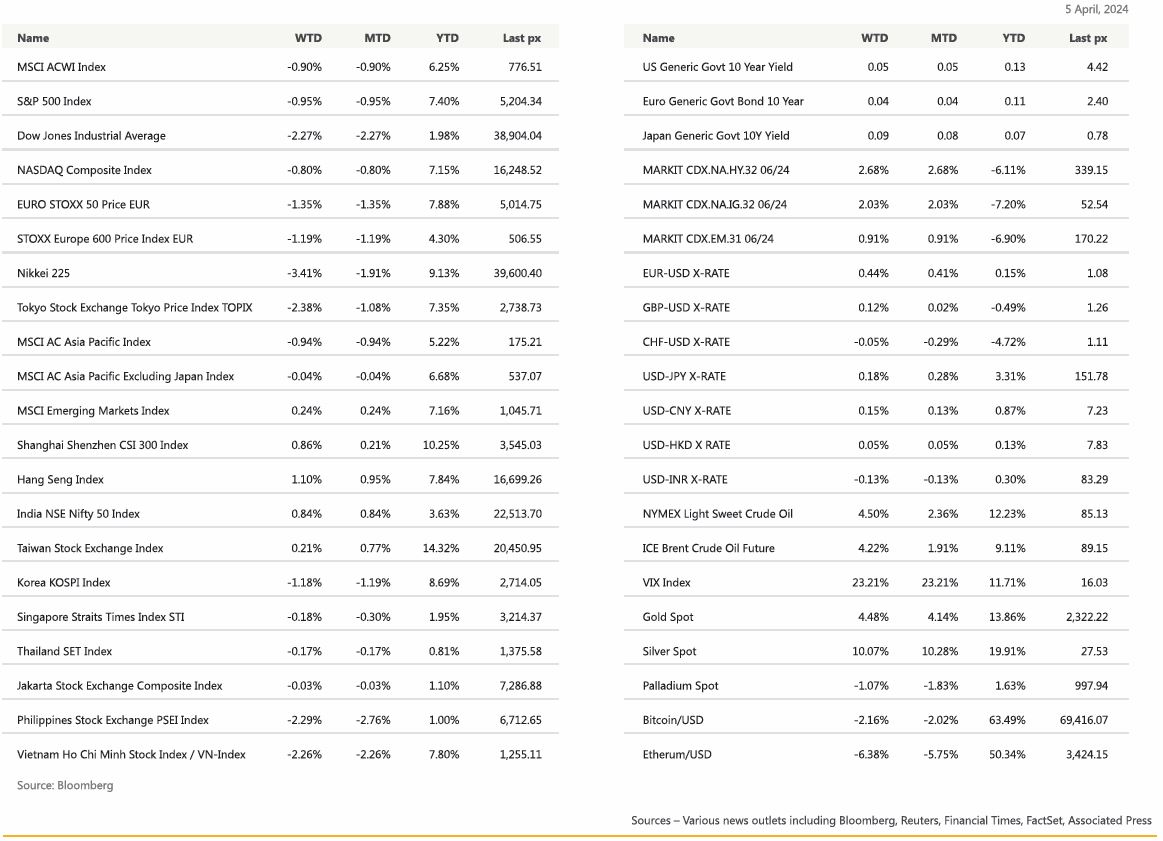

KEY MARKET MOVES

MACRO OVERVIEW

US

In what appeared to be a twist of fate on Friday, US markets had their best day in weeks after a robust labour market release gave investors’ confidence that the US economy can withstand a delay in Fed rate cuts. However, the S&P 500 still posted its biggest weekly decline since early January on rising geopolitical concern in the Middle East and hawkish comments from Fed board members. Focus is now firmly on this week’s CPI and PPI data ahead of the kickoff of Q1 earnings reports. Chipmakers, Nvidia, AMD and Intel in the Philadelphia Semiconductor Index gave the market a boost after succumbing to losses earlier in the week.

Oil prices which spiked to above $91 a barrel for WTI on tensions in the Middle East had spooked sentiment earlier. Tension flared after Israel attacked Iran’s embassy in Syria. OPEC+ earlier on Wednesday, announced no change in production levels where a 2 mln barrels per day cut will remain until the end of June.

March US Manufacturing PMI came in a little bit lower at 51.9 Vs 52.5 expected, but the March ISM Manufacturing printed at 50.3, well above expectations of 48.3 and well above previous Month of 47.8. The subcategories of the ISM were obviously much stronger, Prices paid printed at 55.8 Vs 53.0 expected and 52.5 the previous Month. The new orders sub-category printed at 51.4 Vs 49.8 expected and 49.2 the previous Month. Only the employment component printed roughly in line with expectations at 47.4 but nevertheless higher than previous Month which was 45.9.

