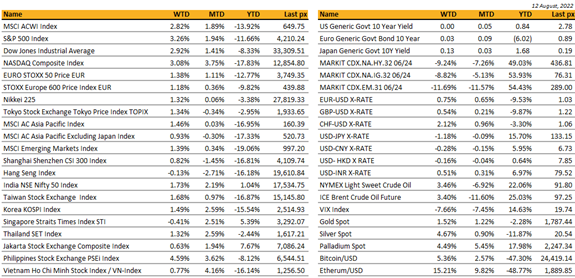

Key market moves

Source: Bloomberg

Macro Overview

Americas:

The stellar recovery from June lows continued into last week as we saw all 3 major US indices clock up rallies of about 3%, finishing higher for a 4th consecutive week. The Nasdaq had its longest winning weekly streak since November, lifting it 20% higher from its June low, signaling a new bull market was in store for the Nasdaq. Bloomberg reported that part of this rally was fueled by hedge funds unwinding mega shorts and started chasing gains. Risk turned on following a slightly cooler inflation reading last Wednesday. It bolstered wagers that the Fed Reserve will rethink its aggression in monetary policy despite several Fed members opined to the contrary. Evans said he expects the Fed to continue tightening this year and Kashkari said the Fed is far away from declaring victory on taming inflation. Only San Fran’s Daly said the cooler inflation reading for July is welcome news and may mean it is appropriate for the Fed to slow its rate increases. Futures are now pricing a 50 bps hike in September. The VIX closed below 20, with its active September contract trading at 23.6.

July CPI came in on the softer side reflecting lower energy prices, with the month-on-month figures coming in flat, below the 0.2% eyed, with core CPI (ex food and energy) at 0.3%, well below July’s 0.7% gain. Year-on-year was the same story, in that CPI was at 8.5% (lower than May’s) with core at 5.9%, again both below market consensus. This was followed by PPI the next day, showing prices falling in July for the first time in over two years. The month-on-month number came in at -0.5%, well below the 0.2% consensus, with ex-food and energy at 0.2%. Year-on-year was the same story, 9.8%, below the 10.4% economists were expecting. All in all, perhaps, the long awaited lagged effect of the Fed’s hikes this year are now starting to take effect. Still, whether the Fed will pivot or if the worst of inflation is truly behind us remain a moot point.

US Treasury Yields were higher at 2.83% for 10’s and 2’s at 3.24%. August has seen a surprising revival of deals in the tech sectors, a sign that shows companies are getting more bullish. There is about $13.4 bln of tech-related M&A in North America alone according to Bloomberg.

Corporate earnings have held up for most companies in the S&P 500, a strong case for growth to remain resilient.

We see opportunities following the recently approved tax, climate & health care bill as well as the CHIPS act. Sectors directly affected by this passage have since risen since the initial news but remain attractive.

Semiconductor ETF’s, EV’s, Solar and utilities (ones that get tax breaks for renewable energy).

Cryptos continue to stay firm with BTC edging closer to $25k and ETH at $2k.

This week will see retail sales, housing data and the release of the last FOMC minutes.

Europe / UK / EMEA:

As the ECB’s deposit rate turns positive, government deposits at the ECB are set to be remunerated at zero. That is likely to result in demand for higher yielding alternatives and is therefore bullish for short-dated spreads.

Norway has announced that the government will lay the groundwork for export controls on electricity later this week. This is a potentially significant development, since Norway is a key exporter of electricity to Europe, and this comes on top of the existing energy disruption thanks to Russia’s invasion of Ukraine, as well as the current European heatwave that has further bolstered demand.

French power prices for 2023 hit a record €543 per megawatt-hour yesterday, and their German counterpart also surged to €406 per megawatt-hour. For context, exactly a year ago today those prices closed at €81.70 and €79.14 respectively, so we’re talking about increases of more than five-fold over the last 12 months.

A fourth heat wave is hitting France. The country is also undergoing a severe drought. Meanwhile, Spain marked July as its hottest month on record, and the UK is bracing for another heat wave.

Italy’s centre-right alliance has pledged to maintain support for Ukraine’s struggle against Russia and deepen integration with the EU, if it comes to power in the next elections.

Turkey restarted offshore gas explorations. After a two-year pause, a drillship set off for the eastern Mediterranean, raising regional tensions as it will operate near waters currently disputed with Cyprus.

Asia:

Some optimism has emerged across Asia this week as traders bet on slower interest-rate increases by the Fed amid signs of price pressures easing. MSCI Asia Ex Japan closed the week up 0.93%. YTD, Indonesia has held up 7.6%, the best performing market in Asia.

