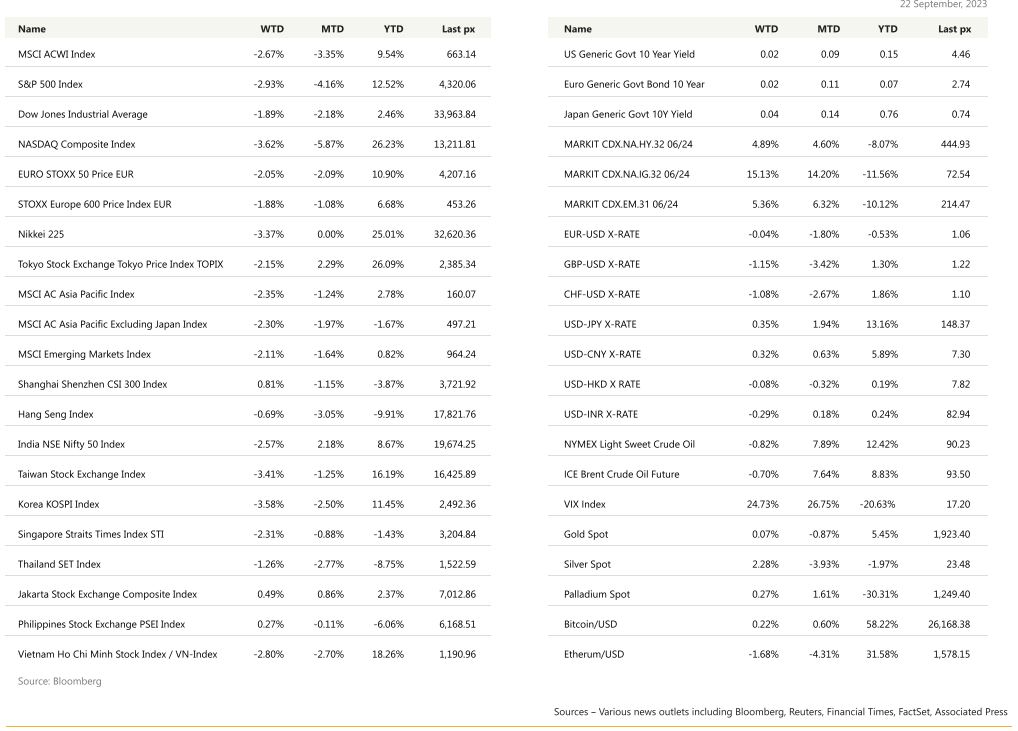

KEY MARKET MOVES

MACRO OVERVIEW

US

US markets endured its worst week in 6 months following the Fed’s hawkish pause statement post FOMC on Thursday. It was the weakest performance since March when fear gripped markets after the sudden collapse of Silicon Valley and Signature Banks. Tech, consumer discretionary and financials bore the brunt of the selloff. Elevated crude prices at WTI$90 pb didn’t help either. Pockets of Tech bucked the trend with Activision Blizzard Inc. shares gaining Microsoft Corp.’s $69 billion acquisition of the gaming company looked set to clear its final regulatory hurdle.

Megacaps including Nvidia Corp. and Meta Platforms Inc. rose about 1.5% and 1.1%, respectively while Broadcom fell on a report that Alphabet Inc.’s Google is considering dropping the company as a supplier for artificial intelligence chips as soon as 2027. Although the Fed left rates unchanged expectedly Thursday morning, 63% of the committee members said that they expect another rate increase by year’s end which was underscored when they increased their target rate for 2024 to 5.1% versus 4.6% previously. Rate cuts next year would only be 50 bps rather than the 100bps expected previously. However, as ex-Chair Bernanke put it previously, dot plots are but penciled-in averages and may not necessarily eventuate.

Regardless of this, higher for longer is not going away anytime soon. Treasury yield flirted with decade-plus highs with UST10’s and 2’s at 4.43% and 5.11% respectively. Outflows continued on fears of a deeper recession despite Fed’s Powell’s base case forecast that a soft landing of the US economy is still the primary objective for the FOMC.

The on-going UAW strike expanded further into the weekend against Stellantis and GM. However, the UAW announced progress in negotiations with Ford and that its strike will remain at just one facility.

