- Switzerland

Read the latest weekly report on the financial sectors and financial …

Our website uses cookies to improve the overall user experience. By continuing, you are agreeing to our Data Protection, to our Disclaimer and use of cookies on the site.

|

You are using an insecure Internet browser Navigateur internet non sécurisé |

||

|

We have noticed that you are using Internet Explorer which is an outdated and insecure Internet browser. Please use one of the browsers below for a safe and optimal experience on our website.

Nous avons remarqué que vous utilisez Internet Explorer, qui est un navigateur internet obsolète et non sécurisé. Nous vous recommandons d’utiliser à la place l’un des navigateurs ci-dessous pour une expérience sûre et optimale sur notre site.

|

||

| Edge | Firefox | Chrome |

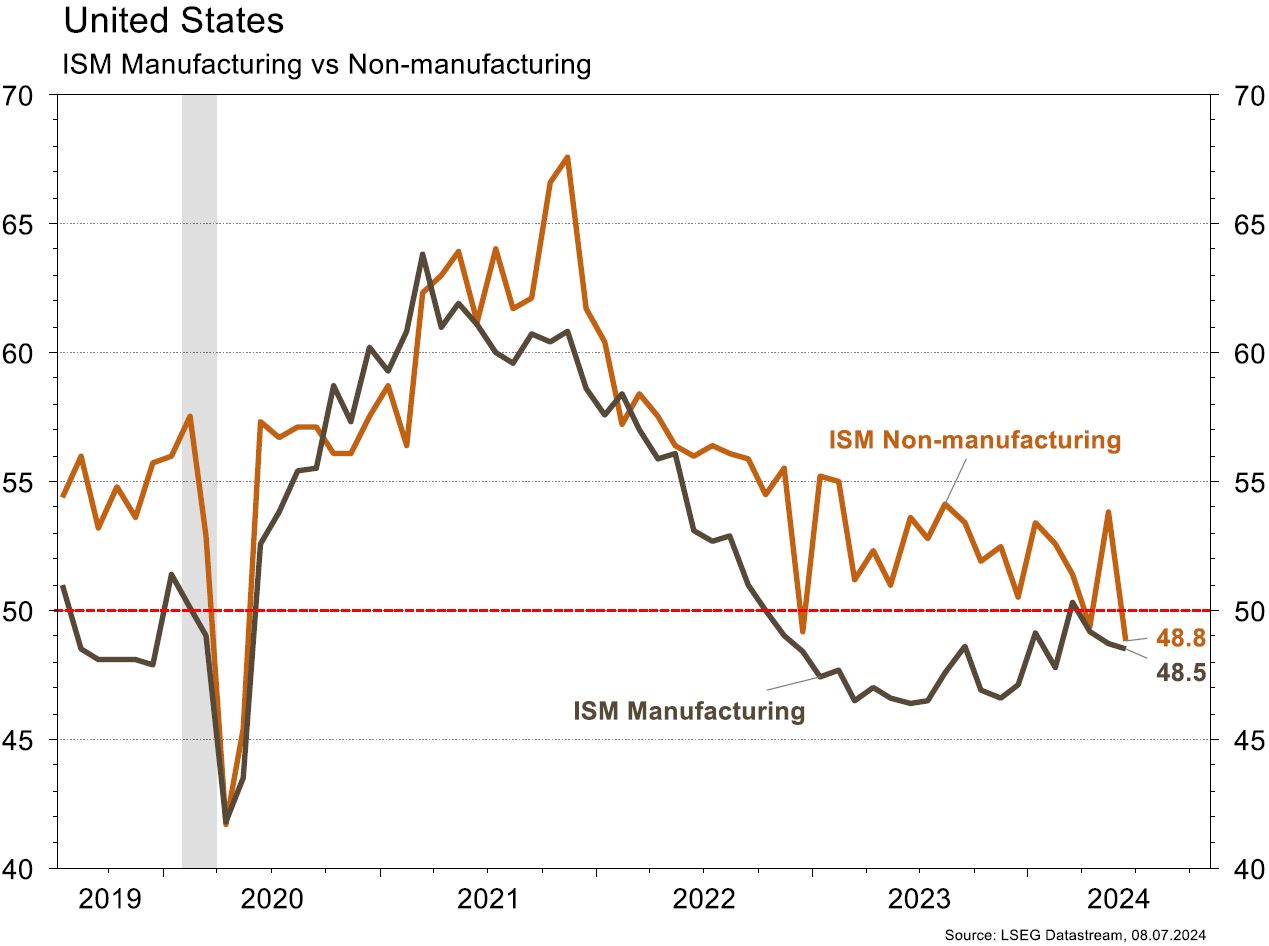

In the United States in June: ISM Manufacturing at 48.5 (-0.2 m/m), Services at 48.8 (-5.0 !) vs 52.5 expected, 206,000 jobs created (vs 190,000 expected and 218,000 in May, strongly revised to 272,000), unemployment rate at 4.1% (+0.1%) and hourly wages up by 3.9% y/y vs 4.1% in May. In Europe in June, the Manufacturing and Services PMIs were stable, the first one remaining in contraction territory for the 24th consecutive month at 45.8, inflation eased to 2.5% y/y (-0.1 pt vs. May), producer prices fell by 4.2% y/y (vs. -5.7% in May), and retail sales rose by 0.3% y/y in May vs. 0.2% expected. Finally, in China, the official and Caixin Manufacturing PMIs for June were stable at 49.5 and 51.8 respectively, while the Services PMI weakened to 50.2 and 51.2 (-2.8 pts vs. May).

