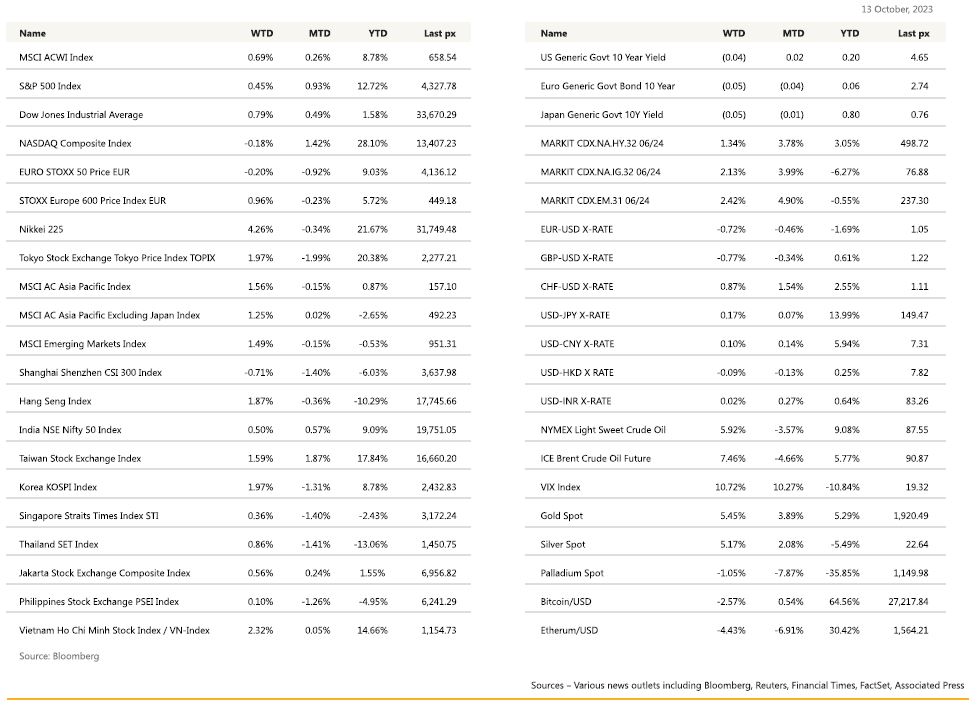

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

With the war in the Middle East escalating, US equities fell as flows diverted toward bonds and gold. Spot gold reclaimed the $1,925 handle once again and UST yields declined to 4.6% from 16-year highs. VIX flirted with the 20 mark before retreating back toward 19.25.

The tech-heavy Nasdaq fell 0.18% for the week whilst the Dow and the S&P 500 managed to record a slight up for the week. Early earnings reports helped lift sentiment toward the close, following upbeat Q3 earnings from banking giants JP Morgan and Wells Fargo as well as United Health. US sentiment fell more than expected in October as inflation expectations rose higher than expected. Fed speak was mixed with some erring on having the LT yield do the heavy lifting and keeping rates on hold while others continue to hum on more rate hikes to bring inflation down to 2%. Atlanta’s Bostic said he does not think rates need to be raised further, Vice Chair Jefferson said he would remain cognizant of the tightening in financial conditions through higher bond yields whilst Minneapolis’ Kashkari said the central bank may need to hike further if the economy is more resilient.

US CPI surprised to the upside as did the PPI the day before driven by higher energy costs. CPI at 0.4% mom came in above expectations (0.3% mom) as did the year-on-year print, which rose at the same pace as August, at 3.7% versus expectations for +3.6%.

However, unlike in August, when inflation rose due to higher energy prices, September’s price drivers came from the likes of shelter costs, which accounted for 70% of the core index’s rise and over 50% of the headline figure which is a concern for the Fed. It isn’t a doubt that inflation is easing, but not at the pace to convince the FOMC that it can declare victory. Minutes from the last FOMC reinforced speculation that its likely done raising rates showing officials agreed that policy should remain restrictive for an extended period but acknowledged that they need to balance the risk of inflation against the economic perils of moving too far.

A less busy week in terms of data coming up, with retail sales, industrial production and housing starts the key releases this week.