Data released earlier in the week PMI data showed activity stagnated or slowed further. Applications for US unemployment benefits fell to the lowest level since January last week, and initial jobless claims dropped by 20,000 to 201,000 in the week ending Sept. 16, below expectations.

This week will see durable goods orders, annualised GDP, consumer confidence as well as the all-important PCE data Friday. Consensus is expecting core PCE Deflator MoM to come in unchanged at 0.2% and YoY at 3.9% from 4.2%.

With the VIX finally at relatively attractive ‘highs’ of 17+ we think FCN’s are compelling, in beaten down sectors we like such as commodities, given recent calls for a re-acceleration of Chinese demand and consumer staples:

Europe

In the Euro area, the annual inflation rate in the Euro Area was revised lower to 5.2% in August 2023 from an initial estimate of 5.3%, marking the lowest reading since January 2022. In August, the biggest upward pressure came from cost of services (5.5% vs 5.6% in July), followed by food, alcohol and tobacco (9.7% vs 10.8%) and non-energy industrial goods (4.7% vs 5%).

The consumer confidence indicator in the Euro Area dropped by 1.8 points from the previous month to -17.8 in September 2023, surpassing market expectations of -16.5 as shown in a preliminary estimate.

This marked the lowest reading since March, with rising borrowing costs and persistent inflationary pressures continuing to exert pressure on household incomes.

In the UK, the CPI results was released 1 day before the MPC meeting. UK inflation dipped to 6.7% in August, below expectations and the headline CPI rose by 0.3%. The MPC said that it will monitor inflation persistence with indicators of (1) labor market activity, (2) wage growth and (3) services inflation.

The MPC hold rates steady and the members voted 5-4 in favour of maintaining this rate at its September meeting while the 4 members prefer another 25bp hike to 5.5%. The majority of committee members judged that the downside surprise in services inflation, signs of labour market loosening and a weaker activity outlook justified holding rates steady. They are starting to see ‘’increasing signs’’ of an impact of tighter monetary policy on the labour market. In terms of the broader activity outlook, the MPC downgraded its forecast for GDP growth in 2023Q3 to 0.1% (from 0.4% previously).

BoE Governor said in a video statement that they will be watching closely to see if further increases are needed. They retained its data dependent guidance, reiterating that evidence of more persistent pressures would require further tightening. This sort of signaled that their job is almost done.

The British pound dropped 0.7% against the USD shortly after the decision. On quantitative tightening, the MPC also voted to cut its stock of UK government bond purchases by 100b pounds over the next 12 months. The committee assessed that this pace was unlikely to disrupt market functioning and noted that it would leave active sales broadly unchanged given higher maturities.

Asia

Markets in Asia were Mixed last week. MSCI Asia was down 2.35%. South Korea and Taiwan led losses closing -3.58% and -3.41% respectively. CSI 300 bucked the trend, up 0.81%.

China kept benchmark lending rates unchanged at a monthly fixing on Wednesday last week, matching market expectations. Recent economic data showed the world’s second-largest economy was picking up steam, while yuan declines have reduced the urgency for authorities to aggressively lower interest rates to prop up slowing growth. Economic data is expected to continue improving in the fourth quarter and the low base effect will mean the country’s growth could easily exceed 5% in the fourth quarter.

Reuters reported the CSRC has inquired with several major brokers over the past few weeks over short-selling activities and trading strategies of their quant clients. It said the Shanghai and Shenzhen stock exchanges have also asked for logic of trading strategies, sources of profit, the situations in which net-long and net-short positions are held. Regulators also asked for Direct Market Access data.

Some data out of Asia last week:

- BOJ stuck to script with a no-change decision on Friday. The yen fell in response, even as Finance Minister Shunichi Suzuki spoke of the urgency to contain its fall.

- Singapore’s non-oil domestic exports (NODX) contracted for the 11th consecutive month in August, falling by 20.0%, with both electronics and non-electronics seeing a decline.

- Taiwan august export orders came in below expectations in August, falling 15.7% over-year-ago. Separately, the Taiwan central bank decided to keep the key policy rates on hold. With the latest decision, the discount rate in Taiwan, stays at 1.875%.

- Bank Indonesia (BI) held rates on Hold. BI noted that the combination of rising energy prices and increasing expectations of high for long policy rates among the DM central banks has led to capital outflows and weakening exchange rates vs the US$.

