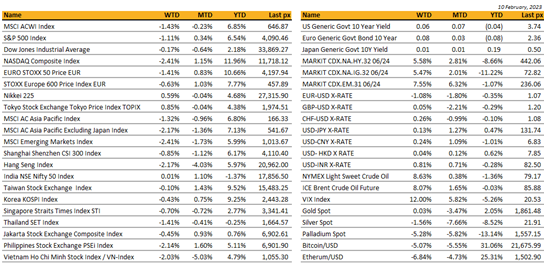

KEY MARKET MOVES

MACRO OVERVIEW

Global

The week that was, ended with the Tech-heavy Nasdaq registering its 1st weekly loss of 2023 following last week’s strong labor data and a host of Fed-speak preaching to the same hymn sheet of higher rates to come.

The bumper NFP is a double-edged sword, on the one hand supporting views of a resilient economy (ie. no recession) but on the other, could keep inflation elevated. A reversion to a deeper inversion between the 2 and 10 year Treasury yields to 80 plus bps reinforced signs that the economy may not be able to withstand additional rate increases without falling into a recession. The last time margins were this wide was in the early 1980’s. The UST10Y closed at 3.73% and the 2’s at 4.517%. US indices remain up a healthy 6.5% and 12.5% for the S&P 500 and Nasdaq 100 respectively.

CPI on Valentine’s Day could see Cupid shoot a lower CPI laced arrow or one with a poison tip in it ~ headline inflation expected at 6.2%, core at 5.5% and monthly at 0.5% and 0.4% respectively.

In its first post Fed meeting chat with Bloomberg’s Rubenstein, Powell mentioned last Tuesday that rates may peak higher than previously expected. Markets chose to instead focus on Powell’s outlook that the Fed expects “2023 to be a year of significant declines in inflation”, hence the rally we saw earlier during the week. Bloomberg reports option bets are building up, targeting a 6% Fed peak rate from the current 4.75% Funds rate. Earnings reports so far, continue to roll in mostly better than expected. Economic releases during the week saw a marginal pick up in both weekly and continuing claims. U. of Mich. Sentiment improved to 66.4 from 64.9, 1-year inflation expectation increased to 4.2% from 3.9% previously whilst the 5-10 year inflation expectation remains unchanged at 2.9%. This week’s highlight is the CPI, followed by retail sales, industrial production and PPI. Otherwise in the political scene, Biden’s administration added 6 Chinese entities connected to Beijing’s suspected surveillance balloon programme to an export list, jeopardizing the warming of ties between the 2 countries, started in Bali. Cryptos underwhelmed, tracking risk sentiment to trade at BTC$21,750 and ETH$1,5050. We think that Fed rates are close to its peak circa 5.10% average December dot plot. With LT yields however, trending higher, we see opportunistically a window to add to duration, whilst remaining in IG in $ yielding 6% to 6.25%.

Asia

Asian equities ended mostly lower Friday. Greater China led the decliners with Hong Kong technology stocks sharply lower, mainland stocks also down. Australia was lower, Southeast Asia also down sharply, India also extended early losses as several Adani stocks saw their weightings lowered in MSCI indices. For the week, MSCI Asia ex Japan closed down 2.17%.

US secretary of state Antony Blinken, who had been due to travel to China, had called off his visit at short notice after the Chinese balloon’s incursion into US airspace became public. US says Chinese balloon that was shot, had tools to collect electronic communications. Today it was reported that the US military said it shot down yet another a high-altitude object over Lake Huron on Sunday. US officials have been trying to identify the origins and purpose of the three aerial objects shot down in the past three days, but so far have not announced any conclusions.

White House preparing new rules to restrict US investment in China. News of this weighed on the Chinese as well as US markets. The new rules would restrict US dollars from flowing to China and that are currently used to finance the development of advanced technologies, which could be used in a war within Chinese borders. Measures are now mostly complete and could be issued within two months.

China is providing technology that Moscow’s military needs to prosecute the Kremlin’s war in Ukraine despite an international cordon of sanctions and export controls, according to a Wall Street Journal review of Russian customs data. The records show Chinese state-owned defense companies shipping navigation equipment, jamming technology and jet-fighter parts to sanctioned Russian government-owned defense companies.

China’s CPI up 2.1%, PPI down 0.8% from a year earlier in January. . Food prices remained a positive driver, though pork prices fell sharply on the month, leaving year-ago increases significantly lower than much of last year. Fuel prices also fell sequentially. Travel prices were up 11.2% y/y reflecting strength in airfares, cinema/performance, and tourism.

China’s number of covid-related deaths and severe cases have both declined by 98% from peak levels of early Jan, and more than 90% of the entire population have been fully vaccinated.

Australia-China relations on the mend after Australia Trade Minister Don Farrell and China Commerce Minister Weng Wentao held virtual talks on Monday. China companies have reportedly resumed purchases of Australian coal after Beijing’ unofficial ban was lifted and there is speculation trade bans on other Australian exports such as wine, barely and lobsters will be lifted, albeit gradually. China students also returning to Australian universities, which is projected to deliver a A$5B boost to Australia’s economy.

