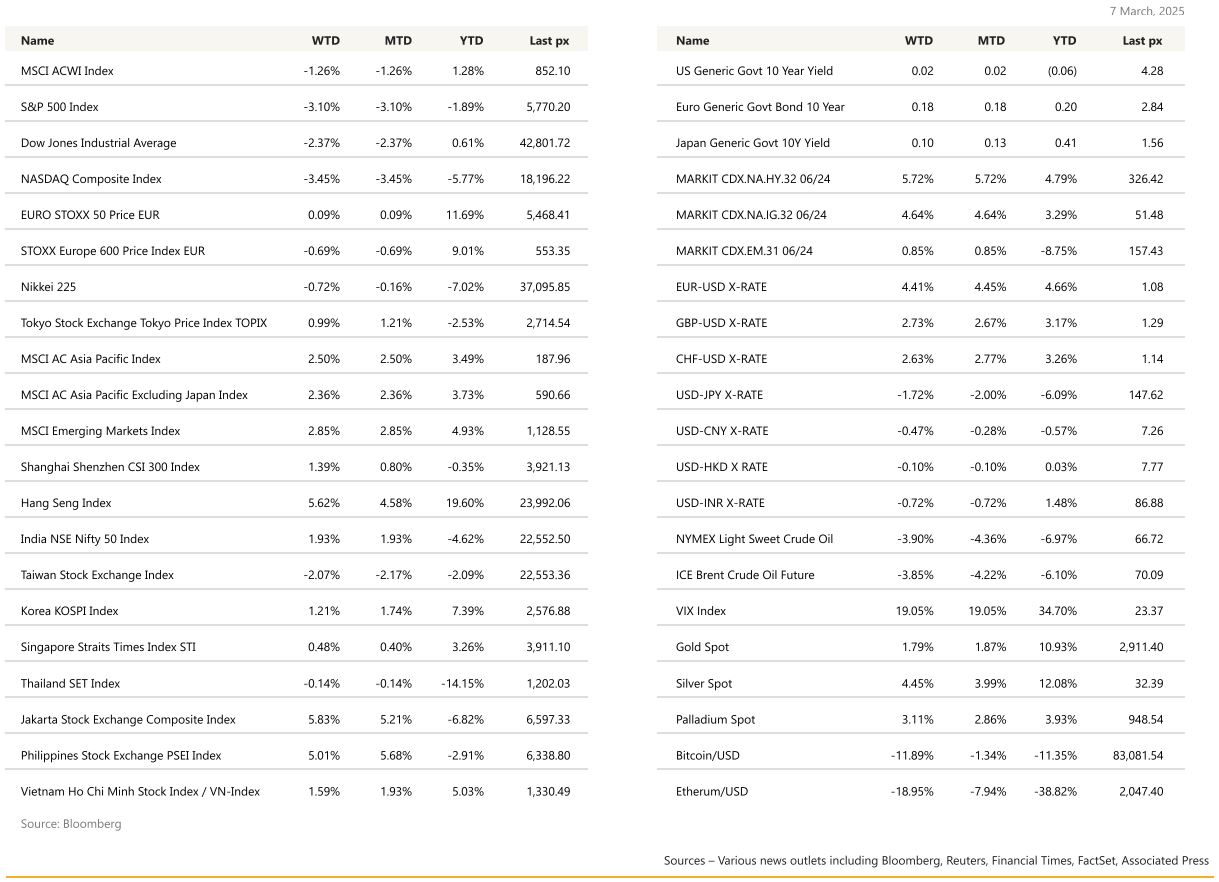

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US Stocks posted its worst week since September of last year as sentiment continued to sour on tariff worries and softening data. Despite a late rally on Friday night, major US indices were down around 3% for the week. The move higher on Friday night followed a speech by Federal Reserve Chair Jerome Powell that investors said leaned dovish. Powell appeared pleased with the progress on inflation and was somewhat dismissive of the recent rise in inflation expectations. His comments certainly clawed back some ground following a smaller than forecast increase in non-farm payrolls of 151k and an unemployment rate that ticked higher to 4.1% released by the BLS earlier. What was concerning was that the report doesn’t account for the recent DOGE job cuts. Businesses are seen as taking a bit of a pause on hiring until there is more clarity on tariff policy and economic outlook. Treasury Secretary Scott Bessent warned Friday the US economy may see some disruption, echoing comments from President Trump who said that “there’ll be a little disturbance, but we’re ok with that”. On the flip side, this could be one way to get the Fed to cut rates, in fact CME futures point to a probability of 3 rate cuts this year against 0 only a month or so ago. Traders have pushed their bets on a start to Fed rate cuts to June, from a view of May before the report, but still see a total of three cuts in 2025.

