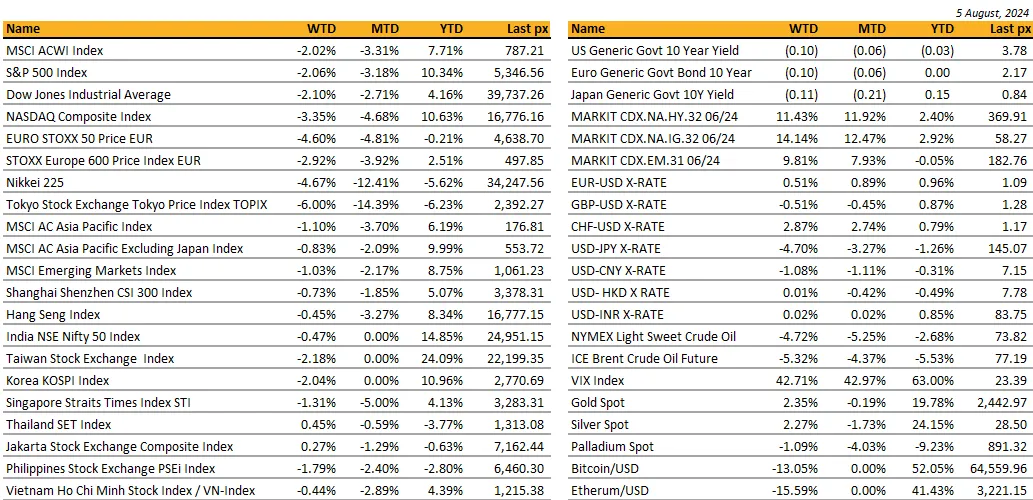

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

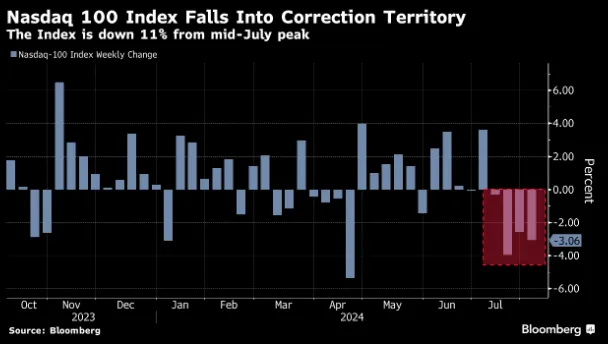

Slowdown fears dictated the week’s move as the Nasdaq 100 led big tech into correction territory. Concerns over earnings and a weak jobs report stoked fears of a possible recession, where the Fed will need to slash interest rates. Just a week and a half ago the GDP annualized QoQ came in higher than expected at 2.8% and the general consensus was that the Fed’s planned soft-landing was in play! The rise in the jobless rate is now close to triggering a recession indicator developed by former Fed economist Claudia Sahm. Known as the Sahm Rule Recession Indicator – it flashes the start of a recession when the 3-month moving average of the unemployment rate rises by 0.5% or more relative to the 3-month average from the previous 12 months. Now, the swaps market is pricing in at least a full percentage cut by year end. The VIX soared to almost 30 before settling back at 23. Friday’s jobs data spooked sentiment as the unemployment rate rose the highest level in almost 3 years to 4.3% from 4.1% and the non-farm payrolls came in way lower than expected at +114k. Geopolitical risk had a part to play in the risk off sentiment as Iran is expected to retaliate against Israel after a leading Hamas leader was assassinated during a visit to Iran.

