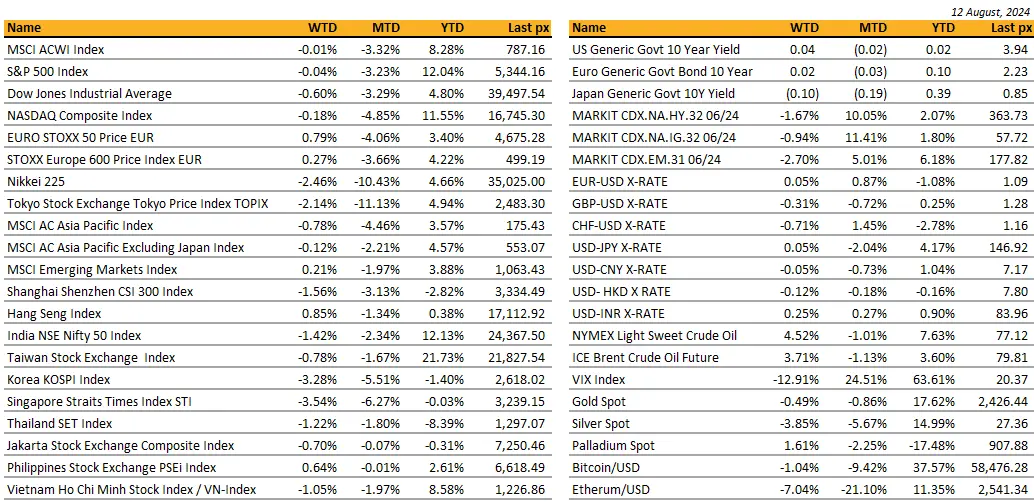

KEY MARKET MOVES

MACRO OVERVIEW

US

The epitome of a rollercoaster ride would best describe the week’s price action on global equity markets. Starting off in Japan on Monday, US equities plunged on open over rising concerns of a slowing economy and overheated gains in the Tech sector. A soft US jobs report from the week before, fuelled worries that the Federal Reserve isn’t moving fast enough to prevent a sharp economic downturn. Just coming back to that jobs data briefly, upon further assessment, average hourly earnings were up 3.6% in July and is still above the last CPI reading of 3%. As for the unemployment rate of 4.3% some 67k people found new jobs in July but 420k new people entered the workforce according to the household employment survey which pushed up the participation rate from 62.6% to 62.7%. Had the participation rate not increased, the unemployment rate as analysed, would have remained at 4.1%.

The VIX soared to trade at an intraday high of 65.73, highest since the start of the Pandemic, before settling back at 20.37 on Friday. For context the largest full day move since the index was first calculated in 1990 was the 21.57 point increase on March 12th 2020 around the initial Covid wave. At no point in the GFC did we ever see a daily move of more than 16.54 points. Blame was squarely placed on the unwinding of Yen carry trades following the BOJ’s rate hike and heightened geopolitical concerns between Iran and Israel. Megacap tech bore the brunt of the losses. Nvidia’s highly anticipated Blackwell chips will be delayed due to design flaws, the Information reported. The chips may be postponed by three months or more, which could potentially hit big tech firms from Meta to Microsoft. Markets started to talk about a FED emergency interest rate reduction prior to its regularly scheduled September meeting, mirroring its reaction to the Covid crisis in March 2020.

There was also talked that the FED could wait until September but cut rates by more than the 25 basis points signalled previously. Most likely, however, it could simply stay the course. First, it is important to remember, as the Fed surely does, that the stock market is not the economy. The Fed responds to inflation and growth, not the level or volatility of share prices. It reacts to the stock market only when volatility threatens financial stability. For the moment, there is no evidence that this is the case. Nor is there evidence of an incipient recession. The stock market has predicted nine of the past five recessions, as the Nobel laureate Paul Samuelson famously observed. It is not a reliable signal of a looming downturn.