Fed policymakers, who in December felt there would likely be two rate cuts this year, are expected to update their rate-path projections at the upcoming policy meeting on March 19-20th.

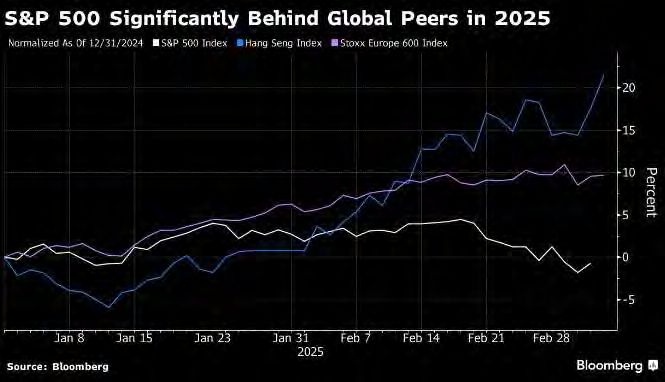

With much uncertainty still in tariffs and a raft of downbeat data that showed higher-than-expected continuing unemployment claims, a wider US trade deficit and a jump in job cuts, Tech especially in US chips, has taken the brunt of it on the chin given its higher than historical average valuations. As a comparison, the S&P 500 YTD is significantly behind global peers:

The February US ISM Manufacturing printed at 50.3 vs 50.7 expected and 50.9 the previous Month. The details of the ISM were not too good with priced paid coming out at 62.4 vs 56.0 expected, new orders printing at 48.6 vs 54.6 expected and employment printing at 47.6 vs 50.10 expected.

The February final US Services PMI came out at 51.0 vs 49.7 expected. The composite PMI printed at 51.6 vs 50.4 expected.

The February ISM Services also came out above expectations, printing at 53.5 vs 52.5 expected. The details of the ISM services were better than the ISM manufacturing earlier last week. Price paid came out at 62.6 vs 60.4 expected, but new orders printed at 52.2 vs 51.5 expected and employment printed at 53.9 vs 51.6 expected.

The January US trade balance figures again surprised on the downside at minus USD 131.4Bn vs minus USD 128.8Bn. Some frontrunning the US tariffs probably happened again in January.

US employment last Friday came out only a touch below expectations with the February NFP printing at 151K vs 160K expected, Private Payrolls came out at 140K vs a consensus at 145K. Unemployment rate printed at 4.10% vs 4.00% expected. Average hourly earnings MoM posted a subdued 0.28% increase (rounded to +0.30%, on the light side of expectations, previous Month was revised down by one tenth of one percent at 0.40%. The YoY figures printed at +4.00% vs +4.10% expected and previous Month was revised down by two tenth of one percent. Participation rate dropped by two tenth of one percent and came out at 62.40%.

This week will see the JOLTS report on Tuesday, followed by CPI on Wednesday. Both the YoY headline and the core MoM reading are expected to tick down to 2.9% and 0.3% respectively. PPI will follow on Thursday whilst Friday will see the U. of Mich. sentiment and inflation expectations.

President Donald Trump’s executive order to establish a Bitcoin strategic reserve and a stockpile of other digital assets has failed to impress crypto markets, with Bitcoin’s value plummeting following the announcement. President Trump’s lack of plans for government purchases disappointed investors ~ BTC trades $86k.

We think for the moment, stay defensive in staple stocks, healthcare and utilities – ones with secular tailwinds, less fundamental downside and high cash generation companies.

