Revised inheritance law from

1 January 2023

Lisa Natalini

Managing Director

Head of Nyon Branch,

Bordier & Cie

Leila Vassiltchikov-Ali Khan

Head of Legal & Tax, Bordier & Cie

Attorney-at-law

Trust and Estate Practitioner (TEP)

Previously, inheritance law in Switzerland had not undergone any major amendments for over a century. However, a degree of modernisation was needed as life expectancies increased and different forms of family life became commonplace. In short, amendments were required to serve present-day realities. The new rules will come into force on 1 January 2023 and will apply to the estates of all persons passing away from that date onwards.

In this newsletter we provide an overview of the main developments and how this will affect families, especially in estate planning.

Purpose of the revision

The guiding idea behind the new inheritance law is to give testators more options.

This is done by reducing the forced heirship**The forced heirship (or forced heirs’ share) is the minimum share of the estate that cannot be denied to specific heirs. The forced heirs will be the spouse or registered partner (for couples of the same gender) and their common issue. If the children are no longer living, their right passes to the grandchildren or great-grandchildren. distributed to descendants, cancelling the parents’ compulsory share and abolishing the spouse’s right to the forced heirs’ share while divorce proceedings are under way, where certain conditions are met.

The disposable portion****Disposable portion: share of the estate that the testator may dispose of freely. is therefore more substantial, leaving the testator free to assign a larger share of their estate to the person or persons of their choosing, be this their spouse, registered partner, common-law partner, their children or any other person or institution/charity of their choice.

Main developments

The main developments resulting from the revision to inheritance law concern the forced heirs’ share. The changes are as follows:

- Reduction in the descendants’ forced heirship;

- Abolition of the compulsory share allotted to parents;

- Impossibility of spouse or registered partner to lay claim to forced heirship while divorce proceedings are ongoing or during dissolution of a registered partnership.

A reduced descendants’ forced heirship and abolition of parents’ compulsory share

From the outset, it is important to specify that in the absence of a testamentary disposition, i.e. either a will or a contract of inheritance, the statutory division of the estate under the new rules is unchanged. The Swiss Civil Code determines who the intestate heirs are and what share of the estate they are entitled to by degree of kinship. Those nearest of kin automatically exclude those who are further removed. Common-law partners cannot be intestate heirs.

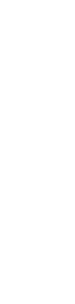

Conversely, from 1 January 2023, forced heirships will undergo significant changes. For descendants, this share will be reduced to ½ of the intestate share (currently ¾), while the compulsory share allotted to the parents will no longer exist.

As a reminder, for inheritances involving a married person under the default system, which is participation in property acquired during the marriage (more rarely, the joint property system), the marital regime of the deceased and their spouse must first be dissolved. Only once this dissolution has been finalised can the probate process begin. There is no liquidation of the marital property regime in cases where a contract has been signed specifying a separation of property.

Abolition of spousal claim to forced heirship during divorce proceedings

The revised rules coming into force on 1 January 2023 also have a bearing on the spousal claim to the forced heirship if divorce proceedings are under way at the time that the spouse passes away. In this instance, the surviving spouse will no longer be entitled to their compulsory share if the divorce was jointly petitioned for, or if the couple has been living apart for two years or more. However, the surviving spouse retains their claim on their intestate share until the divorce settlement comes into effect, unless a testamentary disposition was made by the deceased to exclude them. These provisions apply by analogy to dissolutions of registered partnerships.

Other developments

The revised inheritance law coming into force on 1 January 2023 introduces other changes, the main ones being:

Life interest in favour of spouse

Article 473 of the Swiss Civil Code states that the testator may grant the surviving spouse or registered partner a life interest in all or part of the estate passing to their common issue, irrespective of how the property rights have been assigned in the disposable portion. This avoids situations wherein the surviving spouse may have to sell their immovable property or home to pay the common children their share of the estate. These children will enjoy bare ownership of this property, while the spouses ensure that the widow or widower can continue living in their home (or rent it to a third party). The disposable portion for these cases (i.e. the fraction that can be granted to the surviving spouse or registered partner) is currently one quarter but this will be increased to one half from 1 January 2023. As a result, the surviving spouse or registered partner will enjoy more extensive rights than is currently the case.

Prohibition on making gifts after execution of a contract of inheritance

According to the existing body of case law, once a contract of inheritance has been entered into, the testator in principle is still free to dispose of their property through inter vivos gifts provided that the contract of inheritance does not contain provisions to the contrary and there is no apparent intent to cause harm. Conversely, the new rules establish a ban on gifts in principle. With the exception of customary gifts, testamentary dispositions and inter vivos gifts are still liable to legal challenge insofar as they are incompatible with the contract of inheritance or have not been reserved by the latter. Contracts of inheritance must therefore clearly indicate if and to what degree the testator can freely dispose of their assets during their lifetime.

Next steps

The Federal Council is planning other legislative measures that will have a bearing on inheritance law.

Company transfers will become easier from 1 January 2023 thanks to the reduced forced heirships. On 10 June 2022, the Federal Council also approved a draft range of measures aiming to make it easier to pass on companies and prevent unnecessary corporate break-ups by giving priority to the descendant(s) taking control of the business. This bill still requires parliamentary approval.

Furthermore, amendments to the Federal Act on Private International Law aim to provide a better fit with EU inheritance rules. These changes are currently under discussion in the Federal Assembly. If approved, this will secure advantages such as the possibility for part-Swiss dual nationals to carry out probate in the country of their other citizenship.

Conclusion

Wills and contracts of inheritance in force before 1 January 2023 will remain valid but may need to be checked and adapted to comply with the new rules. Now might likewise be a good time to review one’s estate.

Marriage law and inheritance law are both complex. We advise obtaining advice from seasoned professionals to find solutions adapted to your personal circumstances and estate.

Bordier & Cie works with a range of experts in their specific fields. For more information, contact your relationship manager.

The following table details the changes between the old and new rules as this affects forced heirships and the disposable portion:

MODIFICATION DES RÉSERVES HÉRÉDITAIRES DÈS LE 01.01.2023

*The forced heirship (or forced heirs’ share) is the minimum share of the estate that cannot be denied to specific heirs. The forced heirs will be the spouse or registered partner (for couples of the same gender) and their common issue. If the children are no longer living, their right passes to the grandchildren or great-grandchildren.

**Disposable portion: share of the estate that the testator may dispose of freely.

"*" indicates required fields

insights

- Singapore

- Switzerland

- Singapore