According to the Statistical Review of World Energy 2024 published by the Energy Institute, solar and wind energy consumption rose by 4.9 Exajoules (EJ) in 2023, while fossil fuel consumption rose by 7.4 Exajoules, or 50% more, including 4.8 Exajoules from oil alone. Of the 620 EJ of energy consumed in 2023, 81.5% will still come from fossil fuels (coal, oil and gas).

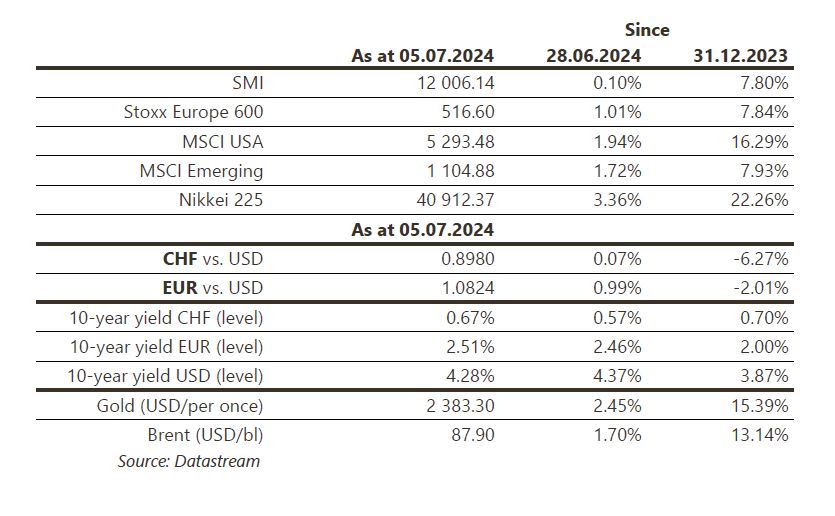

Expectations of rate cuts by the Fed have increased, leading to a rise in equities (Emerging Markets +1.7% and US +1.9%, S&P500 and Nasdaq at all-time highs, Japan +3.4%, Europe +1%), corporate bonds (0.5-1.0%) and commodities (copper +3.6%, oil +1.7%) and a fall in the dollar (-0.9%), with gold jumping 2.5%. Sovereign bonds are more dispersed (Italy +1%, US +0.8%, Germany -0.4%). This week we will be watching: in the US, credit figures for May, general inflation, producer prices and SME confidence in June. In Europe, the Sentix confidence index for July. In China, the loan figures, money supply and trade balance figures for June.

Coming up this week: air traffic statistics for June (Flughafen Zürich). The following companies are due to release sales figures or results: Hypi Lenzburg, Barry Callebaut, BC du Jura, Docmorris, Partners Group (assets under management (AuM) S1) and Ems-Chemie.

BYD (Satellite): sold 341,658 NEVs (New Energy Vehicles) in June 2024 (+35% vs June 2023) and announced the start-up of a new factory in Uzbekistan. At the same time, according to Automotive News quoting Turkish officials, BYD is expected to announce the construction of a factory in Turkey. This would be BYD’s 2nd plant for the European market, after the Hungarian plant, which is due to start up in 2026.

ROCHE (Core Holdings) last week announced the failure and termination of a study evaluating tiragolumab in lung cancer. The likelihood of such a scenario was high, following the announcement in 2022 of a first failure of this treatment. Consensus expectations had been sharply revised downwards. The impact on the stock price is limited.

SWISS RE (Satellite): Hurricane Beryl, currently a Category 1, is expected to make landfall soon off the Texas coast. Some forecasts predict that it could strengthen further to reach a (weak) category 2 intensity. While insurance losses due to this peril have so far been relatively contained and very manageable for the industry, Beryl nevertheless heralds an early and probably very active hurricane season for reinsurers.

In the US, economic momentum continues to slow, with a contraction in the ISM services index (48.8 vs 52.5 expected) and a poor employment report showing the unemployment rate rising to 4.1% (+0.1pp). Against this backdrop, the market is now anticipating 2 rate cuts for 2024 and rates have fallen along the curve (2Y -15bp/10Y -12bp). In Europe, investors were reassured by the 1st round of French parliamentary elections, leading to a rally in OATs (10Y -9bp) and peripheral bonds (BTP 10Y -14bp). Credit spreads narrowed in Europe (IG -5bp/HY -7bp).

Stock markets

The US indices ended the week at all-time highs, supported by technology stocks. On the macro side, in the US we have the CPI and PPI, but above all J. Powell’s hearings before the Senate, while the results season begins on Friday with the US banks. Caution is the order of the day.

Currencies

Following this weekend’s French elections, in which neither the RN nor the left-wing coalition obtained the majority needed to form a government, the CHF is being sought as a safe-haven currency: the EUR/CHF is at 0.9680. Better-than-expected US employment figures did not convince the dollar, as the market is expecting a fall in job creation, so EUR/USD climbed to 1.0840 and USD/CHF is at 0.8945. The ounce of gold rose by 2.5% last week, reaching USD 2,392/oz.

This document has been issued for information purposes and is exclusively supplied by Bordier & Cie SCmA in the framework of an existing contractual relationship with the recipient of this document. The views and opinions contained in it are those of Bordier & Cie SCmA. Its contents may not be reproduced or redistributed by unauthorized persons. The user will be held liable for any unauthorized reproduction or circulation of this document, which may give rise to legal proceedings. All the information contained in it is provided for information only and should in no way be taken as investment, legal or tax advice provided to third parties. Furthermore, it is emphasized that the provisions of our legal information page are fully applicable to this document and namely provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier Bank does namely not provide any investment services or advice to “US persons” as defined by the Securities and Exchange Commission rules. Furthermore, the information on our website – including the present document – is by no mean directed to such persons or entities.

"*" indicates required fields

insights

© 2024 Bordier & Cie

Please select your location and language below. If your location is not listed please select "International".