Europe

European markets closed lower Friday, rounding off a volatile week marked by whipsawing policy on US tariffs, the latest rate cut from the ECB and the German fiscal reforms and a regional defense spending boost. The Stoxx 600 index closed 0.69% lower for the week, snapped a 10-session winning streak, its longest since early 2024.

The ECB cut policy rates by 25bp to 2.5% and modified the language in its monetary policy statement, acknowledging that policy remains restrictive but meaningfully less so after 150bp of deposit rate reduction since June 2024. The ECB lowered its 2025 economic growth forecast, released quarterly, for the fourth consecutive time, putting expansion at 0.9% for 2025, 1.2% for 2026 and 1.3% for 2027. Inflation was meanwhile seen at 2.3% this year, above the 2.1% seen three months ago. Ms Lagarde nevertheless said disinflation in the euro area remained on track and that inflation was due to hit the target of around 2% by early 2026. « The downward revisions (in growth) for 2025 and 2026 reflect lower exports and ongoing weakness in investment, in part originating from high trade policy uncertainty as well as broader policy uncertainty, » the ECB’s statement said.

In data, Euro area real GDP growth was revised higher in Q4 to +0.2% q/q from the previous estimate of 0.1% q/q. This was on the back of a strong upward revision in Ireland’s print, from -1.3% q/q to 3.6% q/q. EA PMIs were broadly unchanged from the flash release at the composite level (50.2), with a slight upward revision to manufacturing output (+0.2pt to 48.9, from 47.1 in January) offset by a slight downward adjustment in services (-0.1pt to 50.6, from 51.3 in January). Headline and core HICP decelerated in February by 0.1pp to 2.4% y/y and 2.6% y/y, respectively. At the EA level, the decline in headline inflation was primarily driven by energy, which decelerated by 1.7pp to 0.2% y/y. The Euro area unemployment rate remained stable at 6.2% in January, considering a 0.1%- downward revision in December. The unemployment rate thus remained at a historic low. Euro area retail sales contracted by 0.3% m/m in January, disappointing the consensus expectation of a moderate increase (+0.1%).

In Germany, the CDU/CSU and the SPD have agreed on a proposal to (i) create a 500bn euro off-balance sheet special investment fund with a lifetime of 10 years for investment in infrastructure, (ii) exempt defence spending beyond 1% of GDP (approx. 2.1% in 2024) from the debt brake to allow for German rearmament, and (iii) increase permissible structural net borrowing rules at the state level from 0.0% GDP to 0.35% to align with those of the federation. These reforms are set to be approved by the current Bundestag before the new parliament is seated on 25 March. European leaders discussed increasing defence spending, with the national escape clause activation being the most immediate response. The Commission proposed a €150bn lending instrument and to mobilise EU budget margins. However, these announcements are unlikely to enable a rapid near-term ramp-up in defence spending.

In the UK, The final February composite PMI was unchanged from the flash, at 50.5 (50.6 in January), due to an upward revision to the manufacturing PMI (+0.5 from the flash to 46.9) and a downward revision to the services PMI (-0.1 from the flash to 51.0). Money and credit data from the BoE for January show a slight recovery, but it remains at low levels consistent with weak economic activity.

This week, we will see industrial production releases for Germany, Italy and the EA on Monday, Thursday and Friday, the February final HICP releases for France, Germany and Spain. We will also have the monthly GDP data in the UK on Friday.

Asia

Asia markets mostly rose with the MSCI Asia ex Japan gained 2.36% for the week and the Hang Seng Index at 5.62%

In China, Headline CPI inflation reversed its upward trend, falling by -0.7% y/y in February from the 0.5% increase in January. The sizable drop in the February CPI was driven in part by the difference in the timing of the Lunar New Year holiday (February in 2024 and January in 2025), as goods and services prices normally decline visibly in the month following LNY. PPI remained in contraction for the 29th month, falling 2.2% y/y in February (Jan: -2.3%). Over the weekend, China’s consumer inflation dropped below zero for the first time in 13 months. The consumer price index declined 0.7% in February from a year earlier, compared with a 0.5% gain in the previous month.

