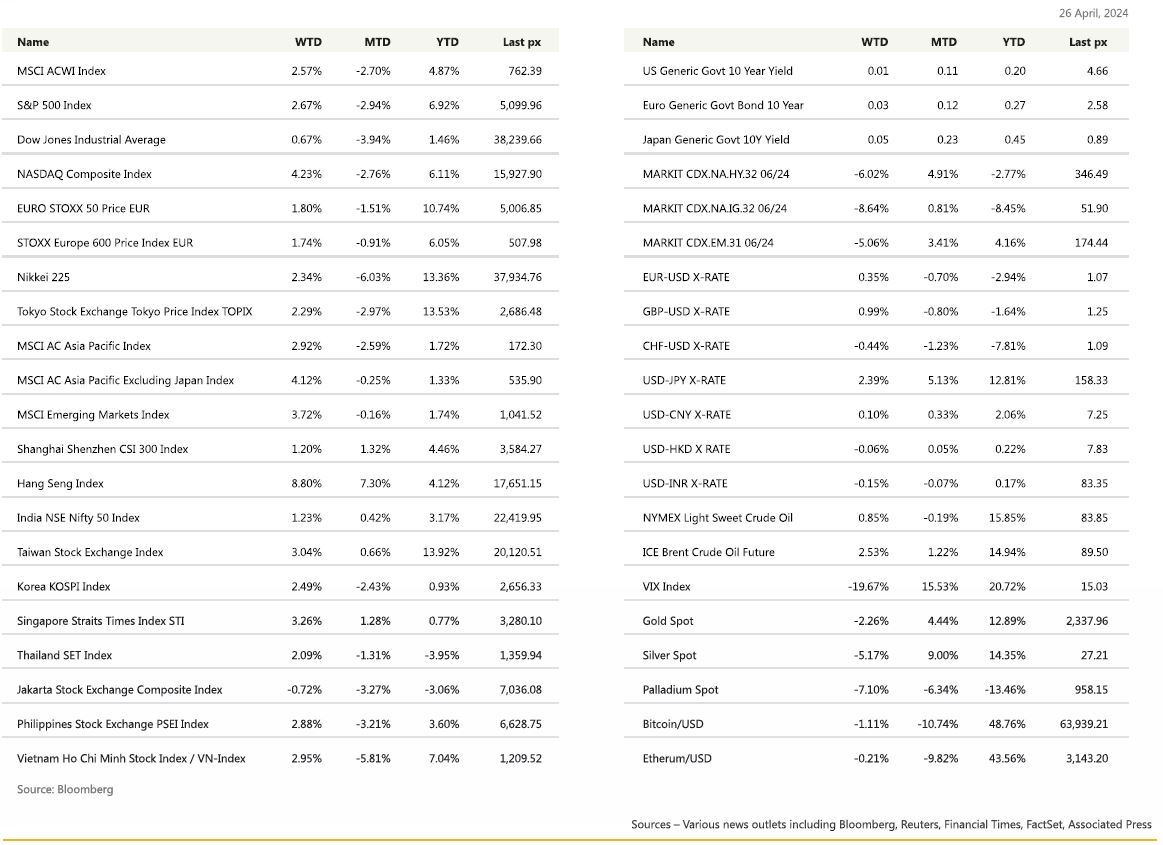

KEY MARKET MOVES

MACRO OVERVIEW

US

Markets recovered strongly toward the end of the week and ended up following a turbulent week filled with hits & misses. In-line monthly PCE inflation data and strong earnings reports from Google and Microsoft lifted spirits at the end of the week. The Nasdaq was up 4.2% and the S&P 500 closed +2.7% for the week. Both benchmarks had their strongest week since November. The core personal consumption expenditures price index, which strips out the volatile food and energy components, rose 0.3% from the prior month, at the same pace as a month earlier as did the core YoY data. The figures eased worries about a potential upside surprise for markets that have already aggressively dialled back bets on interest-rate cuts this year. Headline PCE YoY rose higher than expected to 2.7% from 2.5%.Core PCE Price Index QoQ was also higher than expected at 3.7%. As the Fed had always said, that last mile toward the 2% target was always going to be the hardest. Market was also relieved that the headline PCE remained in the “2% range”. Nvidia rallied nicely, back from last week’s selloff as some of the chip giant’s biggest clients are doubling down on AI investments. Both Meta and Tesla had earlier dampened sentiment following disappointing earnings reports as well as economic data which underwhelmed. Both M7 members recovered later following analysts taking comfort from Meta’s further investment in AI as well as Tesla speeding up delivery of its cheaper models sooner than anticipated. The S&P Global US Manufacturing, Services and Composite PMI’s came in below expectations as did the final Annualised QoQ GDP at 1.6% against expectations of 2.5%.

