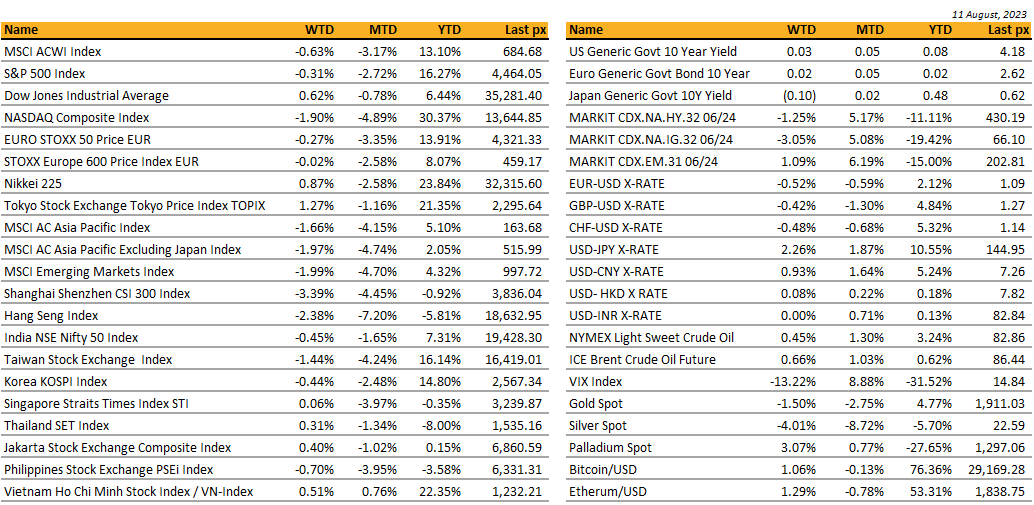

KEY MARKET MOVES

MACRO OVERVIEW

Global

The week came that came to pass saw US stocks inching lower overall with the Nasdaq giving up the most at -1.90%. Despite inflation cooling somewhat, the Fed Reserve remains split on its hiking path. Plenty of Fedspeak last week:

SF’s Daly said the Fed has more work to do to “resolutely bringing inflation back down to its 2% target” and Fed Governor Bowman reiterated her view that the Fed may need to raise further to fully restore price stability, whilst Philly’s Harker said the Fed may now be able to cease rate increases though rates may need to stay at current levels for some time. Chicago’s Goolsbee sought patience through the disinflation process and is hopeful of its 2% target without causing a recession. Atlanta’s Bostic said rates are in a restrictive stance, employment gains are slowing, and that there is no need to hike rates further.

Data out Thursday showed the core consumer price index — which excludes food and energy costs — rose 0.2% for a second month, marking the smallest back-to-back gains in more than two years. The overall CPI also increased 0.2% in July and 3.2% from a year earlier. Headline and core producer prices for July however, came in a little stronger than expected, data showed Friday, boosting Treasury yields and sinking Tech megacaps. The recent upswings in oil and LNG was not captured in the last report – increases that some investors suggested could soon force the Fed back into a hawkish posture. Fed Chair Jerome Powell could signal ongoing hawkishness at its Jackson Hole, Wyoming, policy symposium at the end of August, as he did last year OR strike a more almost there” tone. Inflationary expectations from the U. of Mich. survey came in lower than expected at 3.3% and 2.9% for the 1-Yr and 5-10 Yr series respectively.

Earlier in the week, Moody’s cut the credit rating for 10 midsize and small US banks yesterday whilst warning that it may also downgrade some of the nation’s biggest lenders, believing that they are being squeezed by funding risks, possible regulatory capital weaknesses and increased risk exposure to commercial real estate loans. The UST10Y yield ended up at 4.15%.

The BLS reported jobless claims climbed to 248k, higher than expected, possibly signalling problems brewing on the labour front. When looking at all this back & forth, the VIX paints a rather demure picture. At 14.84 it is hardly alarm bells blaring.

- We take this opportunity, whilst maintaining an exposure to equities – to start switching into value stocks: via the SPYV ETF which continue to lag that of the S&P at +13.55% YTD.

- We would also take this opportunity in USD strength to look at hedging out some bbb USD exposures into Euro (circa 1.0900-20) where we view a 1.1200 target in the next quarter cannot be ruled out as the Fed sits pat whilst the ECB maintains its hiking path.

This week will see the release of retail sales, manufacturing & industrial production data together with the last FOMC meeting minutes.

Asia

MSCI’s broadest index of Asia-Pacific ex Japan Index lost 1.97% last week. Japan’s Nikkei 225 Index was the best performer last week, supported by the weak yen.

