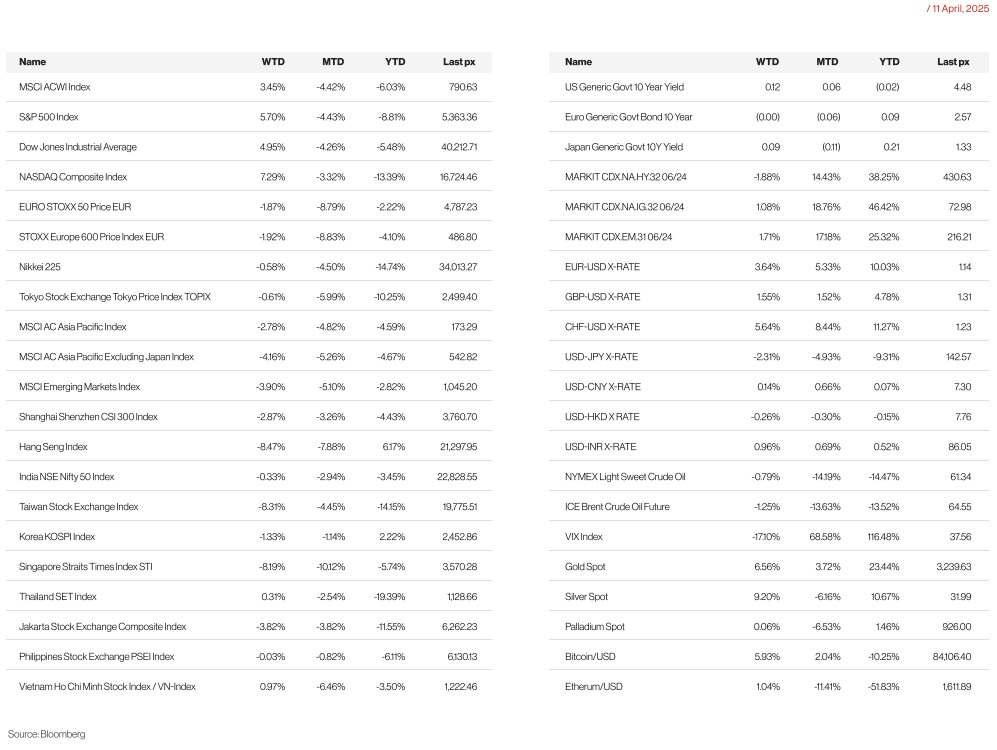

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

The S&P 500 posted its best weekly performance since November 2023 and the Nasdaq since November 2022 following Friday’s performance which was lifted after Boston’s Federal Reserve President, signalled that the central bank “ would absolutely be prepared” to help stabilize the market if needed. Stocks erased earlier losses on Friday, which were driven by a surge in bond yields that calmed in the afternoon. But, not after seeing a wild week for US stocks where the S&P 500 flirted in bear market territory on Monday and Tuesday, before rebounding. The move came after President Donald Trump on Wednesday announced a pause on some of his harshest tariffs on Wednesday afternoon, propelling the S&P 500 to its biggest one-day gain since 2008.

During the week the UST10 yield hit an intraday high of 4.5864% before settling at 4.4895%. Blame fell on hedge funds who were apparently unwinding so-called basis trades and speculation that perhaps China was also behind the selloff. In a parallel universe without tariff pains, the market would otherwise be quite healthily chugging along. CPI and PPI both came in below expectations: core MoM CPI was at 0.1% (exp. 0.3%) and headline CPI YoY fell to 2.4% from 2.8% whilst MoM PPI final demand fell into negative territory at -0.4% against expectations of 0.2%. YoY fell to 2.7% from 3.2% squarely pointing to a fall in energy prices. US consumer sentiment fell to an almost three-year low, according to survey data from the University of Michigan. Meanwhile, year-ahead inflation expectations jumped to the highest levels since 1981, again on fears of tariff induced supply-side inflation.

Friday saw the official start of earnings, where for Q1 analysts now see the S&P 500’s year-over-year earnings growth of 6.7% for the S&P 500, down from about 11.1% in early November when Trump was elected, according to data compiled by Bloomberg Intelligence. For all of 2025, Bloomberg Intelligence sees profits rising 9.4%, compared with a projection of 12.5% at the beginning of the year.

Over the weekend, Reuters reported that the CBP (US Customs & Border Protection) published a notice late Friday night (confirmed subsequently by the White House) listing 20 product categories including computers, semiconductors & components, smartphones, and a number of other electronic devices that are to be exempted from reciprocal tariffs, including the 125% reciprocal tariff on China and the 10% « baseline » reciprocal tariffs on other countries, effective retroactive to 5-Apr. Some positive vibes to start Monday with perhaps? Buckle up.

