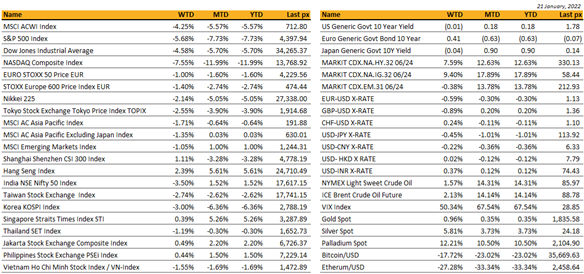

Key market moves

Source: Bloomberg

Macro Overview

Americas:

US markets endured its worst weekly drop since March of 2020 on angst that the Fed Reserve will raise rates in March. Though this is already built in, anxiety surrounding what the Fed might say later this week after the FOMC meets added to the soured sentiment. The Fed Reserve may deliver more than a 25-basis point hike in March, is what’s spooking investors.

Selling was exaggerated when the S&P 500’s 200 day moving average was breached and expiration of more than $3 trl worth of options added to market turbulence. Earnings from some tech and financial companies which disappointed added to concern that this could be a prelude of things to come. Analysts are warning that this early earnings takeaway indicates that inflation is eating further into corporate earnings. UST10Y yields ended lower at circa 1.75%. Oil soared during the week testing 7 year highs earlier amid robust demand and strained supplies.

Earlier in the week, we saw lackluster earnings results from JP Morgan and Goldman and later, Netflix which tumbled when it fell short of its subscriber outlook for Q1.

A higher than expected reading on jobless claims for the week had little impact largely because it is probably caused by closures from the Omicron variant, and unlikely to change the Fed’s direction.

Wage inflation remains pressing. Remaining hopeful of supply-side inflation easing, the Biden administration has agreed to start talks with the UK to resolve steel tariffs of 25%, slapped on previously by Trump in 2018.

This week will see more earnings releases, as well as the FOMC meeting and Q4 GDP results. A bright spark in an otherwise downward spiral in markets did come in the form of an M&A when Microsoft announced its gigantuan purchase of Activision for approx $70 bln. A step many think is the start of MSFT’s foray, albeit a serious one, into the Metaverse. The deal is expected to close in 2023. Microsoft will now become the 3rd largest gaming company by revenue, behind Tencent and Sony.

Cryptos suffered together with the wider tech selloff amidst rising regulatory and taxation threats, and concerns around tightening US monetary policy. Russia’s central bank is the latest to propose a ban on cryptos entirely. Bitcoin is down more than 40% from its November peak. Ether trades around $2,500.

Europe / Middle East (EMEA):

Europe’s equity markets booked their third straight weekly decline amid the ongoing sharp sell-off in bonds, reflecting concerns over a more hawkish shift by central banks which have signaled the need to tighten more aggressively. Rising oil prices on geopolitical concerns and supply-demand dynamics also further contributed to anxiety over hotter inflationary trends. According to Reuters, European value shares have risen 4.4% YTD, while growth stocks have slid 5.7%. The 11% performance gap between MSCI Europe value and growth is the widest in 19 years.

Also, latest data from Refinitiv shows that Stoxx 600 companies are expected to post a 48.6% y/y rise in quarterly profit during this earnings season. That’s about twice the estimate for the S&P 500, which currently stands at 23%. On top of that, Stoxx 600 companies are trading at around 17 times projected earnings and offer a 3.3% dividend yield, vs S&P 500 stocks, which trade at a forward P/E multiple above 21 and yield just 1.3%.

The December ECB minutes confirmed increased divisions on the inflation outlook, while the BoE said inflation was likely to remain strong in the near-term and expectations are growing that the BoE will press ahead with its tightening cycle next month.

Several countries such as UK, Ireland, France, Spain, Denmark have started to reduce Covid restrictions this week. Ireland the latest to announce dropping most pandemic restrictions just days after the UK outlined its own move to scrap rules forcing people to wear face masks in shops and ending mandatory isolation for positive cases. France is relaxing some curbs despite maintaining the need for proof of vaccination to access most venues. Denmark is also reopening most entertainment venues.

The Russia/Ukraine issue started to highlight cracks in the Western front this week, as the Eurozone appears divided on how to respond to a Russian invasion in Ukraine. Germany’s leadership appears split regarding potential sanctions that involve the Nord Stream 2 pipeline. Senior SPD politicians have defended Nord Stream 2, while the Greens party want the pipeline to be targeted by sanctions. Germany may push for minimal sanctions and veto any exclusion of Russia from the SWIFT system, but without the German support, the rest of Europe is unlikely respond in a coordinated way, which could sour ties with the US and play into Putin’s hand. On Sunday, the US ordered family members of its embassy staff to leave Ukraine because of the threat of “significant military action” against the country by Russia.