On Wednesday March US Service PMI came out in line with expectations and previous Month, printing at 51.7. However, March ISM Services Index printed at 51.4, lower than expectations (52.8) and previous Month (52.6). Price paid subcategory printed at 53.4, 5points below expectations and its lowest since March 2020.

Fed-speak from Dallas’ Logan who said its too early to consider cutting rates, Governor Bowman expressed concern about upside risks to inflation, Minneapolis’ Kashkari signalled its possible the Fed might not cut at all, Atlanta’s Bostic forecasting only one cut this year was all but enough to start the week on its back foot.

Then a blockbuster non-farm payroll rolled in at +303k jobs beating expectations and, unemployment fell to 3.8% from 3.9% previously. Average hourly earnings MoM and YoY came in as expected. Perhaps what also aided in the rally on Friday was Powell’s comments previously, acknowledging that a strong jobs market will not preclude the Fed from lowering rates – recognising that inflation can keep falling even if the labour market stays strong. Pressure is building however on the supply side of inflation:

Source: Bloomberg

Interest rates went up significantly following the release of these data, and surprisingly US equity index also went up last Friday.

After spending much of this year making bets that were much more dovish than those of Fed officials, investors have now flipped in the opposite direction. They’re forecasting about 65 basis points of rate reductions in 2024, compared to the 75 basis points signalled by the median estimate of projections released following the Fed’s March 19-20 meeting. At one stage, the probability of a 25-bps cut in June briefly dropped below 50% on Monday night.

The other sector that was hit was US health-insurance shares after regulators failed to boost payments for private Medicare plans like the industry expected. The trajectory of the markets is starting to be questioned – no doubt about it.

We have decided to hedge about half of our equity positions in anticipation of a potential pull-back in the weeks leading up to the summer months. Cryptos extended its decline to a 2nd week amid fading bets for Fed rate cuts and cooling demand for dedicated US exchange-traded funds. Bitcoin, the largest cryptocurrency, dropped the most in two weeks.

Ties appear to be warming with Treasury Secretary Yellen’s visit to China on Sunday: She and He Lifeng agreed to talks on “balanced growth” to address what the US sees as China’s growing overcapacity. The countries’ ties are now on a “more stable footing,” the Treasury secretary told Li Qiang in a visit that stayed cordial despite tough criticism on trade.

Key data releases this week will be CPI on Wednesday expected at 0.3% MoM and a YoY headline of 3.4% from 3.2% previously. PPI on Thursday and U. of Mich. 1 Yr and 5-10 Yr inflation expectations on Friday expected to come in at 2.9% for both readings. “Handle With Care”.

Europe

European markets closed lower on Friday, the STOXX 600 index ended 0.84% lower, with all the sectors and major markets in negative territory. Retail and utilities stocks fell more than 2%, while household goods shed 1.6%.

Last week, both euro area headline and core inflation came in 0.1pp below the consensus forecasts. Headline inflation eased from 2.6% in February to 2.4% in March, while core declined by 0.2pp to 2.9%. The momentum over the past 3 months prints around 2.9% annualized. Services inflation was at 4%yoy for the 5th month in a row. This was despite a weakerthan- expected Easter effect in both Germany and France that normally pushes up the prices of flights, accommodation, and package holidays. While the march print was distorted by the early Easter holiday, upcoming prints will let us know whether the resilience and upside in services inflation that we have seen since the start of the year will persist.

The final March PMIs were revised up by 0.4pp to 46.1 for the manufacturing index and 51.5 for services and 50.3 for the composite. Although these indices point to an improving outlook, they remain below average.

In another light week for data in the UK, there were signs of progress on inflation together with resilience on growth. The BoE’s closely watched Decision Makers Panel (DMP) survey for March provides further evidence that inflation is heading lower and thus paves the way for rate cut to begin in June. The survey showed a further moderation in business inflation and wage expectations. This survey is a survey of CFOs from small, medium, and large UK businesses to monitor developments in the economy and to track business’s view.

This Thursday, we expect no policy changes at the ECB meeting. The markets are pricing a 25bp for a June cut, with data determining the pace and scope of cuts. This week is light on data. This week in the UK will be dominated by the February GDP and the publication of the BoE’s forecasting review.