China’s macro data fell significantly short of expectations. Retail sales increased 2.7% year-on-year in July, missing expectations of 5%. Industrial production also missed expectations, up 3.8% YoY, missing expectations of a 4.3% increase.

China’s consumer inflation accelerated in July to the highest level in two years, largely due to surging pork costs. The consumer price index rose 2.7% last month from a year earlier as pork prices surged 20.2%, National Bureau of Statistics data showed.

The People’s Bank of China lowered the rate on its one-year policy loans by 10 basis points to 2.75% on Monday. China’s 10-year government bond yield fell four basis points to 2.69% after the surprise move, lowest since 2020. The rate cut shows that the Chinese authorities are still deeply concerned about growth and sluggishness in credit demand, while inflation pressure is mild.

China’s exports of automobiles reached a new monthly record in July. The country’s auto firms exported about 290,000 units of cars last month, up 67 percent year on year and 16.5 percent over June, according to the China Association of Automobile Manufacturers.

China declared its military exercises around Taiwan complete on Wednesday.

Japan’s gross domestic product grew at an annualized rate of 2.2% in the April to June period, following a 0.1% increase during the previous quarter. The growth was mainly driven by a pickup in private consumption, which rose 1.1% from the same period a year earlier as spending on clothes and other goods increased. But despite the recent recovery, economists say the Japanese economy faces major headwinds in the coming quarters due to a resurgence in Covid cases at home, rising cost of import goods and the slowdown in the US and other key trading partners.

Taiwan cut its forecast for 2022 growth for a second time as slowing global demand for electronics, high inflation and rising geopolitical pressure from China cloud the economy’s outlook. Gross domestic product is likely to grow 3.76% for the year, the Cabinet’s statistics department said in a statement Friday. That’s lower than the most recent formal estimate of 3.91% in May.

Australian consumer sentiment fell to a decade low of 81.2% in August while business confidence rebounded as demand remains resilient.

In Singapore, a total of S$60.7 billion in tax revenue was collected in the 2021/22 financial year, a 22.4 per cent jump from the previous year as the economy rebounded after COVID-19 restrictions were eased.

Malaysia’s gross domestic product grew 8.9% in the second quarter of 2022 compared to the same period last year, signaling economic recovery from the two-year-long pandemic

Thailand’s central bank in line with expectations raised its key policy rate by 25 basis points (0.25%) to 0.75% last week, signaling its shift of focus by tightening monetary policy to keep the country’s increasing inflationary pressures in check

China removed 12,000 crypto social media accounts. The purge is the latest episode in a broader regulatory crackdown on cryptocurrencies, which were banned last year.

COMPANIES

SoftBank reported a record $23 billion quarterly loss. The investment conglomerate was hit by a downturn in tech stocks.

Softbank will slash its stake in Alibaba. The Japanese conglomerate expects to make $34 billion from the sale of around 38% of its most famous investment after reporting a record first quarter loss.

Baidu has won approval to deploy the first fully autonomous self-driving taxi in designated areas in Wuhan and Chongqing. Winning the permit has given Baidu, the operator of China’s largest search engine, an edge over its rivals, including Pony.ai, WeRide and AutoX, which are racing to develop fully autonomous driving software systems. The permit would allow the company to carry out more testing of its vehicles, and analysts estimate that commercialisation generating significant revenue is still two to three years away.

Taiwanese national security officials want to force Apple supplier Foxconn to unwind an $800mn investment in Chinese chip company Tsinghua Unigroup, as Taipei seeks to align itself more closely with the US.

China and the UK agreed to restart direct passenger flights. Suspended since late 2020, Chinese airlines will lift off first, with British Airways slated to follow.

Vietnam’s leading beer producer Sabeco (Saigon Beer) recorded strong recovery in Q2 with highest profits in 5 years, with net sales and net profits grew +25% YoY and +67% YoY respectively. Saigon Beer has been the beneficiary of Vietnam’s easing social-distancing restrictions and reopening of border, rising the demand and consumption of alcohols over the past few months. The country has gradually reopened to foreign visitors since Mar, registering more than 954,600 foreign tourists YTD as of Jul, 10 times more than the same period last year.

ByteDance bought a Chinese hospital group. TikTok’s parent company acquired Amcare Healthcare for $1.5 billion—amid a broader trend of tech sector expansion into medical services—though it hasn’t said why.

Pfizer bought Global Blood Therapeutics. The American pharmaceutical giant paid $5.4 billion to acquire the sickle cell disease drugmaker.