Few surprises from RBA Statement on Monetary Policy. Near-term CPI forecasts revised up due to energy prices and labor costs. Inflation not expected to return to target until 2025. Forecasts based on assumed peak cash rate of ~3.75% in H2 (implying around two more rate hikes).

News post the close that Japan’s government will nominate Kasuo Ueda as its next BOJ Governor a major surprise. The former member of BOJ policy board was not mentioned as shortlisted candidate however early interpretations are this could represent a substantial departure from Kuroda’s ultra-low rate policy era.

Indonesia GDP expanded 5.01% y/y in Q4, compared to consensus 4.92% and follows 5.72% in the previous quarter. Left full-year growth at 5.31%, matching expectations. Also consistent with government forecast range of 5.2%-5.3% and central bank projection of 4.5%-5.3%.

Philippine January CPI rose +8.7% y/y vs est. +7.6% and December’s +8.1%. The Reserve Bank of India hiked rates 25 bps as expected and left the door open for further hikes by keeping ‘withdrawal of accommodation’ stance but paradoxically hinted at a pause to see how past hikes will affect the economy.

MSCI confirmed Thursday it would not delete any Adani stocks from its indices in quarterly review. Adani Group stocks in past few days rallied as group has repaid loans and pledged to reduce debt ratios however Enterprises stock price still more than halved from pre-Hindenburg research report.

Credit

Not much changes on the shape of the US Treasury Curve were all points on the curve continued to moved higher last week, with the 2years up 17bps, 5years up 23bps, 10years and 30years were up 19bps.

This week will be much more busy in term of economic data from the US with the January CPI tomorrow, the January Retail sales and the Industrial Production on Wednesday and the January PPI on Thursday.

Prime Minister Fumio Kishida was expected to pick a continuity candidate to be the Bank of Japan’s next governor from a conventional shortlist, as Haruhiko Kuroda prepares to step down after a decade at the helm of the central bank. Instead, the Japanese leader sent shockwaves across global markets on Friday following reports that he had broken with tradition and picked an outsider to Japan’s policy and political establishment: economist Kazuo Ueda. If the Diet approves Ueda’s nomination as expected, it would be the first time in postwar Japan that an academic was appointed central bank chief, a role that had historically rotated between officials from the BoJ and the finance ministry.

FX / COMMODITIES

DXY USD index rose 0.69% to 103.63, as markets take terminal rate pricing to a new cycle peak above 5.15% and increase the probability of consecutive 25bp hikes lasting into June following the strong labor data. In addition, hawkish fed speakers support the USD upward trend, with inversion in 2s10s reaching its deepest level since the early 1980s at -87bp. Data wise, Michigan consumer sentiment came in at 66.4, above consensus, while initial jobless claims came in at 196k, above consensus.

EURUSD fell 1.08% to 1.0678 despite hawkish ECB members speech, as risk on carry trades were squared. Data wise, retail sales came in at -2.7%, below consensus.

GBP rose 0.05% against USD to 1.2062, and 1.14% against EUR to 0.88531, as UK narrowly avoids a technical recession with GDP qoq at 0.0%, in line. Manufacturing production and industrial production were better than consensus.

USDJPY rose 0.13% to 131.36 last week. Last Friday, media reports suggested Kazuo Ueda will likely be nominated as the next BoJ governor, which implies a less dovish policy. This announcement comes as a surprise to markets as USDJPY initially falls 150 pips, below 130, before paring losses as Ueda says the Bank’s current policy is appropriate. Data wise, wage growth in Japan rises to 4.8% yoy (C: 2.5%), its highest level in about 26 years, with limited FX impact though.

Oil & Commodity Bloomberg Commodity Index rose 1.50%, as both WTI and Brent rose 8.63% and 8.07% respectively, to 79.72 and 86.39. This was following Russia announcement that it would cut oil production by 500k bpd, or 5% output, in retaliation for Western price caps on Russian oil. In addition, media reports indicated OPEC+ would not boost production despite the Russian output cuts. Gold was almost unchanged at +0.03%.

ECONOMIC DATA

M – SZ CPI

T – NZ House Sales/ Food Prices/ Inflation Exp., AU Cons./Biz Confid., JP GDP/ Indust. Pdtn,

UK Unemploy. Rate, NO GDP, SZ PPI, EU GDP/ Employ., US Small Biz Opti./ CPI

W – CH LFR, JP Tertiary Industry Index, UK CPI/PPI, EU Indust. Pdtn/ Indust. Pdtn, US Empire

Mfg/ Retail Sales/ Indust. Pdtn, CA Housing Starts/ Mfg Sales

Th – JP Trade Balance/ Core Machine Orders, AU Unemploy. Rate, US Initial Jobless Claims/ PPI

F – UK Retail Sales, SW Unemploy. Rate, US Leading Index

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.