Asia

MSCI Asia Index was lower by 0.94% last week, MSCI Asia excluding Japan was flat. China and India led gains while the rest of Asia closed lower.

Japan’s Nikkei tumbled 3.4% last week weighed down by worries about yen-buying intervention that would hurt exporter profit outlooks and returns for foreign investors. Official warnings of intervention have stepped up since the yen weakened to a 34-year low of 151.975 per dollar last week, and Japanese Finance Minister Shunichi Suzuki repeated on Monday that he won’t rule out any options against excessive moves. BOJ Governor Ueda signals chance of another rate hike if certainty of meeting inflation goal increases.

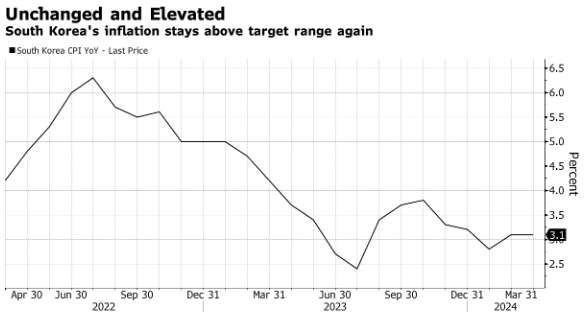

South Korea’s consumer prices rose 3.1% in March from the same month the year before, in line with market expectations. South Korean chips helped Asia’s fourth-largest economy post export growth for a sixth consecutive month in March. Exports rose 3.1% from the same period a year prior to $56.56 billion. Overseas sales of chips grew for a fifth successive month, rising 35.7% and logging the best performance by value in two years, trade ministry data showed. Inflation is on the minds of South Korean voters as they prepare to go to the polls this week to form a new parliament. The outcome of the April 10 election will influence President Yoon Suk Yeol’s ability to carry out his policy agenda for the rest of his term ending in 2027.

Indonesia’s annual inflation rate accelerated more than expected in March to 3.05% , the quickest since August 2023, amid rising demand during the fasting month of Ramadan, data from the statistics bureau showed on Monday (Apr 1). The inflation data, which followed a report that the February trade surplus came in at the smallest in nine months, may strengthen the central bank’s decision to keep interest rates unchanged for the next few months, analysts said.

Bank Indonesia (BI) policymakers have said they see room to cut rates in the second half of 2024. The Jakarta Composite index was flat for the week, taking year to date gains to just 1.1%.

In other data points, RBI kept its base repo rate unchanged at 6.5% as widely expected and held its “withdrawal of accommodation” stance unchanged too as a surging economy and easing bank liquidity concerns gave the bank additional wiggle room.

Japan household spending fell by less than expected, distorted by leap year effects. Australian trade surplus narrowed with export growth capped by slump in iron ore shipments. Singapore retail sales surged y/y although seasonally adjusted were up by less; Thailand inflation in contraction for a six consecutive month; Philippines food inflation surged by the most in six months.

GeoPolitics

Israel – Palestine: Israel said on Sunday it had withdrawn more soldiers from southern Gaza, leaving just one brigade, as it and Hamas sent teams to Egypt for fresh talks on a potential ceasefire in the six-month conflict. The military spokesperson did not give details on reasons for withdrawing soldiers or numbers involved. But Defence Minister Yoav Gallant said the troops will be preparing for future operations in Gaza.

Israel – Iran: Suspected Israeli warplanes bombed Iran’s embassy in Syria on Monday last week in a strike that Iran said killed seven of its military advisers, including three senior commanders, and that marked a major escalation in Israel’s war with its regional adversaries.

Iran’s supreme leader declared on Tuesday that “Israel will be punished” for the attack last week that killed members of the Revolutionary Guards, including two generals, at the Iranian embassy compound in Damascus. The attack and rhetoric have raised concern that Israel’s war in Gaza threatens to escalate major conflict across the region. Iranian President Ebrahim Raisi declared that the “cowardly crime will not go unanswered.” Hezbollah, the Iran-affiliated armed group that has been swapping attacks with Israel across the border with Lebanon since the start of Israel’s war on Gaza, joined in, warning that the attack on the Iranian diplomatic premises “will not pass without the enemy receiving punishment and revenge”.

China – Indonesia: President Xi Jinping hosted Indonesia’s president-elect Prabowo Subianto in Beijing, telling him that China is willing to deepen cooperation with Indonesia and calling for two countries to push for an equal multipolar world. Xi added Beijing viewed its relations with Jakarta from a “strategic and long-term perspective”. Prabowo said he was determined to build on President Jokowi’s achievement with China as foundation once he becomes president in October. Recall China has spent billions of dollars on Indonesia under Belt and Road Initiative in sectors such as nickel, EV manufacturing.