The annual NPC meeting convened on March 5, and Premier Li delivered the government work report. The numerical targets announced at the NPC have no major surprises, including a 5% growth target, 4% budget fiscal deficit, 2 trillion yuan fiscal expansion within the budget, 2% CPI inflation target, and modest fiscal support for consumption.

Hong Kong: In January, inbound tourism during the LNY holiday benefitted local retail sales, with sales volume expanding 3.1%m/m sa, partially offsetting the 4.5% fall in December.

Taiwan: Taiwan’s manufacturing activity is settling at a steady pace in the current quarter. The manufacturing PMI rose moderately by 0.5-pt to 51.5 in February, after easing by 1.6-pt in January. Taiwan’s February trade report beat expectations, led by strong tech exports and shipments to the US market, and may partly reflect front-loading demand amid concerns of US tariff hikes. February headline CPI inflation eased more than expected, coming in at 1.6% y/y, following the January uptick to 2.7% y/y.

Japan: Deputy Governor Uchida spoke on 5 March and the speech was largely stuck to the YTD communications of the BoJ’s Policy Board members. The markets were largely unchanged after his speech.

GeoPolitics

The US-China tariff war 2.0 escalated. The US hiked an additional 10% tariff on China on March 4, and China has responded. About $19bn US imports (2024 data, mainly soya beans) will face 10% additional tariff and $3.4bn US imports (mainly cotton) will face 15% additional tariff, lifting the average effective tariff rate (China on US imports) by 1.5%. This is like the previous round of retaliatory tariff increase (effective on February 10) that lifted the average effective tariff rate by 1%. China also announced other non-tariff measures, e.g. adding 10 US companies onto the Unreliable Entity List and another 15 US companies on the Export Control List, though overall, China’s reactions are asymmetric, targeted and constrained.

China has also announced retaliatory tariffs on some Canadian Agricultural goods after Ottawa slapped import duties on Chinese-made electric vehicles and steel and aluminium products last year. Beijing said a 100% tariff would be imposed on Canadian rapeseed oil, oil cakes and peas, while a 25% levy would be placed on aquatic products and pork originating in Canada.

Japan’s Trade Minister Yoji Muto will be visiting the US from March 9 – 11, just before the President’s extra levies on Steel and aluminium are expected to kick in on 12 March.

US and Ukraine officials to meet in Saudi Arabia on Tuesday in bid to move forward peace talks stalled by last month’s acrimonious Oval Office meeting. Trump anticipates good progress this week with Ukraine expected to sign minerals deal. US will gauge Ukraine’s willingness to compromise in bid to progress talks with Trump yet to be convinced on its commitment to peace.

Credit/Treasuries

The US Treasury curve steepened last week with the 2years yield down 2bps, 5years & 10years yield up 3bps and the long bond yield gained 6bps. US IG 5years credit spreads widened by 3bps while US HY 5years credit spreads widened by 20bps. VIX gained 3.5% and is now trading around 23.50. Regarding the German Fiscal Stimulus that was announced, Germany is smiling but Italy is suffering. The 10years yield BTP (Italian Government Bond) increased by 80bps over the last 3Months which include a rebound of 40bps last week only. Italy will be marginally positively impacted by the German “Whatever it takes” but will be negatively impacted by higher cost of servicing their debt moving forward. Italy Debt/GDP ratio around 140%, Germany Debt/GDP ratio around 64%.

FX

DXY USD Index posted the worst weekly performance since 2022, falling 3.51% to close the week at 103.84, driven by stagflation worries surrounding tariffs and deterioration in broad US macro data.