Had it happened, it would have been a disaster signal to markets! In spite of the selloff in the earlier part of the week, the S&P 500 and the Nasdaq Composite both ended relatively unchanged for the week at -0.02% and -0.17% respectively. The Dow closed down by half a percent. US stocks closed a back-and-forth session in the green on Friday to wrap up a week of sharp swings across equity markets that saw the S&P 500 Index log both its best and worst one-day moves in roughly two years. The turnaround came about after the BOJ’s deputy governor Uchida pledged to refrain from raising rates when markets are unstable. Thursday’s less than expected jobless claims relieved some of those concerns regarding spiralling unemployment. Initial jobless claims fell by 17,000, the most in nearly a year, to 233,000 in the week ended Aug. 3, according to Labor Department data. Smart money investors from hedge funds to LT institutional investors were also reportedly buying on this “dip”. Boston’s Fed Chief Susan Collins said her US central bank colleagues could begin easing interest rates if inflation continues its downward path amid a strong labour market. Perhaps calm has indeed returned to the markets. Sell side analysts from Bank of America to Barclays opined that the selloff across equities has become dislocated and still seen as a mild economic softening. B of A went further as to say that “Technical levels that would flip Wall Street’s narrative from soft to hard landing have not been broken,”. On the other side of the fence, JP Morgan said it now sees a 35% chance of the US economy tipping into a recession by the end of the year — up from 25% as of the start of last month, hinting at a “sharper-than-expected weakening in labour demand and early signs of labour shedding.”

An earlier Treasury bond auction sale saw a lacklustre demand which sent treasury yields higher before closing at 3.94% and 4.05% for the 10s and 2s respectively. We now have key inflation readings on Wednesday to look forward to, with a 25bps cut all but baked in, in September. Bloomberg expects headline YoY to come in at 3% and the MoM core rate at 0.2%. PPI will be on Tuesday, retail sales on Thursday and Friday will see the U. of Mich. consumer sentiment, and inflation expectations.

Cryptos hunted with the hounds and ran with the foxes to trade at BTC$60k and ETH$2,600 with little to add.

We remain focussed on utilities, especially electricity generation companies (AEP, Duke) and would also take this opportunity with higher volatility to consider FCN’s on (battered) big Tech (AMZN, Apple, Meta, Google, NVDA).

Europe

European stocks closed higher on Friday as global equity markets looked to rebuild from the recent sell-off. The pan-European Stoxx 600 gained 0.57%, taking the index to 499.18 — above its level a week ago, before a sharp downturn on Monday. Technology stocks were 0.22% lower as healthcare rose 1.77%.

The August Sentix survey declined materially, pushing the euro area’s business cycle clock further into recessionary territory. Therefore, we believe the euro area August composite PMI is likely to fall below the all-important level of 50 and signal contraction. This would support market pricing for further cuts, amplifying concerns of a short-lived economic recovery.

This was led largely by the automotive industry, which increased output 7.5% m/m, from -9.9% in May. The final EA PMIs were broadly consistent with the preliminary readings, pointing to a clear slowdown in the recovery momentum at the beginning of Q3. The EA composite index remains only narrowly above the 50 no-expansion mark (+0.1pt, to 50.2pt), with the upward revision in the German composite (+0.4pt, to 49.1pt) being mostly offset by the downward revision in France (-0.4pt, to 49.1pt).

Finally, EA retail sales edged down slightly in June (-0.3% m/m, but +0.3% q/q in Q2). The decline was broad-based across goods categories, showing further signs of consumer restraint. Abstracting from the month-on-month volatility, EA retail sales have remained broadly flat since early 2023.

In Germany, industrial production and factory orders recovered after the very weak May numbers. Industrial production ex-construction grew 1.6% m/m in June, from a downward revised -3.1% m/m in May.

This week will have a handful of important data releases. In terms of economic activity, our focus will be on the second estimate of Q2 euro area real GDP growth and the Q2 employment figures (Wed). Last, on inflation, providing further details on price pressures, we will be getting the Spanish and French July final HICP (Tue and Wed).