Thailand’s Prime Minister Srettha Thavisin said on Sunday the country is expected to receive investment of at least $5 billion from Tesla, Google, and Microsoft. “Tesla would be looking into an EV manufacturing facility, Microsoft and Google are looking at data centres,” he said. Fresh foreign investment would boost Thailand’s flagging economy, which is expected to grow by 2.8% this year, less than previously projected, due to weaker exports.

Thailand resumed negotiations for a free trade agreement with the European Union, the first time since talks were frozen after a 2014 military coup. Thailand and EU plan to hold talks three times per year and aim to conclude a deal within 2025. Chinese tourists will now be able to vacation in Thailand visa-free. The policy is aimed at rebooting Thailand’s economy after months of political instability.

Rising oil prices are a concern for the Indian economy but its outlook remains bright after better September monsoons and a retreat in the prices of some key food items, the government said in its monthly economic report on Friday. India, the world’s third-largest energy importer, purchases more than 80% of its crude oil from international markets. RBI was not expected to hike its key policy rate anytime

soon and instead start cutting in the second quarter of 2024. India’s baseline estimate for economic growth is 6.5%, according to the

Government report.

GEOPOLITICS

The US has approved the sale of 25 additional F-35 fighter jets to South Korea. The announcement comes after the North Korean and Russian leaders discussed “possibilities” for military cooperation last week.

Turkey and China are reportedly in the final stages of their decade-long negotiations to build a nuclear power plant in Turkey. Russia is already building Turkey’s first plant (it’s expected to come online next year). And South Korea and Russia are in the mix to build Turkey’s second plant. So this proposed China-built plant would be Turkey’s third.

Upgrading their ties, China and East Timor agreed to cooperation under the Belt and Road Initiative championed by Xi, that could open the way for investment in infrastructure. In a joint declaration, released on state run China Central Television (CCTV) on Saturday, China said it would provide help for East Timor’s economic and societal development. Both sides agreed on close high-level military interactions, an expansion of bilateral investment, and cooperation in areas including infrastructure and food, the statement said. The two governments also said they would strengthen energy policy exchange and study possibilities for joint exploration for oil and gas. East Timor is looking to start producing natural gas from its Greater Sunrise fields around 2030, hoping to develop the offshore project that has been stuck in limbo for decades.

Looking beyond Southeast Asia, China has built ties with small nations in the Pacific during recent years, worrying the United States and allies Australia and New Zealand, who have long seen the region as their sphere of influence.

The Russian minister of economic development held “in-depth” discussions on economic cooperation with the Chinese commerce minister in Beijing on Tuesday, coinciding with a trip by China’s top diplomat, Wang Yi, to Moscow for strategic talks that led to the confirmation of Russian President Vladimir Putin’s visit to Beijing next month.

Italian foreign minister Antonio Tajani confirmed that PM Giorgia Meloni has informed China that Italy plans to exit China-led Belt and Road Initiative. Italy was the only G7 country that signed up for the program.

CREDIT/ TREASURIES

FOMC kept rate stable and is comfortable with current positioning and will be data dependent to determine the extent of additional policy firming that may be appropriate.

Fed acknowledged the resilience and strength of the US Economy, expanding at a solid pace so far this year, exceeding expectations. Consumer spending has been particularly robust. Activity in the housing sector has somewhat picked up, though it remains well below previous year’s level due to higher mortgage rates. Higher interest rates appear to be weighting on business fixed investments. They revised SEP up, real GDP now at 2.10% for this year. Fed expect growth to cool, with median projection falling to 1.50% next year.

Labor market remains tight, but supply and demand continue to come into better balance. Payroll job over the past 3 months averaged 150k jobs per month, a strong pace nevertheless well below earlier this year. Participation rate has moved up. Nominal wage growth has shown some signs of easing and job vacancies have declined. Although the jobs-to-workers gap has narrowed, labor demand still exceeds the supply of available workers. Fed expect rebalancing in the labor market to continue, easing upward pressure on inflation. The median unemployment rate projection in the SEP is expected to reach 4.10% in the next two years.

Inflation remains well above Fed’s longer-term goal of 2%. Core PCE prices rose 3.90% over the last 12Months. Inflation has moderated somewhat, and longer-term inflation expectations appear to remain well anchored. Nevertheless, the process of getting inflation sustainably down to 2% has a long way to go. PCE might only reach their 2% target in 2026.

