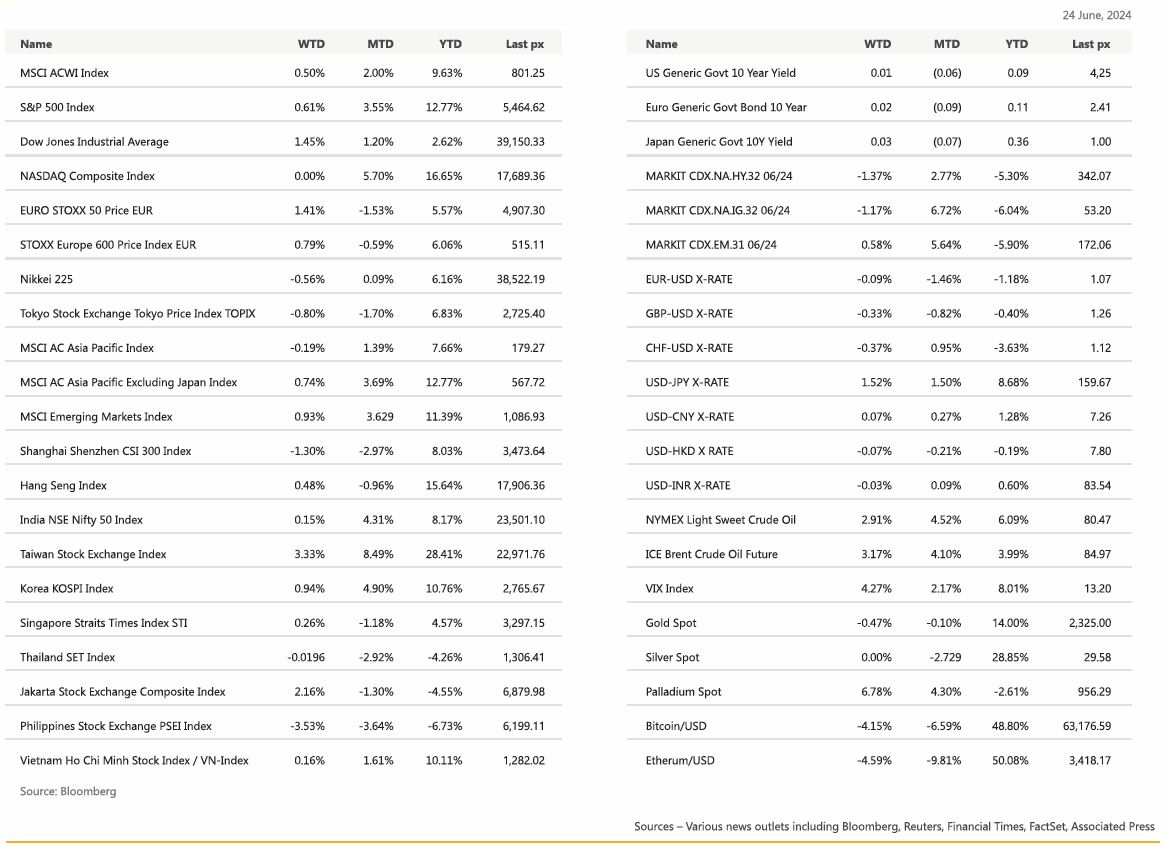

KEY MARKET MOVES

MACRO OVERVIEW

US

Fatigue set in, in a shortened trading week as markets struggled to gain ground following multiple new highs being recorded over the last few sessions. While the S&P 500 has charged from one record to the next this year, fewer and fewer stocks are participating in the rally, stoking concerns about narrowing breadth. Friday’s triple-witching mass options expiry kept stocks at bay but didn’t stop equities from closing out a third straight week of gains. Interest rate sensitive stocks may be more in focus as more Fed-speak is expected this week. Comments from Minneapolis Fed’s Kashkari Thursday who reiterated his view that the outlook for interest rates remains dependent on the path of the economy and that inflation may take up to 2 years to return to its 2% target also sapped sentiment. Fed Governor Adriana Kugler however, said it will likely be appropriate for the US central bank to cut rates “sometime later this year” if economic conditions unfold as she anticipates.

All in all, expectations remain of only a single cut by year end. Semiconductor stocks traded lower amid broader risk-off sentiment even as Dell Technologies CEO Michael Dell said the company is building a “Dell AI factory” for Elon Musk’s startup xAI alongside Nvidia and Super Micro Computers.

Retail sales came in lower than expected across all sectors with the advance MoM reading coming in at 0.1% vs 0.3% expected as prior months were revised lower. Mid-June initial jobless claims were roughly in line with consensus, but Continuing Claims continues to print higher.

