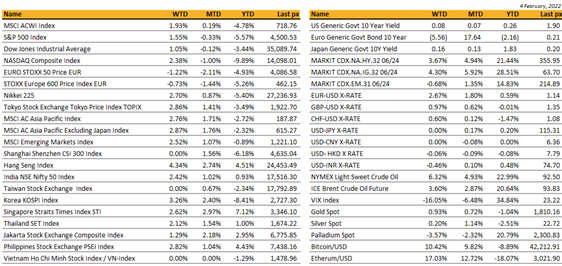

Key market moves

Source: Bloomberg

Macro Overview

Americas:

The S&P 500 capped off January with its worst start to a year in more than a decade as lingering uncertainty surrounding the Fed’s number and swiftness of rate hikes weighed.

After yet another volatile week, US markets ended the week up – a good omen perhaps as we start the new Tiger year positively. All 3 major indices ended the week up more than a percent with the Nasdaq +2.4%.

Amazon, almost single-handedly kept markets above water shaking off worries about jobs data that came out Friday, spurring worries that the Fed Reserve may raise rates faster than expected. Tech was pressed earlier in the week after Facebook and Paypal disappointed with their results, only to rally back and some, after both Amazon and Snap enjoyed outsized gains. Amazon Prime also announced a price hike to its Prime membership.

Not all doom & gloom however, as only about 18% of those that have reported results across all sectors thus far in the earnings season, fell short of projections. US’ Labor Department showed US employers added 467k jobs in January against expectations of 125k. December’s number was also revised upward significantly. The unemployment rate inched higher to 4% with a participation rate of 62.2% from 61.9%. What the data tells us is that more people are returning to work, confirming that the Omicron is less threatening and hopefully, more “wheels start to turn” and we could finally see productivity increase. High velocity data such as this is unlikely to steer the Fed either way from its trajectory despite some calls from analysts citing “50 bps back on the table for the Fed’s March meeting”. Do bear in mind that just on Monday, Fed officials (Esther George, Mary Daly, Raphael Bostic) stress not jamming brakes on the economy as hikes loom!

We will get another look at US CPI this Thursday, with CPI YoY expected at 7.3% from 7% prior and the monthly CPI ex. Food & Energy at 0.5%.

Russia’s President Putin repeated his claim that it’s the US and NATO that is stoking security tensions over Ukraine, while suggesting further talks would help defuse them.

Major cryptos Bitcoin and Ether rallied back up above $40k and $3k respectively as risk appetite returned fueled in parallel to growth stocks Alphabet, AMZN, MSFT and Apple. A definitive break above 50-day moving averages for BTC 43k and ETH 3250 is needed before a more sustained rally can be called.

Europe / Middle East (EMEA):

The STOXX Europe 600 index booked its fifth straight week of losses, even though it saw Growth rebound against Value. Banks and Energy were still the biggest outperformers and bond market volatility remained elevated as the ECB and BoE presented hawkish updates that led to the German 10Y bund and Gilt yields to surge to their highest level in three years. The week also saw the euro move up more than 2.5% versus the dollar and the sterling about 1% higher.

As expected, the BoE delivered a rate hike of 25bps to 0.5% and signaled it will begin the process of balance sheet reduction. All members backed the process of shrinking the balance sheet. The BoE lifted its forecasts for peak inflation to 7.25% in April, vs previous estimate of a peak around 6%, mainly reflecting higher global energy and tradable goods prices. Markets are pricing-in up to five rate increases this year.

The ECB left its key policy settings on hold, but President Lagarde’s press conference caught the market by surprise after she delivered her strongest warning yet on inflation and hinted that it would update its policy roadmap in March. For the first time in many years, Lagarde said inflation risks were now tilted to the upside and no longer ruled out a rate hike this year. January inflation hit a record 5.1% y/y, and this heightened market expectations that the ECB may be a bit behind the curve. Economists expect the ECB to raise rates in September and December by 25 bps.