Data this week will see Empire Manufacturing, Retail Sales and housing data among the key releases, in a shortened week ahead of Good Friday.

Europe

European equity markets mixed on Friday. German DAX and France CAC underperformed, but FTSE 100 and Italy’s MIB higher. Real Estate, Healthcare, Utilities, Basic Resources and Food/Beverage outperformed; Industrial Goods/Services, Oil/Gas, Travel/Leisure and Technology lag. EURO Stoxx 50 ended the week lower 1.87%.

ECB widely expected to lower rates by 25bps at 17-Apr meeting, reducing deposit rate to 2.25%. Markets likely to focus intensely on Lagarde’s communication style, particularly whether she convincingly signals ECB’s readiness to respond if conditions deteriorate. Analysts project further 25bp cuts at upcoming meetings, potentially bringing deposit rate to 1.50% by Sep-2025.

UK monthly activity data showed the economy expanded by a largerthan-expected 0.5% in February versus consensus 0.1% and prior 0.1% contraction. In the three-months to February, economy is estimated to have grown 0.6%. Growth was seen in all main sectors of the economy compared with January. Industrial production expanded 1.5%, construction 0.4% and services 0.3%. Within the industrial sector, manufacturing output gained 2.2%. Output in consumer-facing services increased by 0.7% after falling 0.1% in prior month.

Tariff updates:

EU announced its own 90-day pause on retaliatory efforts to give negotiations an opportunity to bear fruit. The EU is open to negotiation with 0 for 0 tariffs. While the EUs preference remains negotiation, Sefcovic warned that the bloc was ready to escalate its response if necessary. This could include invoking the Anti-Coercion Instrument (ACI), allowing the EU to restrict US companies access to public contracts or target American services. France is pushing for US digital services to be targeted, but this is fiercely resisted by Ireland, where many US tech firms, including Apple, Google, Microsoft, and Meta, have their European headquarters. The Commission has said that all options are on the table but has not confirmed that services will necessarily be targeted.

While the EU considers its options, it is also re-engaging with China. SCMP said EU leaders plan trip to Beijing in July for summit with Xi Jingping. Earlier this week, US Treasury Secretary Bessent warned the EU against seeking pivot towards China and away from US. Separately, Handelsblatt reported EU has also started talk with China on bloc’s duties on electric vehicles. Have agreed to discuss cooperation in their electric vehicle supply chains.

Asia

The week started on turmoil as Trump stood firm over his tariffs despite fears of a recession and even threatened an additional 50% tariff on China. On Monday, Hong Kong’s Hang Seng index plunged 13.2 per cent in its worst day in nearly three decades. Taipei stocks suffered their worst fall on record, tanking 9.7 per cent, while Tokyo closed lower by almost 8 per cent. However, things took a turn on Wednesday evening when Trump announced sudden reversal on tariffs lowering most to 10% but hiking China’s to 125%, then clarifying as 145% and only to declare later on Friday, that the tariffs excluded smartphones, computers and other electronics from the increased import duties, narrowing the scope of his tariffs on goods from China and a baseline 10% on imports from most other countries. MSCI Asia Ex Japan corrected lower by 4.16% while Hang Seng took the worst hit, falling 8.47% for the week.

The chaos, uncertainty, and real damage of the Trump Tariff Tax will likely not disappear in 90 days as new policy new exemptions, new timelines emerge for the Tariff saga. Trump’s latest exemptions cover almost $390 billion in US imports based on official US 2024 trade statistics, including more than $101 billion from China, according to data. China’s government views the US latest exemption of certain consumer electronics from tariffs as a small step towards correcting the US’s « wrongful action » and urges the US to do more to revoke the levies.

China’s consumer price index fell 0.1% year on year, compared to a flat reading expected by economists polled by Reuters. Producer prices saw a larger-than-expected decline, falling 2.5% year on year in March. PBOC weakened yuan daily reference rate for fifth consecutive session on Wednesday with some moderation in pace of adjustment. Goldman Sachs lowered its forecasts for China’s GDP growth to 4% in 2025 and 3.5% in 2026 in a report published on Thursday, citing the effects of tariffs.

Reserve Bank of India’s cut interest rate by 25 basis points to 6 per cent to support growth. The central bank’s decision came on the same day that the Trump administration’s reciprocal tariff of 26 per cent for the world’s most populous nation came into effect. Economists project that Trump’s tariffs drive will impact India’s GDP growth, with analysts at Goldman Sachs reducing their forecast for the current fiscal year from 6.3 to 6.1 per cent.

