“Every collectivist revolution rides in on a Trojan horse of ‘emergency’.

– Herbert Hoover, 31st US President

CHINA – Not Entirely Uninvestible But Certainly Not a Screaming Buy Either.….

The world awaited what the 20th Congress of the Chinese Communist Party could bring to China’s and indeed the world’s fortunes. Instead, we were gifted not with fortunes, but with fear – fear of the unknown. Fear that we could be thrown deeper into a world of chaos, confrontation and de-globalization. Chaos as zero covid policies remain and mini-riots are sprouting, Confrontation as relations with the US just got even colder (especially Taiwan) and De-globalization as China has been cut from most western exported tech, something China would now need to focus (more) inwardly.

The Congress gathering’s significance is considerable, witnessing not only the re-coronation of Xi as party general-secretary for an unprecedented 3rd term but also a generational turnover of Chinese Communist Party leadership and a look-back at the CCP’s accomplishment to date. Of course, there is also a priority list for the next 5 years.

Having secured the top post, it was in with the new and out with the old, the ‘old’ having to retire officially. The rules for the Communist Party’s top politicians are already generous. Ministerial ranking officials such as the Minister of Finance, need to retire by 65. Deputy ministers, such as heads of China’s biggest banks and SOE’s leave their posts by 63. As for everyone else in the nation’s wide bureaucracy, the ceiling is 60. Xi is 69.

The Politburo Standing Committee of 7 including Xi had a turnover of 4 senior CCP leaders. Amongst the casualties were market reformist ex-Premier Li Keqiang and Wang Yang a former vice Premier.

So influential was Li Keqiang that an index was named after him entitled China Li Keqiang Index, that provided an estimate of overall economic activity in its economy released in advance of quarterly GDP estimates. Wang Yang on the other hand, was seen as a man for all seasons who demonstrated flexibility, a quality that saw him earn favours as he leaned from right to left along the party’s ideological spectrum throughout his career. In their place, was a wave of promotions of senior party and military elites. Gone are individuals who believed to have strong reformist or market-oriented tendencies, IN with a new slate of Xi loyalists who are likely to be staunch supporters of Xi’s agenda of centralized control and hardline policies.

President Xi warned the 2,000 plus delegates that “We must be more mindful of potential dangers and be prepared to deal with worst-case scenarios” which sounded rather aggressive, a far cry from just over a year ago in June of 2021 when Xi urged Chinese officials to create a “trustworthy, lovable and respectable” image for the country as a sign of diplomatic rethink. Xi’s concern also extends beyond external threats with challenges emanating from societal problems from lack of jobs & incomplete housing to constant lockdowns resulting in political dissent and unrest among China’s vast populace of 1.4 bln citizens. It is widely understood that the Communist Party rulers are more fearful of their own people and domestic instability than they are about threats from offshore. Hence centralized control to strengthen control over all sectors of society is crucial. Or is it? We’ve seen the detrimental effect of this through the lens of private online education providers or the 3 red lines property policy or an overarching Tech crackdown that went beyond 18 months. Are we going to face more of the same of which that has not worked?

When markets re-opened the Monday post-Congress, it is no wonder onshore & offshore Chinese markets collapsed to multi-year lows.

What then has Xi up his sleeve now? To get more of an idea, let’s take a brief look back at when he first assumed power, in 2012.

