DEBTS : what we know we know & what we know we don’t know

US Sovereign debt or what we know we know

All around the world, bond traders are finally coming to the realization that the rock-bottom yields of recent history might be gone for good. The surprisingly resilient US economy, ballooning debt and deficits, and escalating concerns that the Federal Reserve will hold interest rates high are driving yields on the longest-dated Treasuries back to the highest levels in over a decade. That’s prompted a rethink of what “normal” in the Treasury market will look like. Strategists are warning investors to brace for the return of the “5% world” that prevailed before the global financial crisis ushered in a long era of near-zero US rates.They are also warning that inflation could remain stubbornly above the Fed’s target, leaving room for long-term yields to push even higher.

“There is a remarkable repricing higher in longer-term rates,” a former Bank of Canada board member recently said. “The market is coming more to the view that there is going to be long-term inflation pressures despite recent progress,” he said. “Macro uncertainty is going to remain the story for the next few years, and that requires greater compensation to own long-dated bonds.” It’s a sharp break for markets that last year started positioning for a recession that would push the Fed to ease monetary policy, raising hopes for a sharp rebound from a brutal 2022 that sent Treasuries to the deepest losses since at least the early 1970s. While higher rates will soften the blow by boosting bondholders’ interest payments, they also threaten to weigh on everything from consumer spending and home sales to the prices of high-flying tech stocks.

What’s more, they will increase the US government’s financing costs, worsening the deficits that are already forcing it to borrow some $1 trillion this quarter to cover the gap.

Some Wall Street forecasters are still calling for an economic contraction that would put downward pressure on consumer prices. Moreover, inflation expectations have remained moored this year as the pace slowed sharply from last year’s highs, a sign the market is anticipating it will eventually draw back near the Fed’s 2% target. The personal consumption expenditures index, the Fed’s preferred measure of inflation, rose at a 3.3% pace in July. That’s down from as much as 7% a year earlier. But many now expect a soft landing that would leave inflation the dominant risk. That was underscored by the release of the Federal Open Market Committee’s meeting minutes from July, when officials expressed concern that more rate hikes may still be needed. They also indicated the Fed may keep paring its bond holdings even when they decide to ease rates to make policy less restrictive, threatening to keep another drag on the

bond market. That helped to push 10Years Treasury yields up as high as 4.33% recently.

Federal Debt: Total Public Debt as Percent of Gross Domestic Product

That’s just shy of the October peak, which was the highest since 2007. Many market commentators are now expecting longer term rates to trade even higher (Summers Says 10-Year Yields Could Average 4.75% in Coming Decade. Alpha Quant sees scope for US 10-Year Yields to Reach 6%. Pimco’s Ivascyn Says It’s ‘Dangerous’ to Think the Fed Is Done. BofA’s warning of a 5% World).

Broader economic shifts are also driving speculation that the low rates, and inflation, of the post-crisis period were an anomaly. Among them: demographics & tightness of the job market globally that may push up wages as aging workers retire; a shift away from globalization or decoupling; higher defence costs and drives to combat global warning by shifting away from fossil fuels. “People are going to need more term premium to own long-term bonds”. Even with the recent rise in yields, though, no such premium has returned. In fact, it remains negative as long-term rates hold below short-term ones, an inversion of the yield curve that’s usually seen as a harbinger of a recession. But that gap has started to narrow, cutting a New York Fed measure of the term premium to around minus 0.65% from around 1.10% in mid-July. That upward pressure has also been exacerbated by US federal spending, which is creating a flood of new debt sales to plug the deficit even as the economy remains at or near full employment. At the same time, the Bank of Japan’s decision to finally allow 10-year yields there to push higher will likely cut Japanese demand for US Treasuries. BlackRock recently said there’s major shift underway at the world’s central banks. For years, they kept interest rates well below the rate that’s considered neutral to spur their economies and ward off the risk of deflation. “This has been flipped now,” “So even if the long-term neutral rate is not changed, central banks will hold policy above that neutral rate to stave off inflationary pressure.”

Some strategist broke the 10-year Treasury yield down into three constituent estimates. First, there’s r*, the “neutral” short-term interest rate that the Federal Reserve would set if it wanted to neither hinder nor stimulate growth. They currently set this at 1%. Then, there’s the average long-term inflation rate: 2.5%. Finally, they estimated the term premium, the added yield that investors will require to compensate for the risks of longer- term lending: 1%. From there, the arithmetic was simple: 1% + 2.5% + 1% = a target yield of 4.5%. That said, secular elements are also evident.

