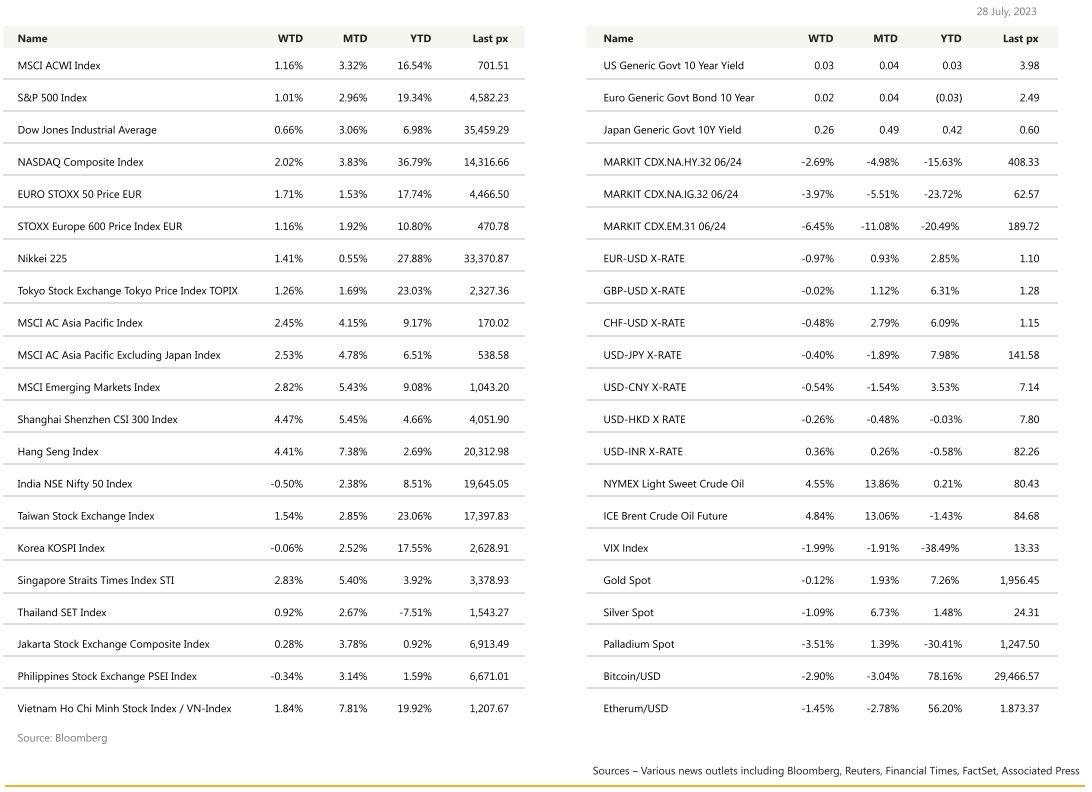

KEY MARKET MOVES

MACRO OVERVIEW

Global

US stocks finished higher on Friday on dwindling recessionary expectations, recording gains for the week over a slew of positive quarterly results, economic data and Fed decisions. Personal spending was higher at +0.5% m/m while PCE price index was inline. Treasuries weakened with 2- and 10-year yields dipping 5bps to 4.88% and 3.95% respectively.

Chair Powell seemed to take a more dovish tack with respect to future policy actions. We saw this in a few areas. First, when asked about the 2023 median dot, which had projected two more hikes at the June meeting, Powell did not ratify those expectations, saying “we have eight weeks now until the September meeting and all that data I recited, we’ll be looking at that and making that assessment then.” Second, the Chair leaned on the cumulative tightening to date and the current restrictive level of policy rates, saying “the federal funds rate is at a restrictive level now. So, if we see inflation coming down credibly, sustainably, we don’t need to be at a restrictive level any more. We can move back to it, to a neutral level and then below a neutral level at a certain point.”

Markets seem to be embracing a goldilocks-type scenario. The Fed and other global central banks may be nearing an end to rate hikes, inflation continues to moderate, and lastly growth remains resilient.

