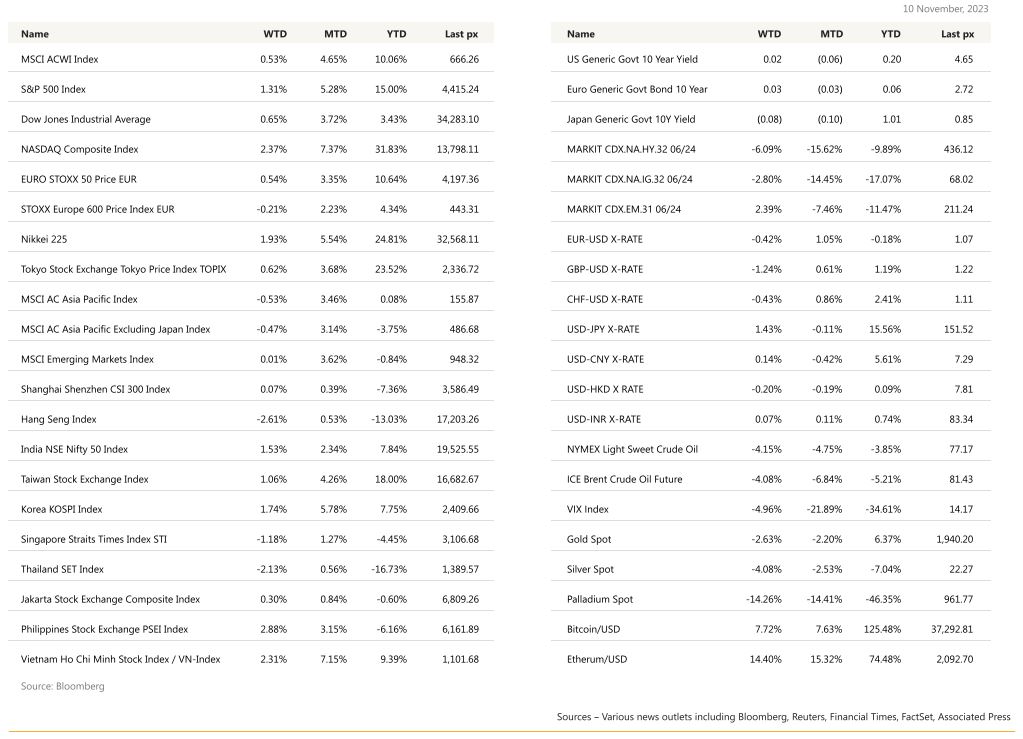

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US equity markets resumed its rally last week with big gains coming on last Friday led by Nasdaq’s tech stocks.

Sentiment brushed off hawkish remarks from Powell Thursday amidst weaker than expected data. The S&P 500 Index advanced 1.6% in New York on Friday to breach the key 4,400 resistance level seen by market technicians as a catalyst for more upside to come. Powell had earlier said the US central bank won’t hesitate to tighten policy further if needed, to contain inflation although that’s nothing really new as he has expressed those concerns repeatedly for many months now. Policymakers are seeing inflation data improving, and that remains the stronger of the recent narratives. Expectations of continued economic and corporate profit growth, and moderating inflation could see the rally continue over the balance of the year. The U. of Michigan inflation expectations overshot consensus on higher energy costs although crude has fallen now to almost 3-month lows – WTI at $77.20 and Brent at $81.55 on weighed concerns over waning demand in the US and China. Inflation expectations for the 1Y horizon came in at 4.4% up 0.2 points m/m (October was revised up from preliminary 3.8% to 4.2%), while 5-10Y inflation expectations were up 0.2pp to 3.2%, highest since 2011. Consumer sentiment slipped to 60.4 versus last month’s 63.8. The fast approaching possible government shutdown (17 Nov) seen fading as House Speaker Johnson over the weekend proposed to push forward a clean stopgap funding bill. On LT rates, the significance of US borrowing plans was evident last week, when the Treasury’s announcement of a smaller-than-expected boost to bond issuance buoyed the S&P 500 and retreated the UST10Y back to 4.53%. Talks of a possible end to the QT capped the yield to circa 4.70% from just over 5% only a couple of weeks ago.

As we write, the market appears to be taking a breather as investors turn their attention to the CPI data due Tuesday for clues on the likely path of interest rates and any pathway to rate cuts. The consensus is expecting MoM CPI to come in at 0.1% from 0.4% and the core at 0.3% unchanged. Headline CPI is expected at 3.3% from 3.7%. PPI follows on Wednesday. On politics, the relations between the US and China appear to be thawing as Biden plans to meet President Xi in San Francisco at the APEC summit on Wednesday.