First, the economy’s strength amid much higher interest rates suggests that the neutral rate is higher than previously believed. This is starting to seep into Fed officials’ forecasts: In the June Summary of Economic Projections, the central tendency for the long-term federal funds rate moved up slightly. Some might expect officials to keep revising their estimates of r* upwards, though this probably won’t be reflected in estimates based on econometric models, which are slow moving and somewhat skewed by pandemic-period data. Second, the US government’s fiscal health keeps deteriorating: Last month, the Congressional Budget Office raised its estimate of this year’s federal budget deficit to $1.7 trillion from $1.5 trillion, and no improvement is likely anytime soon given the political deadlock in Washington. The outlook will probably deteriorate further as higher interest rates drive up debt service costs and retiring baby boomers push up Medicare and Social Security expenditures.

Larger deficits push up r* and add to the bond term premium by increasing the risk of long-term lending to the US government. The supply of government debt will be even greater than the deficit alone suggests. For one, the Treasury must borrow more to rebuild its cash balance (TGA) at the Fed, after depleting it to get through the latest debt ceiling standoff. Also, debt must be issued to replace the Fed’s holdings, which are declining at an annual rate of $900 billion as part of the central bank’s quantitative tightening program and will probably keep doing so for about two more years, even if the Fed reverses course on interest rates. The bond term premium is the hardest part to forecast. Prior to the 2008 financial crisis, it averaged, at least, about 100 basis points. Since then, it has been around zero, in large part because there was little risk: Bonds were viewed as a good hedge against recession, and against the danger that the Fed’s monetary policy would become ineffective as interest rates got pinned to the zero lower bound. Now, chronically higher inflation is a much greater threat, one that might push the term premium back up to its pre-2008 level. Nobody can pretend to know how bond yields will move in the near future. Growth, employment and inflation will be the main drivers. But for the longer term, the steady economic expansion that followed the 2008 financial crisis is no longer relevant. The paradigm has shifted, and higher yields are back. With $32 trillion of debt (approximately 120% of GDP) and large deficits as far as the eye can see and higher refinance rates, an increasing supply of Treasury is assured. When you couple new issuance with QT, adding to that the expected reduced appetite of some historical large foreign sovereign buyers of US Treasuries, it is hard to imagine how the market absorbs such a large increase in supply without materially higher rates.

China LGFV’s or what we know we don’t know

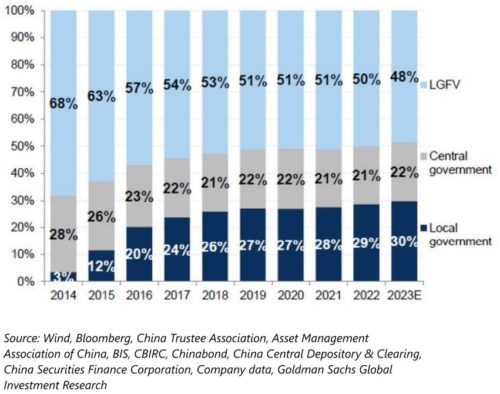

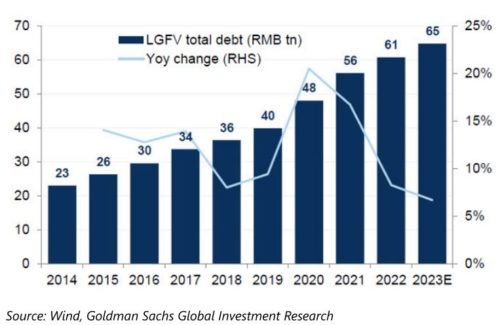

China’s hidden local government debt has swelled to around half the size of the economy, according to economists at Goldman Sachs Group Inc, who said the government will need to be flexible in dealing with this as revenue is already under pressure due to a slowdown in land sales. The total debt of local government financing vehicles (LGFVs) rose to about 53 trillion yuan ($8.2 trillion) at the end of 2020 from 16 trillion yuan in 2013, the economists wrote in a report. That’s equal to about 50% of 2020 gross domestic product and is larger than official outstanding government debt. The LGFVs are a tool for local governments to borrow money without it appearing on their balance sheets, but it is seen as the same as a government liability by financial markets and many domestic investors. There were some signs that government was making inroads in cutting this debt as the economy’s rebound gave room to focus on tackling financial risks. Now with growth facing more headwinds including reluctant consumers, a housing market crisis which has caused demand for land to slump, power shortages, and supply chain disruptions, markets are looking for signals of a rethink of that hawkish policy stance. “More official local government bond issuance and increased flexibility on local government financing are probably needed to support overall economic growth” as land sales are slowing. Land sales are a major source of revenue for local governments and sales have slowed down as the crisis at property developers worsens. The liabilities of local financing vehicles are mostly concentrated in construction, transportation and industrial conglomerates sectors, with these three sub-industries borrowing close to 40% of the total LGFV debt. Jiangsu tops all the provinces in the size of the borrowing, with about 8 trillion yuan in 2020: Tianjin, Beijing, Sichuan, Guizhou and Gansu are the most leveraged provinces as a share of local economic output. Around 60% of the bonds issued by local platforms are used to repay maturing debt in 2020-2021, rather than new investment. China doesn’t have an official account of local governments’ hidden debt, as it’s technically against the law, and private estimates by different institutions vary significantly. One estimate by S&P Global Ratings in 2019 put the size at 20 trillion yuan, while another that same year from Rhodium Group put it in between 41 trillion to 51 trillion yuan. LGFVs debts have swelled to over $9 trillion according to International Monetary Fund (IMF) estimates, posing a major systemic risk to the world’s second-biggest economy. According to a government-linked think tank, there was 14.8 trillion yuan of hidden debt in 2020. Goldman’s calculation is based on an analysis of more than 2,000 LGFVs’ statements of their interest-bearing debt, including bonds and bank loans.