Roblox on Tuesday reported revenue was up 30 per cent from a year ago to $591.2mn in its second quarter. But the company also reports “bookings” – a figure adjusted for deferred revenue and which measures sales of Robux, the game’s virtual currency that users spend to customise their avatars. Bookings were down 4 per cent from a year ago to $639.9mn, missing Wall Street expectations by almost $5mn. The company reported a 21 per cent yearly increase in daily active users to 52.2mn, but the average bookings per active user fell by 21 per cent, down to $12.25. Roblox shares fell 17 per cent in after-hours trading.

Capri Holdings, owner of the Jimmy Choo and Michael Kors brands, beat expectations for the three months to early July, but hinted that times could be getting tougher for luxury companies as it cut its revenue outlook for the rest of the year. The company, which also owns Versace, said revenue increased 8.5 per cent in the quarter from the prior year to $1.36bn, driven by strong sales across all three bands. This surpassed analysts’ expectations for $1.29bn. Earnings of $1.40 per share also beat expectations of $1.36.

US hotel group Hyatt swung to a first-half profit, as the easing of pandemic restrictions buoyed leisure, group and business travel. The hotelier reported that revenue per available room, or revpar, a widely used industry metric, excluding greater China, was higher than pre-pandemic levels in 2019. “Our outlook remains optimistic, with strong . . . booking trends for future periods continuing in July,” said Mark Hoplamazian, Hyatt’s chief executive. Hyatt posted revenue of almost $1.5bn in the quarter, up from $663mn a year ago, beating the forecast of $1.37bn.

McDonald’s will reopen restaurants in Ukraine. The fast food giant’s decision follows rival Yum Brands’ reopening of its stores in the war-torn country.

Ryanair said the time of cheap flights is over. CEO Michael O’Leary stated the average fare price would rise from about $40 (£33.75) to $50 (£42.25) over the next five years amid rising fuel costs.

BlackRock launched bitcoin offerings. Bitcoin’s price rose after the world’s biggest asset manager enabled institutional clients to invest directly in the cryptocurrency.

FX

DXY USD Index fell 0.93% to 105.631, as both headline and core PPI/CPI underperformed consensus expectation. Headline PPI yoy came in 9.8% (C: 10.4%; P: 11.3%), while Core PPI yoy came in 5.8% (C: 5.9%; P: 6.4%). Headline CPI yoy fell to 8.5% (C: 8.7% P: 9.1%) from last month’s 40-year high, while Core CPI yoy came in 5.9% (C: 6.1% P: 5.9%). Even though CPI surprised to the downside, but underlying details suggest uncomfortably high inflation is likely to persist. Regardless, markets rejoice with risk rallying with broad based USD weakness.

EURUSD rose 0.75% to 1.0183 due to broad based USD weakness. However, EURCHF fell 1.37% to 0.96609, as Media reports suggested falling water levels in the Rhine river mean it will be effectively impassable at a key point after August 12, which further weighted on European growth sentiment. In addition, German and French power prices hit record highs amid an ongoing heat wave.

GBP fell 0.23% against EUR to 0.84543, but rose 0.54% against USD to 1.2138. Data wise, UK data was weak, as UK GDP came in at -0.1% QoQ and 2.9% YoY, beating consensus. Industrial production mom came in at -0.9% (C:-1.4%) and manufacturing production mom came in at -1.6% (C: -1.9%). In addition, reports suggest the UK is planning potential power cuts in January, under the government’s latest “reasonable” worst case scenario, which add to GBP weakness.

AUD & NZD rose 3.04% and 3.55% against USD to 0.7121 and 0.6452 respectively as a record China trade surplus boosts risk sentiment for the Antipodean currencies.

NOK rose 2.30% to 9.5696 as inflation surprises to the upside at 4.5% y/y (C: 3.8%; P: 3.6%), the highest 12-month growth in core inflation since the index’s inception.

Oil & Commodity Bloomberg commodity index rose 4.54% to 117.8512 as markets rally amid below consensus expectation US CPI. Iron Ore rose 4.23%, while Copper rose 2.83%. Brent and WTI rose 3.40% and 3.84% to 98.15 and 91.46 respectively.

ECONOMIC INDICATORS

M – JP GDP/Indust. Pdtn, CH Indust. Pdtn/Retail Sales, SZ PPI, US Empire Mfg, CA Mfg Sales/Existing Home Sales

T – JP Tertiary Industry Index, UK Unemploy. Rate, EU Zew/Trade Balance, US Building Permits/Indust. Pdtn, CA CPI

W – JP Core Machine Orders, AU Wage Price Index, NZ RBNZ OCR, UK CPI/PPI, EU GDP, US Retail Sales/MBA Mortg. App./FOMC Mins

Th – AU Unemploy. Rate, EU CPI, US Initial Jobless Claims/Existing Home Sales/Leading Index

F – NZ Trade Balance, JP CPI, UK Retail Sales, EU Current Acc, CA Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.