Q4 earnings season was well underway with 67.4% of companies having already reported exceeding their expectations, a figure well above the 52% beat of a typical quarter. On average, European earnings surprised by 12% on the positive side, beating US companies, which have surprised by an average of 9% so far. JPMorgan said Q4 EPS growth is coming in at +17% y/y, surprising positively by 6%. Overall, BNP Paribas said the season so far is showing corporate earnings expectations revised higher and that is a sign that markets don’t expect economic momentum to fade yet despite the extent of policy tightening being priced-in globally, which is a positive tailwind for stock markets.

While NATO continued to send reinforcements to eastern Europe this week, Russia President Putin met with China President Xi Jinping to prepare a new deal to supply China with more natural gas, and sweetened the deal by supporting China’s stance on Taiwan. Beijing reciprocated by opposing further NATO expansion in eastern Europe. Meanwhile, the European Commission outlined detailed sanctions that Russia would face if it were to invade Ukraine, in particular the limitation of access to foreign capital and export controls, but these sanctions are expected to have very little impact on Russian economy.

Asia:

Markets were supported by strong Jan US jobs data, AMZN, SNAP earnings helped overall market sentiment, with tech index Nasdaq leading the way. Asian markets ended the week green, led by strong gains in Hang Seng (+4.3%) and Kospi (+3.2%). MSCI Asia Ex-Japan index was up 2.76%.

China has joined Russia in opposing further expansion of Nato, a significant step up in Beijing’s backing for Moscow as the leaders of the two countries agreed to deepen co-operation across a range of security, political and economic areas. The two countries said they were “seriously concerned” over the Aukus security pact reached between Australia, the UK and US last year. They also pledged to “increase co-operation” to counter attempts by external forces to undermine security and interfere “under any pretext”.

Russia’s Gazprom also signed a deal with China’s CNPC to supply gas via a new route with deliveries of 10bn cubic metres a year over 25 years.

China’s official manufacturing PMI slowed down to 50.1 in January whilst Caixin PMI focusing on smaller and export-oriented firms dropped to 49.1, the worst in almost two years given early Chinese New Year this year. The soft reading is likely to reinforce market expectations that policymakers need to roll out more support measures to stabilize the faltering economy. China’s central bank has already started cutting interest rates and pumping more cash into the financial system to bring borrowing costs down, and further easing steps are expected in coming weeks.

Inflation in China will remain modest in 2022, the nation’s top economic planner said a statement Sunday, if shifting monetary policies elsewhere weaken the rally in global commodities. Last year, when commodity prices soared, Beijing cracked down on hoarders and capped domestic coal, gas and steel prices. It said prudent monetary policy helped it avoid flooding markets with unnecessary stimulus. China expects monetary tightness in western countries to weaken price inflation on imports.

Singapore has signed a deal to host the Formula One race for seven more years, the longest extension to date. With a pandemic yet to be tamed, much is at stake for this year’s race weekend, slated for Sep 30 to Oct 2. New local cases tripled more than 13k after CNY. With less than eight months to go until this year’s race, question marks remain over the spectator turnout and the fringe entertainment activities, which would hinge on COVID-19 rules.

South Korea reported a record number of locally-transmitted Covid cases on Sunday, surpassing 1 million total infections for the first time. Thailand reported 10,879 new infections on Sunday, the highest single-day tally in four months. Vietnam will purchase 21.9 million doses of Pfizer Inc. Covid-19 vaccine doses for children aged five to 12, according to a post on the government’s website. Overseas tourists will be allowed to visit Australia by the end of February, after a Covid-related hiatus of almost two years, the Herald Sun paper reported Sunday.

COMPANIES

Facebook’s latest earnings disappointed. The company’s stock plunged more than 18% in after-hours trading yesterday because of the weaker results. The social media company has struggled to maintain its edge with teenagers and younger users, while a string of privacy and moderation scandals have battered its reputation.