Last week was a quiet week in the UK, the REC Report on Jobs looked marginally dovish in July, although most of the indicators showed little movement, leaving the conclusions from the June report largely consistent with July.

On the other hand, the most recent RICS survey showed an improvement in the ratio of house sales to unsold stocks, suggesting there is emerging excess demand or at least shrinking excess supply in the UK housing market. Historically, this indicator has had a strong relationship with house prices and therefore, suggests we may be heading to a further recovery in the UK housing market. The demand is there for a UK housing recovery, with the new buyers’ enquiries balance improving to 1.8 in July from -5.9 in June. There was an even larger improvement in expected sales in the next three months and new instructions.

The rate cut from the BoE gives a housing market recovery more momentum, especially as weakness in the US labour market puts downward pressure on UK swap rates. Ultimately, the BoE is likely to struggle to match current market pricing, which will limit how low mortgage rates can go.

Asia

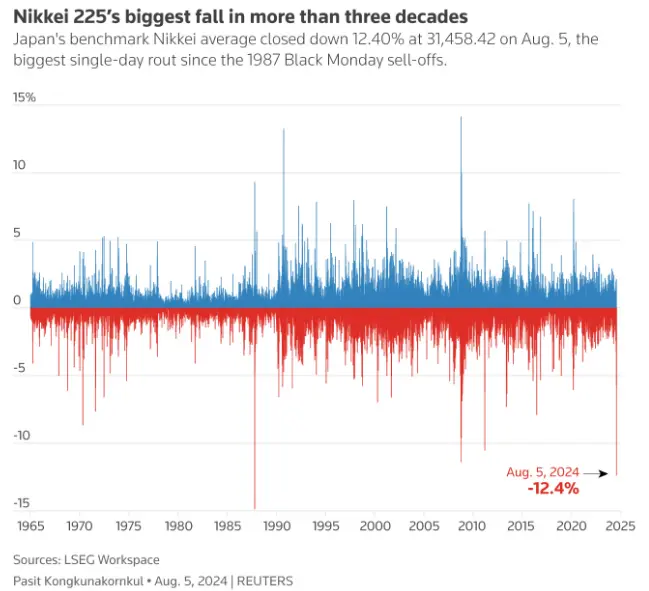

Black Monday, Turn around Tuesday, some reprieve came on Wednesday when the Bank of Japan said it won’t raise its policy interest rate if financial markets are unstable, according to deputy governor Shinichi Uchida. Recent market moves are “extremely volatile” and the central bank needs to keep monetary policy easy for the time being, Uchida said. Monday saw a ~12% sell off for the Nikkei. The single biggest one day fall since 1987. Japan saw the highest turnover day ever for TOPIX was more than 8 trillion YEN – so there was real volume backing the move. The benchmark indexes in Japan had fallen by more than 20% from their all-time highs on July 11 end of trading on Monday. Concerns about the markets were exacerbated by investors winding down yen-funded trades that had been used to finance the acquisition of stocks for years after a surprise Bank of Japan rate hike last week. The Nikkei enjoyed a decent retracement on Tuesday, as comments from the Fed’s Daly and a stronger-than-expected ISM services report soothed fears of a panic Fed cut next week. Nikkie closed the week lower by 2.46%. YTD it is still up 4.66%.

The dollar-yen pair has now fallen more than 9% as of this morning, since peaking five weeks ago and is in highly oversold territory. The yen is therefore vulnerable to any upside surprises in U.S. macro data. This could help Japanese equities stabilize further . There is little expectation of sustained momentum in the yen’s decline. CFTC data indicates that speculative short positions against the yen were rapidly unwound by the end of July. Historically, the liquidation of carry trades has often led to significant yen strengthening. For example, in 2007, net short positions in the yen were similar in size to current levels, and the unwinding process saw the yen strengthen significantly, especially during the 2008 Lehman Brothers collapse. Similarly, in 1998, yen appreciation was rapid following the LTCM crisis. Although there is no immediate financial crisis looming today, geopolitical risks and other factors are amplifying upward pressure on the yen. Mizuho Research & Technologies has estimated the fair value of USD/JPY to be around 142-143 based on current yield differentials. However, the potential narrowing of the policy rate gap between the US and Japan suggests further yen appreciation could be on the horizon, with some analysts eyeing a possible move towards the 130 level.

