.

EUR outperforms within the European currencies bloc, as ECB Vice President suggests the possibility of a rate hike in July. OIS is pricing over three 25 bps hikes by year end. In the Eurozone, the final Headline CPI print for March came in at 7.4%, slightly below the flash estimate of 7.5%. EURCHF rose 1.38% to 1.0337. GBPUSD fell 1.69%, alongside a string of poor economic data which included a weak retail sales report, declining consumer confidence, and soft PMI data. On SEK, Riksbank Governor gives the clearest signal yet that the central bank is preparing for a substantial pivot in policy at its next meeting on April 28, supporting the currency.

USDNOK rose 1.65%, despite trade surplus in Norway widening to a new all-time high. This is another sign the economy is benefitting substantially from higher oil prices.

AUD and NZD lead broader G10 declines against USD following relatively modest 25bp RRR cut in China and disappointing Chinese retail sales data, with AUDUSD falling 2.04% to 0.7244 and NZDUSD falling 1.85% to 0.6639. RBA minutes affirmed that the recent rise in wage growth and inflation expectations have brought forward the likely timing of the first increase in interest rates, while slower than expected acceleration in NZ consumer prices contributed to NZD decline.

ECONOMIC INDICATORS

M – JP Leading Index, US Chicago Fed Nat Act./Dallas Fed MFG Act.

T – JP Jobless Rate, US Durable Goods Orders/Cons. Confid./Richmond Fed MFG/New Home Sales

W – AU CPI, US MBA Mortg. App/Wholesale Inv/Pending Home Sales

Th – NZ Trade Balance/Biz Confid., JP Retail Sales/Indust. Pdtn/BOJ Rate Decision, EU Econ/Indust./Svc Confid., US GDP/Core PCE/Initial Jobless Claims

F – NZ Cons. Confid., AU PPI, EU CPI/GDP, US Personal Income/Personal Spending/MNI Chic. PMI/Mich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.