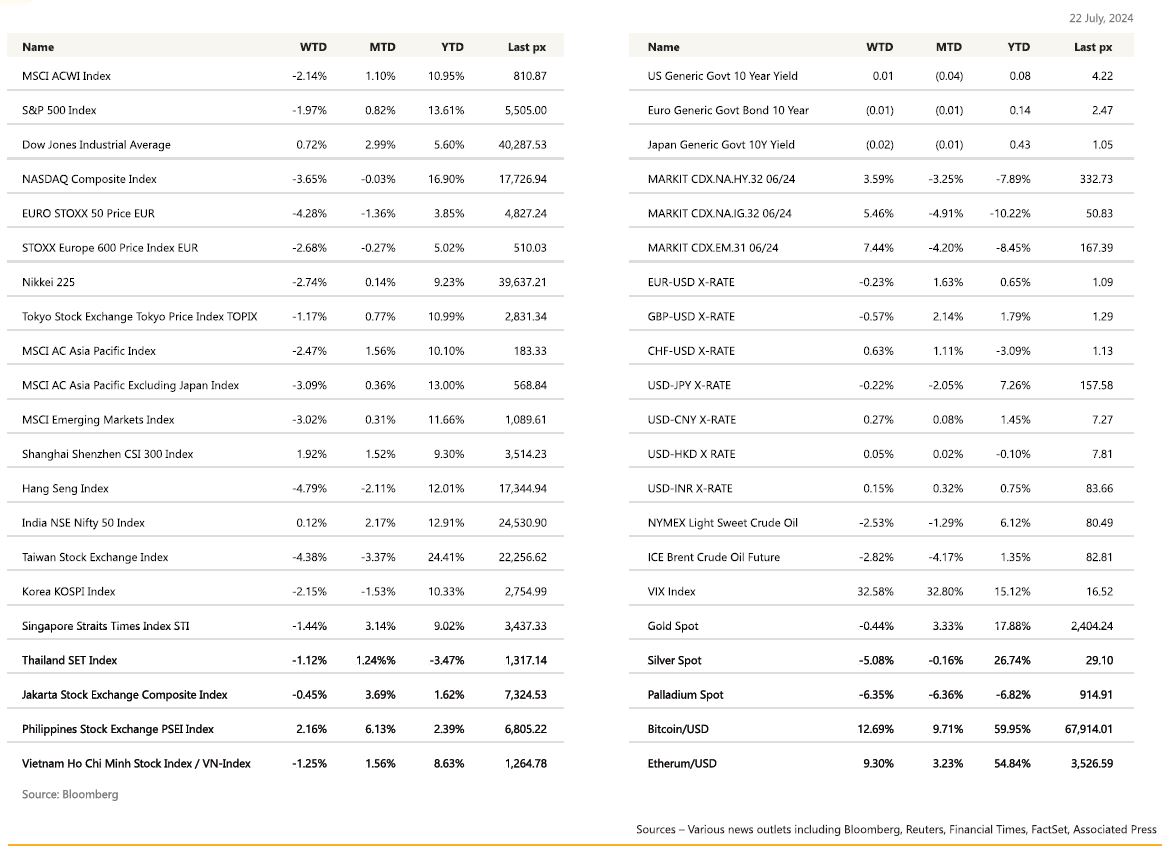

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

News UPDATE over the weekend: Biden will not seek re-election. Kamala Harris is endorsed by Biden as his replacement. Initial reaction to markets have been relatively muted. Biden’s exit leaves markets guessing what’s next for the “Trump trade”.