Singapore’s central bank eased its monetary policy settings for a second straight review and warned that a persistent weakening in global trade will have “significant ramifications” on the city-state’s economy, with growth forecast to soften this year. The Monetary Authority of Singapore, which uses the exchange rate as its main policy tool rather than interest rates, said on Monday it will reduce the slope of its policy band while leaving the width and centre unchanged. Singapore’s Ministry of Trade and Industry downgraded the country’s 2025 growth forecast to 0-2% from a previous 1-3%.

Bank of Japan Governor Kazuo Ueda said on Wednesday the central bank will continue to raise interest rates if the economy keeps recovering.

South Korea’s government has approved Jun 3 as the date for a snap presidential election. South Korea has faced months of political turmoil since Yoon Suk Yeol stunned the country by declaring martial law, triggering his impeachment by parliament and the impeachment of acting leader Prime Minister Han Duck-soo. Han’s impeachment was later overturned by the Constitutional Court and he will continue in the role of acting president until the election.

Indonesia’s stock market dropped 9 per cent in early trade on Tuesday (Apr 8), triggering a 30-minute trading halt, and the rupiah fell 1.8 per cent to a record low as markets reopened after an extended holiday break and reacted to the global market. The rupiah dropped to 16,850 per US dollar, going past its Asian Financial Crisis trough to its lowest on record.

Philippines central bank resumes easing with 25bps cut from 5.75% to 5.50% and signalled further easing amid a “more challenging external environment”.

Tariffs and Asia:

- Thailand bans short – selling effective 8th April, till 11 April. Thailand faces tariffs of 36% on exports to the United States – its biggest market, with a trade surplus of around US$45 billion.

- South Korea on Wednesday announced it was increasing the size of a financial support package for its auto sector in an effort to cushion the blow of Donald Trump’s 25 per cent tariffs on auto imports.

- Vietnam and the United States agreed to start negotiations on a reciprocal trade agreement, Hanoi said on Thursday (Apr 10), hours after Washington delayed imposing an enormous tariff on the Southeast Asian manufacturing powerhouse.

- Australia on Thursday declined Beijing’s proposal to work together to counter U.S. tariffs, saying instead it would continue to diversify its trade and lower its reliance on China, its largest trading partner.

- On Thursday Apr 10th, ASEAN ministers gathered to formulate a collective response to the tariffs, which was a marked change of institutional behaviour. Six of nine Southeast Asian countries targeted by the U.S. administration were slapped with much bigger-thanexpected tariffs of between 32% and 49% before the 90-day pause was announced.

- Xi Jinping will travel to Southeast Asia next week in a bid to shore up China’s relationships with neighbouring countries. He will travel to Vietnam, Malaysia, and Cambodia from April 14 to 18.

GeoPolitics

US- Iran: President Donald Trump announced Monday that the United States plans to engage in direct negotiations with Iran over its nuclear program, issuing a stark warning that failure to reach a deal could result in severe military action. If they don’t make a deal, there will be bombing — the likes of which they have never seen before, Trump told NBC News in March. While Tehran has indicated the talks would remain indirect, tensions continue to escalate. Trump has repeatedly demanded Iran abandon its nuclear ambitions and criticized its support for regional militant groups, including Hamas, Hezbollah, and the Houthis. U.S. officials confirmed that six B-2 stealth bombers were deployed in March to a joint U.S.-British military base on Diego Garcia, a strategic move amid ongoing U.S. airstrikes in Yemen and rising hostilities with Iran. Despite the rhetoric, U.S. intelligence agencies have reaffirmed there is no evidence Iran is actively pursuing a nuclear weapon. Iranian President Masoud Pezeshkian echoed that sentiment, saying, We are not after a nuclear bomb. You have verified it 100 times. Do it 1,000 times again.

North Korea: North Koreas status as a nuclear weapons state can never be reversed, no matter how much the United States and its Asian allies demand it, state media reported on Wednesday, citing the powerful sister of its supreme leader. The comments, which state news agency KCNA said were likely a response to a joint statement by the foreign ministers of South Korea, Japan and the United States made on the sidelines of a NATO meeting last week. The three foreign ministers reaffirmed the commitment to the complete denuclearization of North Korea, according to the joint statement.