USDJPY traded at 144.9 last week, Yen by 2.26%. Toyota (7203.T), Honda (7267.T) and Nissan (7201.T) recently reported earnings that topped analyst estimates by 6% to 21% in the three months through June, and all cited the currency as a factor.

Chinese financial markets faced a sharp decline with the Shanghai Stock Exchange Index dropping by 3.01% and the CSI 300 blue chip index losing 3.39%. Meanwhile, Hong Kong’s Hang Seng Index retreated by 2.38%.

Investor sentiment was negatively impacted by growing signs that China’s economic recovery has peaked. This was highlighted by the simultaneous decrease in consumer and producer prices, a trend not seen since November 2020, indicating weakened demand. Additionally, recent credit data disclosed the lowest level of new loans in July since 2009.

The situation worsened due to the financial struggles of debt-laden property developers. Notably, Country Garden, a major developer, missed interest payments on dollar-denominated bonds, prompting trading suspension for multiple onshore bonds while it plans repayment discussions.

Chinese shares and Asia in general is seen to be struggling today ahead of China data that is likely to amplify the case for serious stimulus even as Beijing seems deaf to the calls. This morning shares of China’s Country Garden (2007 HK) plunged more than 12% trading after the real estate company suspended trading in 11 of its onshore bonds from Monday.

- We are looking to trim our China exposure.

- ASEAN – Vietnam, Indonesia, and India remain our favourites in the region. While we invest in active fund managers in these regions, some passive ETFs for consideration are VNAM, IEDO, and INDA.

Asian markets will get key economic signals this week that could determine monetary policy in the continent’s two biggest economies – retail sales and industrial production and house prices from China, and Japanese GDP and inflation. Markets also will watch for interest rate decisions from New Zealand and the Philippines, inflation figures from India. Major corporate earnings reports from China this week are Tencent, Lenovo CNOOC and JD.com.

CREDIT/ TREASURIES

Moody’s last week lowered the credit ratings for 10 small and midsize US banks and said it may downgrade major lenders including U.S. Bancorp, Bank of New York Mellon, State Street, and Trust Financial, as part of a sweeping look at mounting pressures on the industry. Higher funding costs, potential regulatory capital weaknesses and rising risks tied to commercial real estate loans amid weakening demand for office space are among strains prompting the review.

Collectively, these three developments have lowered the credit profile of a number of US banks, though not all banks equally. Rising interest rates force firms to pay more for deposits and bump up the cost of funding from alternative sources. At the same time, those higher rates are eroding the value of banks’ assets and making it harder for commercial real estate borrowers to refinance their debts, potentially weakening lenders’ balance sheets. Rising funding costs and declining income metrics will erode profitability, the first buffer against losses.

There was a weak demand for an increased US 30Years Treasury auction of USD 23Bn which sold at a yield of 4.189%, the highest since 2011, pushed yields, on the long part of the curve, significantly higher. The Treasury sold last week a combined USD 103bn of new 3, 10 & 30years debts. The market expects further increases given the expected deficits the US Government is facing.

- We still believe that adding duration gradually make sense but, as this 30 Years auction demonstrate, some volatility element will remain moving forward.

The shape of the US Treasury Curve was roughly unchanged last week with the 2years yield up 11bps, 5years yield up 13bps, 10years yield up 12bps, the 30years yield was up by only 7bps.

In term of performances, US IG lost about 55bps last week due to higher rates, but US HY and leverage loans end the week roughly unchanged. Credit spreads on IG & HY were also mostly unchanged over the week.

A commentary from Bill Ackman, CEO of Pershing Square, on long bonds and another short commentary from Bill Gross, ex-CIO of PIMCO on the same topic, that we found quite interesting.

Bill Ackman (CEO of Pershing Square) commentary on long bonds :

I have been surprised how low US long-term rates have remained in light of structural changes that are likely to lead to higher levels of long-term inflation including de-globalization, higher defence costs, the energy transition, growing entitlements, and the greater bargaining power of workers. As a result, I would be very surprised if we don’t find ourselves in a world with persistent ~3% inflation.

From a supply/demand perspective, long-term Treasurys (T) also look overbought. With $32 trillion of debt and large deficits as far as the eye can see and higher refi rates, an increasing supply of T is assured. When you couple new issuance with QT, it is hard to imagine how the market absorbs such a large increase in supply without materially higher rates.

I have also been puzzled as to why the US Treasury hasn’t been financing our government in the longer part of the curve in light of materially lower long-term rates. This does not look like prudent term management in my opinion.