May housing starts as well as building permits printed much lower than expected.

While this may bode well for the outlook for inflation, it could also be the beginning of a slowdown in growth which could hurt more than a couple of rate cuts. In terms of flows, a survey by Bank of America Corp. showed that global investors are likely to keep pumping money into record-hitting stock markets. Political tensions in Europe ahead of a French snap election are also seen keeping US stocks in favour, Citigroup Inc. strategists said earlier last week.

June preliminary US Manufacturing & Services PMI’s printed higher than expected at respectively 51.7 Vs 51.0 & 55.1 Vs 54.0 expected. The employment subindex of the US services PMI returned to expansionary territory, rising to 51.4 after below-50 readings in May and April, which is likely positive for the June employment report. Lastly, the prices paid and received indices came down for both manufacturing and services. The combination of stronger business activity and lower prices supports a soft-landing scenario. We had a very different situation in Europe with France & Germany Manufacturing & Services PMI’s printing lower than expected.

Looking ahead, we will see a wave of economic data this week, including a consumer confidence reading on Tuesday, jobless claims Thursday and the key PCE Deflator gauge & personal spending data on Friday. Headline PCE and core YoY are both expected to come in at 2.6% and MoM at 0%, both softer than previous month’s. On Friday morning Asian time, we will watch the much-awaited first debate between Donald Trump and Joe Biden.

We remain cautious – neutral, as we enter the last week of June as volumes are expected to thin out with Summer holiday season kicking in.

Europe

The European Stoxx 600 index ended the Friday session down 0.69%, with the bank stocks tumbling 1.5% as utilities managed a 0.1% gain.

On the data front, the surprise came from the flash June PMIs that brought an end to the gradual improvement in sentiment observed since the beginning of the year, with the composite PMI now only marginally in expansionary territory at 50.8pt, the headline services PMI edging down to 52.6pt and the headline manufacturing PMI dropping to 45.6pt.

Weaker output was reported across countries and sectors, though manufacturing remains the euro area’s weakest spot. Composite PMI price balances were weaker, this was concentrated in the services sector, with manufacturing input and output prices rising on the month.

This week, the focus will continue to be on the French general elections. Presently at the French general elections, a hung parliament, in which the far-right Rassemblement National (National Rally, RN) has a relative majority, appears to be the likely outcome. On 20 June, a Harris Interactive Poll suggested that the RN and its allies would win up to 280 seats (best-case scenario), falling short of the 289 needed for an absolute majority. Nevertheless, much can still change between now and the election and turnout will be a crucial factor to consider.

Over in the UK, services inflation dropped to 5.7% in May, down from 5.9% a month before, as prices rose for airfares and accommodation. Services inflation appears far too sticky for the BoE. The ongoing strength in wage growth may mean that it takes some time for services inflation to call sufficiently to be consistent with achieving the inflation target in the medium term.

BoE leaves rates unchanged at 5.25% in a 7-2 vote, as expected. The MPC left official guidance broadly unchanged with respect to policy weighing on activity, inflation persistence moderating but still elevated, and the need to keep rates restrictive for sufficiently extended period. Nonetheless, there were some clearly dovish adjustments to the Bank’s comments, and the market-implied probability for an August rate cut increases to 62%.

Majority of analyst had forecast a cut in August after the country’s July 4 election. The decision came after data released Wednesday showed that UK inflation rose by annual 2.0% in May, hitting the central bank’s inflation target. This means that the headline inflation in the UK is now below that of the US and the Eurozone.

The Swiss National Bank lowered its policy rate by 25bps to 1.25%, a move that was anticipated by two-thirds of economists. The decision follows a similar move in March and means the SNB retains its position as a front-runner in the global policy easing cycle.

This week, we will have the final GDP release which will provide key updates on household disposable income and the savings rate. The BoE will publish its Financial Stability Report on Thursday.

Asia

Asian markets were generally up, MSCI Asia Ex Japan closed the week higher by 0.74%. Taiwan was the clear leader, up 3.33% last week.

Both Nikkei 225 and TOPIX in Japan were weaker. Bank of Japan Governor Kazuo Ueda said the central bank could raise interest rates next month depending on economic data. “Our decision on bond-buying taper and interest rate hikes are two different things,” Ueda said. Also, the Reuters Tankan poll for June showed Japanese manufacturers are markedly less confident about business than three months ago due to higher materials costs. The manufacturers’ sentiment index declined to +6 from +10 three months ago and from +9 in May, with firms hurt by a yen that is trading near 34-year lows and inflating costs of raw materials that resource-poor Japan needs to import from abroad.