Investors are concerned about Chinese banks’ exposure to local government debt, earnings risks stemming from such debt, and diverging fortunes among individual banks. The sector is already suffering from record-low margins as the government cuts interest rates to revive a flagging post-COVID recovery. Goldman analysts expect China’s six largest banks to step up and take on more local government debt in a bid to reduce risks faced by smaller lenders, potentially eroding their margins. They expect dividend yields of the Chinese banks they cover would come in at 4-6% this year, two percentage points lower than before the adjustment. In addition, “dividend payout targets could come under increasing pressure, on weaker earnings growth” and high capital adequacy requirements due to higher NPL. In this report, they also revised down pre-provision operating profit estimates for large Chinese banks by 5-6% this year and next. However, GAM Investments, sees limited earnings impact from banks’ local government debt exposure. “We don’t expect that, if the local government debt goes into trouble, it will be the banks that shoulder that cost,” expecting the central government to assume some of the costs.

Growth rate in LGFV indebtedness to slow in 2023

LGFV debt outstanding and annual growth rate

Growth rate in LGFV indebtedness to slow in 2023

LGFV debt outstanding and annual growth rate.

China sends finance experts to tackle region’s debts

Beijing is making one of its biggest top-down efforts in years to tackle the debts racked up by local governments in a sign of authorities’ mounting concern over the risk to financial stability as the economy falters. China’s state council, the country’s cabinet, has recently sent teams of officials to more than 10 of the country’s financially weakest provinces to scrutinise their books, including the liabilities of opaque off-balance sheet entities, and find ways to cut their debts. Working groups from the central bank, finance ministry and securities watchdog are involved in the debt resolution effort in those provinces and will report directly to Premier Li Qiang. The enormous debts accumulated by China’s provinces have become an urgent problem for policymakers as they try to end the country’s long reliance on a debt-fuelled infrastructure binge to drive economic growth. Goldman Sachs estimate puts the total local government debt pile at Rmb94tn ($13tn), including liabilities off-balance sheet. A meaningful debt resolution would reshape the regional investment and financing landscape but would also trigger repricing of locally raised bonds and could affect the shares of regional banks that lent heavily to LGFVs. While the plans being drawn up could change, one of the most important tasks would be to review and categorise LGFVs’ “hidden debt” often raised off-exchange or through other non-public channels. Under the initiative, some of this debt could be swapped to official local government debts, while the rest could face restructuring. A source close to the finance ministry said among the options was to allow local authorities to use some low-interest special purpose vehicles and other bonds to pay off relatively high-interest LGFV debt. The working groups will also press policy and commercial banks to extend the maturity of loans to LGFVs to ultra-long terms and cut interest rates.

One of the biggest sticking points between central and local governments was who should pay for a clean-up. Beijing wants provinces to sell assets to help repay debt, but local officials plead that many assets are illiquid, and that the central government must do more to help with rescues. The groups may keep pushing local authorities to sell assets to pay down their debt and stick to the principle of no direct central government bailouts to avoid moral hazard. The plans have been drawn up by China’s leading decision-making body politburo, chaired by President Xi Jinping, which vowed in July that it would “formulate and implement a package of plans” to help de-risk local government debt. Since 2015 China has undertaken repeated attempts to curb debt issuance by LGFVs, which ballooned as infrastructure and property spending fuelled booming economic growth but resulted in many ill-advised and vanity projects.

However, the current effort is one of the most concerted to date to resolve the issue. Local governments’ spending model became increasingly unsustainable after the coronavirus pandemic drastically pushed up their costs, while a collapse of land sales on which many relied for revenue has triggered a deterioration in the broader financial health of China’s regions. However, concerns remain over how the trillion-dollar debt problem can be solved at a time when China’s economic growth has slowed. This year’s target of 5 per cent growth is the lowest in decades, and the world’s second-largest economy is facing deflationary risks as annual consumer prices fell in July for the first time since early 2021. “Debt swap programmes won’t resolve the root problem as highly leveraged local governments may still have trouble paying off their debt going forward,” “Much slower future economic growth will undermine fiscal revenue, which is a major source of debt repayment.” “It’s a typical chicken and egg issue,” Moody’s Investors Services said. “Without growth, how can you generate more resources to repay the debt?”

