- Singapore

A brief recap of the market’s past week, by Bordier Singapore

Our website uses cookies to improve the overall user experience. By continuing, you are agreeing to our Data Protection, to our Disclaimer and use of cookies on the site.

|

You are using an insecure Internet browser Navigateur internet non sécurisé |

||

|

We have noticed that you are using Internet Explorer which is an outdated and insecure Internet browser. Please use one of the browsers below for a safe and optimal experience on our website.

Nous avons remarqué que vous utilisez Internet Explorer, qui est un navigateur internet obsolète et non sécurisé. Nous vous recommandons d’utiliser à la place l’un des navigateurs ci-dessous pour une expérience sûre et optimale sur notre site.

|

||

| Edge | Firefox | Chrome |

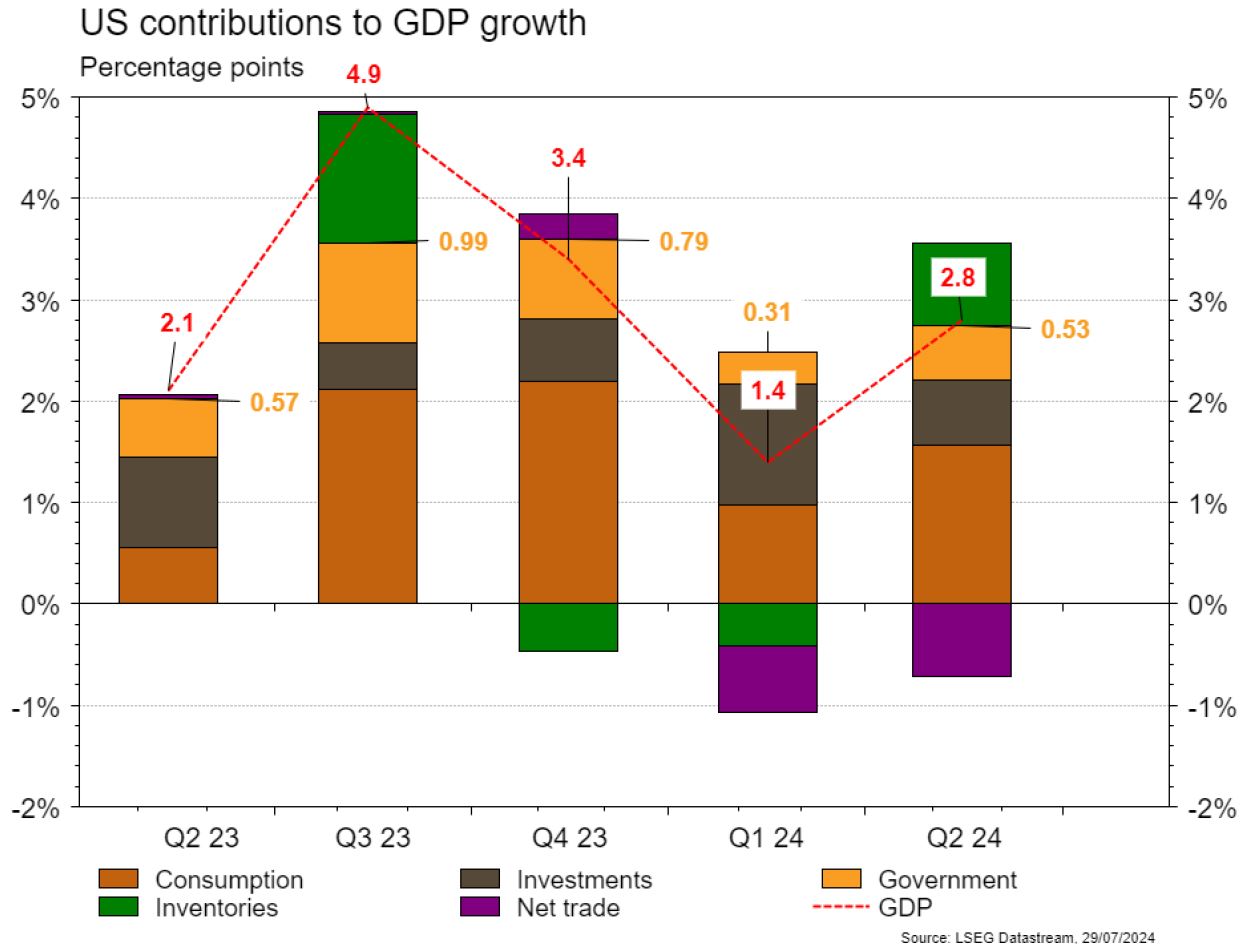

The statistics published in the United States were mixed. The manufacturing PMI disappointed, falling from 51.6 to 49.5 in July, while its services counterpart rose from 55.3 to 56 (54.9 expected). Q2 GDP surprised on the upside (+2.8% q/q annualised vs. 2% expected). Durable goods orders fell by 6.6% m/m in June, whereas an increase had been expected. The real estate sector is suffering: sales of existing homes contracted by 5.4% m/m in June (-3.2% est.), as did sales of new homes (-0.6% m/m vs +3.4% expected). The rise in the PCE price index (+0.1% m/m; +2.5% y/y) is slowing and reassuring. In the eurozone, the PMIs disappointed in July: the manufacturing PMI fell slightly, from 45.8 to 45.6, and the services PMI fell from 52.8 to 51.9. In China, the PBoC continues to ease monetary policy, cutting medium-term interest rates from 2.5% to 2.3%.

In its mid-year report on electricity, the International Energy Agency estimates that solar electricity production will grow by 33% in 2024, with the total of solar + wind exceeding global hydroelectric production for the first time. By 2025, renewables as a whole should overtake coal-fired generation for the first time, accounting for 35% of global consumption.