Israel – World: At least five employees of the World Central Kitchen (WCK) non-governmental organization, including foreigners, were killed in an Israeli airstrike on Gaza, the Hamasrun Gaza government media office said late on Monday. Those killed in the incident in central Gaza’s Deir al-Balah included citizens of Poland, Australia and Britain, as well as one Palestinian, a spokesperson for the media office said.

Credit/Treasuries

Treasuries took a beating with the UST10 yield pushing up some 20 bps from late last week. It was because of the nonfarm payrolls data for March surged past expectations. The US Treasury curve flattened over the week with the 2years yield up by 15bps and 5, 10 & 30years gained 20bps. US IG credit spreads were 1bps wider and US HY credit spreads were 10bps wider. 10years yield is trading at 4.40%, its highest level since last November. Vix has increased from 13.5 to 16 over the week. In term of performances, US IG lost 1.35% and US HY lost 0.65%. Leverage loans were flat.

FX

DXY USD Index fell 0.18% to 104.298 despite the upside surprise on non-farm payroll. Total Nonfarm Payrolls rose by 303k in March (C: 214k; P: 270k), just enough to move the unemployment Rate down to 3.83% in March (C: 3.8%; P: 3.86%). Wage gains moderated on a y/y basis and point to a noninflationary expansion of the labor market. The probability for a rate cut at the June meeting dropped toward 50%, and pricing of the first full 25bp cut was pushed out from July to September. Most FOMC participants see it as likely to be appropriate to begin lowering the policy rate at some point this year but reiterated that there is no urgency to adjust the rate.

EURUSD rose 0.44% to close the week at 1.0837. Data wise, the flash CPI print for March saw headline CPI fall to +2.4% (vs. +2.5% expected), whilst core CPI fell to +2.9% (vs. +3.0% expected), which is its lowest since February 2022. Retail Sales fell by 0.5% m/m in February (C: -0.4%; P: 0.0%).

GBPUSD rose 0.12% to close the week at 1.2638. Data wise, UK S&P Global Construction PMI rose to 50.2 in March (C: 49.9; P: 49.7), in expansion territory for the first time since August. Mortgage approvals rose to 60.4k (C: 56.5k; P:55.2k), a level last seen in October 22.

JPY has seen broad based weakness last week following the rise in global yields due to upside surprise on US non-farm payroll. USDJPY closed the week at 151.62 (+0.18%), trading in a new band between 150 and 152 after BoJ rate decision. Through an interview with a media outlet, BoJ Governor Ueda suggested a possible time for the next rate hike may be around the summer to autumn because of high wage growth from the spring wage negotiation pass-through to consumer prices.eads were 10bps wider. 10years yield is trading at 4.40%, its highest level since last November. Vix has increased from 13.5 to 16 over the week. In term of performances, US IG lost 1.35% and US HY lost 0.65%. Leverage loans were flat.

Oil & Commodities

WTI crude rose last week, with WTI and Brent rising 4.5% and 4.22% to close the week at 86.91 and 91.17 respectively, as supply concerns intensified given an escalation of geopolitical tensions in both the Middle East and Russia. This pushes both WTI and Brent to overbought territory based on RSI indicator.

Gold rose 4.48% to 2329.75 (historical new high), as geopolitical risk intensifies in the middle east. This was despite the jump in US treasury yields with the 2 years and 10 years +13 and +20 bps. The jump brought gold price to extreme overbought territory based on RSI indicator.

Economic News This Week

-

Monday – JP BoP Current Acc, SZ Unemploy. Rate, EU Sentix Inv. Confid., US NY Fed 1 Yr Inflat. Exp.

-

Tuesday – AU Cons./Biz Confid., JP Cons. Confid. Index, US Small Biz Optim.

-

Wednesday – JP PPI, NZ RBNZ OCR, Norway CPI, US MBA Mortg. App./CPI/Wholesale Inv./FOMC Mins., CA BOC Rate Decision

-

Thursday – JP Money Stock, AU Cons. Inflat. Exp., CH CPI/ PPI, Norway GDP, EU ECB Rate Decision, US PPI/Initial Jobless Claims

-

Friday – NZ Biz Mfg PMI/Food Prices, JP Indust. Pdtn, CH Trade Balance, SW CPI, UK Indust. Pdtn/Mfg Pdtn/Trade Balance, CA Existing Home Sales, US Mich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.