- Singapore

A brief recap of the market’s past week, by Bordier Singapore

Our website uses cookies to improve the overall user experience. By continuing, you are agreeing to our Data Protection, to our Disclaimer and use of cookies on the site.

|

You are using an insecure Internet browser Navigateur internet non sécurisé |

||

|

We have noticed that you are using Internet Explorer which is an outdated and insecure Internet browser. Please use one of the browsers below for a safe and optimal experience on our website.

Nous avons remarqué que vous utilisez Internet Explorer, qui est un navigateur internet obsolète et non sécurisé. Nous vous recommandons d’utiliser à la place l’un des navigateurs ci-dessous pour une expérience sûre et optimale sur notre site.

|

||

| Edge | Firefox | Chrome |

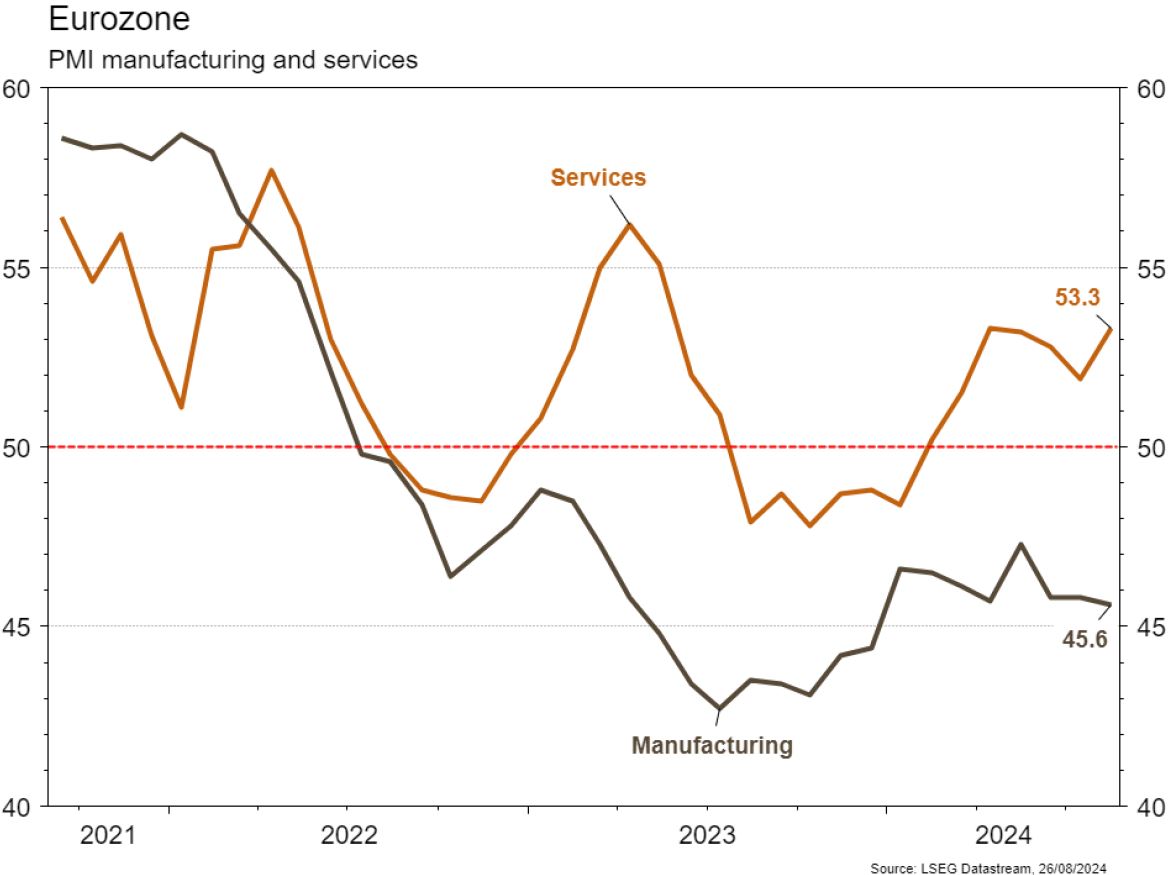

The statistics published in the United States were again mixed. Among the disappointments was the manufacturing PMI, which fell from 49.6 to 48 (49.5 expected) in August. By contrast, the services PMI surprised on the upside, rising from 55 to 55.2. Existing home sales were up by 1.3% m/m (in line), while new home sales well exceeded consensus forecasts (+10.6% m/m vs +1% m/m expected) in July. In the eurozone, the manufacturing PMI disappointed slightly, falling from 45.8 to 45.6 in August. Its services counterpart, driven upwards by the OG in France, came as a pleasant surprise, rising from 51.9 to 53.3 (51.7 expected). Household confidence fell from -13 to -13.4, although a modest improvement had been expected. Unsurprisingly, 1- and 5-year loan rates are unchanged in China.

Indonesia is moving its capital from Jakarta to Nusantara, 1,400 km away, where the administration and half of the current capital's population of over 10 million will be transferred within 20 years. Jakarta is sinking into the sea because of the weight of its skyscrapers. In addition to the effects of global warming, pumping water from the water table is also to blame.

