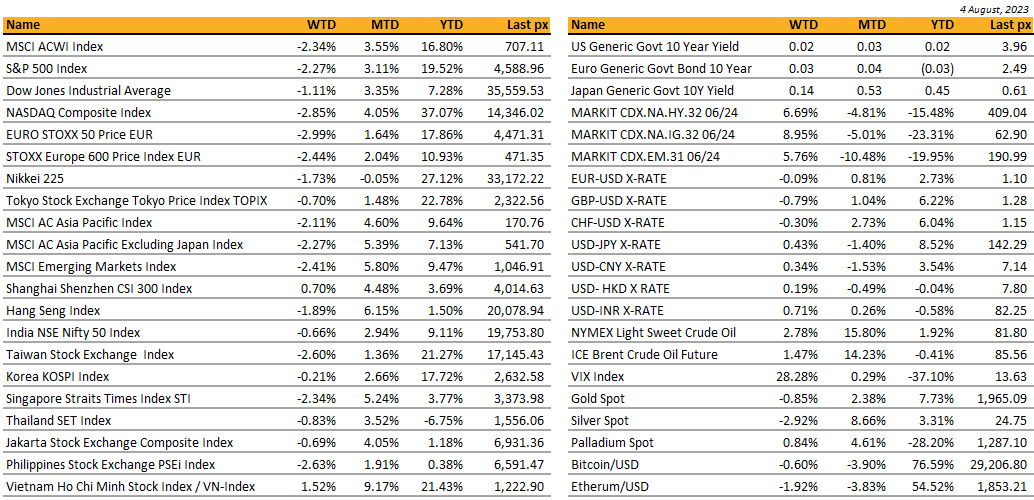

KEY MARKET MOVES

MACRO OVERVIEW

Global

US equities declined this week, with the S&P 500 falling for the first time in four weeks, while the tech-heavy Nasdaq underperformed. Factors contributing to the downturn include concerns about a Fitch downgrade of US debt, apprehensions over a prolonged period of higher Fed-set interest rates, overbought market conditions, weakened investor sentiment, disinflation affecting earnings, fading economic normalization benefits, and rising oil prices. Mixed tech earnings, particularly Apple’s weaker hardware trends, added to the uncertainty. However, positive aspects like anticipated support for a soft economic landing, a peak in Fed actions potentially transitioning to rate cuts in early 2024, ongoing disinflation, favourable macroeconomic surprises, and strong household financial positions offer counterbalance to these concerns.

More than half of the S&P has now reported, with 80% of reporters showing a positive EPS surprise (better than the five- and 10-year averages) while 64% logging a positive revenue surprise.

Fitch downgraded the United States’ long-term credit ratings to AA+ from AAA and removed Rating Watch Negative. Key drivers of the ratings downgrade are “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance” after repeated debt limit standoffs and last-minute resolutions. Fitch estimates “the general government (GG) deficit to rise to 6.3% of GDP in 2023, from 3.7% in 2022, reflecting cyclically weaker federal revenues, new spending initiatives and a higher interest burden.

The main driver of the increased borrowing estimate ($274bn) from May was the Treasury General Account (TGA). This higher TGA build will likely be accounted for in the form of increased bill supply (of which, so far, has been absorbed smoothly post debt-limit resolution in early June) over the coming months. This likely does cause Treasury to deviate from its May refunding guidance of “modest” increases in auction sizes later this year. Although continued increases in near-term deficit estimates ($83bn for the July-September quarter) and expectation for T-bill share of outstanding debt to rise above Treasury Borrowing Advisory Committee (TBAC) recommended 15-20% range, skews risk to more coupon increases at November refunding and beyond.