Alphabet surged 7.5% during the regular session after posting record quarterly sales on Tuesday and announcing plans for a 20-to-one stock split, which Neil Wilson, chief market analyst for Markets.com, believes will make it more enticing to ordinary investors. Alphabet is still making lots of money. Google’s parent brought in $20.6 billion in profits last quarter.

Amazon.com Inc. shares surged Friday to the biggest increase in almost seven years. The shares rose 14% to $3,152.79 at Friday’s close. The company reported strong performance in its cloud division, a huge boost in profit largely driven from an investment in Rivian Automotive Inc., and a price hike in its flagship Prime membership offering.

Sony Group Corp. fell as much as 8.6% in Tokyo on Thursday after cutting its PlayStation 5 sales forecast and announcing weaker-than-expected results from its gaming division over the holiday period. Sony earlier this week announced an acquisition, a $3.6 billion deal for Bungie Inc., which was intended to help the company reach more users on platforms outside its PlayStation hardware ecosystem.

Advanced Micro Devices Inc rose 5.1% after the firm forecasted 2022 revenue above forecasts on Tuesday, amid global supply bottlenecks, following strong quarterly demand for its transistors. The positive sentiment extended to other chipmakers including Nvidia Corp, Qualcomm Inc and Micron Technology Inc, which advanced between 2.5% and 6.3%.

FX/ COMMODITIES

DXY. DXY USD index fell 1.84% to close the week at 95.485, as the direction in USD was dominated by EUR strength, despite a strong US payroll. NFP beats at 467k against consensus of 125k, while unemployment rate underperforms at 4.0% against consensus of 3.9%. Trading range between 94.0 and 97.5.

EUR. EURUSD rose 2.67% to close the week at 1.1449, as ECB President Lagarde delivered a hawkish pivot in the ECB’s post meeting press conference, announcing that risks to the inflation outlook are tilted to the upside, particularly in the near term. There might be a chance for a 2022 rate hike, as there was unanimous concern about inflation surprises. Overnight index swaps are now pricing in 43bps worth of rate hikes from the ECB this year alone.

GBP. GBPUSD rose 0.97% to close the week at 1.3531, as BOE voted to raise Bank Rate by 25bps to 0.5%, marking the first back-to-back rate hike since 2004. There were two big hawkish surprises where, (1) the hike decision was not unanimous, with four members voting for a 50bp hike. (2) BoE will cease to reinvest in its corporate bond portfolio from the end of 2023. BoE also upgraded their inflation forecasts once again, and now see CPI peaking around 7.25% in April. Overnight index swaps are now pricing in an additional 5 BoE hikes over the rest of the year.

AUD. AUDUSD rose 1.20%, but was unchanged against NZD. RBA kept its cash rate unchanged, but ended its QE purchases. RBA policy meeting included an upward revision to its inflation outlook, but guidance leaned dovish as the RBA noted the ceasing of QE purchases does not imply a near-term increase in interest rates.

Oil. Both the WTI and Brent hits a year to date high of 92.31 and 93.27 respectively end of last week. OPEC+ group agreed to a further output increase of +400k barrels per day in March, although recently the issue has been that suppliers are struggling to meet their quotas for a number of reasons, which has helped oil prices reach post-2014 highs lately. One of the reason for the oil rally was due to a surge in US natural gas futures amidst signs of further cold weather ahead.

ECONOMIC INDICATORS

M – CH PMI Comps/Svc, SZ Unemployment Rate, NO Indust. Pdtn, EU Sentix Inv Confid.

T – JP Current Account, US Small Biz Opti./Trade Balance

W – AU Cons. Confid., US Mortg. App./Wholesale Inv.

Th – JP PPI, AU Cons. Inflat. Exp., NO/US CPI, US Initial Jobless Claims

F – NZ MFG, UK GDP/Indust. Pdtn/MFG Pdtn/Trade Balance, SZ CPI, US Mich Sentiment