Then consider China’s (and other countries’) desire to decouple financially from the US, YCC ending in Japan increasing the relative appeal of Yen bonds vs. T for the largest foreign owner of T, and growing concerns about US governance, fiscal responsibility, and political divisiveness recently referenced in Fitch’s downgrade.

So if long-term inflation is 3% instead of 2% and history holds, then we could see the 30-year T yield = 3% + 0.5% (the real rate) + 2% (term premium) or 5.5%, and it can happen soon. There are many times in history where the bond market reprices the long end of the curve in a matter of weeks, and this seems like one of those times.

That’s why we are short in size the 30-year T — first as a hedge on the impact of higher LT rates on stocks, and second because we believe it is a high probability standalone bet. There are few macro investments that still offer reasonably probable asymmetric payoffs and this is one of them.

The best hedges are the ones you would invest in anyway even if you didn’t need the hedge. This fits that bill, and also I think we need the hedge.

Bill Gross commentary :

Bill Gross, the one-time bond king, said stock and bond bulls are wrong, as both markets are “overvalued.” The former CIO of PIMCO, said the fair value of the 10-year Treasury yield is about 4.5%, compared with the current level of around 4.16%.

Gross, who retired from asset management in 2019, said inflation may prove sticky at around 3%. He pointed out that 10- year yields historically traded about 135 basis points above the Federal Reserve’s policy rate.

So even if the Fed lowers interest rates to about 3%, the current 10-year yield remains too low, given the historical relationship. In addition, the skyrocketing government deficit will add supply pressure on the bond market, he said, reiterating his view outlined in his recent investment outlook. “All of the bulls on Treasuries,” said Gross, “I’d like to think their arguments are a little misplaced.” As for the stock market, Gross said the equity risk premium – measured by the difference between the earnings yields and bond yields, are at historical lows, suggesting that stocks are too expensive.

FX

DXY USD rose 0.81% to 102.84 due to deteriorating risk sentiment and sharp rise in US real yields, despite slight downside surprises on both core and headline US CPI. Risk sentiment deteriorates, as Moody downgraded ratings for ten small and mid-size lenders and puts others on negative outlook. In addition, July China trade data was weaker than expected, and further cracks on China property sector appears. Data wise, US Core CPI rose by 0.16% mom (C: 0.2%; P: 0.16%), which brought the yoy rate down to 4.70% (C: 4.7%; P: 4.8%). US Core PPI came in at 0.2% mom (C: 0.2%; P: 0.1%), which brought the yoy rate to 2.7% (C: 2.5%; P: 2.7%). Michigan Consumer Sentiment was in line at 71.2 (P: 71.6). Long-term Inflation Expectations ticked down to 2.9% (C: 3.0%; P: 3.0%), a low since March, while Near-term Inflation Expectations fell to 3.3% (C: 3.5%; P: 3.4%). Initial Jobless Claims for the week ended August 5 rose to 248k (C: 230k; P: 227k)

GBP fell 0.42% to 1.2696 against USD, but rose 0.10% to 0.8625 against EUR. Data wise, 2Q23 prelim UK GDP came in at 0.2% qoq (C: 0.0%), which brought the yoy to 0.4% (C: 0.2%). Markets pared the likelihood for BoE rate cuts in 2024 and priced in a cumulative 50bp of rate hikes by December 2023.

USDJPY rose 2.26% to 144.96 as a drop in Treasuries pushed up US yields and deteriorating risk sentiments supported USD safe-haven strength. USDJPY is now close to the level where the Japanese authorities intervened last year, where it traded above 145.

Oil & Commodity

Bloomberg Commodity Index fell 0.33%, as further signs of distress for China’s largest property developer dampened risk appetite. In addition, China July Credit data and trade data were weaker than consensus. As a result, Aluminium and Copper fell 2.93% and 3.84% respectively. Despite the negative risk sentiment, WTI and Brent rose 0.45% and 0.66% respectively, as IEA reported that global oil demand surged to a record, boosted by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity. Gold fell 1.5% to 1913.76 due to higher US real yields.

ECO

T – NZ Hse Sales, JP GDP/ Indust. Pdtn, CH LFR/ Indust. Pdtn/ Retail Sales, AU Wage Px Index, UK Unemploy. Rate, SW CPI, EU Zew, CA CPI/ Mfg Sales, US Retail Sales/ Empire Mfg

W – NZ RBNZ OCR, UK CPI, EU GDP, US MBA Mortg. App./ Housing Starts/ Indust. Pdtn/ FOMC Mins

Th – JP Core Machine Orders, AU Unemploy. Rate, EU Trade Balance, US Initial Jobless Claims

F – JP CPI, UK Retail Sales, EU CPI

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.