The US Treasury sell-off persisted through economic data releases, which showed a still-challenged US manufacturing sector along with modest signs of slack in the labour market. The July ISM Manufacturing rose slightly to 46.4 in July Vs 46.0 the previous Month, but still below consensus, but the employment subindex fell to 44.4 Vs 48.1 the previous Month, the lowest level in three years. Simultaneously released JOLTS Job Openings came out roughly in line with consensus at 9.6Mio, but the total private sector quits rate fell back to recent lows of 2.70% Vs 2.90% the previous Month. Friday’s employment report was mixed, with weakness in job gains, offset by a drop in the unemployment rate to 3.50%, followed by another strong reading for average hourly earnings at +4.40% but the workweek dropped by 0.1 to 34.3. Participation rate was unchanged.

US job openings missed, down to 9.58mn in June (consensus at 9.6mn). Private sector quits dropped back to 2.7% after jumping up to 2.9% in May (2.7% is equal lowest since early 2021). Details show easing labour market pressures at the margin, but job openings to unemployed remains elevated at 1.6.

This week main economic data releases in the US are the July CPI and PPI numbers as well as the University of Michigan sentiment Index.

Asia

Asia markets inched lower last week. MSCI Asia dipped 2.11%. The Shanghai Stock Exchange Index gained 0.37% while the blue-chip CSI 300 advanced 0.7%. China’s manufacturing activity fell for a fourth straight month in July. The Caixin manufacturing purchasing managers index declined to a six-month low of 49.2 in July from 50.5 in June. To counter this trend, China’s State Council introduced measures to boost consumption in the automobile, real estate, and services sectors. These include enhancing electric vehicle charging infrastructure, supporting affordable housing, and promoting tourism by reducing admission fees.

Data from China Real Estate Information Corp reported value of new home sales by top 100 property developers fell 33.1% y/y to CNY350.4B ($49B) for second month in a row. The drop was the sharpest in a year and seen as a blow to developers who need cash to alleviate ongoing crisis, which might lead more to default in near future.

Beijing has unveiled a system to limit minors’ device usage. The Cyberspace Administration of China require device makers, operating systems, apps and app stores to build out a new function called “minor mode” that will set time limits and curfews on usage. Hong Kong-traded shares in social media giant Tencent ended the day down 3 per cent when the news was announced. Shares in video service Bilibili fell 7 per cent and short-video maker Kuaishou declined 3.5 per cent. The rules also push online content providers such as ByteDance and Tencent to create a separate and limited pool of videos and games available to anyone under 18 using a device in minor mode.

- In China, we stick to Value based strategies. For China credit, we like absolute return strategies as we believe the choppiness in the property sector offers many opportunities on both sides of the trade.

China’s struggling economic recovery had a significant impact on major manufacturing economies in North – Asia. Taiwan experienced one of the most notable declines, dropping around 2.6% last week. Taiwan’s Purchasing Managers’ Index (PMI) fell to an eight-month low of 44.1, while Japan’s PMI slightly decreased to 49.6, as reported by S&P Global and au Jibun Bank. Although South Korea’s PMI showed a marginal improvement to 49.4 in July, it remained below the 50-mark that indicates a contraction.

Domestic demand partly helped insulate Southeast Asia, with new business and steady production propelling factory activity to expand to a region’s best 53.3 in Indonesia and 51.9 in the Philippines. The downturn in manufacturing hub Vietnam, meanwhile, eased to 48.7 from 46.2 amid subdued demand in its export markets. Thailand’s central bank raised its benchmark interest rate to the highest level in nine years, while signalling it may be nearing the end of its tightening campaign. BoT increased the one day repurchase rate by 25 basis points to 2.25% as widely expected.

- We continue to like ASEAN as a growth pocket in wider Asia. We continue to hold exposure to Vietnam via funds. We also like some companies in Indonesia focusing on the consumer/ consumption theme which is benefiting greatly in the middle-class expansion and digitalization of the country.

Delhi is restricting the import of laptops, tablets and servers in a move designed to boost domestic manufacturing. Prime Minister Narendra Modi’s government is seeking to elevate India as a tech manufacturing hub.