UK PM Johnson’s leadership is coming under threat as Conservative MPs have started to submit letters of no confidence to the committee responsible for overseeing leadership challenges. It follows weeks of negative press and briefings against his leadership and handling of the Covid pandemic, including a breach of rules during the first lockdown. Johnson reiterated an apology for attending a Downing Street event during the lockdown but said he had no intention of resigning and told MPs to wait until for the outcome of an inquiry due next week.

Asia:

With the exception of China and HK indices, most Asian Stocks ended the week flat or down. India and South Korea were the worst hit last week, down 3.5% and 3% respectively.

China’s GDP beat in Q4, rising 4%yoy. High frequency data continues to show weakness in consumption and property. China’s longer-term growth challenges include a deteriorating demographic profile. Births fell 12% year on year to 10.6m, the lowest number recorded since the Chinese Communist party took power in 1949.

The People’s Bank of China cut the one-year loan prime rate from 3.8 percent to 3.7% by 10 basis points. The prime rate for five-year loans was cut by 5 basis points, from 4.65% to 4.6 percent. Xi Jinping spoke at the World Economic Forum. Via video link, the Chinese president cautioned against shaky supplies chains and dramatic shifts in monetary policy.

Chinese regulators are reported to be drafting nationwide rules to make it easier for property developers to access pre-sale funds held in escrow accounts, in its latest move to ease a severe cash crunch in the property sector. This move has the potential to be a very meaningful positive development for the sector, as it will allow developers to access more of the cash held at their local project subsidiaries for debt repayments.

The Cyberspace Administration of China is drafting new guidelines that will require any company with more than 100 million users or over 10 billion yuan ($1.6 billion) in revenue to seek the watchdog’s approval before such deals before making investments or raising funds.

The Bank of Japan has shifted its view on inflation risk for the first time since 2014, driving the yen lower as a nation that has battled deflation for decades faces the mounting pressure of price rises in food and energy. BoJ has revised its inflation projection upward from 0.9 per cent to 1.1 per cent for the fiscal year starting in April. Despite the historic change of view, the BoJ made no change to its monetary stance last Tuesday, opting to keep its negative interest rate, asset purchases and yield curve control policies unchanged.

Hong Kong reported 140 confirmed Covid-19 cases on Sunday, the highest number in about a year. Hong Kong’s secondary schools close today in the city’s latest wave of measures meant to counteract the spread of covid. Primary schools, gyms, movie theaters, salons, and restaurants (after 6pm, anyway) have already been shuttered. Last week, the Hong Kong government demanded that pet shops and hamster owners turn over 2,000 of the rodents after 11 in a single shop tested positive.

Western Australia reported 24 new community cases Sunday, prompting the state’s Health Minister Amber-Jade Sanderson to say that omicron can’t be eliminated. A poll by Japanese newspaper on Saturday showed 46% of those surveyed said they were fearful about the spread of omicron coronavirus variant but not as concerned as they were with the delta strain. New Zealand will move to tighter restrictions after evidence showed that the omicron variant is circulating in the community. Thailand to resume quarantine free program for vaccinated international travelers.

COMPANIES

The Fed on Wednesday is expected to signal a March liftoff in interest rates and balance-sheet reduction later this year to help fight inflation. Aside from the Fed, earnings updates from titans such as Apple Inc. will shape sentiment too following an uneven start to the reporting season. Earnings reports are due from companies including Apple, Boeing, GE, 3M, Deutsche Bank, Microsoft, Samsung Electronics and Tesla

Microsoft Corp is buying “Call of Duty” maker Activision Blizzard for $68.7 billion in the largest game industry deal in history. Microsoft unveiled its largest-ever deal on Tuesday, which is expected to be the largest all-cash acquisition in history, bolstering its firepower in the expanding videogame market, where it competes with leaders Tencent and Sony. It represents the American multinational’s wager on the “Metaverse”. French video game publisher Ubisoft surged over 11% after news that Microsoft has agreed to acquire Activision Blizzard for USD68.7 bn. Sony shares fell as much as 9.8% in Tokyo, their biggest intraday drop since March 2020.

The US is probing Alibaba’s cloud business. The focus of the probe is on how the company stores U.S. clients’ data, including personal information and intellectual property, and whether the Chinese government could gain access to it. Alibaba’s U.S. cloud business is small, with annual revenue of less than an estimated $50 million, according to research firm Gartner Inc.