Japan exports rose 13.5% y/y in May. It was above consensus of 12.7%. By product breakdown, auto exports rose 13.6% and shipments of chips and chipmaking equipment climbed 16.9% and 45.9% respectively. Imports rose an in-line 9.5% y/y, up from April’s 8.3% increase and driven by fuels, and machinery (PCs and parts) purchases. However, weak yen played an outsized role in boosting exports with volumes shrinking on-year. The USD has appreciated more than 8% YTD versus the Yen. Japan has acknowledged it has spent 9.8 trillion yen ( $61.3 billion) in the period between 26th April and 29th May.

Addressing Lujiazui Forum in Shanghai, Governor Pan Gongsheng signaled PBOC might soon start trading in secondary bond market and emphasized adding such operations into monetary policy toolbox does not mean quantitative easing but rather creates suitable liquidity environment. Governor Pan said China’s monetary policy has been supportive to aid economic recovery. Stressed central bank will continue flexible use of various monetary policy tools, including interest rates and RRR, strengthen counter-cyclical and cross-cycle adjustments, and avoid big expansion or contraction. Added country will “resolutely” prevent exchange rate overshooting.

China’s one-year loan prime rate (LPR), a market-based benchmark lending rate, came in at 3.45% Thursday, unchanged from the previous month. The over-five-year LPR, on which many lenders base their mortgage rates, also remained unchanged from the previous reading of 3.95%.

Bank of Korea Governor Rhee said Tuesday pace of consumer inflation continues to slow in country, hinting bank may be ready to cut interest rates by year end. Rhee said the recent slowdown in oil and agriculture prices mean future retail inflation should slow, in line with bank forecasts made in May whereas consumer pressure on prices likely to stay contained, due to the end of fuel tax cuts and rise in utility costs will add upward inflationary pressure. Consensus sees BOK cutting rates by total 50 bps in Q4 as headline inflation nears bank’s target 2.0%.

India is expected to grow by 7.2% in the current fiscal year, stronger than earlier expected, with its central bank opting for just a one-quarter-point rate cut in that period, Fitch Ratings said in its quarterly Global Economic Outlook (GEO) report published on Tuesday. “We forecast real GDP growth of 6.5% in FY25/26 (unchanged from March), and 6.2% in FY26/27, driven by consumer spending and investment,” they wrote. Fitch expects headline inflation in the South Asian nation to continue declining to 4.5% by calendar year-end, and average 4.3% in 2025 and 2026, staying slightly above the mid-point of the Reserve Bank of India’s 2% to 6% target range. The Nifty index is up more than 8% YTD.

Thailand’s central bank remains firm in its opposition to a government plan to give $14bn in cash to almost all adult citizens to revitalise consumption activity with private consumption forecast to expand about 4% this year after a record growth of 7% last year, there’s no need to stimulate demand across the board.

Indonesia’s central bank left its benchmark interest rate unchanged for a second straight meeting. BI may be viewing any further rate hikes as a last resort to protect the growth momentum, especially since inflation remains well within target.

GeoPolitics

Israel – Thousands of Israelis protested Prime Minister Benjamin Netanyahu’s government on Monday.

The Israeli military on Tuesday night said senior officers had approved “operational plans for an offensive in Lebanon”, as fears grow that Israel and Hezbollah could slide into a full-blown conflict. The announcement came hours after Hezbollah, one of the world’s most heavily armed non-state actors, released a nine-minute video of what it said was footage gathered by its surveillance drones of parts of Israel. Netanyahu said Sunday that the current phase of fighting against Hamas in Gaza is winding down, setting the stage for Israel to send more troops to its northern border to confront the Lebanese militant group Hezbollah.

China – Japan: Japan imposed trade restrictions on China-based companies as part of a fresh round of sanctions against individuals and groups supporting Russia’s war on Ukraine, the foreign ministry said in a statement on Friday. The new sanctions also target firms in India, Kazakhstan, and Uzbekistan. It marks the first time Japan has imposed sanctions on China-based firms in connection with the war in Ukraine, according to Japan’s foreign ministry.

China – Malaysia: Premier Li Qiang met Malaysian PM Anwar Ibrahim in Putrajaya, marking 50 years of diplomatic ties. Two sides signed a slew of deals and renewed a five-year economic cooperation pact. Li said China is ready to work with Malaysia and agreed to allow imports of fresh Malaysian durians after it meets sanitary requirement

China – EU: Both have reached agreements for talks on planned imposition of tariffs on Chinese-made electric vehicles imported to Europe.