Europe

European stock markets closed lower on Friday. The Stoxx 600 ended 1% lower, with technology and travel and leisure sectors leading losses. Oil and gas stocks made the biggest gains, by 1.2% as crude oil prices rose sharply. Despite the sharp rise in geopolitical volatility resulting from the outbreak of the devastating Israel-Hamas war, stocks have strongly outperformed this week, with the Stoxx 600 snapping its three-week losing streak to gain nearly 1% for the week.

The economic situation in the Eurozone remains difficult. The overall sentix economic index drops again slightly in October to -21.9 points and is only slightly above the low for the year from July 2023. The situation assessment of the professional and private investors surveyed by sentix drops to -27 points. This is the lowest level since November 2022, meaning that the recessionary tendencies in the economy continue to persist.

Consumer expectations for euro-area inflation increased marginally in August. The expectations for the next 12 months edged up to 3.5% from 3.4% and for 3 years ahead increased to 2.5% from 2.41%.

Industrial Production MoM in the European Monetary Union advanced 0.6% in August, exceeding the 0.1% rise expected in the markets although overall output was down by 5.1% YoY decline.

Also, ECB released its meeting minutes last Thursday and it reflected a more heated debate on inflation and the policy rate. Recent developments have put the ECB in an even more difficult position and that a pause at the next meeting looks like a done deal but a rate hike in December remains a possibility.

Recalling back, the initial market reaction to the ECB’s September decision was dovish. The market also had the initial impression that the September hike and the dovish communication was marking the end of the ECB’s hiking cycle. As much as the ECB has tried to keep the door to further rate hikes open since the September decision, recent developments have clearly complicated its position.

While the surge in oil prices will put new upward pressure on inflation and could make reaching 2% target at the end of 2025 more unlikely, the conflict in Israel and the Middle East as well as the rally in bond yields will further dampen eurozone growth prospects. Overall, the recent developments mean that a pause at the ECB’s next meeting 2 weeks from now has become more certain. However, for the December meeting, a rate hike is still on the table.

This week, we see foreign trade numbers in the EU and the HICP final figures.

Asia

MSCI Asia closed higher last week, up 1.56%. All major Asian indices closed higher except for China’s CSI300. It closed lower by 0.71%. India extended early gains to reach threeweek highs last week. Year to date, the Nifty in India is up by 9%. The markets saw an improvement in risk appetite end of the week following dovish remarks from Fed officials that spurred a climb in US indices and better-than-expected domestic August trade data, though jitters over the rise in global crude prices on the back of the Israel/Hamas conflict and its effect on domestic inflation are expected to remain.

The People’s Bank of China added a net 289 billion yuan ($39.6 billion) into the financial system via a one-year policy loan on Monday, the most since Dec. 2020. It kept the interest rate unchanged at 2.5%, in line with expectations. The nation is tussling with a stuttering economy, with consumer prices reflecting weak demand while data released last week showed the amount of loans made missed expectations. China CPI missed in September; consensus looked for a 0.2% yoy rise. Producer prices also missed, down 2.5%yoy, consensus at -2.4%yoy.

Japan core machinery orders fell for a second straight month in August. Core orders, which exclude volatile numbers from shipping and electric utilities, declined 7.7% YoY in August.

Business morale at large Japanese manufacturers was subdued in October, although the services-sector mood edged up, the Reuters Tankan poll showed on Wednesday, as upbeat domestic demand helped partly offset the hit to the economy from global headwinds.

South Korea’s central bank governor said on Wednesday he sees headline inflation slowing to just above 3 per cent by the end of this year as price pressures would cool towards the year-end despite uncertainties including global oil prices. The Bank of Korea’s inflation target is currently 2 per cent. The BOK meets on Oct. 19 to determine whether it will keep interest rates steady at the current 3.50 per cent to curb price pressures or resume hiking. South Korea’s consumer inflation accelerated for a second month to 3.7 per cent in September, above market expectations, supporting prospects of the central bank maintaining its restrictive policy for some time.

Indonesian exports rebounded on a month-on-month basis. Indonesia posted a strong USD $3.12 billion trade surplus in August 2023. It is the 40th consecutive month of trade surpluses for Southeast Asia’s biggest economy, an indication that global commodity prices (particularly coal and palm oil, which are the key non-oil and gas export items of Indonesia) remain at lucrative levels.