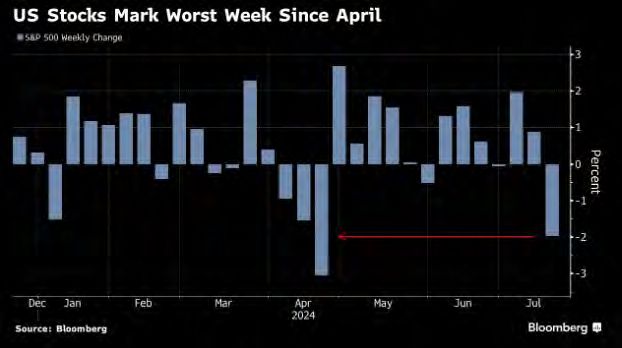

As they say, a correction is always healthy and that’s exactly what we got for the week. The S&P 500 fell about 2% marking its worst week in 3 months. Friday night capped off a third straight decline, roiled by uncertainty related to the US Presidential election, continued geopolitical angst and an unprecedented global tech outage. In an almost life imitating art scene from a movie on Friday, businesses and public services from Australia through to the US were disrupted after CrowdStrike Holding’s Falcon Sensor threat-monitoring service caused Microsoft’s Windows operating system to crash. These then coincided with disruptions of MSFT’s Azure cloud and 365 office services. Tech stocks were already declining prior to the outage, the Nasdaq having its worst day in 19 months Wednesday, amid a growing risk of tougher trade restrictions on semiconductors.

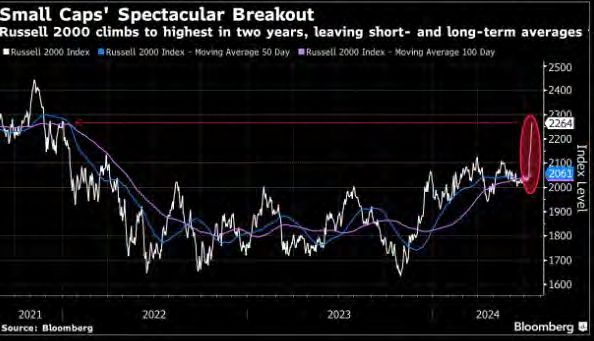

Investors wary about tighter US restrictions on chip sales to China, Biden’s likely exit from the race came amid a rotation into shares of smaller, riskier companies, pushing the Russell 2000 Index 1.7% higher for the week. It rose 6% in the previous week. Optimism about the potential for rate cuts appears to be driving a surge not just in US small caps but also across the pond as well.

However, B of A strategists report that investors are flocking to US equities as they grow more certain of a September cut by the Federal Reserve and that Donald Trump will win the US presidential election. This however, is in contrast to the Trump 2.0 administration, as investors remain edgy about trade tariffs and geopolitical uncertainties.

Commodity companies linked to copper retreated following China’s less than stellar measures to support its domestic economy, although this may not be all of it. Data out earlier in the week supported retail purchases which excluding motor vehicles, rose 0.4% last month, following an upwardly-revised 0.1% advance in May. The data bucks a trend in recent months that had shown a gradual slowdown in consumption growth, reinforcing speculation that the Federal Reserve is guiding the economy toward a soft landing. At the same time, Fed Chair Jerome Powell’s comment on Monday that inflation is heading in the direction of the central bank’s 2% goal was interpreted as paving the way for near-term interestrate cuts. Weekly and initial jobless claims both came in higher than expected. For this week, we will have US Global PMI data, GDP annualised (exp. at 1.9% QoQ), Core PCE and Personal Income & Spending. A busy week is expected. We also have the U. Of Mich. Inflation expectations on Friday.

On politics, the Republican National Convention showed a slightly bandaged Trump take stage to a hero’s applause. The prior weekend’s events were largely seen as giving another jolt of momentum to Trump’s candidacy as supporters rallied around the former president. Markets are tilting to a higher inflation outlook under Trump as he culls immigration and slaps tariffs across the board. We think there will be a mismatch in the timeline of this possible outcome, which could of itself not be an outcome as such! In short, unless derailed, we would continue to ride the trend and view these pullbacks as opportunities to add to risk. “Stay the course”.