We will be watching this coming week data on US initial jobless claims, productivity, factory orders, ISM Services, due Thursday and US unemployment rate, non-farm payrolls, due Friday.

Asia

Asian equities ended broadly higher last week. MSCI Asia ex Japan was higher by 2.53% last week, taking YTD gains to +6.51%. Hong Kong and China’s CSI 300 were buoyant on the back of China’s pledge to step up policy support for its stuttering economy soothed sentiment and lifted beaten down Hong Kong and Chinese stocks. They were up by about 4.4% last week each.

After China’s Politburo meeting, China’s leaders have vowed to spur consumer spending, tackle unemployment, and give more support to the ailing property sector. A readout from the meeting said, “It is necessary to boost the consumption of automobiles, electronic products and home furnishing, and promote the consumption of services such as sports, leisure, and cultural tourism”. The Politburo also acknowledged challenges to the economy, including “insufficient domestic demand” and difficulties faced by some businesses, a slightly bullish signal.

Officials from the National Development and Reform Commission, and other ministries will hold a press briefing at 3pm Monday in Beijing to outline measures to expand consumption.

The Bank of Japan announced unscheduled bond-purchase operations as yields on benchmark 10-year debt climbed to a fresh nine-year high in the wake of last week’s policy adjustment. The yield climbed 6.5 basis points to 0.605% before easing back 0.6% after the BOJ said it would buy 300 billion yen ($2.1 billion) of five-to-10 year notes at market yields. The BOJ’s step Friday to make its previous 0.5% ceiling a reference point, not a definite limit, is rumbling through Japanese rates markets and debt trading globally. With the BOJ now seen tolerating moves up to 1%, this bolsters the view that a wave of Japanese cash invested in everything from Treasuries to European bonds to Brazilian debt may soon flow out of global markets toward home.

Japan’s population fell in all of its 47 prefectures for the first time. The country’s numbers fell by 0.65%, or 800,000 people, in 2022—and the number of foreigners living in the country hit a record 3 million.

Bank Indonesia kept its 7D reverse repo rate unchanged at 5.75% as expected. Deposit facility rate also kept steady at 5.0%, lending facility at 6.5%. Bank said current rate level sufficient to ensure inflation stayed within target this year after falling to within target range in May. Policymakers had been under some pressure to cut rates given some evidence of deflationary trend but weakening rupiah seen as trumping price concerns.

Thailand – Exports shrank for a ninth consecutive month in June, albeit at a smaller rate than expected, as global demand remains sluggish, but the commerce ministry said on Wednesday it still expects some growth for the full year. Customs-based exports, a key driver of Thailand’s economy, dropped 6.4% in June from the same month a year earlier, beating analysts’ average estimated decline of 7.3% in a Reuters poll. Exports rose 2% from May.

Thailand’s parliament is scheduled to meet on Aug 4th to pick a new prime minister as a coalition of pro-democracy parties seek to end a political impasse that has gripped the country since the May general election. The planned vote will be the first after Pheu Thai Party took the lead in forming the government. Pita Limjaroenrat, Move Forward party leader, was twice thwarted by conservative senators who objected to his reformist agendas.

Geopolitics – US/ China/ Chips

The Chinese embassy in Japan said on Monday that NATO’s plan to expand into the Asia-Pacific violates U.N. rules and hoped Japan, in its interaction with NATO, would refrain from actions that undermine trust among countries in the region.

China has made significant progress building a naval base in Cambodia and is close to completing a pier that could berth an aircraft carrier. The Pentagon believes China is building a facility in Cambodia to boost its ability to project naval power. China and Cambodia have denied that the People’s Liberation Army will have access to the base.

U.S. President Joe Biden is planning to sign an executive order to limit critical U.S. technology investments in China by mid-August. The order would focus on semiconductors, artificial intelligence and quantum computing, Bloomberg reported, adding that it would not affect any existing investments and would only prohibit certain transactions.

CREDIT/ TREASURIES

Positive US real growth and expectation of a peak US interest rate resulted in credit spreads tightening last week. High Yield credit spreads tightened to 408.33, a level last seen in February this year, while Investment credit spreads tightened even further to 62.57, a level last seen in February last week.

