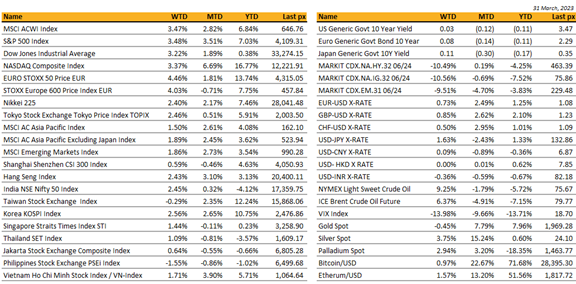

KEY MARKET MOVES

MACRO OVERVIEW

Global

US markets ended March on a high on optimism that rate hikes by the Fed will end soon as economic data continued to point to cooling inflation. The Fed’s preferred inflation gauge, the PCE deflator showed price growth eased last month to 0.3% against views of 0.4% whilst the YoY rate came in at 4.6% versus expectations of 4.7%. This reading follows lower than expected CPI and PPI data released earlier in the month. A lower personal spending and a slowdown in personal income growth data fueled further expectations of a cooling inflation outlook. The U. of Mich. 1 Yr inflation expectation fell to 3.6% from 3.8% previously. Whilst this disinflation-train continue to buoy markets, skeptics are just as plenty with prominent money managers choosing not to chase the rally calling the expectations for easier Fed monetary policy are overblown with inflation still running hot. “Should any cuts come, they would be intended to halt an economic downturn that also would bode poorly for equity returns”, the thinking goes. Regardless, risk sentiment returned with the VIX closing below 19 on Friday. Concerns surrounding the last couple of weeks’ banking failures and liquidity crises eased following reports that the Fed Reserve’s lending to the banking sector declined by some $11 bln for the week to $153 bln.

In March, US stocks have seen a big sector rotation with Tech stocks rallying amid bets on lower interest rates, whilst economically sensitive cyclical sectors trailed following their outperformance at the start of the year. The Nasdaq 100 index recorded its first bull-market run (>20%) in nearly 3 years at the close of business Wednesday. As LT yields remained inverted, we think there are legs left for Tech to run (see previous Generative-AI piece).

Fed-speak during the week stuck to their rate hike narrative of further hikes if inflation remained high. Swap traders currently price about a 50% probability the Fed will raise rates by a quarter point at its next meeting in May…..with plans to ease thereafter.

This coming week will see ISM data in manufacturing & services, JOLTs openings and key employment data. Bloomberg expects the unemployment rate to remain unchanged at 3.6% with NFP to come in at 240k.

Cryptos staged a decent comeback with BTC emerging from the crypto-winter at above $28k and ETH at $1800.

Asia

Q1 2023 ended on a positive note for Asia. MSCI Asia Pacific index was up 4% in Q1. Taiwan led the gains, up some 12% for the quarter. Followed closely by South Korea, up 10.75% for Q1. India was the worst performer in the region, down 4% since the start of the year.

Hong Kong’s market this week was supported by internet giants, as both Alibaba and JD.com announced listing plans for its units. HSI closed the week higher at +2.43%. Alibaba said it was planning to split into six units and explore fundraising or listings for most of them, the biggest corporate restructuring in its 24-year history. The six units are Cloud Intelligence, Taobao Tmall Commerce, Local Services, Cainiao Smart Logistics, Global Digital Commerce and Digital Media & Entertainment. Alibaba shares surged some 17% last week.

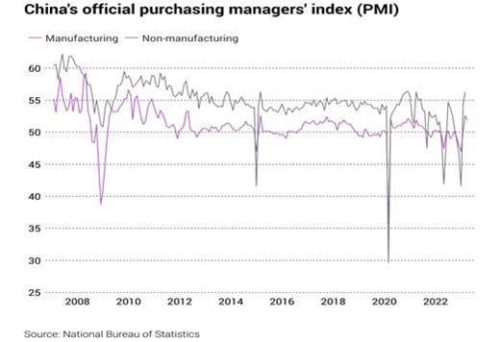

Many believe China’s economic recovery is on track coupled with government’s pledge to support private sector and foreign businesses. In his first public address to international audience as China’s premier, Li Qiang said China had acted “responsibly” in its role as a big country and offered “an anchor” for global peace. Li also struck an optimistic tone about China’s economy recovery, saying March will likely fare better than first two months of the year, citing stronger consumption, investment and sentiment. Reiterated China to purse stability, expand domestic demand, keep opening up and safeguard financial stability. Official PMIs beat expectations again with non-manufacturing reading at 58.2, the highest level since May 2011. The official composite PMI, which includes both manufacturing and services activity, rose to 57 in March, up from 56.4 in February.

Bank of Thailand raised its base interest rate by 25 bps to 1.75%, as expected, trimmed growth expectations.

Thailand has brought forward its carbon neutrality and net-zero emission target to 2050 and 2065 respectively, with environment minister Varawut Silpa-archa saying the first step in Thailand’s new adjusted timeline for net-zero is to shift the target of reducing GHG emissions from 30% to 40% within 2030. In light of this, STACS and TGO said they will work closely together to exchange ESG data and digital technology with the aim of accelerating the carbon market development in Thailand and ASEAN.

