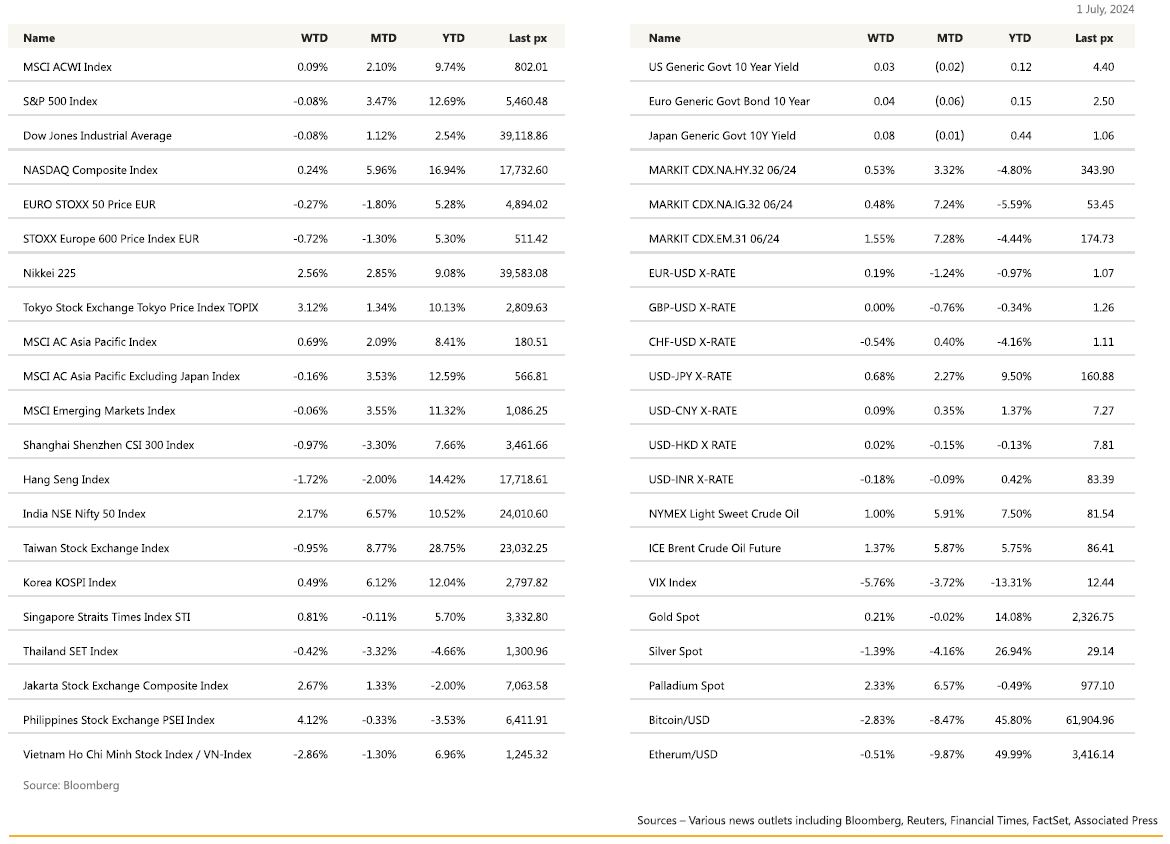

KEY MARKET MOVES

MACRO OVERVIEW

US

What a week that was, from a rollercoaster ride in markets to a somewhat one-sided Presidential debate which pushed US markets to end the last week of the quarter down marginally. The Nasdaq however, eked out a small gain for the week coming in at +0.26%. The latest string of inflation data in PCE came in on the nose which decelerated last month, supporting optimism for interest rate cuts later this year. The core PCE MoM increased 0.1% from April which was the smallest increase in six months and the YoY was at 2.6% which was the least since early 2021.