Consumer sentiment expectedly fell given heightened geopolitical tensions. U. of Mich. inflation expectations for 1 Yr was higher at 3.2% whilst the 5-10 Yr inflation rate remained unchanged at 3%. After spending the best part of the week above 18, the VIX closed lower circa 15.

The coming week will see the Fed meet for their FOMC on the 1st of May. No change is expected in rates. What is communicated later will be key – Powell we’re sure will continue to re-emphasise having the need to gain confidence from data releases, of the dis-inflation process continuing toward 2%. We will also have US unemployment data on Friday which is expected to remain unchanged at 3.8% with a change in non-farm payrolls of 250k. We continue to advocate lightening up (taking profit) on Mega Tech on rallies. Hold cash as dry-powder on deposit. We would look to start deploying into some utilities and/or into managed care (such as UnitedHealth Group), defensively.

Europe

European market closed higher on Friday, regaining momentum after a dip in the previous session. The STOXX 600 index provisionally ended 1.2% higher, with all sectors in positive territory.

Last week, the Euro Area’s April flash PMIs rose for the second consecutive month to reach 51.4. This uptick was primarily fueled by robust services, although there was a minor decline in manufacturing attributed to sluggish orders. Despite a dip in expected business, overall service sectors remained robust. Germany’s composite PMI index entered expansionary mode at 50.5, while France stabilized at 49.9.

In April, the EA European Commission’s preliminary consumer confidence inched up by 0.2 points to -14.7. Last week’s ECB communication was mixed as well. Executive Board member Schnabel highlighted potential upward risks to inflation. Conversely, Governors Panetta and Centeno, along with the latest ECB economic bulletin, recognized that growth risks persistently lean towards the downside. March monetary development data indicated a softening drag from credit creation, albeit still notable, while the M3 money supply saw a 0.9% y/y increase.

There are important releases this week. On inflation, we will get the preliminary April HICPs for Germany and Spain on Monday, and for France, Italy and the EA as a whole on Tuesday. The high energy prices likely to put upwards pressure on the headline number. On activity, we will get the EA and country-level Q1 GDP data on Tuesday. Finally, there are releases of final April EA consumer confidence on Monday, final April PMIs and Thursday.

Over in the UK, the April PMI survey suggests that the UK economy continues to expand at the beginning of Q2. However, behind the strong headline, sectoral divergence widened in April and input price pressures strengthened on the back of the 10% national living wage (NLW) increase. In April, households turned slightly more optimistic than in March as indicated by the uptick in the Gfk consumer confidence to -19 from -21.

While last week’s data provided more evidence in favour of an improving growth outlook for the UK, policymakers have been emphasizing the persistent inflationary pressures in their public statements.

As they have entered the communications blackout, no more MPC members are scheduled to speak before the MPC meeting on 9 May. This week will also be light on major data, with only final April PMIs and the March money and credit data. The primary focus of the week will be on the May local elections, encompassing 2,655 contested seats, alongside the 10 mayoral elections, serving as the last major polling event before the anticipated general election in the autumn. Not only will this be a gauge of momentum for all parties, but the party about to enter government usually makes significant gains in the final polling event before the general election.