Local governments’ bond repayments likely to reach a new high in 2023

China will allow provincial-level governments to raise about 1 trillion yuan ($139 billion) via bond sales to repay the debt of local-government financing vehicles and other off-balance sheet issuers, a small step toward addressing one of the biggest threats to the nation’s economy and financial stability. The Ministry of Finance has informed relevant authorities about the “refinancing bonds” program.

The quota has been set for each region, without providing further details on sizing. All provincial-level governments but Beijing, Shanghai, Guangdong and Tibet will be able to use the bonds to repay off-balance sheet liabilities. Authorities also identified 12 provinces and cities as “high-risk” areas where more support will be provided, including the provinces of Guizhou, Hunan, Jilin and Anhui, as well as Tianjin city. The program will in effect bail out weaker issuers including LGFVs, shifting the debt burden to provincial governments instead.

The program comes weeks after the ruling Communist Party’s Politburo, its top decision-making body, said it would use a package of measures to resolve local government debt. President Xi Jinping has previously described the issue as one of the “major economic and financial risks” facing China. The amount covered under the debt swap program, though, is a drop in the bucket compared to the 66 trillion yuan the International Monetary Fund estimates local government financing vehicles will hold by the end of this year. It’s also far smaller in size than a similar initiative launched by the government in 2015. Back then, China deployed a massive debtswap arrangement worth 12.2 trillion yuan for a few years in a bid to lower the amount of off-balance sheet debt carried by local governments. The costs of servicing debt have risen in recent years, creating a drag on Chinese fiscal spending. At the same time, many local governments have seen their income drop due to a two-year property market slump and two years of pandemic relief spending. That’s raised the risk that LGFVs will default on their debt, which could destabilize China’s financial system. Even so, the swap program this time around may help defuse the risks of default faced in the regions where it’s implemented.

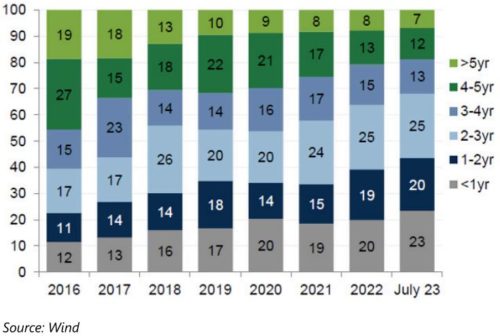

The share of shorter duration bonds are rising amongs LGFVs

LGFV bonds outstanding breakdown by maturity (%)

It can also bring down the financing costs on the hidden debts, give local governments more time to repay, and improve funding conditions in those places. The issuance will be planned in batches. Unlike a write-off, however, the debt will still have to be serviced, squeezing the room already debt-laden local governments must sell more bonds to fund infrastructure investment and spur economic growth. Aside from the scale of the program, there are a few key differences between this debt swap program and the initiative from 2015.

The initial debt swap plan involved issuing extra bond quota, while more recent programs including this one is intended to make use of unused quota from prior years. As of the end of 2022, regional governments across the country had a total of 2.59 trillion-yuan worth of unused quota, based on data from the Ministry of Finance. It remains unclear how provinces will distribute the quota between different LGFVs under their jurisdiction. Some LGFVs are owned at the provincial level, while others are owned by city or county governments. Beijing has tried a few other ways to resolve debt woes in recent years.

In 2019, some counties in less-developed regions were picked by the government to replace their hidden debt with bonds in a trial program to improve their financing ability. In late 2020, special local bonds for refinancing purposes were introduced, first as a way for weak regions to reduce their off-balance sheet liabilities, and then as a strategy for rich places including Beijing, Shanghai and Guangdong in southern China to clear hidden debt. Guangdong in 2021 became the first to claim it had successfully eliminated such debt. While the person familiar with the latest plan didn’t explain why Beijing, Shanghai, Guangdong and Tibet had been excluded from the new debt swap program, those four places either have no “hidden” debt or have very little, based on officials’ data.

Disclaimer

The documents herein are issued for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. Please refer to the provisions of the legal information/disclaimer page of this website and note that they are fully applicable to any document herein, including and not limited to provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier & Cie does not provide any investment service or advice to “US persons” as defined by the regulations of the US Securities and Exchange Commission, thus the information herein is by no means directed to such persons or entities.

© 2020 Bordier Group and/or its affiliates.