Credit/Treasuries

U.S. Treasury yields rose to a two-month high on Friday and 10-year yields were on track for their biggest weekly increase in decades, while the U.S. dollar fell, as a turbulent week drew to a close. The 10-year UST yield surged from its low of 3.9% in early April to 4.48%. US 10-year TIPS yield surged from 1.77% in early April to end last week at 2.27%. This was the biggest weekly rise since 2001. And the U.S. Dollar Index has declined from its January peak of 110 to below 100. The moves came despite the strong 10yr and 30yr Treasury auction. USD 39bn of 10-year notes were issued at a yield of 4.435%, -3.0 bps below the pre-sale yield, which came amid very strong demand by indirect bidders, and the Atlanta Fed’s GDP Nowcast projects a -2.4% annualized contraction for Q1 2025— raising concerns of a looming recession. None of this suggests the market thinks the tariffs are going to make America great.

Markets are contending with simultaneous declines in U.S. equities, Treasuries, and the dollar, along with renewed stress on bank balance sheets. With the 10-year yield surpassing levels seen during the 2023 banking crisis and nearly $12 trillion in new U.S. debt set for issuance this year, analysts warn that escalating trade tensions could further destabilize a fragile economic backdrop.

FX

DXY, the USD Index fell to a low of 99.01 last Friday before closing the week at 101.10 (-2.84% for the week). Trade war between US China escalated further with US imposing a 145% overall tariff on China, while China retaliated by raising its tariff rate on US to 125% before the end of the week. Broad based US dollar weakness prompted questions around capital repatriation out of US driven by the reversal of US exceptionalism and potentially, US treasuries losing its safe-haven appeal. On US macro data, both US CPI and PPI both surprised to the downside, which further lowered PCE estimates. University of Michigan Consumer Sentiment falls for the fourth straight month with 1y inflation expectations surging even higher to 6.7% (P: 5.0%), the highest reading since 1981. The March FOMC minutes reiterated the Fed s stance that policy is well positioned to wait for more clarity on inflation and economic activity, while emphasizing a high degree of uncertainty to the outlook.

European Currencies rose against USD, with EUR (+3.64%) to 1.1355, GBP (+1.55%) to 1.3087 and CHF (+5.34%) to 0.8148. EUR touched a high of 1.147 last Friday as market participants continued to look for investments outside the US amidst continuing trade tension. GBP strengthened, but trailed behind EUR as some market participants remain wary of the lack of fiscal space in the UK, despite stronger than expected UK GDP last week. CHF appreciated the most among the European currencies due to its safe-haven status.

Antipodean Currencies rose against USD, with AUD (+4.12%) to 0.629 and NZD (+4.09%) to 0.583. The RBNZ lowered its policy rate by 25bp to 3.5% at its April meeting, as widely expected. The MPC outlined its expectation that global trade barriers may further weaken the economic activity in New Zealand, alongside its already-weak household spending and residential investment.

USDJPY touched a low of 142.07 last Friday before closing the week at 143.54 (-2.31%). Expectations for a near-term BoJ rate hike fall amid the risk-off macro environment and after February base salary data unexpectedly slows to 1.9% y/y (C: 3.0%; P: 3.0%). Despite this, JPY gained amidst the deteriorating risk sentiment.

USDCNH rose to a high of 7.429 mid-week before paring back to close the week at 7.288 (-0.10%). Despite the uncertainty around trade policy, CNH gained on reports of a potential front-loading of stimulus. Both China CPI and PPI came in below consensus, amid weaker global oil price and more notably, a sharp slowdown in durable consumer goods prices possibly due to tariffs.

Oil & Commodity

WTI crude and Brent crude oil futures touched a four year low of 58.4 and 55.12, before paring its losses to close the week at 61.5 (-0.79%) and 64.76 (-1.25%) respectively. The sharp decline was driven by a combination of demand (tariff and global risk-off) and supply (unexpected OPEC hike). According to Goldman Sachs, the worldwide crude market is expected to have a glut of 800k barrels a day in 2025, and a wider surplus of 1.4 million barrels a day in 2026. Key support level on WTI at 50, while on Brent at 60.

Gold rose to a record high of 3237 (+6.56%), while Silver rose to 32.30 (+9.20%) for the week, driven by broad-based USD weakness. This was despite US yields rising significantly.

Economic News This Week

- Monday – JP Indust. Pdtn, CH Trade Balance, US NY Fed 1Yr Inflat. Exp.

- Tuesday – NZ Food Prices, AU RBA Mins., UK Employ., EU Zew/ Indust. Pdtn, CA CPI, US Import Price Index

- Wednesday – JP Core Machine, AU Westpac Leading Index, CH GDP/ Indust. Pdtn/ Retail Sales, UK CPI/ RPI, EU CPI, US Retail Sales/ Indust. Pdtn, CA BOC Rate Decision

- Thursday – NZ CPI, JP Trade Balance, AU Employ., EU ECB Rate Decision, US Housing Starts/ Initial Jobless Claims

- Friday – JP Natl CPI

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.