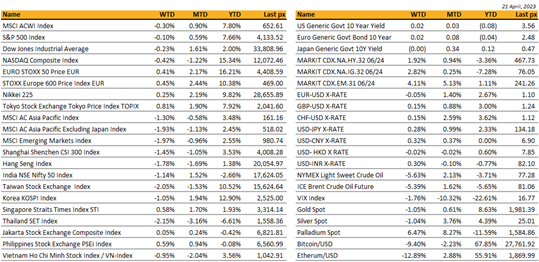

KEY MARKET MOVES

MACRO OVERVIEW

Global

US markets closed the week relatively flat as it wades its way through mixed earnings reports and Fed-speak. April so far, is seeing markets consolidate following March’s turbulent regional banks turmoil. Big Tech, which has been powering the year’s performance in the Nasdaq and are heavyweights in the S&P 500, will report its earnings this week. So far, albeit early days yet, 77% of S&P 500 companies that have reported, beat estimates. The VIX closed at 2021 levels, at 16.77. Some mixed data releases added to angst about the path of rate hikes, with the purchasing managers’ index unexpectedly climbing to a near one-year high threatening to reignite inflationary pressures. All 3 components of manufacturing, services and composite measures beat expectations. Geopolitical tensions remain, this time from Biden reportedly aiming to sign an executive order in coming weeks, to limit US businesses’ investment in key parts of China’s economy.

Thursday’s continuing claims jumped to the highest since 2021 at 1.865 mln indicating some weakening in the labour market but not yet seen as enough to alleviate wage pressures. Still, we’ll take what we can get. Fed Cleveland’s Mester signaled support for another rate hike and urged to watch recent bank stress and NY’s Williams said price gains remained too high. Philadelphia’s Harker said the US central bank is getting near to the end of its interest rate hike campaign to cool high inflation.

The Fed’s Beige Book report showed that the US economy stalled in recent weeks, with hiring and inflation slowing and access to credit narrowing – possibly giving the Fed some leeway to cut rates by year end as inflation trickle down to its long run target. As we stand some 10 days away from the next FOMC, a 25 bps hike in the Fed funds rate to 5.25% is baked in.

This coming week will see the Fed’s preferred inflation gauge, the PCE Core Deflator data on Friday expected to be at 4.5% YoY and 0.3% MoM, followed by the U. of Mich. sentiment and Inflation expectations.

Cryptos surrendered some of its recent gains to trade below BTC30k after inflationary angst brought on by a stubbornly high UK inflation fanned fears of higher for longer rates.

BTC trade $27,600 and ETH at $1,860.

With LT yields in $ expected to progressively fall as the Fed ends its hiking cycle, Gold vols have expectedly fallen albeit only just below its average of ATM vol of 15.20 ~ currently at 14.60.

We’re looking at selling a Gold put strike at $1,950 (previous early Feb peak) for a yield of 6.5% per annum for 3 months.

Asia

Asian markets closed lower last week. MSCI Asia Ex Japan was lower by nearly 2%.Year to date, Asian markets are holding on to their gains still with the exception of India and Thailand, both negative for the year at -2.6% and -6.6% respectively. Taiwan and South Korea markets are leading year to date gains up 10.5% and 12.9% respectively.

Last week, China reported a Q1 GDP beat. The YoY figure came in at 4.5% (vs 4.0% median estimate on Bloomberg), and was supported by strong retail sales growth in a sign of a more consumer-led post-covid recovery. However, we also saw soft industrial production (YoY 3.9% vs 4.4% expected) and fixed asset investment data for March, in contrast to a retail sales beat (10.6% vs 7.5%). So this has highlighted an uneven recovery at this stage. The jobless rate fell to 5.3% in March, and youth unemployment hit the second-highest mark on record, at 19.6%

Treasury Secretary Yellen called for a constructive and healthy relationship while rejecting idea of decoupling from China. The positive tone of her remarks contrasted somewhat with reports of President Biden set to sign G7-backed executive order restricting investment in parts of China’s economy.

US House Committee on China war gamed Taiwan invasion scenario that demonstrated significant dangers for global economy and called for arming Taipei “to the teeth.” The war game wasn’t about planning a war, lawmakers said. It was about figuring out how to strengthen U.S. deterrence, to keep a war involving the U.S., China and Taiwan from ever starting.

Exports in Japan rose +4.3% y/y in March, down from growth of +6.5% in February mainly due to a drop in China-bound shipments. Imports outpaced exports, increasing 7.3% in the year to March. This was the smallest advance in two years. Japan’s trade deficit narrowed for the second consecutive month, contracting to 754.5 billion yen ($5.6 billion) from an upwardly revised deficit of 898.1 billion yen in February. PMI was 49.5 in April, remaining in contraction territory for a sixth consecutive month. Core CPI inflation remained steady at 3.1% y/y in March.

Russia and India have resumed free trade discussions after initial talks were delayed by Covid-19 and Russia’s invasion of Ukraine. Russia’s Deputy PM made the announcement while visiting Delhi last week. Even without a free trade agreement (FTA), India-Russia trade is flourishing. Russia’s exports to India have quadrupled since the West sanctioned Moscow last year. India now imports half its oil from Russia, up from 1% before the war.