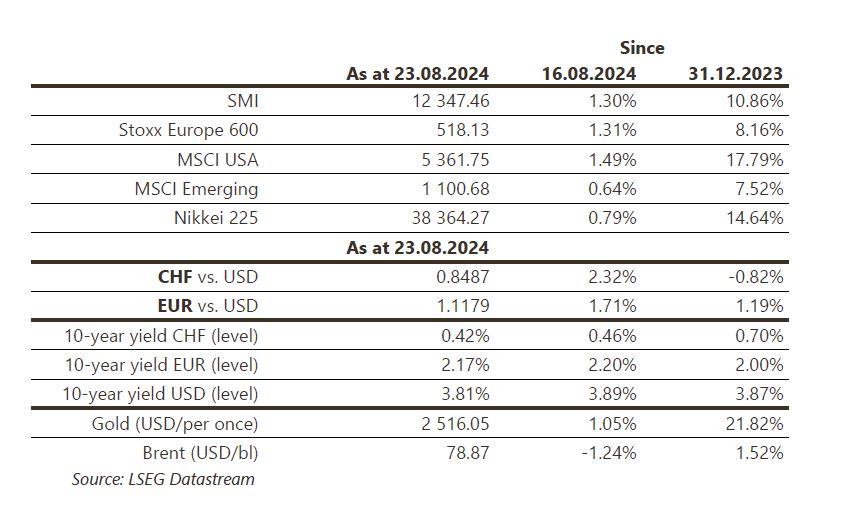

J. Powell's statements at Jackson Hole, acknowledging the deceleration in inflation and expressing concern about developments in the labour market, validated the start of the Fed's monetary loosening in September. As a result, 10-year sovereign yields fell (USD: -8bp; EUR: -2/-8bp) and the dollar depreciated (dollar index: -1.7%). Gold (+1%) benefited, as did equities (US: +1.5%; Europe: +1.3%; emerging markets: +0.6%). The fall in oil (-1.2%) is temporary, with renewed tensions in the Middle East. Coming up this week: durable goods orders, house prices (FHFA and S&P CoreLogic), household confidence and PCE price index in the US; EC confidence indices (economy, industry and services), consumer price index and unemployment rate in the eurozone; industrial profits in China.

Coming up this week: Q2 employment barometer (FSO), 2023 national accounts (FSO) and August economic barometer (KOF). The following companies are due to release H1 results: Hiag, Pierer Mobility, Molecular Partners, Accelleron, TX Group, Vetropack, Arbonia, Flughafen Zürich, Intershop, Allreal, Stadler Rail, Hochdorf, Salt, Warteck Invest, Jungfraubahn, Financière Tradition and ZKB.

BYD (Satellite): according to specialist platform Marklines, BYD became the world’s 7th largest manufacturer in terms of the number and type of vehicles sold in the 2nd quarter of 2024, overtaking Honda and Nissan with 980,000 units.

CADENCE DESIGN SYSTEMS is a new Core Holdings recommendation. The group is a leader in electronic design automation and is capitalizing on the increasing complexity of chips and the growing demand for verification tools. We expect annual growth of 15% over the next 5 years, as well as margin expansion: our fundamental value is USD 307.

EATON, which entered the market in April 2020, has been removed from our Satellite recommendation list after a total return of 4.6x. The stock is struggling to bounce back from its summer slump, with a premium PE fwd of 45-60% compared with its 10-15 year average.

SALESFORCE (Satellite) will report its second quarter FY2025 results this Wednesday (28 August). Although market conditions remain challenging for contract wins, Salesforce is targeting accelerating growth with the Data Cloud suite. We look forward to seeing recent activity in this segment.

In the US, J. Powell's dovish speech at Jackson Hole marked a turning point, confirming that employment has become the FED's priority, while the unemployment rate has risen sharply in recent months. Several 50bp cuts between now and the end of the year are therefore conceivable. We have seen a bull steepening in the yield curve (2Y -14bp/10Y -8bp). In Europe, rates are moving out of sync (10Y Bund -2bp) and the 10Y UST-Bund spread is now at its lowest since September 2023. For the time being, the market is anticipating a less aggressive rate-cutting cycle than in the US.

Stock markets

Powell’s speech heralded the start of a rate cut to support employment. On these words, the US markets are close to their all-time highs. On the micro side, all eyes will be on Nvidia’s results on Wednesday, and on the macro side we will have the core PCE price index in the US, while unemployment and CPI figures will be published in the eurozone. We remain cautious.

Currencies

J. Powell’s comments on future rate cuts push the dollar lower: €/$ 1.1179, $/CHF 0.8467, $/JPY 143.7. We expect the following ranges: €/$ 1.1070-1.1275, $/CHF 0.8333-0.8695. Clashes in the Middle East push CHF and gold higher: €/CHF 0.9466, sup. 0.9210 res. 0.9606, xau/$ 2517, sup. 2470 res. 2550. The pound is up sharply at £/$ 1.3190 sup. 1.3077 res. 1.3298.

This document has been issued for information purposes and is exclusively supplied by Bordier & Cie SCmA in the framework of an existing contractual relationship with the recipient of this document. The views and opinions contained in it are those of Bordier & Cie SCmA. Its contents may not be reproduced or redistributed by unauthorized persons. The user will be held liable for any unauthorized reproduction or circulation of this document, which may give rise to legal proceedings. All the information contained in it is provided for information only and should in no way be taken as investment, legal or tax advice provided to third parties. Furthermore, it is emphasized that the provisions of our legal information page are fully applicable to this document and namely provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier Bank does namely not provide any investment services or advice to “US persons” as defined by the Securities and Exchange Commission rules. Furthermore, the information on our website – including the present document – is by no mean directed to such persons or entities.

"*" indicates required fields

insights

© 2024 Bordier & Cie

Please select your location and language below. If your location is not listed please select "International".