Markets initially rallied on the back of the data only to turn negative at the end of the session. Wild swings in Nvidia’s stock during the week and Micron Technology Inc.’s inability to reach sky-high expectations have raised questions on how much longer the rally can keep going, prompting punters to take some chips off the table. A couple of investment banks, Goldmans and Citi put out notes to clients advising them to trim stock exposure, warning of a near-term pullback. Still the S&P 500 logged its seventh monthly gain in the last eight, setting a wave of records thanks to a boost from artificial intelligence enthusiasm. Fed speak from SF’s Daly was quick to comment that the latest inflation data shows monetary policy is working, but added it’s too early to tell when it will be appropriate to lower borrowing costs. Nike and Walgreens tumbled after its full year outlook missed expectations, echoing a slowdown in personal spending & consumption despite personal income increasing in May by more than expected. As Bloomberg columnist Mohamed El-Erian commented on the media, the look back data remains strong but the forward looking ones are showing cracks starting to form and expects the Fed to be late again, this time in cutting rates. Initial and continuing claims were on balance as expected. The U. of Mich. 1 Yr and 5-10 Yr inflation expectations fell to 3% for both readings. June Dallas Fed Manufacturing activity printed in line with consensus at -15.1, stronger than previous Month (-19.4).

US consumer confidence eased this month on a more muted outlook for business conditions, the job market, and incomes. The Conference Board’s gauge of sentiment decreased to 100.4 from a downwardly revised 101.3 reading in May.

The Fed’s bank-stress tests on 31 big banks (compared to 23 last year) delivered a surprise surge in capital requirements, and large US banks passed them. Wells Fargo, Goldmans, JP Morgan, Bank of America and Morgan Stanley announced plans to raise their 3rd quarter dividends on Friday, proving that they have enough capital to withstand severe economic and market turmoil.

May Canada CPI printed at 2.90, much higher than expected (2.60%) and higher than previous Month (2.70%). May Australian CPI printed at 4.00%, higher than consensus at 3.80% and much higher than previous Mont (3.60%). Nomura believes that the 6 August RBA policy meeting is now very live, and a rate hike is now a real possibility. June Richmond Fed Manufacturing activity printed at -10, lower than expected.

On the debate, Thursday night’s hotly anticipated presidential debate saw President Joe Biden struggle against Republican candidate Donald Trump, with 67% of debate watchers giving Trump the win, according to a CNN flash poll. Democrats had publicly and privately expressed alarm in the aftermath, with doubts growing over Biden’s candidacy. An analyst from Jefferies noted that opinion polls in key swing states are reporting declining support for Biden BUT polls are also indicating that a majority of voters do not like either Trump or Biden. Hence, should the Democrats field a new candidate, it could alter the election dynamics, which remains underpriced.

Risks remain elevated with elections across the pond in France and the UK leading more humps ahead for risk assets. To this extent we remain invested in the cybersecurity sector which continues to be attacked.

This week main economic data in the US will be the June ISM Manufacturing & Services, the May Jolts as well as the June Payrolls, unemployment rate, average hourly earnings & labor force participation.

Europe

European stocks closed 0.24% lower Friday, marking a 4th consecutive session in the red.

In May, consumer spending rebounded sharply in France at +1.5% but consumers and business confidence indices for June again point South. The June economic sentiment indicator for the euro area of the EC Business and Consumer Survey edged down to 95.9. This was driven by industrial (-10.1 from – 9.9) and services (6.5 from 6.8), while consumer confidence was stronger at -14.0 (from -14.3). This week, we will focus on final manufacturing PMIs (Monday), services and composite PMIs (Wednesday).