China and Brazil have reached an agreement to settle trade in renminbi. Banco BOCOM BBM, a Rio-based subsidiary of China’s state-owned Bank of Communications, will be connected to China’s Cross-border Interbank Payment System (CIPS) to facilitate trade settlements between the two nations. This arrangement marks Banco BOCOM BBM as South America’s first direct participant in the CIPS and follows the previous agreement between China and Brazil to settle trade in their own currencies.

Geopolitics

EU’s Ursula von der Leyen, warned the bloc to scale back the risks in dealing with an increasingly assertive China, rather than decouple completely. She said “it’s neither viable nor in Europe’s interest to decouple…the focus is on de-risking, not decoupling.” She noted China’s stance on Russia’s invasion of Ukraine will be a determining factor in EU-China relations. She will visit China this week with French President Macron.

Japan plans to impose export restrictions on 23 types of equipment used to make semiconductors, following similar curbs by the US designed to restrict China’s access to cutting-edge chips in an intensifying battle over the technology. The move by Japan fulfils its side of a three-way agreement with the US and Netherlands that would significantly curtail China’s ability to import equipment used to produce the most advanced types of semiconductors. The restrictions, which come into effect in July, will affect a broader range of companies than previously expected.

South Korea set to pass its own version of the “Chips Act” to increase tax credit for firms. South Korea is home to major chipmakers, such as Samsung Electronics and SK Hynix. The new Chips Act will provide these companies with financial incentives and policy support, enabling them to expand their production capacity and invest in cutting-edge technologies. In turn, this will help South Korean chipmakers maintain their competitive edge in the global market and reduce the nation’s reliance on semiconductor imports, particularly from the United States and China. South Korea chip production fell 41.8% whilst shipments dropped 41.6% attributed to CN-US tensions and looming recession.

credit

The US Treasury curve inverted further last week, after 3weeks of flattening, with the short part of the curve rebounding. The 2years yield was up by about 30bps, the 5years gained 19bps, 10years gained 12bps and the 30years gained 4bps. Volatility on rates remains very elevated. Even though the yield on the short part of the curve rebounded last week, it is still trading about 1% lower than where it used to trade less than a Month ago, prior to the period of stress on some US financial institutions.

In term of performances, US IG gained 1.20% last week, US HY gained 2.80% and leverage loans gained 0.65%. All fixed income segments were up last week even though interest rates were higher, but credit spreads compression more than offset the negative impact of higher rates. To illustrate that, US HY credit spreads tightened by roughly 42bps over the week.

FX / COMMODITIES

DXY. USD index fell 0.59% to 102.51, as risk sentiment improves with all 3 US equity indices rising for the week. Fed’s Williams expects inflation to fall to around 3.25% in 2023 (which is below median Fed expectation), magnitude of impact of recent bank turmoil “uncertain”. Data: Consumer Confidence at 104.2 (C: 101.0); GDP QoQ (4Q) at 2.6% (C: 2.7%); Core PCE QoQ at 4.4% (4.3%); Michigan Sentiment at 62.0 (C: 63.3).

EURUSD rose 0.73% to 1.0839 with broad based EUR strength alongside a rise in market pricing for the ECB terminal rate above 3.60%. ECB Chief Economist Lane notes the ECB’s baseline scenario consists of an environment where current tensions “settle down” and then “more hikes will be needed.” Data: EU unemployment rate at 6.6% in-line. Headline inflation y/y (March) at 6.9% (C: 7.1%), core inflation y/y at 5.7% in-line.

GBPUSD rose 0.85% to 1.2337 as risk sentiment improves. The BoE Financial Policy Committee report revealed UK banks are resilient, well-capitalised and strong enough to support households and businesses. Data: GDP y/y (4Q final) at 0.6% (C: 0.4%)

USDJPY rose 1.63% to 132.86, as risk sentiment recovers adding to JPY weakness. In addition, US yields rose especially in the short end, adding to wider US-JP yield differential, where 2 yr yield rose 25 bps. Data: JP jobless rate rose 2.6% (C: 2.4%), headline inflation y/y at 3.3% (C: 3.2%), core inflation y/y at 3.2% (C: 3.1%)

Oil & Commodity– Bloomberg Commodity Index rose 2.41%, driven by a continued rebound in WTI (+9.25%) and Brent (+6.37%) last week, as an EIA report showed a surprise decline in crude oil inventories. Just this morning, OPEC+ announced a surprise oil production cut of more than 1 million barrels a day, adding to upward pressures on oil prices and inflation. Oil future rose another 6% at the time of writing. Iron Ore rose 6.32% and Aluminium rose 3.29% respectively. Gold fell 0.45% to close the week at 1969.28, while Silver rose 3.75% to 24.10.

ECONOMIC DATA

M – JP Tankan Index, AU/JP/CH/SZ/EU/UK/NO/US/CA Mfg PMI March Final, AU/SZ Inflation, US ISM Mfg/Prices

T – AU RBA OCR, EU PPI, US Factory Orders/Durable Goods Orders

W – AU/JP/EU/UK/US Svc/Comps PMI March Final, NO Indust. Pdtn, US Mortg. App./ADP Employ./Trade Balance/ISM Svc Index

Th – NZ Commodity Prices, AU Trade Balance, CH Svc/Comp PMI March, SW Indust. Orders, UK Construction PMI, CA Unemploy. Rate, US Initial Jobless Claims

F – US Nfp

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.