The RBA has just left the cash rate on hold at a 12-year high of 4.35% for a sixth meeting in a row, despite the looming prospect of high inflation becoming entrenched. In the post-meeting statement, the board kept its options open on future moves, preferring not to rule anything in or out. Meanwhile, refreshed economic forecasts from the RBA showed that underlying inflation will ease to 3.5% by the end of this year, and then hitting 3.1% in mid-2025.

The Reserve Bank of India (RBI) kept its key interest rate unchanged at 6.5% on Thursday as expected. According to the RBI governor, “Growth remains resilient, inflation has been trending downward and we have made progress in achieving price stability, but we have more distance to cover.”

China – Caixin services PMI 52.1 vs consensus 51.4 and 51.2 in prior month and the Caixin Composite PMI 51.2 vs 52.8 in prior month. China’s consumer price index (CPI), a main gauge of inflation, increased by 0.5% year on year in July. In contrast, the producer price index (PPI) saw a year-on-year decline of 0.8% in July, maintaining the same rate of decline as in the previous month. Trade data – China’s imports jumped 7.2% y/y in July, beating Reuters forecast of 3.5% and reversing 2.3% drop in prior month; while exports rose 7% and came below 9.7% consensus and 8.6% growth in June. Exports also grew for fourth straight month. Trade surplus stood at $84.65B, below $99B expected and $99.05B in June, which was at record high since at least 1990. Bloomberg added Chinese economy was heading to a bumpy start to Q3 while grappling with weak domestic demand and prolonged property market doldrums. Boom in exports was one of few bright spots this year however is increasingly inviting more tensions with EU and US.

Indonesia’s 2Q 2024 GDP came in slightly better than expected, up 5.0% q/q on a par with the pre-pandemic trend. The stronger than expected print was led mainly by domestic demand.

GeoPolitics

Lebanon: Western governments have stepped up calls for their citizens to leave Lebanon while commercial flights are still available, as an anxious region braced for the possibility of a full-blown regional war. Britain and Egypt asked their airlines on Wednesday to avoid Iranian and Lebanese airspace amid growing fears of a possible broader conflict in the region after the killing of senior members of militant groups Hamas and Hezbollah. Many airlines globally are revising their schedules to avoid Iranian and Lebanese airspace while also calling off flights to Israel and Lebanon. British carriers are not flying to Lebanon currently, according to flight tracking website Flightradar24. Singapore Airlines, stopped flying through Iranian airspace since 2nd August and is using alternative routes, saying safety is its top priority.

Iran: Nasser Kanaani said, Iran is not looking to escalate regional tensions but believes it needs to punish Israel to prevent further instability, the foreign ministry spokesperson said on Monday, following the killing of Hamas leader Ismail Haniyeh in Tehran last week. Kanaani called on the United States to stop supporting Israel, saying the international community had failed in its duty to safeguard stability in the region and should support the “punishment of the aggressor.”

Credit / Treasuries

Last Wednesday, Investors were picky on the levels where they are willing to buy long-dated US Treasuries. The 10Years US Treasury auction tailed by 3bps with the highest primary dealer take up since April, driving the US Treasury curve another leg steeper in the process. Following this auction, and after 25Months of inversion, the 2-10 part of the curve almost got back to being normalized again, with the 2years yield only 2bp higher than the 10years yield (see chart below). The 2-10 ended the week with a 10bps inversion.