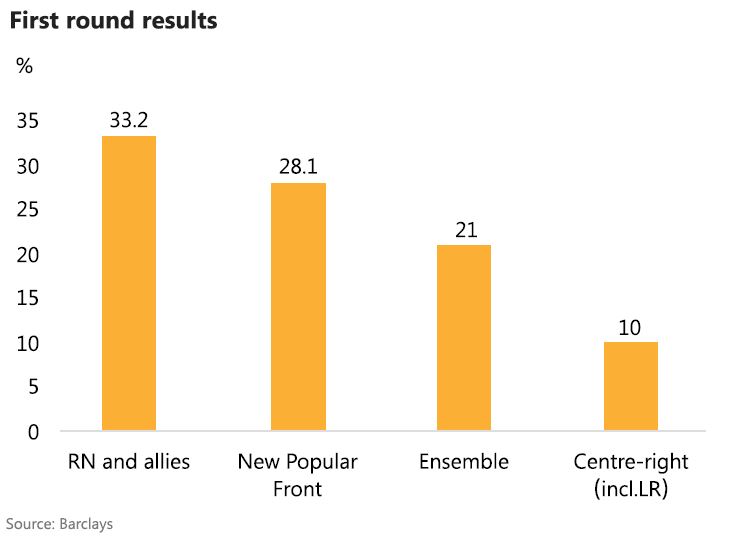

The focus turns to elections in France. Marine Le Pen’s far-right National Rally (RN) party has taken the lead in the first round of France’s parliamentary elections yesterday. The National Rally gained 33.2% of votes cast, while left-wing New Popular Front (NFP) coalition is in second with 28.1% and President Emmanuel Macro’s Ensemble alliance slumped to 20.3%. The RN has had a surge in support in the country in recent months, while Macron’s centrist alliance lost its parliamentary majority in 2022 and has been plagued by divisions and disorder. Never before has the far right won the first round of a French Parliamentary election.

Participation during this snap election was very high, close to 60%, much higher than 2years ago when participation rate reached only 39%. After the first round, there is now a record number of potential “triangular” elections next weekend, currently estimated between 290 & 320 contests. During the latest legislative election 2years ago, only 8 such contest happened. As a reminder, the first two leading candidates will face each other during the second round if nobody won more than 50% during the first round. For a “triangular” 2nd round contest to happened, the candidate finishing third during the first round should have gained at least 12.50% of the vote in the local jurisdiction. The total number of parliament members in France is 577, therefore the number of potential “triangular” is especially high and it now remain to be seen what decision will be taken by the different political parties this week. As of this morning, it looks like the leader of LFI, which is part of the far left Popular Union, would advise for all candidates from the Popular Union who finished third during the first round to step down in order to try stopping the election of the candidates from the farright party. The European currency is slightly rebounding this morning after the first-round elections but a lot of uncertainty remain before the 2nd round elections next weekend.

If the vote sees a repeat of the first round, Le Pen’s party could feasibly form a government. If that does happen, Jordan Bardella, the 28-year-old candidate representing Le Pen’s party, will become France’s next Prime Minister.

Without an absolute majority, France will have a hung parliament and the RN will be unable to push through its plans for immigration, tax cuts and law and order. However, the final outcome of the election remains hard to forecast.

Last week’s economic in the UK had been mixed. The CBI industrial trends survey reported a rise in the orders balance to a three-month high, a move that was more related to domestic than to foreign orders. Output remained positive and improved looking three months ahead. The final print of Q1 UK GDP was revised up to 0.7% qoq from 0.6%. Consumer spending was better than previously reported at 0.4% (previously 0.2%), while imports fell by more.

We will see UK’s general election this Thursday. Polls and seat projections suggest that Labour is comfortably on course to win a majority and form a government.

Asia

Asian markets were mixed last week. We had Japan and India finishing the week strong with Nikkei up 2.56% and Nifty up 2.17%. India markets setting fresh record highs, with the Nifty up 6.57% for the month of June and up 10.52% YTD. The upward momentum comes after the volatility related to Lok Sabha poll results 2024 cooled down. According to analysts, overall optimism surrounding the Union Budget in July, increasing foreign inflows, and robust domestic economic data contributed towards the positive movement in the market.

The rest of Asia was muted, the largest laggard was Vietnam down 2.86%. Vietnam’s economic growth accelerated in the second quarter on robust exports, government data showed on Saturday. Gross domestic product is estimated to have expanded to 6.93% in the second quarter. Inflationary pressures continue to build as a government decision to raise base salaries for state employees by 30% and pensions for retirees by 15% from July 1 is expected to add to inflation pressures.

China’s industrial profits rose at a much slower pace in May. Earnings rose 0.7% year-on-year last month after a 4% increase in April while gains over the first five months also eased to 3.4% from 4.3% in the January-April period, according to National Bureau of Statistics (NBS) data. State-owned firms posted a 2.4% drop in profits in the first five months, foreign firms tallied a 12.6% gain, while private-sector companies saw profits up 7.6%, according to a breakdown of the NBS data.

Yen fell to its weakest since 1986, testing 161 per dollar and hit an all-time low against the Euro. The Japanese yen, hit a 38-year low against USD on Wednesday. It is now well below the 160.00 per dollar level that triggered large-scale yen-buying intervention from Japanese authorities nearly two months ago. As of this morning, USDJPY was trading around the 160.88 handle.