Adjustment in Japan YCC pushed global yields higher, while US treasury yields bear steepened last week, as UST 10 and 30 years rose 11 bps, and 2 years rose 3.7 bps.

FX

DXY USD Index rose 0.55% due to strong US data and weakening EUR. Data wise, Real growth (Advance release of 2Q23 US GDP) came in above consensus at 2.4% q/q (C: 1.8%; P: 2.0%), supported by strong business investment and resilient personal consumption at 1.6% qoq (C: 1.2%; P: 4.2%). Core PCE inflation in June came in at 4.1% yoy (C: 4.2%; P: 4.6%).

On the FOMC, the FED hiked 25bps as expected, and the statement was largely in line with expectation, reiterating the data-dependent approach. Chair Powell stated that the FED staff is no longer forecasting a recession, and do not see inflation back at 2% until about 2025. Slow-down in June CPI is welcome, but it is only one month.

EURUSD fell 0.97% to 1.1016, as ECB President Lagarde says the near-term economic outlook has deteriorated and the ECB needs

to keep an “open mind” about decisions in September and beyond. ECB delivered a 25bp rate increase to raise the depo rate to 3.75%. The statement reiterates past hikes continue to be transmitted forcefully, and financial conditions have now tightened again and are increasingly dampening demand. Data wise, Composite PMI for July prelim came in at 48.9 below consensus, as both the Manufacturing (42.7) and Service PMI (51.1) were below consensus.

GBP fell 0.02% against USD to 1.2851, while it rose 0.95% against EUR to 0.8656, as GBP was supported by positive risk sentiment. Data wise, composite PMI for July prelim came in at 50.7 below consensus, as Manufacturing PMI at 45.0 and Services PMI at 51.5 were both below consensus. We have the BoE rate decision this Thursday, where BoE is expected to hike 25 bps.

JPY was volatile last Friday, as BoJ adjusted the conduct of its YCC framework to allow 10y JGB yields to fluctuate in a range of +/- 0.5% around zero, with the upper and lower bounds of the range now references, not rigid limits. The rationale for conducting YCC with greater flexibility was to enhance the sustainability of monetary easing. USDJPY fell close to 138, before rebounding to close the week at 141.16, as BoJ explicitly states sustainable and stable achievement of the 2% price stability target “has not yet come in sight.” Data wise, Tokyo CPI (ex-fresh food) was 3.0% yoy in July (C: 2.9%; P: 3.2%). Tokyo CPI (ex-fresh food and energy) accelerated to 4.0% yoy in July (C: 3.7%; P: 3.8%).

Oil & Commodity

Bloomberg Commodity Index rose 0.97%, supported by positive risk sentiment, given the substantial upside on US 2Q GDP and a more dovish than expected China Politburo. More dovish-thanexpected Politburo meeting suggests more China stimulus to come, promising housing easing, local debt resolution, and a boost to capital markets. WTI and Brent both rose more than 4.5% last week, with WTI at 80.58 and Brent at 84.99. Gold fell 0.12% to 1959.49.

ECO

Monday – JP Retail Sales/ Indust. Pdtn, NZ Biz Confid., AU Inflation, CH PMI, UK Mortg. App., EU GDP/ CPI, US Chic. PM

Tuesday – NZ Building Permits, JP Jobless Rate, JP/CH/EU/NO/UK/US/CA Mfg PMI July Final, AU Building App./ RBA OCR, UK Nationwide House Px, EU Unemploy. Rate, US JOLTS/ ISM Mfg/ ISM Price paid

Wednesday – NZ Unemploy. rate, US Mortg. App./ ADs

Thursday – JP/CH/EU/UK/US Svc/Comps PMI July Final, AU Trade Balance, SZ CPI, EU PPI, US Initial Jobless Claims/ Factory Orders/ Durable Goods/ ISM Svf

Friday – UK Construction PMI, EU Retail Sales, CA Unemploy. rate, US NFP

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.