In specific Tech news, Intel fell the most in 40 years following a grim outlook while Amazon slid by 8.78% after telling investors that profit would take a back seat to heavy spending on AI for now. Microsoft fell after its Azure cloud service posted a slowdown in quarterly growth. Meta bucked the earnings trend after its revenues top expectations as did Apple which released its Q3 financial results that bettered estimates. Apple appears to be the safe haven tech play as Wall Street likes its spending on its AI investments of around $2.2 bln versus the $14 bln Microsoft reported in its June quarter. The broader economic concern is hitting tech particularly hard amid worries over whether the artificial intelligence boom had gone too far. Consumer sensitive stocks fell after the latest batch of US data fuelled worries the Fed has been too slow to cut interest rates. UST rates tumbled to 3.88% and 3.79% for the 2’s and 10’s respectively. Headline ISM manufacturing and jobless claims figures signalled that the labour market was cooling further. Markets earlier in the week cheered the post-FOMC meeting presser from Powell after he said an interest rate cut could come as soon as September. The Fed as expected left rates unchanged at 5.25%-5.5%. A much quieter week ahead with only ISM services and weekly claims to take note of. SLOOS on Tuesday should also give us the state of the credit tightness.

Bitcoin and ETH took a hit after rallying earlier in the week as risk off mood in the fiat world spilled over to cryptos. BTC and ETH traded around $55k and $2,350 respectively.

Until we get more indicators of an impending recession and earnings collapse, the long-overdue correction is still seen by most as a buying opportunity. We continue to favour utilities – electric companies for its continued demand for AI advancement both in the short & long term horizons.

Europe

European equity markets close sharply lower last Friday. Tech sector biggest decliner and financials under pressure. European banks index had the worst day on Thursday since March 2023, down 4.5%. Defensive sectors like utilities and food/beverage catching haven inflows. Real Estate is also holding up.

In the euro area, HICP accelerated to 2.6% yoy in July from 2.5% in June. Core HICP printed unchanged from June at 2.9% yoy. The all-important services HICP came in at 4%. In terms of underlying momentum, services HICP ticked up marginally to 0.31% mom, from 0.3% in June. This is well below than the average of 0.45% per month from January to May, meaning momentum is slowing. Most of the jump in the euro area core HICP appears to have come from core goods prices. Euro GDP growth printed at 0.3% qoq in Q2 2024, weaker than ECB’s forecast of 0.4%. As a result of Q2 2024 GDP growth figures being marginally weaker than the ECB had expected, ECB staff likely to revise the ECB’s 2024 GDP growth forecast by 10bp to 20bp lower relative to the 0.9% forecast in June. This, in turn, support a continued return to ECB’s 2% target next year, making the ECB rate cut in September more plausible.

The Euro area unemployment rate unexpectedly rose 0.1%pt to 6.5% pt in June. The number of unemployed increased by 41,000, having increased by 34,000 in May. Easing in labour market conditions should help reinforce the disinflation process but the rise in the unemployment rate to date is likely too modest to have a meaningful impact on wages or inflation.

The BoE MPC voted 5-4 to cut Bank Rate by 25bps to 5% with the new Deputy Governor Clare Lombardelli casting a crucial vote for a cut. The other four members voted to keep rates unchanged. For these members, there was a risk of structural shifts in the natural rate of unemployment and a rise in the long-run neutral interest rate. As a result, they wanted to see stronger evidence that these upside pressures won’t materialise. The minutes suggest the decision to vote for a cut was ‘finely balanced’ for those who did, although the press statement and conference was more dovish. Reflecting the close decision, the statement still spoke of a risk of ongoing persistence, and the forecast show the reintroduction of upside skew to BoE’s medium term inflation projections. Their modal inflation forecast drops well below target to 1.7% in two years time, based on market rates. This is down from 1.9% previously and this suggests that rates could be cut more quickly that markets expect over the coming months. Markets now price in 50% chance of a 25bp cut in September, though initial takeaways leaning a bit hawkish. Meanwhile, the BoE’s Decision Maker Panel survey published Thursday showed firms’ expectations for wage growth over the next 12 months cooled in July to 4.1% versus prior 4.2%.