Gold has as expected, retreated from its highs to trade at a more midling level of $1,935 an oz. The VIX has stabilised around 15 for the time being.

We are keeping an eye on the development of the Biden-Xi meeting to see if the Tech-war can be de-escalated albeit slowly.

Prefer to add to some quality growth sectors – AI Tech which has retreated off its highs and smart mobility plays.

Europe

Performance on the major indices in Europe are mixed last week, with gains in Eurostoxx 50 (+0.54%), but fall in UK FTSE 100 (-0.77%) and Swiss SMI (-0.23%). UK FTSE 100 underperformed, weighed down by its large share of energy and materials stocks, while Swiss SMI underperformed, driven by CHF strength.

Eurozone final October Composite PMI came in at 46.5 (C: 46.5; September: 47.2), in-line with the preliminary estimate while the Services PMI came in at 47.8 (C: 47.8: September: 48.7), in-line with the preliminary estimate. Retail Sales fell by 0.3% m/m in September (C: -0.2%; P: -0.7%).

Switzerland SNB reserve data released is a reminder why CHF is the best performing currency this year as reserves fell another CHF20.5bio representing a 160% yoy decline as SNB sells foreign assets to maintain CHF strength and inflation.

UK 3Q23 GDP came in at 0.0% q/q (C: -0.1%; P: 0.2%), net trade and inventories masked very weak domestic demand. Final domestic demand was a 70bp drag – private consumption was down by 0.4% q/q, business capex contracted by 4.2% q/q, and residential investment is now – after four consecutive quarters of declines – ~8% off its 3Q22 peak. GDP expanded by 0.2% mom in September (C: 0.0%; P: 0.1%), aided by an 11bp boost from healthcare and education. Consumer-facing services fell sequentially.

Asia

Performance on the major indices in Asia were mixed last week, with Hang Seng Index (-2.61%) the worst performing market, driven by the negative China trade and inflation number. Despite this, China CSI (+0.07%) closed the week relatively flat. Japan Nikkei 225 (+1.93%) and Topix (+0.62%) rose for the week. Korea KOSPI index rose 1.74%, as FSC announced a short-selling ban on domestically listed stocks until June 2024, while Taiwan Index rose 1.06%. Within ASEAN, Philippines and Vietnam both rose more than 2%, while Thailand and Singapore Index fell 2.13% and 1.18% respectively.

China latest trade data showed that exports declined for a 6th consecutive month, dropping -6.4% yoy, (C: -3.5%, P: -6.2%). Imports surprisingly rebounded +3.0% yoy in October (C: -5.0%, P: -6.3%). The resulting trade surplus amounted to $56.53 billion (vs $82.0 billion expected). China headline CPI came in at -0.2% yoy in October (C: -0.1%; P: 0.0%) and Core CPI edged down to 0.6% yoy (P: 0.8%), mainly due to weaker food prices, led by pork. PPI fell 2.6% yoy in October (C: -2.7%; P: -2.5%) as both input and output PMI softened.

IMF upgrades China’s 2023, 2024 GDP growth forecasts, with China economy set to grow at 5.4% this year, having made a “strong” post-COVID recovery. This was against an earlier forecast of 5% growth.

AThe IMF said continued weakness in the property sector and subdued external demand could restrict gross domestic product growth to 4.6% in 2024, which was still better than the 4.2% forecast published in October. The upward revision followed a decision by China to approve a 1 trillion yuan ($137 billion) sovereign bond issue and allow local governments to frontload part of their 2024 bond quotas, in a move to support the economy.

Australia RBA lifted its cash rate by 25 bps (first time in five months) to a 12-year high of 4.35% citing a slower-than-expected decline in inflation while still indicating that inflation would return to its target range of 2% to 3% in a reasonable timeframe. The forward guidance leaned slightly dovish, but reiterated that further hikes remain possible. As a result, AUDUSD fell 2.33% to close the week at 0.636. Australia RBA Statement on Monetary Policy, updated wage and unemployment forecasts will colour the risks around a December hike.

Indonesia 3Q23 GDP grew 4.94% yoy (C: 5.00%; P: 5.17%) and 1.60% qoq (C: 1.67%; P: 3.86%). Fixed investment and private consumption were strong, up 5.77% yoy and 5.06% yoy, respectively.