Europe

European markets closed lower on Friday with the European Stoxx 600 index closed 0.77% lower as travel tumbled 2.07% due to the major global Microsoft outage which disrupted banks, airlines and emergency services worldwide. European markets have retreated throughout the week, with the Stoxx 600 closing lower on five consecutive days.

As widely expected, ECB leaves policy rates unchanged, including its deposit rate at 3.75% after cutting rates by 25bps in June. Reiterated it will continue to follow a data dependent, meeting-by-meeting approach and was not pre-committing to a particular rate path. Highlighted that some of the measures of underlying inflation picked up in May owing to one-off factors, but most measures were either stable or edged lower in June. However, majority of economists anticipate another rate cut in September. President Lagarde has said it needed to be more certain before it can ease policy again with the labor market more resilient than it expected. Lagarde may be reluctant to provide any pre-emptive signal for September amid reports that hawkish officials were critical after the president signaled a June cut in April. Data wise, Euro area industrial output declined by 0.6% mom in May. If June prints flat, Q2 2024 would contract by 0.1% qoq, and would be a drag on headline GDP growth yet again. This further underscore weakness in the European manufacturing sector. Since the start of 2023, manufacturing output has contracted each quarter and averaged -0.7% qoq per quarter. Services output, meanwhile, has averaged 0.3% q-o-q since the start of 2023, accelerating from 0.2% qoq in Q1 2023 to 0.5% qoq in Q1 2024.

The main data releases this week will be the EC consumer confidence on Tuesday, Preliminary PMIs on Wednesday and money and credit data for June on Thursday.

In the UK, services inflation in June was 5.7% yoy, 0.1pp higher than consensus expectations. However, the only component that was significantly stronger than we had anticipated for June was accommodation, particularly hotels. This alone contributed to the entire 0.1 percentage point increase in services inflation. These sparks debate about how much Taylor Swift’s UK June concerts might have been responsible. Headline and core CPI in June moved sideways at 2% yoy and 3.5% yoy respectively. Retail sales for June missed expectations, declining 1.2% mom. Retail sales remain 1.3% below their pre-pandemic level in February 2020. The sharpest downward contributions came from department stores, clothing and footwear retailers.

The wage data were more promising with private sector regular wages for May rising 0.27% mom. Also, the payrolls measure of median pay was weaker – recording the first monthly decline (-0.4% mom in June) so far this year. The 3-6m annualised rates are now running around 5%, versus peaks of around 8% during the previous three months. The unemployment rate remained at 4.4% at the highest level since 2021. The Bank of England expects the unemployment rate to rise further in the coming quarters, albeit only gradually to 4.8% by early 2026. Vacancies were down on a quarterly basis by more than in recent months – a fall of 30k qoq, which is the fastest decline in four months to 889k and is now down for 24th consecutive period, yet still above pre-covid levels.

This week, we will see the prelim PMIs in the UK and it is expected to show a small post-election bounce.

Asia

Markets took a leg down last week, MSCI Asia ex Japan was lower by 3%, with Hang Seng (-4.79%) and Nikkei 225 (-2.74%) taking the lead in declines. Onshore China, CSI 300 managed to close up 1.92% while India too managed to stay in the green, closing the week +0.12%.

China’s ruling Communist Party commenced its so-called third plenum last week, a major meeting held roughly once every five years. The closed-door meeting presided by Xi Jinping ended on Thursday. In recent decades, the third plenum has focused on long-term economic reforms. PBOC injected a net CNY674B ($93B) via reverse repo operations, the most amount since January, to keep liquidity abundant as tax payments mount while top Chinese leaders meet at the Third Plenum. The People’s Bank of China cut a key short- term policy rate for the first time in almost a year, stepping up support for the economy after growth disappointed and steering a shift toward a new policy benchmark. The seven-day reverse repo rate is lowered by 10 basis points to 1.7%, the PBOC said in a statement this morning.