Swiss inflation remained steady at 1.3% year-on-year in July, in line with consensus and previous figures, after a 0.2% monthly dip due to lower prices for international package holidays, air transport, and seasonal sales in clothing and footwear. With inflation within the SNB’s target and below the 1.5% forecast for Q3, analysts anticipate a rate cut in September. Additionally, the Swiss franc’s recent strength against the euro supports the disinflationary trend. Switzerland’s inflation rate is one of the lowest in Europe, with the EU’s harmonized measure showing a 1.2% increase, while the euro area’s inflation rose to 2.6% in July.

This week we will see the EU and the UK PMI final for July and the EU Sentix Investor Confidence on Monday. We expect a drop in the Sentix in August as European stock market indices have been weaker recently, although August has a slight positive seasonal pattern. On Tuesday, we will see the UK PMI construction survey for July and the EU retail sales.

Asia

Asia stocks fell sharply in a volatile week. Japan’s equity benchmarks slid about 20% from record highs reached last month as investor confidence crumbled from the surge in the yen, tighter monetary policy and the deteriorating economic outlook in the US.

Steep falls everywhere else however with tech-orientated boards in Seoul, Taipei and Australia down the most. There was also steep falls among AI-related chip stocks including SK Hynix, TSMC and Hon Hai following Intel’s miss overnight in the US. Renewed fears over the state of the US economy behind the structural move in stocks and bonds post weaker-than-expected factory output data raised fears over whether the US really could avert a recession.

The Bank of Japan has lifted its benchmark interest rate to 0.25% and outlined plans to scale back its ¥6tn ($39bn) monthly bond-buying programme to about ¥3tn in January to March of 2026. Core inflation, which excludes volatile food prices, rose 2.6 per cent from a year earlier in June, exceeding the BoJ’s 2 per cent target for 27 consecutive months. However, Japan’s economy contracted in the first three months of the year as the yen’s decline and rising living costs hurt household spending. JPY surged after the BoJ rate hike on Wednesday: USDJPY closing Friday at 146.53, and 145.22 this morning as we write this. Also, Japan’s jobless rate dropped to 2.5% in June (v/s +2.6% expected) from a level of +2.6% in the previous month. Meanwhile, the jobs-to-applicants ratio slipped to 1.23 in June from 1.24 in May.

South Korea’s factory activity expanded for the third straight month in July, but at a slower pace as weak domestic demand crimped output and new order. The PMI came in at 51.4, slightly lower than 52 we saw in June.

China’s manufacturing activity fell for a third consecutive month in July. The country’s official manufacturing purchasing managers’ index came in at 49.4.

GeoPolitics

Israel – Middle East: Hamas has said its political leader Ismail Haniyeh was killed in an Israeli strike in Iran early on Wednesday, an attack that dramatically raises the risk of a further escalation of regional hostilities. Haniyeh is highest ranking Hamas official to have been eliminated since Oct-7 attacks that triggered Gaza war. His death is expected to fuel uncertainty around prospects for Gaza ceasefire agreement given Haniyeh was key participant in talks.

US – Japanese: Authorities have agreed to upgrade the US military command in Japan, aimed at deepening security cooperation between the two allies. Japan is already home to 50,000 US troops, but they currently take orders from US ‘INDOPACOM’ in Hawaii, in a time zone 19 hours behind.

US Export policy: US President Joe Biden would exempt Japanese, South Korean and Dutch manufacturers from upcoming chip export restrictions to China. Dutch chipmaker ASML Holding jumped 9.5 per cent at the open.

US – Singapore: Singapore Foreign Affairs Minister Vivian Balakrishnan and US Secretary of State Antony Blinken inked the civil nuclear cooperation agreement on Wednesday (Jul 31) during an official visit by Blinken to Singapore. Singapore is studying all potential options to decarbonise our power sector while maintaining our energy security and cost-competitiveness, as we work towards our target to achieve net-zero emissions by 2050. A 123 Agreement with the US also allows Singapore to work with other countries that use nuclear technology originating in the US. The US has 24 active 123 Agreements, including with countries such as China, India, Indonesia, Vietnam and the Philippines.