Tariffs, President Trump provided one-month tariff reprieve for USMCA goods (including autos), putting some focus back on the tariffs as a negotiating tactic narrative. US macro data was mixed: February ISM Manufacturing Index deteriorated to 50.3 (C: 50.7; P: 50.9), but arguably the more notable element was that both the new orders and employment indices unexpectedly fell into contraction. Moreover, the prices-paid index rose sharply to 62.4 (P: 54.9), the highest since June 2022. ISM Services rose to 53.5 in February (C: 52.5P: 52.8). ADP Employment grew 77k in February (C: 140k; P: 186k), and Factory Orders rose 1.7% m/m in January (C: 1.7%; P: -0.9%). US Nonfarm Payrolls rise 151k (C: 160k), softer-than-expected gains but still signalling solid labor growth; household report hints at some weakness with the unemployment rate rising, despite a fall in the labor force participation rate. US Nonfarm Payrolls rise 151k (C: 160k), softerthan-expected gains but still signalling solid labor growth; household report hints at some weakness with the unemployment rate rising, despite a fall in the labor force participation rate. Fed Chair Powell said the US economy is « in a good place” despite “elevated levels of uncertainty” and that the Fed does not “need to be in a hurry” to ease.

European Currencies rose against USD, with EURUSD +4.41% to 1.0833, GBPUSD +2.73% to 1.292, USDCHF -2.57% to 0.88 and USDSEK -6.36% to 10.0957, driven by broad based USD weakness and on the back of Germany’s plans to increase defence and infrastructure spending. It signals a significant shift in fiscal regime stance and could be about as much money as the country has invested in East Germany since reunification if the figures reported are realised. The ECB cuts rates by 25bp, as expected, describing monetary policy as “becoming meaningfully less restrictive” with ECB President Lagarde maintaining optionality for meetings to come. On Eurozone macro data, Headline HICP slowed to 2.4% y/y (C: 2.3%; P: 2.5%) while Core HICP slowed to 2.6% y/y (C: 2.5%; P: 2.7%) in February. Retail Sales fell 0.3% in January (C: 0.1%; P: -0.2%) after subdued releases in Italy, Germany, and France. 4Q24 GDP growth was revised up to 0.2% q/q (Preliminary: 0.1%; C: 0.1%; 3Q24: 0.0%).

Antipodean Currencies rose against USD, with AUDUSD +1.55% to 0.6305 and NZDUSD +2% to 0.571. Australia 4Q24 GDP rose 0.6% q/q (0.5%; C: 0.6%; P: 0.3%), the strongest quarterly growth since 2022. Retail Sales rose 0.3% m/ m in January (C: 0.3%; P: -0.1%). In the minutes from the RBA’s February Policy meeting, the board expressed caution over future easing of monetary policy following the central bank’s first cut of the cycle. The RBA stressed future decisions would be « guided by the incoming data and evolving assessment of risks ».

USDJPY fell 1.72% to 148.04 on the back of further convergence of US and Japan rates differentials. In addition, US President Trump’s comments that the Japanese government should not continue to reduce the value of JPY drove market positioning for a higher BoJ terminal rate.

USDCAD price action was volatile last week, touching an intraweek high of 1.4543 before falling to a low of 1.4242 after autos and auto-parts in compliance with USMCA were postponed for one month from the recently imposed US tariffs on Canada. Downside surprise in Canada employment with labor demand slowing after three months of solid gains, as employment rose 1k in February (C: 20k; P: 76k) while the unemployment Rate remained at 6.6 (C: 6.7%).

Oil & Commodity

WTI crude and Brent crude oil futures plunged 3.9% and 3.85% to close the week at 67.04 and 70.36 respectively. Global economic growth fears and supply concerns after the OPEC+ decision to resume production increases in April weighed on prices. The EIA report for the week ending February 28 showed a 3.6mn barrel increase in crude oil inventories, further supporting the decline in prices.

Gold rose 1.79% to close the week at 2909.10, driven by broad-based USD strength. In addition, demand for gold was supported by heightened growth uncertainty stemming from tariff and deteriorating US macro data.

Economic News This Week

- Monday – Norway CPI, EU Sentix Inv Confid., US NY Fed 1Yr Inflat. Exp.

- Tuesday – AU Cons. Confid./Biz Confid., JP GDP/ Machine Tool Orders, US Small Biz Optim./ JOLTS

- Wednesday – JP PPI, US CPI, CA BoC Rate Decision

- Thursday – SW CPI, EU Indust. Pdtn, US PPI/ Initial Jobless Claims

- Friday – NZ Food Prices/ Biz Mfg, UK GDP/ Indust. Pdtn/ Mfg Pdtn, CA Mfg Sales, US UMich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.