India’s wholesale prices (WPI) rose 3.36% y/y in June, slightly lower than consensus forecast 3.50% but above May’s 2.61% rise as vegetable prices rose strongly in face of inclement weather. Price rises offset by small declines in fuel and power. The data represents fourth consecutive month of WPI increases and highest in 16 months. Ministry of commerce and industry acknowledged food price increase, said crude petroleum and natural gas prices, manufacturing cost increases also contributed to overall inflation figure. June consumer prices rose 5.08% from May’s 4.75%, above consensus forecasts; retail food prices rose 9.36% y/y versus May’s 8.69%, including more than 29% y/y gain in vegetable prices following extreme heat, floods in northern states.

Reuters Tankan survey showed Japan manufacturer confidence strengthened for first time in four months. Japan services sector sentiment slipped but remained at elevated level. Japan trade balance swung to surplus of ¥224B in June from ¥1.22T deficit in prior month and contrasted with forecast deficit of ¥185.7B. Export growth slowed to 5.4% y/y from 13.5%, lower than consensus 7.2%. Weak yen inflated value of exports with average USD/JPY averaging 156.64, down 12.5% y/y. Exports to China rose 7.2%, slower than prior month’s 17.8% increase while export growth to US halved to 11%.

Singapore exports sharply lower on one-offs but underlying trend still negative.

Bank Indonesia kept its base interest rate steady at 6.25%, as expected.

GeoPolitics

US- EU – Ukraine : Alarm bells rang across Europe after Trump picked Senator J.D. Vance, who opposes military aid for Ukraine and warned Europe will have to rely less on the United States to defend the continent, as his candidate for vice president. Germany was planning on halving military aid to Ukraine next year. German aid to Ukraine will be cut to 4 billion euros ($4.35 billion) in 2025 from around 8 billion euros in 2024, according to a draft of the 2025 budget seen by Reuters. Perhaps this will change with the VP candidate announcement.

US – China: In one of the first interviews after being named as Trump’s running mate, JD Vance said China is the biggest threat to America, foreshadowing likely more hawkish stance of a likely Trump 2.0. Recall Trump has promised to hike tariffs to 60% on all Chinese imports if re-elected. UBS research noted Trump’s proposal to impose up to 60% tariffs on Chinese goods caries negative implications for China’s economy and would slice 2.5% from China GDP growth over 12 months, reflecting direct impact on exports and indirect effect on consumption and investment. UBS economists noted in response China is seen more likely to ease fiscal and monetary policy, while allowing yuan depreciation of 5 to 10% to cushion blow from tariffs.

UK: Britain said it would boost its “hollowed out” armed forces to make sure the country was prepared to face what the head of a defence review called a “deadly quartet,” comprising China, Iran, North Korea and Russia. The government named George Robertson, the former NATO secretary general, on Tuesday to lead a review of Britain’s armed forces which will report back in the first half of 2025. Prime Minister Keir Starmer announced the strategic defence review as one of his first major acts after taking office on July 5.

US- Taiwan: Taiwan should pay the U.S. for its defence as it does not give the country anything, Republican presidential candidate Donald Trump told Bloomberg Businessweek, sending shares of Taiwanese chip manufacturer TSMC lower on Wednesday. The United States is Taiwan’s most important international supporter and arms supplier, but they have no formal defence agreement, unlike what Washington has with South Korea and Japan. The U.S. is, however, bound by law to provide Taiwan with the means to defend itself. Taiwan Premier Cho Jung-tai, responding to Trump’s comments, said Taiwan and the U.S. have good relations despite the lack of formal ties, and is dedicated to bolstering its own defences. “Taiwan has steadily strengthened its defence budget and demonstrated its responsibility to the international community,” he told reporters in Taipei.

China – EU: China named Danish Crown A/S, as well as Dutch and Spanish pork firms as targets in an anti-dumping probe into EU pork imports. Move came after EU levied provisional duties of up to 37.6% on Chinese EVs. Analysts noted China’s investigation mainly aimed at Denmark, Netherlands and Spain, which were seen as supportive of EV tariffs, in seemingly a tit-for-tat action.