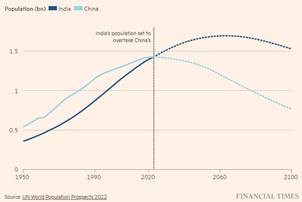

India became the world’s most populous country. With 1.4286 billion people, India now surpasses China’s 1.4257 billion; the US remains a distant third.

el nino

Finally on a separate note, concern is growing about the possibility of an El Nino weather event later this year. If history is any guide, that could bring a higher frequency of natural disasters, impacting harvests and food supply. The result would be renewed upward pressure on food prices and inflation, which recently have been receding. If an El Nino event does occur, changes in temperatures and weather events have the potential to negatively affect crops and the harvest, with a knock-on effect to food prices.

Agricultural goods like sugar or cocoa could be particularly affected. Sugar prices are trading at their highest prices over the last seven years and prices gained more than 20% over the last Month. The US Climate Prediction Center have issued an El Nino Watch. They think there is a 62% chance of an El Nino developing over May-July 2023, with the chances rising to 80% by the July-September months. Food prices make up around 13.5% of the US consumer basket but the impact on emerging market economies could be much worst as, in some countries, food makes up at least a third of consumer expenditure, making EM countries more vulnerable to shocks.

Finally, El Ninos are correlated with the spread of climate-sensitive infectious diseases. For instance, one study found that the El Nino in 2015 was a contributing factor to the spread of the Zika virus, since it created conditions beneficial for mosquito-borne transmission.

credit

Following the release early last week of these indicators, growing optimism around the economy’s near-term performance means that investors are now almost fully pricing in another Fed rate hike at their meeting on May 3. In fact, futures took the chances up to 88%, which is their highest since the SVB collapse. And looking further out, the rate priced in by the December meeting rose +8bps to 4.55%, which is likewise a post-SVB high. In many respects, what we’ve seen so far is reminiscent of the Fed ‘pivot’ trades over the last 18 months, when investors would dial back the prospect of rate hikes and grow hopeful about a dovish shift in response to some shock, before ratcheting them even higher still as both the economy and inflation proved resilient.

As a reminder the balance sheet of the Fed started to decrease about a year ago when the balance sheet level was reaching USD 8.95Trillions. The pace of the reduction was then increased to USD 95Bio per Month around September last year. Many participants in the market were saying that the announced pace of Quantitative Tightening or QT would be equivalent to 2 to 3 additional 25bps monetary policy tightening. But did QT really happened at the pace that was announced by the Fed. The answer is simply no. Based on what was initially announced, by now, the reduction of the Fed balance sheet should have reached close to USD 1Trillion, bringing down the balance sheet to around USD 8trillions. As of last week, the balance sheet of the Fed is still standing close to USD 8.6Trillions, therefore way behind what was projected about a year ago. The main but not only factor explaining this difference is the balance sheet increase of roughly USD 300bio that happened last Month after the fall of Silicon Valley Bank and other financial institutions in the US.

In term of the US Yield curve and fixed income performances, the shape of the curve was roughly unchanged, evolving along the mix set of data that were reported. US IG gained 0.20%, US HY lost 0.10% and leverage loans were unchanged over the week.

FX / COMMODITIES

DXY USD index fell to low of 101.42 following a weaker than expected ADP employment last Wednesday. DXY recovered to close the week at 102.09 after a weaker ISM services index as risk sentiment deteriorates. Non-farm payroll came in above consensus but lower than prior month. (Actual: 236k, Consensus: 230k, Prior: 311k). Unemployment rate came in at 3.5%, lower than consensus of 3.6% as well.

EURUSD rose 0.61% to 1.0905 following broad based USD weakness. ECB Chief Economist Lane says “if the baseline we developed before the banking stress holds up, it will be appropriate to have a further increase in May,” though “we need to be data-dependent about the assessment of whether that baseline still holds true at the time of our May meeting.”

GBPUSD rose 0.66% to close the week at 1.2418 following broad based USD weakness. Sterling rose to a year to date high of 1.2525 intra-week after the US ADP employment release though.

USDJPY fell 0.53% to 132.16 following broad based USD weakness. Media reports suggested Japanese Prime Minister Kishida will meet with new BoJ Governor Ueda on April 10, and that Kishida would not request any policy changes anytime soon; however, the reaction in FX markets appeared to be relatively limited.

Oil & Commodity. Bloomberg Commodity Index rose 0.69%, driven by a continued rebound in WTI (+6.65%) and Brent (+6.71%) last week, as OPEC+ announced a surprise oil production cut. Both WTI and Brent consolidated at its psychological levels of 80 and 85, closing the week at 80.7 and 85.12 respectively. Gold broke its psychological level of 2,000, rising 1.96% to close the week at 2007.91, as US yields continued to fall. Aluminium and Iron Ore fell 3.69% and 3.85% respectively towards the end of the week as risk sentiment deteriorates.

ECONOMIC DATA

M – JP Trade Balance, US Wholesale Inv.

T – AU Cons. Confid./Biz Confid., CH CPI/PPI, JP Machine Tool Orders, NO CPI, EU Sentix Inv. Confid., US Small Biz Opti.

W – JP PPI/Core Machine Orders, US MBA Mortg. App./CPI/FOMC Mins

Th – AU Unemploy. Rate, CH Trade Balance, UK Indust./Mfg Pdtn/Trade Balance, EU Indust. Pdtn, US Initial Jobless Claims/PPI

F – NZ Biz Mfg, SW CPI, CA Mfg Sales, US Retail Sales/Indust. Pdtn/Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.