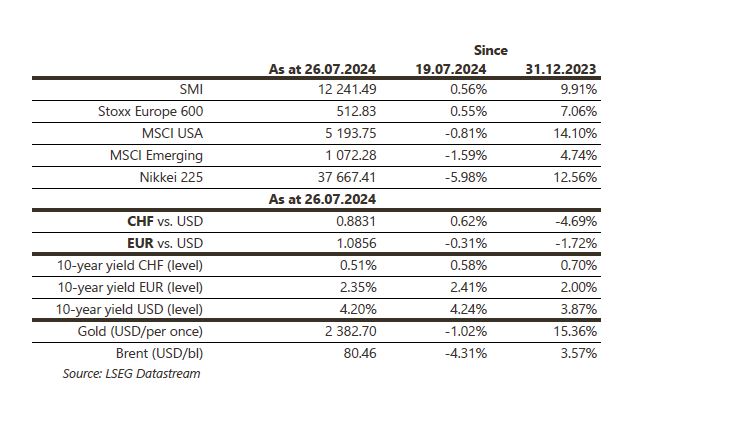

Reassuring figures on price growth in the US enabled 10-year sovereign yields to fall by 7bp in the US, 6bp in EUR and 7bp in CHF. European equities outperform (+0.6%) other regions (US: -0.8% and emerging markets: -1.6%). Gold (-1%) did not benefit from the fall in interest rates and the stable dollar (dollar index: -0.1%). The fall in the price of oil barrel (-4.3%) is good news for global inflation. Coming up this week: house prices (FHFA and S&P CoreLogic), household confidence, Fed meeting, ISM manufacturing and employment report in the United States; EC confidence indices (economy, industry and services), Q2 GDP, consumer price index and unemployment rate in the eurozone; manufacturing and services PMI in China.

Coming up this week: economic barometer July (KOF), SNB S1 results, inflation July (FSO) and PMI purchasing managers' indices July. The following companies are due to release H1/Q2 results: Sika, Kardex, Clariant, SIG Group, Comet, Inficon, Swiss, Swisscom, Interroll and Mobimo.

The ALPHABET (Core Holdings) report confirms the solid trend in Capex, but raises questions about returns on investment. Big tech companies are obliged to invest massively to remain competitive, as the CEOs of Alphabet and Meta have pointed out, preferring to risk over-investing rather than under-investing, as the cost of not keeping up with technological change would be much higher.

DEUTSCHE BOERSE (Core Holdings) delivered good results, without any false notes but without any material surprises capable of causing estimates to be raised. That said, the relevance of a balanced revenue mix, between cyclical revenues, stable revenues and M&A, has once again been clearly demonstrated.

HARTFORD (Satellite) reported an excellent Q2, with EPS at $2.50 ahead of expectations ($2.24). All segments exceeded expectations, and management confirmed that sales momentum remains very robust and that margins are continuing to improve. And the icing on the cake is that the valuation remains very attractive, with multiples discounted by 15-25% despite ROE (17.4% in Q2) 15% > competitors.

ROCHE (Core Holdings): According to the Financial Times, quoting CEO Thomas Schinecker, Roche plans to accelerate the development of its anti-obesity treatments. The first therapy could be launched as early as 2028. In addition, while the company has disclosed information about only three assets, the CEO says it has inherited seven compounds through the acquisition of Carmot.

US growth came in above expectations at 2.8%, while inflation continued its return to target (0.1% m/m & 2.5% y/y). We have noticed a bull steepening in the yield curve (2Y -13bp/10Y -7bp) and the market is firmly expecting a first cut in September. At the FED meeting on Wednesday, J. Powell is expected to make a statement along these lines. In Europe, the PMIs disappointed once again and yields ended lower, with a similar movement in the US (Bund 2Y -16bp/10y -6bp). Market expectations are starting to point to 3 further cuts between now and the end of the year.

Stock markets

After an eventful week, the waltz of quarterly results will continue to punctuate trading: in Europe we will have L’Oréal, HSBC, Axa and Clariant, while in the US Amazon, Microsoft, Apple, Meta and McDonald’s, among others, will be releasing their results. On the macro side, we have the FOMC meeting (no change in rates expected) and the employment figures, both in the US and in Europe. It should be another volatile week.

Currencies

The €/$ failed to break res. 1.0870, and a test of sup. 1.0765 is possible this week. Forex traders’ attention will be focused on the central banks: BOJ, FED and BOE, and we expect high volatility. The dollar is up slightly at $/CHF 0.8843 sup. 0.8810 res. 0.8926. The CHF remains in demand at €/CHF 0.9595, sup. 0.9545 res. 0.9680. The pound is down at £/$ 1.2847, sup. 1.2710 res. 1.2920. Gold rebounds to $2,392/oz, sup. $2,350 res. $2,425.

This document has been issued for information purposes and is exclusively supplied by Bordier & Cie SCmA in the framework of an existing contractual relationship with the recipient of this document. The views and opinions contained in it are those of Bordier & Cie SCmA. Its contents may not be reproduced or redistributed by unauthorized persons. The user will be held liable for any unauthorized reproduction or circulation of this document, which may give rise to legal proceedings. All the information contained in it is provided for information only and should in no way be taken as investment, legal or tax advice provided to third parties. Furthermore, it is emphasized that the provisions of our legal information page are fully applicable to this document and namely provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier Bank does namely not provide any investment services or advice to “US persons” as defined by the Securities and Exchange Commission rules. Furthermore, the information on our website – including the present document – is by no mean directed to such persons or entities.

"*" indicates required fields

insights

© 2024 Bordier & Cie

Please select your location and language below. If your location is not listed please select "International".