Credit / Treasuries

The US Treasury curve bull flatten with the 2years yield down by an amazing 61bps last week, while the 5years yield lost 55bps, 10years yield dropped by 46bps & 30years yield lost 38bps. In the meantime, US IG credit spread widened by 8bp, from 50 to 58bps & US HY credit spread widened by 40bps over the week, from 329 to 369bps.

In term of performances US IG gained 2% last week while US HY and leverage loans lost 20bps. VIX index increased last week from 16.5 to 23.4 last week and even touched intraday last Friday a high of 29.65.

FX

DXY USD Index fell 1.06% to 103.21 driven by expectation of further rate cuts due to underperformance of US macro data. Market is now pricing for more than 4 rate cuts (or 116 bps cuts) in 2024, compared to below 3 rate cuts (or 68 bps cuts) a week ago. Non-farm payroll came in at 114k (C: 175kk) and unemployment rate rose to 4.3% (C: 4.1%), highest since Nov 2021. ISM Manufacturing fell to 46.8 in July (C: 48.8), lowest since Nov 2023. ISM Employment fell to 43.4, lowest since June 2020 during Covid. Earlier in the week, the Fed kept rates unchanged for the 8th meeting in a row. FOMC is largely in line with the Fed not hinting Sep cut as a done deal, but a possibility depending on data. Additionally, Powell also ruled out the possibility of a 50bps cut.

EURUSD rose 0.51% to 1.0911, driven by USD weakness. Data wise, EU headline CPI rose to 2.6% (C: 2.5%). Core inflation held stead at 2.9% for a third consecutive month (C: 2.8%). Advance estimate for 2nd Quarter GDP came in at 0.3% qoq (C: 0.2%). GBPUSD fell 0.51% to 1.2801, as BOE cuts its policy rate by 25 bps to 5% with a close 5-4 decision. Markets are expecting further cuts to follow in the coming months, with another cut fully priced in by the meeting-after-next in November. However, Governor Bailey acknowledged the risk “that inflation could be higher than expected if we cut interest rates too much or too quickly.”

USDJPY fell 4.7% to 146.53, driven by US-JP interest rate differential. BoJ raised rates by 15 bps to 25 bps against consensus. On QT, BoJ will reduce its JCB purchases by Yen 400 billion per quarter, targeting Yen 3 Trillion by 1st Quarter 2026. Hawkish guidance points to further hikes. In addition, USD weaken as US treasury yield fell substantially with the 2 years and 10 years falling 50 and 40 bps respectively.

AUDUSD fell 0.57% to 0.6511, driven by weak inflation data. AU headline inflation was in line with consensus, up 1.0%qoq / 3.8%yoy in Q2. But underlying inflation was much weaker than expected, up 0.8%qoq / 3.9%yoy.

Commodity

Oil future fell last week, with WTI and Brent falling 4.72% and 5.32% respectively, despite rising geopolitical tensions in the Middle East over the death of Hamas leader in Tehran. There were media reports of Iran’s supreme leader ordering a retaliatory attack on Israel. Instead, oil movement was dominated by the risk off sentiments from the weak US macro data.

Gold rose 2.35% to 2443.24 driven by rising geopolitical tensions in the Middle East and weak USD. Immediate resistance level at 2483 (YTD high) and 2500, while support level at 2400 and 2366.

Economic News This Week

M – AU/JP/CH/EU/UK/US Svc/Comps PMI Jul Final, AU Melbourne Inflation, EU Sentix Inv. Confid./ PPI, US ISM Svc Index

T – AU RBA OCR, SZ Unemploy./ Retail Sales, UK Cons. PMI, EU Retail Sales, US Trade Balance

W – NZ Unemploy., CH Trade Balance, US MBA Mortg. App.

Th – JP Curr. Acc. Balance, NZ 2Yr Infl. Exp., US Initial Jobless Claims

F – CH PPI/CPI, Norway CPI, CA Unemploy.

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.