Russia – Vietnam: Vietnam welcomed Russian President Vladimir Putin, underlining its decades-old relationship with Moscow. Hanoi is brushing aside Western criticism of its invitation to Putin, who last visited Vietnam in 2017 when it hosted the Asia-Pacific Economic Cooperation Summit. The US Embassy in Hanoi, in a statement Monday, said “no country should give Putin a platform to promote his war of aggression and otherwise allow him to normalize his atrocities.” Russia’s Novatek PJSC plans liquefied natural gas projects in Vietnam, Putin wrote in the country’s Communist Party newspaper Nhan Dan ahead of his visit, without providing details. He also mentioned an initiative to establish a centre for nuclear energy and technologies with the support of Russia’s state nuclear corporation Rosatom. State-owned Vietnam Oil and Gas Group, or PetroVietnam, has also signed a deal with Russia’s state energy giant Gazprom PJSC for oil drilling and exploration. Vietsovpetro, a joint venture between Vietnam and Russia, runs the Southeast Asian country’s largest oil field.

Russia – North Korea: Russian President Vladimir Putin has warned that U.S. ally South Korea would be making “a big mistake” if it decided to supply arms to Ukraine, and that Moscow would respond to such a move in a way that would be painful for Seoul. The pact signed by Putin and North Korean leader Kim Jong Un on Wednesday commits each side to provide immediate military assistance to the other in the event of armed aggression against either one of them. U.S. State Department spokesperson Matthew Miller said the defence pact signed is “incredibly concerning.

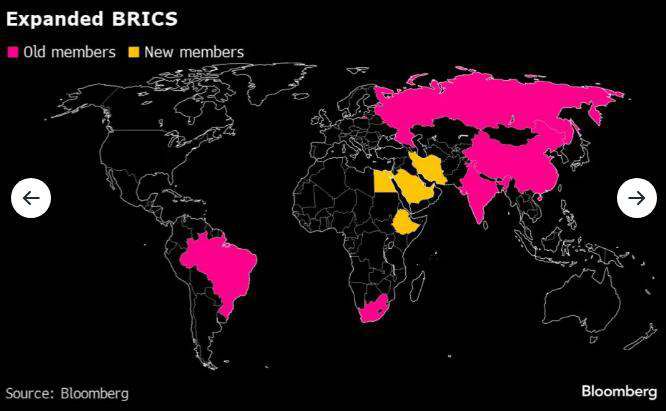

Russia is all set to host the BRICS+ Forum 2024 meeting on June 21 and a delegation of 21 countries will attend the summit. BRICs last year began to expand its membership as it looks to challenge a world order dominated by Western economies, with Saudi Arabia, Iran, Ethiopia, Egypt, Argentina and the United Arab Emirates joining and more than 40 countries expressing interest. Malaysia too is preparing to join the BRICS group of emerging economies, Prime Minister Anwar Ibrahim said in a recent interview.

BRICS countries contribute to over $28 trillion of the world’s $100 trillion economy. The group says it wants emerging economies to have a larger representation worldwide, arguing that Western countries in North America and Western Europe dominate global financial bodies such the World Bank and the International Monetary Fund.

Credit / Treasuries

The US Treasury curve was very quiet during this short week compared to recent volatile weeks, with roughly no change on the shape of the curve with all the points on the curve up by 2bps. US IG credit spreads were unchanged over the week while US HY credit spreads tightened by 5bps.

In term of performances, US IG gained 15bps, US HY gained 35bps and leverage loans lost 10bps.

FX

USD has been well supported recently. Since the European Parliament elections two weeks ago, DXY Index is up about 1.50% and is slowly trading close to its highest point this year. US dollar has been particularly strong over the last few weeks against Euro but also against Japanese yen, which is trading at its lowest YTD, currently very close to the 160 level. BOJ might intervene in the FX market as the pace of depreciation recently has been accelerating. Finally, even though the Swiss National Bank again cut interest rate, Swiss franc has also been well supported, gaining close to 4% against Euro since the beginning of June.

Economic News This Week

-

Monday – Taiwan Industrial Production, Mexico Bi-weekly Core CPI/CPI

-

Tuesday – Spain GDP QoQ/YoY

-

Wednesday – Germany Gfk Consumer Confidence, France Consumer Confidence, Australia CPI YoY

-

Thursday – Euro Area M3 Money Supply/Consumer Confidence, BoE Financial Stability Report, US GDP Annualised QoQ, US Durable Goods, JP Retail Sales YoY/MoM

-

Friday – Euro Area Consumer Expectations Survey, France/Italy/Spain CPI MoM/YoY, UK GDP QoQ/YoY, UK Current Acc Balance, US Personal Income/Spending, US PCE Deflator MoM, US PCE Core Deflator MoM, JP Tokyo CPI YoY, JP Industrial Production MoM/YoY

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.