If the economy evolves as projected, the median participant projects that Fed Fund Rate will be at 5.60% at the end of this year, 5.10% at the end of 2024 & 3.90% at the end of 2025. Compared with June, the September median projection for Fed Fund Rate remains unrevised for end of this year but has moved up 0.50% at the end of the next two years. These projections are not the committee decision or plan. If the economy does not evolve as projected, the path of policy will adjust as appropriate. Financial markets will now have to adjust to the new Fed’s guidance. Prior to last week FOMC, market participants were expecting around 125bps of interest rate cut for next year. The “higher for longer’’ explains the adjustments observed on risky assets.

- Building permits printed 100K above expectations.

- Jobless claims and continuing claims better than expected (201K Vs 225K & 1’662’000 Vs 1’692’000).

- September Manufacturing PMI 48.9 Vs 48.2 expected, Services 50.2 Vs 50.7 expected.

FX

DXY USD Index rose 0.25% to 105.58, as the Fed kept policy on hold at 5-5.25% as expected with a clear hawkish undertone. Median dot for 2023 was unchanged, but the median dots for 2024 and 2025 were both revised up by 50bps to 5-5.25% and 3.75-4% respectively. So the median FOMC member is pencilling in only two rate cuts in 2024, after one more hike this year. Unemployment projections were lowered for both 2024 and 2025 by 0.4pp to 4.1%. That would be only a slight uptick from the latest 3.8% level.

EURUSD was relatively unchanged from previous week at 1.0653. Data wise, March’s 2023 HICP forecast is up from 5.6% yoy to 5.7% reflecting the rise in oil prices, with core stable at 5.1% yoy. In 2024 HICP is seen at 2.3% yoy, up from 2.1% yoy. 2024 core HICP is revised up from 2.5% yoy to 2.7% yoy. September preliminary composite PMI improved, as services PMI was better than expected. However, Mfg PMI continued to fall. SNB left rates unchanged at 1.75%, contrary to the consensus of a 25bp hike. EURCHF rose 0.96% to 0.966.

GBPUSD fell 1.15% to close the week at 1.2241, as BoE left policy on hold at 5.25% against consensus of a 25 bps hike, with a narrow 5-4 vote among the committee. This ended the run of 14 successive hikes. This was following a big miss on UK CPI, where headline CPI was up just 0.3%mom in August (C: 0.7%), which brought the yoy to 6.7% (C: 7.0%). Core dropped to 6.2% yoy from 6.9% yoy, consensus was at 6.8%. Preliminary September UK Composite PMI shows a further decline into contraction territory. The fall on GBPUSD broke a support level of 1.23 and open the door to test 1.20 (key support level). However, based on RSI indicator, GBPUSD is now in oversold territory.

USDJPY rose 0.35% to close the week at 148.37 (YTD high at 148.48), as BoJ left policy unchanged (in line with expectations) and there were no meaningful changes in the text, economic judgement or outlook. BoJ Governor still believes risk of disinflation from premature tightening remains higher than sticky inflation above target. Data wise, JP CPI came in at 3.2% (C: 3.0%, P: 3.3%). Core CPI came in at 3.1% (C: 3.0%, P: 3.1%). JP preliminary PMI for September were all below expectations.

Oil & Commodity

Bloomberg Commodity Index fell 1.16% as the FED signalled less rate cuts in 2024 than what market expected. As a result, risk assets were registering negative returns last week. WTI and Brent fell 0.82% and 0.70% to 90.03 and 93.27 respectively. Gold was relatively unchanged last week, closing at 1925.23

ECO

- Monday – US Chicago Fed Nat Activity, Dallas Fed Mfg Activity

- Tuesday – US New Home Sales/ Cons. Confid./ Richmond Fed Mfg Index

- Wednesday – AU CPI, CH Indust. Profits, JP Machine Tool Orders, EU M3 Money Supply, US MBA Mortg. App./ Durable Goods Orders

- Thursday – NZ Biz Confid., AU Retail Sales, EU Cons/Econ/Indust./Svc Confid., US GDP/ Initial Jobless Claims/ Core PCE/ Personal Cons./ Pending Home Sales

- Friday – JP CPI/ Jobless Rate/ Retail Sales/ Indust. Pdtn, UK GDP/ Mortg. App., EU CPI, CA GDP, US Personal Income/ Personal Spending/ Chicago PMI/ Michigan Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.