In 2012, Xi sought to centralize his control over the CCP and the Peoples Liberation Army through extended anti-corruption drives and conducted the most comprehensive and thorough reorganization of China’s defense in 30 years. Claims of safeguarding China’s sovereignty by building artificial islands in the South China Sea to facilitate the military was another. He then targeted restructuring the economy through reasserting central controls over most sectors and re-emphasized the importance of SOE’s. Xi suppressed dissent in Hong Kong ostensibly disallowing the previously agreed one country, two systems policy that was still in place causing the former British colony much unrest and harm to its reputation. The latter half of his 2nd term also led to bloody clashes between Chinese and Indian border troops that involved notably, lethal hand to hand fighting in mid-2020. And his last major directive was to engage in a ramp-up pattern of provocations in and around the Taiwan Strait with the aim to normalize military operations and establish a de facto Beijing control over the ocean separating the mainland from Taiwan. And amidst all of this, Covid-19 cases were handled quite simply, brutally with random lockdowns across the nation, even during times of natural disasters despite advisers within his inner circle advising Xi to ‘loosen’ up. Xi’s Covid-zero policy remains even as the whole world reopened by late 2021 while China’s lockdowns clearly hammered its economic growth missing its growth target of 5.5% by a mile plus some.

What we can derive from his pattern of past is:

- The high priority assigned to ensure centralized control of all aspects of internal and external state activity

- The focus on military modernization across the board for national security and social stability

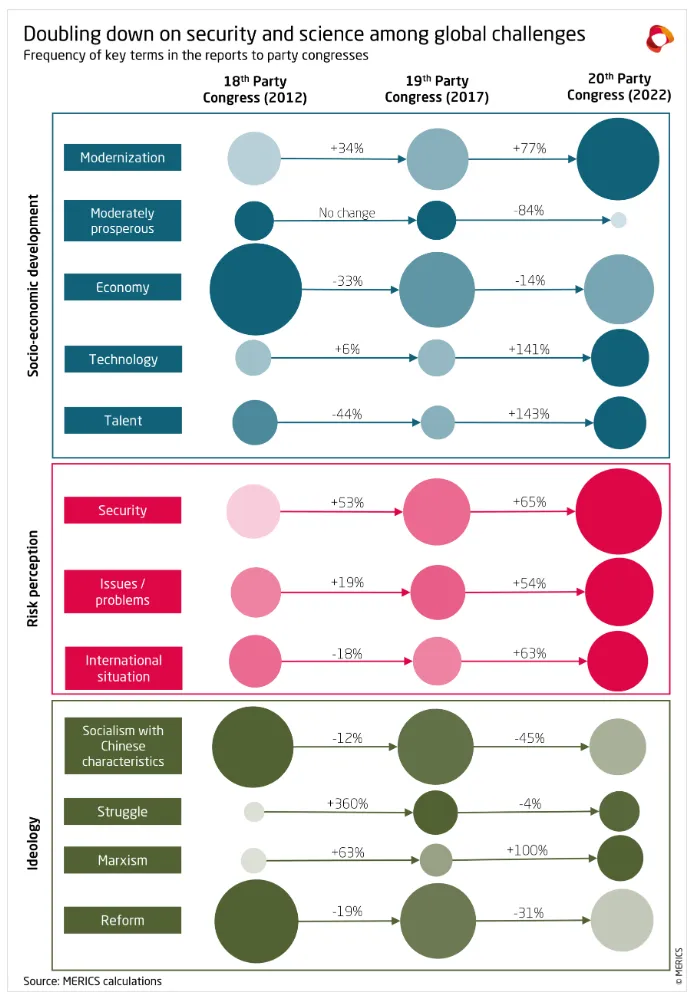

- A heavy focus on self-reliance particularly in the areas of technology with the newly added science-technology section, outlining how education, science, technology and talent will be the strategic drivers for a “modern socialist country”

- A warning of dark times ahead (which is the scariest of them all)

- Praising dynamic zero’s (on Covid-19) policy as a success

- The focus of growth appears to have taken a back seat, shifting to a longer-term initiative

In summary:

To this end, we think China is not yet a screaming buy with its many headwinds in play. Despite promises of support for capital markets and welcoming FDI’s, the undercurrent of Xi’s new appointments & policies have yet to be felt (further), in particular missing ‘market friendly’ leaders in the Standing Committee, re-emphasizes to us that the time is not yet afoot. Domestically focused Funds, particularly in areas mentioned above would be the only place to dabble in, for now.

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to “US persons” as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities.

© 2020 Bordier Group and/or its affiliates.