Asia

Markets in Asia closed the week +2.92% with Hong Kong leading the gain with +8.80%. All Asia markets rose between 2 to 4% except for Indonesia, as it fell 0.72%. China CSI 300 index underperformed the broad Asia market, rising only 1.23% for the week. This came with the absence of further escalation in the Middle East geopolitical tensions, as both US and Europe rebounded to close the week higher. Japan followed the developed market as well, with Nikkei and Topix rising 2.34% and 2.29% respectively.

High speed Thai Chinese rail phase2. Phase 2 will start from Nakorn Ratchasima to Nong Kai which covers 357km and costs Bt341bn, thus, the cost is about Bt0.96bn/km. We believe this is slightly positive for the construction sector as there has been no large infrastructure projects coming out for some time.

Bank Indonesia may be forced to raise its key rate by 25 basis points to 6.25% at its policy meeting Wednesday to strengthen support for the rupiah, which has taken a beating from Fed signals that US easing may be delayed.

The Maldives’ ruling party is set to win a two-thirds majority in Sunday’s (Apr 21) parliamentary election, local media said. President Muizzu, elected last year, has pledged to end the country’s “India First” policy, putting relations with New Delhi under strain. His government has asked dozens of Indian military personnel to leave the country, a move critics say could accelerate the Maldives’ shift towards China.

Asian Economic Data

Japan flash PMI showed manufacturer sentiment stabilized while services activity strengthened. Australian PMI contracted at slower pace with business activity rising at its fastest rate n two years. India PMI expanded again. South Korean PPI inflation slowed for a second month on a m/m basis, Singapore inflation dipped by more than expected.

HSBC Flash India PMI revealed further economic growth in April as new business orders and output both expanded. April composite index reached 62.2 from March’s 61.8, services rose to 61.7 from 61.2, manufacturing stable at 59.1. Data suggested India in line to remain fastest growing major economy in 2024. However, ability to pass on prices to customers may mean inflation remains above RBI target, postponing potential rate cuts.

South Korea Q1 GDP was better than expected, underpinned by growth in construction but officials warned of obstacles ahead. Authorities there also rolled out a market monitoring system to detect illegal short selling ahead of a possible end to the current ban in June.

Stronger core and headline Australian inflation supported AUD, as market participants fully priced out any cuts by the RBA in 2024. Headline CPI rose by 1.0% q/q in 1Q24 (C: 0.8%; P: 0.6%) and Trimmed Mean CPI rose by 1.0% q/q in 1Q24 (C: 0.8%; P: 0.8%); the monthly indicator also showed sequential momentum.

China consensus forecasts for 2024 GDP growth raised to 4.8% from 4.6% on the back of surprising strength in Q1 data.

GeoPolitics

China – Russia: Russia remained China’s top oil supplier in March, with Chinese imports of Russian crude jumping 12.5% y/y. Swedish foreign minister said the EU’s next package of Russian sanctions should include steps against Russia’s ability move oil using shadow tankers.

US- China: The US is drafting sanctions against specific Chinese banks that would cut them off global financial system for aiding Russia’s war in Ukraine (Reuters). Reports earlier this week noted Secretary of State Blinken is set to visit Beijing this week with a warning of punitive actions unless Beijing halts shipments of weapons-related material to Russia.

The US House of Representatives has placed legislation to force TikTok’s parent company ByteDance to divest its ownership stake on a fast track (Bloomberg). Separately, TikTok also moved to remove its US-based general counsel, Erich Andersen, who was responsible for lobbying efforts in the US.

US Secretary of State Antony Blinken told top official in Shanghai that US seeks healthy economic competition with China and a level playing field for American workers and companies operating in China as he began three-day China trip. China dismissed criticism that its manufacturing capacity is excessive. Blinken will head to Beijing for talks with his counterpart Wang Yi and possibly President Xi Jinping, which he will press China to stop its firms from aiding Russia’s war efforts in Ukraine. No real progress is expected to be made amid deep differences.

Europe – China: Bloomberg reported EU formally launched probe of China’s procurement of medical devices ahead of President Xi Jinping’s scheduled visit in May. The investigation will seek to address concerns that China unfairly favors domestic suppliers under International Procurement Instrument. Relations between Brussels and Beijing have been tense, as Europe is getting more assertive in response to China’s trade policies.