Credit / Treasuries

As prediction markets increased the probability of a Trump presidency, trades that some market participants believe will benefit with this outcome gained ground. Long-term Treasuries sold off as higher term premium was priced in amid some market participants’ expectations for higher tariffs, looser regulations, and increased tax cuts. The US treasury curve bear flattened with the 2 years, 10 years and 30 years rising 5.95, 5.6 and 5.09 basis points respectively. Both IG and HY credit spreads wider due to possible stricter Chips/Trade restrictions by the Biden administration on China.

FX

DXY USD Index rose 0.29% to 104.40. USD as a safe-haven currency was bided due to risk off sentiment from possible stricter Chips/Trade restrictions by the Biden administration on China.

In addition, June retail sales were strong across the board alongside upward revisions to May data. Market participants attached a higher probability of Trump presidency, and as a result, a stronger dollar driven by looser fiscal policy (tax cuts), deregulation and tariffs. On the Fed rate cut communication, both Fed Governor Waller and New Year Fed President Williams signals that the FOMC is ‘getting closer’ to rate cuts. Fed Chair Powell does not give signal on the timing of rate cuts but notes that there have been “three better readings” on inflation that “do add to conference” that inflation is heading toward target.

EURUSD fell 0.23% to 1.0882. As widely expected, ECB left their deposit rate unchanged at 3.75%, but maintained an implicit direction towards further easing after the first cut last month. President Lagarde didn’t give any concrete guidance and refused to label this as a cutting cycle, but she mentioned risks are titled to the downside, US tariffs will be closely watched, and wage growth is expected to cool significantly in the coming years.

GBPUSD fell 0.57% to 1.2914 despite slight diminishing probability of a BoE August rate cut from a slight upside surprise in UK inflation. UK Headline CPI remained at 2.0% in June (C:1.9%), Core CPI remained at 3.5% y/y in June (C: 3.4% ), and RPI Inflation fell to 2.9% y/y in June (C:2.9%, P: 3.0%). UK unemployment rate remained at 4.4%, in-line. However, UK retail sales came in below consensus across board.

USDJPY fell 0.22P to 1C .48.There were numerous comments from various political leaders on USDJPY, including Japan’s Digital Transformation Minister Kono who argues the BoJ needs to raise rates in response to a weak yen and presidential candidate Trump with his preference for USD weakness particularly against JPY. Data wise, Japan core inflation rose for a second straight month, but was below consensus (A: 2.6%, C:2.7%, P:2.5%)

Oil & commodities

Oil future fell last week, with both WT: and Brent falling more than 2P, driven by disappointing economic data in China with softer-than-expected 2m24 GDP and retail sales, both of which signal weakening in the consumer. This is on contrary with the weekly EIA Crude Oil Inventory Report where US crude oil inventories fell for the third consecutive week and were down by 4.9mn barrels in the week ending July 12

Gold fell 0.44P to close the week at 2400.83, after touching a YTD high of 2483. 3 intra-week. Gold price weakness was driven by USD strength and market participants took the opportunity to take profit given it traded at a YTD high.

Economic News This Week

-

Monday – NZ Trade Balance, CH LPR, US Chicago Fed Nat. Act.

-

Tuesday – JP Machine Tool Orders, EU Cons. Confid., US Richmond Fed Mfg/Existing Home Sales,

-

Wednesday – JP/EU/UK/US Mfg/Svc/Comp PMI July Prelim., US MBA Mortg. App./Wholesale Inv/ New Home Sales, CA BOC Rate Decision

-

Thursday – JP PPI, EU M3 Money Supply, US GDP/ Core PCE/

Initial Jobless Claims/ Durable Goods Orders -

Friday – JP Tokyo CPI, EU ECB CPI Ecp., US Personal Income/

Personal Spending/ Core PCE/ Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.