ByteDance, the company that owns TikTok, has shut down its investment department. ByteDance chose to strengthen the business focus, eliminate investments with little connection (to the primary business), and disperse people from the strategic investment department to various lines of business following an assessment at the start of the year. Dealmaking has come under scrutiny as Beijing continues to tighten regulations on the local IT sector and several internet behemoths have been slapped with fines for failing to register old contracts.

JD and Shopify announced partnership to for cross-border e-commerce. The deal will allow Shopify merchants in the US to sell products on JD Worldwide, giving them access to JD’s 550 million active customers in China, and end-to-end logistics from the US to China, price conversion and translation of product names and descriptions. Similarly, Chinese brands and merchants will receive support with access and compliance matters in seeking consumers in Western markets. Chinese government has set a target to increase national online retail sales by around 44% between 2021 and 2025. JD and Alibaba will be a key part of that push.

Samsung Electronics Co. introduced its first mobile processor powered by Advanced Micro Devices Inc. graphics as the company tries to better compete with the gaming prowess of archrival Apple Inc.’s iPhones. The graphics chip built on AMD’s RDNA 2 architecture, dubbed Xclipse, is described in Samsung’s announcement as bridging the gap between console and mobile performance.

Richemont shares jumped around 5% after the Swiss luxury goods giant posted a sharp rise in quarterly sales, fueled by its jewelry segment. Burberry. shares gained over 6% after it reported a strong set of results and lifted its profit outlook on the back of accelerating full-price sales growth.

Netflix shares fell after a disappointing earnings report on Friday. Shares tumbled 21.8%, weighing on the S&P 500 and the Nasdaq, after the streaming giant forecast weak subscriber growth. Shares of competitor Walt Disney fell 6.9%, dragging on the Dow, while Roku also slid 9.1%.

FX/ COMMODITIES

DXY. DXY USD index rose 0.50% to close the week at 95.642, as risk off sentiment persisted with US treasury yields falling. USD rose against risk on currencies, but fell against safe haven currencies such as JPY and CHF. Data wise, initial jobless claims came in 286k, above consensus. Trading range between 94.0 and 97.0 remain intact.

JPY. JPY rose 0.45% against USD due to risk off movement. Data wise, BoJ slightly revised its median price outlook for FY22 and FY23 up by 20bp (to 1.1%) and 10bp (to 1.1%), respectively. The BoJ also revised its risk category for the outlook on prices from “downside” to “balanced”. BoJ Governor Kuroda maintained his dovish tone pushing back against speculation of future monetary policy tightening.

EUR. EUR fell 0.59% and 0.88% against USD and CHF. EURCHF continued to give up gains from earlier in January and moved back to the 1.0350 area. In the near term, geopolitical uncertainty and the upcoming Italian Presidential election may continue to weigh on EURCHF. Data wise, Euro Area Consumer Confidence remained broadly stable in January at -8.5 with consensus at -9.0.

GBP. GBP continues to fall for a second consecutive week, down 0.89% to 1.3553, after touching the 200 days MA of 1.3740 this year. This was despite UK Dec inflation surprising to the upside, with headline print rising 5.4%, above consensus of 5.2%, highest level since 1992. UK retail sales print was a large downside surprise relative to consensus expectations, but GBP’s immediate reaction to the print was limited given the rapid spread of Omicron in December and the backward-looking nature of the print.

AUD. AUD rose 0.92% against NZD, but fell 0.32% against USD, in the wake of a stronger-than-expected employment print, which sent the unemployment rate (4.2%) sharply lower to near all-time lows (4.0%)

NOK. NOK fell 1.63% to close the week at 8.9062, as Norges Bank kept rates unchanged at the non-forecast meeting and maintained guidance “the policy rate will most likely be raised in March”. Oil prices continue its uptrend momentum last week.

CNH. CNH rose 0.26% against USD, despite several policy easing measures last week. The PBoC cut its short-term (7-day reverse repo) and medium-term (1-year) MLF policy rates for the first time since the initial Covid shock in early 2020, cut the 1-year and the 5-year loan prime rate (LPR) and lowers the standing lending facility (SLF) rate by 10bp to 2.95%. Data wise, China’s GDP beat in Q4, rising 4%yoy, consensus at 3.3%.

ECONOMIC INDICATORS

M – AU/JP/EU/UK/US COMPS/SVC/MFG PMI Jan Prelim, US Chic Fed Nat Act.

T – AU CPI/Biz Confid., US Cons. Confid./Richmond Fed MFG

W – NZ Trade Balance, US Wholesale Inv./New Home Sales, CA BOC Rate Decision, US FOMC Rate Decision

Th – NZ CPI, US Initial Jobless Claims/Durable Goods/GDP/Core PCE

F – NZ Cons. Confid., JP CPI, AU PPI, EU Econ/Indust./SVC Confid., US Personal Income/Mich Sentiment