The Bank of Thailand expects slower economic growth in the third and fourth quarters this year on a quarterly basis, citing a high base effect. Second-quarter GDP is anticipated to expand 1% from three months earlier, down from 1.5% growth recorded in the first quarter. The cabinet ordered the Interior Ministry to study whether to let foreign buyers own up to 75% of a condo units in a building, up from 49% at present. Thailand’s bid to allow more foreign ownership of condominiums to revive the sluggish property market has triggered an uproar.

Foxconn Singapore has been awarded a licence to invest $383 million in a factory to produce printed circuit boards in Vietnam, state media reported on Monday. The plant in the northern province of Bac Ninh will produce 2.79 million products a year, Cong Thuong newspaper reported. Foxconn has invested more than $3.2 billion in Vietnam since fist entering the Southeast Asian country in the 2000s. Most of its manufacturing plants are located in the northern provinces of Bac Ninh and Bac Giang. Earlier this month, Vietnamese state media said Foxconn will produce 5G AirScale equipment for Nokia at Bac Giang.

GeoPolitics

Israel: The unanimous ruling dismisses a long-standing exemption from military service for ultra-Orthodox Jewish seminary students. The ruling could have political ramifications, because Prime Minister Netanyahu’s coalition relies on the support of two ultra-Orthodox parties that have long backed the waiver.

Ukraine – US: Two key advisers to Donald Trump have presented him with a plan to end Russia’s war in Ukraine — if he wins the presidential election — that involves telling Ukraine it will only get more U.S. weapons if it enters peace talks. The strategy outlined by Kellogg and Fleitz is the most detailed plan yet by associates of Trump, which could quickly settle the war in Ukraine if Trump beats President Joe Biden in the Nov. 5 election. The proposal would mark a dramatic shift in the U.S. position on the war and would face opposition from European allies and within Trump’s own Republican Party.

US Allies: United States, Japan and South Korea vowed on Wednesday (Jun 26) to cooperate on strategic issues including artificial intelligence (AI) safety, export controls, clean energy and semiconductor supply chains.

China – US: China says it’s opposed to proposed American investment restrictions on its tech industry — and that it reserves the right to take action against the measures. American officials have reportedly asked South Korea, Japan, and the Netherlands to restrict exports of memory and advanced logic chip equipment and technology to China.

China – EU: Beijing wants the EU to scrap proposed tariffs on Chinese electric vehicle imports before they are due to take effect on July 4. Commerce Minister Wang Wengtao has hinted to his German counterpart that Beijing open to lowering exiting tariffs on large-engine car imports if Germany convinces EU not to proceed. Elsewhere, Canada began 30-day consultation period in first step before government can impose tariffs on China EV imports.

Credit / Treasuries

USTs bear-steepened in a busy quarter-end session. This came alongside growing attention towards the US election following the debate on Thursday night that may have led to market participants adding trades to support various election outcome views, 2 years US Treasury yield gained 115bps & 30years gained 18bps. Mostly of the yields rebound happened last Friday. The 10’s and 2’s closed at 4.40% and 4.75% respectively. The VIX also ended higher at 12.44.

US IG credit spreads ended the week roughly flat while US HY credit spreads widened by 4bps. In terms of performances, US IG lost 1% over the week, US HY lost 22bps and leverage loans lost 6bps.

FX

USD has been well supported recently. Since the European Parliament elections two weeks ago, DXY Index is up about 1.50% and is slowly trading close to its highest point this year. US dollar has been particularly strong over the last few weeks against Euro but also against Japanese yen, which is trading at its lowest YTD, currently very close to the 160 level. BOJ might intervene in the FX market as the pace of depreciation recently has been accelerating. Finally, even though the Swiss National Bank again cut interest rate, Swiss franc has also been well supported, gaining close to 4% against Euro since the beginning of June.

Economic News This Week

-

Monday – Germany CPI Harmonized MoM/YoY, Euro Area Manufacturing PMI, S&P Global UK Manufacturing PMI, US ISM Manufacturing, Australia Retail Sales MoM

-

Tuesday – Euro Area CPI MoM/YoY, US May JOLTS

-

Wednesday – Eurozone Services and Composite PMI, S&P Global UK Services/Composite PMI, US Trade Balance, US ISM Services Index

-

Thursday – UK S&P Global UK Construction PMI, UK General Election, Australia Exports/Imports MoM

-

Friday – Germany Industrial Production SA MoM, France Industrial Production MoM/YoY, US Unemployment rate, AHE MoM

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.