GEOPOLITICS

The US and its allies are ratcheting up efforts to prevent the war between Israel and Hamas from engulfing the wider region. The US has warned Iran in recent days through backchannel talks about the risks of escalation, White House National Security Advisor Jake Sullivan said. Israel’s emergency government has vowed to wipe out Hamas and mobilized 300,000 reservists ahead of a major ground attack.

With hostilities centering around the blockaded enclave in Israel’s south, the US has asked Qatar to tell Hezbollah not to open up a second front to the war. Already more than 2,300 Palestinians have died in Israel’s retaliatory bombing of Gaza, amid concerns that the attack will spark a humanitarian catastrophe.

Iran, which provides money and weapons to Hamas and Hezbollah, has vowed that its so-called “axis of resistance” will respond to Israel’s “war crimes.” If Israel pursues its invasion of Gaza “no one can guarantee control over the situation and prevent the conflict from spreading,” Iran’s Foreign Minister Hossein Amirabdollahian said in a meeting with Qatar’s Emir Sheikh Tamim bin Hamad Al Thani in Doha.

Chinese President Xi Jinping said on Monday (Oct 9) that ChinaUS ties would impact the “destiny of mankind”, as he met with a group of American senators in Beijing. They also discussed the current Israel and Palestine conflict, with the US asking China to use its influence to cool middle eastern tensions.

In March 2023, China—Iran’s largest trade partner—brokered an agreement between Iran and Saudi Arabia to restore diplomatic ties seven years after severing relations. The deal reflected Beijing’s growing influence and interest in Iran. For the 10th consecutive year, China was Iran’s largest trade partner. Iran’s trade with China reached almost $16 billion in 2022, up seven percent from 2021.

The project, being built by a consortium of Indonesian and Chinese state companies, is running US$1.2 billion over budget, according to Indonesia’s government. The new loan is in addition to a 2017 loan worth US$4.55 billion that the China Development Bank has approved for the consortium. That loan has a 40-year tenure, with a 10-year grace period, and an interest rate of 2 per cent per annum.

A submarine arms race is intensifying as China embarks on the production of a new generation of nuclear-armed submarines that for the first time are expected to pose a challenge to growing US and allied efforts to track them. Analysts and regional defence attaches say evidence is mounting that China is on track to have its Type 096 ballistic missile submarine operational before the end of the decade, with breakthroughs in its quietness aided in part by Russian technology. The prospect is in part, the AUKUS deal among Australia, Britain and the US, which will see increased deployments of British and US attack submarines to Western Australia. By the 2030s, Australia expects to launch its first nuclear-powered attack submarines with British technology.

Russian President Vladimir Putin will travel to China this week to meet Xi Jinping, the Kremlin chief’s first trip outside the former Soviet Union this year. For China, Russia is a not only a major source of oil and gas: the world’s biggest nuclear power is also a rich potential source of technology as the People’s Liberation Army (PLA) seeks to modernise its conventional and nuclear forces by 2035. Trade between Russia and China soared 30% in the first half of this year and will rise to more than $200 billion in 2023, Russian Economy Minister Maxim Reshetnikov said on a visit to China. Russia is now China’s second largest trade partner outside Asia, second only to the United States.

Credit/treasuries

Credit spreads on US IG and HY widen last week, with IG and HY rising 2.13% and 1.34% respectively. US treasury yield curve bull flattens into the weekend amid a near-term escalation in geopolitical tensions in the Middle East, as 30 years fell 21 bps, 10 years fell 19 bps and 2 years fell 2.75 bps. Volatility on rates were at extreme level, with both the US 10 years and 30 years falling close to 30 bps after Hamas attack on Israel, and both rebounding roughly 15 bps after a strong US CPI. The move on the 30 years was the biggest daily rise since March 2020 at the height of the financial turmoil around the Covid-19 pandemic.

Investors weighed the outlook for interest rates following remarks from Fed officials and the latest inflation data. Philadelphia Federal Reserve President Patrick Harker said earlier Friday he thinks the central bank can “hold rates where they are.” Two central bank meetings remain this year, the first on Oct. 31 and Nov. 1 and the second in December. Markets are currently pricing in only a small chance of a rate hike in November.