The US Treasury announced the removal of Korea from the Monitoring List on 7 Nov. This reduces macro risk for Korea as the probability of FX manipulator designation is materially lowered.

Credit/treasuries

Mid last week, US Treasury surged, driven by a poor USD 24 billion 30-years UST auction and balanced remarks by Fed Chair Powell. The $24bn 30y UST auction stopped out at 4.769%, a 5.3bp tail, which followed the 3.7bp tail in the $20bn October 30y re-opening auction. Underlying auction statistics showed a clear retrenchment in demand from end-users.

USTs bear-flattened to close the week with the 2years (+22 bps), 10 years (+18 bps) and 30 years (-5bps) as Moody’s announced it had changed the ratings outlook on United States sovereign credit to Negative from Stable.

According to Moody’s, the key driver of the outlook change to Negative is that the “downside risks to the US’s fiscal strength have increased and may no longer be fully offset by the sovereign’s unique credit strengths.” Further Moody’s expects US fiscal deficits will remain very large, significantly weakening debt affordability, amid higher rates, in the absence of fiscal policy measures to reduce government spending or increase revenues. Moody’s also cited continued “political polarization” within the US Congress as a risk that consensus will not be reached on a fiscal plan to slow the decline in debt affordability. With that said, Moody’s did affirm the US’s Aaa sovereign credit rating.

FX

DXY USD Index rose 0.8% to close the week at 105.86 due to a surge in UST short term yields and balanced Fed’s Powell speech. Chair Powell says that “If it becomes appropriate to tighten policy further, we will not hesitate to do so”. But also, “we will continue to move carefully”. UST yields surge after the weak 30 years auction, and bear flatten after Moody’s cuts the outlook on United States sovereign credit to Negative from Stable, but affirms the Aaa credit rating.

EURUSD fell 0.42% to close the week at 1.0686, driven by broad USD strength. ECB President Lagarde stressed the ECB will not cut rates for the “next couple of quarters”. Immediate support on EURUSD at 1.06, while immediate resistance level at 1.075/1.08.

GBPUSD fell 1.24% to close the week at 1.2227, driven by broad USD strength and dovish comments from BoE Chief Economist. BoE Chief Economist Pill said October inflation may drop below 5%, and he expects UK inflation will match price pressures in the rest of the world soon. In addition, he suggested market pricing of cuts mid 2024 is not “unreasonable”. Data wise, UK GDP Q3 came in flat (C: -0.1% qoq).

USDJPY rose 1.43% to close the week at 151.52, driven by broad USD strength and slightly more dovish comments by BoJ Governor Ueda. BoJ Ueda said BoJ will keep easy policy until it is 100% sure they have reached their inflation goal and that won’t be until after the Spring wage negotiations. In addition, minutes from BoJ September meeting was released, where members agreed sustainable and stable achievement of the price stability target, accompanied by wage increases had not yet come into sight. Thus, the BoJ needed to patiently continue monetary easing under its YCC policy. Strong resistance level on USDJPY at 152.

Oil & Commodity

Crude oil fell for the third consecutive week, driven by rising demand fears and easing concerns over supply risks from the Middle East, as well as news crude production reached a record high of 13.2 million barrels per day. The latest monthly EIA report now foresees an annual decline in US oil consumption this year. WTI and Brent fell 4.15% and 4.08% respectively, to close the week at 77.17 and 81.43. On Base Metal, both Aluminium (-1.63%) and Copper (-2.57%) closed the week lower, while Iron Ore rose 2.7%. Gold fell 2.63% to close the week at 1940.2, with perceptions of geopolitical tensions on the decline, its largest weekly decline since the end of September.

ECO

-

Monday – JP PPI/Machine Tool Orders

-

Tuesday – NZ Food Prices, AU Cons. Confid./Biz Confid., UK Labor, SW CPI, EU GDP, US CPI

-

Wednesday – JP GDP/Indust. Pdtn, CH LFR/Indust. Pdtn/ Retail Sales, UK CPI/PPI, EU Indust. Pdtn, US MBA Mortg. App./Retail Sales/PPI/Empire Mfg

-

Thursday – NZ Hse Sales, JP Core Machine Orders, AU Employ., CA Housing Starts, US Initial Jobless Claims/Indust. Pdtn

-

Friday – NZ PPI, UK Retail Sales, SW Employ., EU CPI, US Housing Starts

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.