Huge volatility on interest rates early last week during what could be considered Black Monday. But volatility did not last long, and yield normalized over the remaining part of the week. The shape of the US Treasury curve did not drastically change, with the 2years & 5years yield up 19bps, the 10years yield gained 16bps and the 30years up by 12pbs. Credit spreads, after initially widening on Monday, finished the week tighter by 5bps for US IG & 29bps tighter for US HY.

In term of performances, US IG lost 55bps, US HY gained close to 1% and leverage loans gained about half a percent.

FX

DXY USD Index was relatively unchanged for the week at 103.135 (-0.07%). Data wise, US July ISM services PMI rose to 51.4 (C: 51.0, P: 48.8), putting the index into expansionary territory. The ISM employment component bounced to 51.1 (C: 46.4), reaching its highest level since last September. In addition, initial claims fell below expectations, coming in at +233k (C: +240k), falling -17k from the previous release, their largest decline since September. Reduced fears over the US economy saw the number of Fed rate cuts expected by year-end fall 14.4bps to 101.7bps.

USDJPY closed the week relatively unchanged at 146.61 (+0.05%) after a volatile week where it touched a low of 141.70. Yen retreated from its high after BOJ Uchida said that the bank will not raise its interest rate when financial and capital markets are unstable. Data wise, Japan’s labour cash earnings came in at +4.5% y/y (C: +2.4%, P: 2.0%), which justify the BOJ’s rate hike last month. Real wages rebounded +1.1% y/y in June (C: -0.9% P: -1.3%), notching up their first rise in 27 months. In addition, BOJ minutes were hawkish and showed that members of the central bank discussed further rate hikes with one member of the policy board stating that interest rates would have to reach around 1% to attain a level neutral to the economy while another called for timely rate increases to avoid rapid hikes.

AUDUSD rose 1.03% to 0.6578. RBA kept the cash rate on hold at a 12-year high of 4.35% for a sixth meeting in a row. In addition, RBA refreshed its economic forecasts, showing that underlying inflation will ease to 3.5% in 2024, and 3.1% in mid-2025, economic growth was upgraded to 1.7% in 2024, and peaking at 2.6% in June 2025. RBA Governor Bullock commented that she does not see interest rates coming down quickly and will not hesitate to raise them if required.

Commodity

Oil future rose last week, with WTI and Brent rising 4.52% and 3.71% respectively. A boost from improving risk appetite and ongoing Middle East concerns was added to by the latest weekly EIA data on US crude inventories, which showed a sixth consecutive weekly decline to their lowest level since February. In addition, news of an outrage at Libya’s largest oil field and concerns over a possible retaliatory attack by Iran supported oil prices. European natural gas rose 10.22% last week, following reports that Ukrainian forces had potentially taken control of the key gas transit point of Sudzha amid their incursion into Russia.

Gold fell 0.49% to 2431.32. Positive correlation was seen between gold price and risky asset last week, where Gold price touched a low of 2,364.43 last Monday due to negative risk sentiment, before rebounding towards the end of the week where fear of a US recession was reduced. Support level at 2400 and 2370 (50 days MA). Resistance level at 2450 and 2480.

Economic News This Week

M – US NY Fed 1Yr Infl. Exp.

T – JP PPI, AU Westpac Cons. Confid., UK Unemploy., EU Zew, US PPI

W – NZ RBNZ OCR, SW CPI, UK CPI/ RPI, EU GDP, US MBA Mortg. App./ CPI

Th – NZ Food Prices, JP GDP/ Indust. Pdtn, CH 1Yr LFR/ Retail Sales, AU Unemploy., UK GDP/ Mfg Pdtn/ Indust. Pdtn/ Trade Balance, Norway Deposit Rates, US Empire Mfg/ Retail Sales/ Initial Jobless Claims/ Indust. Pdtn

F – NZ Biz Mfg PMI, JP Tertiary Indust. Index, UK Retail Sales, US Housing Starts/ Building Permits/ Mich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.