The Reserve Bank of Australia left its cash rate at 4.1% for a second straight meeting. Even so, Lowe maintained his tightening bias, highlighting ultra-low unemployment of 3.5% and still-high consumer prices. Core inflation at 6% is double the top of the RBA’s 2-3% target. “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon the data,” Lowe said in his post-meeting statement.

CREDIT/ TREASURIES

The durability of the US rates sell-off despite some weak data suggested the presence of technical forces, perhaps anticipation of increased US Treasury supply and/or follow-through positioning ahead of potential actions of market participants in the wake of the BoJ’s decision to incorporate greater flexibility into its YCC framework. It is important to note that BOJ proceeded with two unscheduled debt purchase operations over the last week.

The 10years JGB yield increased by 17bps over the last 6 trading sessions, reaching 0.62%. In that regard, long-end US Treasuries underperformed as 10Years and 30Years yield went up by 10bps & 19bps respectively, reaching their highest level since mid-November. This was the driving force in a continuation of the steepening in 2s10s, trading currently at -74bps, nearly 35bp steeper compared to 1Month ago. US IG lost 1.50% over the week while US HY lost 65bps.

We believe that, for client accounts holding a high level of liquidity, it might make sense to start adding some duration risk back into their portfolios, but we would recommend doing this very gradually as some further flattening of the curve is not to be excluded.

FX

DXY USD Index rose 0.39% to 102.02, as Fitch downgrade of the US long-term credit ratings to AA+ from AAA invokes concerns across risk markets. Data wise, Non-farm payrolls came in below expectation at 187k (C: 200K), while unemployment rate came in lower at 3.5% (C: 3.6%). Average hourly earnings came in at 0.4% mom, above consensus. ISM manufacturing came in at 4.4, below consensus, while ISM prices paid were below expectation as well.

EURUSD fell 0.09% to 1.1001, relatively unchanged last week. Data wise, a plateau in preliminary July euro area core inflation at 5.5% yoy (C: 5.4%; P: 5.5%), while stronger-than-expected 2Q23 euro area advance GDP came in at 0.3% qoq (C: 0.2%; P: 0.0%). Unemployment rate came in at 6.4% (C: 6.5%), while retail sales mom for Jun came in below expectation.

GBPUSD fell 0.79% to 1.2749, as BoE delivered a 25bp rate hike to bring Bank Rate to 5.25%, with a focus on a “higher for longer” message as policy transmission is working, though the decision was split 3 ways. Market is now pricing two more rate hikes till the end of the year.

JPY was volatile last week, with two BoJ’s unscheduled bond purchase operation in a week. USDJPY rose to a high of 143.89, before paring its gain to close the week at 141.76, after the weaker than expected US non-farm payrolls. BoJ intervened to slow yield spike, as 10 years JGB yield eventually close the week at 0.649. BoJ Deputy Governor Uchida explains the goal of YCC with greater flexibility is to continue monetary easing patiently, but with a nimble response against both upside and downside risks amid the significant uncertainty in domestic and overseas fundamentals.

Oil & Commodity

Bloomberg Commodity Index fell 1.21% due to negative risk sentiment from the US long term credit rating downgrade. Copper and Iron Ore fell 1.50% and 1.62% respectively. WTI and Brent rose 2.78% and 1.47% respectively, as Saudi Arabia extended its unilateral oil production cut by another month and said it could be prolonged further or even deepened. That will hold output at about 9 million barrels a day, the lowest level in several years. Gold fell 0.85% to 1942.91 due to USD strength.

ECO

M – SZ Unemploy. Rate, NO Industrial Pdtn, EU Sentix Inv. Confid.

T – JP BoP Current Acc, AU Cons. Confid./ Biz Confid., CH Trade Balance, US Small Biz Optim.

W – CH CPI/PPI, CA Building Permits

Th – JP PPI, AU Cons. Inflation Exp., NO CPI, US Initial Jobless Claims/ CPI

F – NZ Biz Mfg/ Food Prices, UK Indust. Pdtn/ Mfg Pdtn/ Trade Balance/ GDP, US PPI/ Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.