Contributing to the higher LT yields was the Treasury bond auction for $20 bln 30-year Treasuries which clocked in at the highest rate since 2007 at 4.837%. Sentiment now surrounds on whether (UST10Y) yields will remain below 5%.

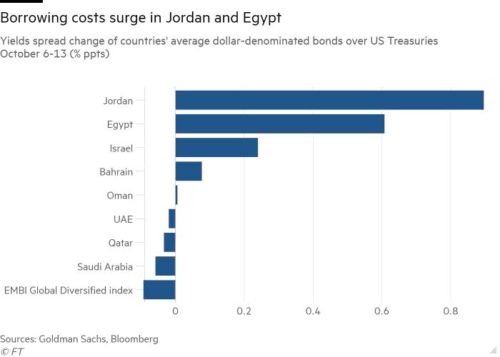

The war between Israel and Hamas is heaping pressure on borrowing costs in neighbouring countries, as international investors grow increasingly concerned that the conflict will rapidly escalate. The spreads — or gaps — between the average yields on both Jordan’s and Egypt’s dollardenominated bonds and equivalent US Treasuries have shot up this week as investors have priced in more risk for owning the debt. Since October 6, the yield on Jordan’s 2030 dollar-denominated bond has jumped from 8.5 per cent to 9.45 per cent, the highest level since October last year. Yields move inversely to prices.

FX

DXY USD Index rose 0.57% to 106.65, as potential for further escalation in geopolitical tensions in the Middle East sparked the bid to safe-haven USD purchase. In addition, the latest US CPI print showed an upside surprise, which led markets to reprice policy rates higher for longer. US headline CPI beats estimates, while core came in in-line. However, the release showed that core CPI was at a 5-month high, with decent increases in some of the stickier categories. In other data, UMich inflation expectations came in higher than consensus. Fed September minutes indicated that “All agreed” rates should stay restrictive for some time, and that Fed can “proceed carefully”. Several Fed members also issued statements in what appears to be a concerted effort to sound more dovish, which suggested that there is a possibility that the recent rise in yields may mean the Fed has to do less. Support level on DXY at 106/105.5, while resistance level at 107/107.5.

EURUSD fell 0.72% to 1.051. Downward trend on EURUSD still intact. EURCHF fell 1.57% to 0.9482 (new ytd low), as CHF becomes the preferred safe-haven currency expression.

GBPUSD fell 0.77% to 1.214. Data wise, UK GDP grew by 0.2% in August, in line with expectations. Industrial production and manufacturing production were weaker than expected. In addition, BoE chief economist Pill commented that interest rate decisions were being “finely balanced”.

USDJPY rose 0.57% to 149.57. Immediate resistance level at 150. Data wise, Japan PPI mom came in below consensus at -0.3%, which bring the yoy to 2.0%. Core machine orders were weaker than consensus.

Oil & Commodity

Crude oil rose as the potential for instability in the Middle East injects concern about supply disruption into the oil market. WTI and Brent rose 5.92% and 7.46% to 87.69 and 90.89, respectively.

Gold rose 5.45% to 1932.82 due to safe haven buying, as geopolitical tensions in the Middle East escalates.

Gold has bounced impressively this week, off intraday lows last week of $1,810.50 to trade at $1,932. Conditions are starting to look overbought, and we’d like to take this opportunity to sell some OTM Gold calls for a month strike at $1,955 for a month at a premium of 1.5% of notional or at a strike of $1,970 with a premium of 1.2% of notional.

ECO

- Monday – CH LFR, JP Industr. Pdtn, CA Mfg Sales, US Empire Mfg

- Tuesday – NZ CPI, AU RBA Mins, UK Unemploy., EU Zew, CA CPI, US Retail Sales/ Industr. Pdtn

- Wednesday – CH GDP/ Industr. Pdtn/ Retail Sales, UK CPI/ PPI, EU CPI, US MBA Mortg. App./ Building Permits/ Housing Starts

- Thursday – JP Trade Balance, AU Unemploy., US Initial Jobless Claims/ Existing Home Sales/ Leading Index

- Friday – NZ Trade Balance, UK Cons. Confid./ Retail Sales, JP CPI, CA Retail Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.