US- Africa: US and Niger agree to have US troops withdraw from country.

FX

DXY USD Index fell slightly by 0.20% to 105.93. Stagflation concerns as 1Q24 US GDP grew at a 1.6% q/q annual rate (C: 2.5%; P: 3.4%) while the Core PCE Price Index increased at a 3.7% q/q annual rate (C: 3.4%; P: 2.0%). In addition, USD weakness was supported by softer-than-expected US PMIs. These drove OIS pricing to push the first full rate cut to November, and 40 basis point cut in 2024. March core PCE of 0.32% in line with 0.3% consensus, up from unrevised 0.27% February print. January revised up to 0.50% from 0.45%. Core PCE 2.8% y/y above 2.7% consensus, though lowest since Mar-21. However, 3m annualized pace jumped to 4.45% from 3.74%, highest since Mar-23, though 6m annualized pace ticked down 2 bp to 2.98% after February 3.0% pace highest since Jul-23.

EURUSD rose 0.35% to 1.0693, supported by strong preliminary euro area PMIs, with strength in services. In the Euro Area, the preliminary April Composite PMI rose to 51.4 (C: 50.7; P: 50.3), Services rose to 52.9 (C: 51.8; P: 51.5), and Manufacturing fell to 45.6 (C: 46.5; P: 46.1)

GBPUSD rose 0.99% to 1.2493, supported by the strong preliminary April S&P Global UK PMIs. In the UK, preliminary April PMIs showed robust growth momentum and an acceleration in input costs due to the minimum wage increase. However, the prices charged index ticked down, which showed weakness in corporate pricing power.

USDJPY rose 2.39% to 158.33, a level last seen in 1990. BoJ maintained its policy rate and guidelines for purchases of JGBs and other assets. Outlook Report suggested that Inflation is on sustained and stable 2% path, calling for CPI inflation excluding fresh foods and energy to continue at around the 2% mark, rising a projected 1.9% in FY24-25 and 2.1% in FY26. During the press conference, Governor Ueda commented that monetary policy does not directly target the exchange rate and FX fluctuations usually have a temporary effect on inflation. With the absence of intervention by Japan MOF, USDJPY grinded higher, and touched 160 this morning.

Oil & Commodities

Oil future rose last week, with WTI (+0.85%) and Brent (+2.53%) to 83.85 and 89.5. This week’s advance was supported by a drawdown in US nationwide inventories. Crude inventories fell by more than expected as refineries ramp up oil processing following maintenance and exports pick up. Exports ticked above 5 million barrels a day amid robust flows to Europe. In the US, refineries are processing the most crude since 2019 on a seasonal level as they build stocks for the summer driving season and meet export demand.

Gold fell 2.26% to 2337.96 due to the absence of further escalation in Middle East geopolitical tensions. In addition, US Treasury yields rose, with US 10 years and 30 years rising 4 and 6 basis points, respectively. Gold fell to a low of 2291.64 intra-week before rebounding. The rebound happens amidst the largely in line March Core PCE released towards the end of the week.

Economic News This Week

- Monday – EU Cons/Svc/Indust./Econ. Confid., US Dallas Fed Mfg Act.

- Tuesday – JP Jobless Rate/Retail Sales/Indust. Pdtn, CH PMI, AU Retail Sales, UK Mortg. App., EU CPI/GDP, CA GDP, US MNI Chic. PMI/Cons. Confid.

- Wednesday – NZ Unemploy. Rate, JP/UK/US/CA Mfg PMI Apr Final, US MBA Mortg. App./ADP/ISM Mfg/ISM Price Paid/FOMC Rate Decision

- Thursday – NZ Building Permits, AU Trade Balance/Building App., JP Cons. Confid., SZ CPI/Retail Sales. SZ/SW/EU Mfg PMI Apr Final, US Trade Balance/Factory Orders/Durable Goods Orders

- Friday – AU/UK/US Svc/Comps MI Apr Final, Norway Rate Decision/Unemploy. Rate, EU Unemploy. Rate, US Nfp/ISM Svc Index

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.