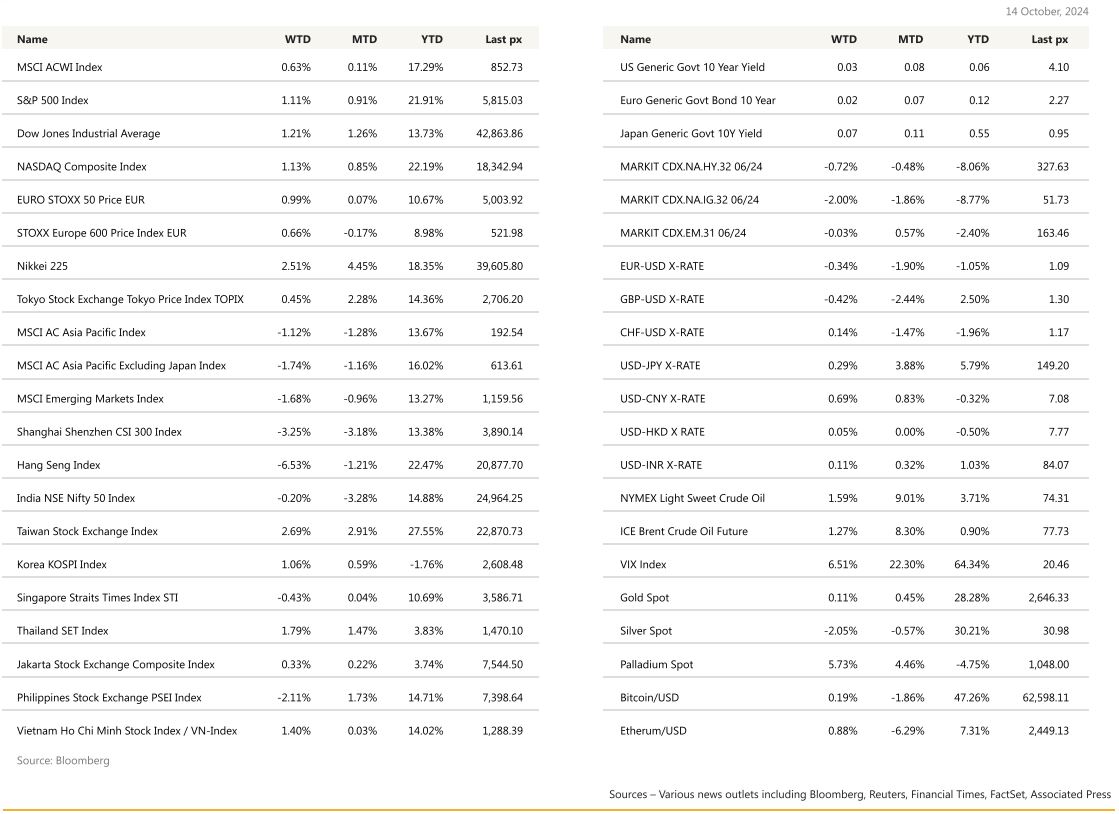

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets closed at a new all-time high on Friday as encouraging early earnings reports from major US banks and fresh inflation numbers allayed concerns about the Fed’s easing cycle. The S&P 500 hit its 45th record high this year with 9 out of the 11 sectors advancing, led mainly by financials and industrials. Also worth noting here that both the Russell 2000 and the equal-weighted S&P 500 were both outperforming suggesting that the rally is widespread and not concentrated to only the large/mega caps. After Thursday’s slightly higher than expected CPI releases, Friday’s PPI releases helped sooth some anxiety as the latter suggested further progress toward tamer inflation. Headline CPI came in at 2.4% against expectations of 2.3% whilst the month-on-month core CPI came in at 0.3%, also higher than expected by 10 bps. The PPI Final Demand was lower than expected at 0% from 0.2% previously. Unemployment claims both came in higher than forecast. Expectations remain that the Fed will reduce rates by 25 bps in the remaining 2 Fed meetings in November and December.

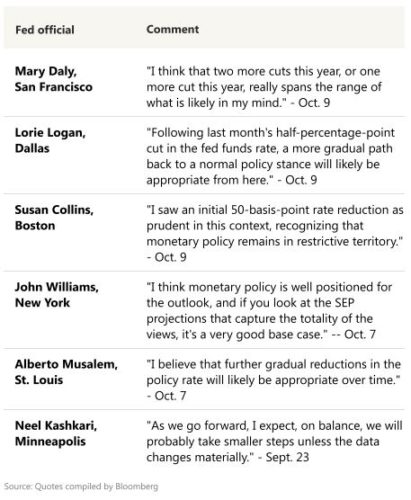

What Fed Officials Are Saying About the Path Ahead

Among individual stocks, the US Justice Department is weighing whether to ask a federal judge to force Google parent Alphabet to sell off parts of its business.

The energy sector was raised to overweight by brokers citing extremely oversold conditions and a combination of Fed cuts and the election cycle supporting a bullish view.

We got the FOMC minutes from the September meeting, where the Fed delivered their recent 50bp rate cut. These said that some participants observed that they would have preferred a 25bp cut and a few others indicated that they could have supported such a decision . So while Fed Governor Bowman was the only dissenting vote in favour of a 25bp cut in the end, the accounts confirm that the 50bp decision saw some pushback within the FOMC. Last Friday, October preliminary University of Michigan sentiment index printed at 68.9, lower than the 71.0 expected.

Elsewhere, Hurricane Milton pelted Florida but fortunately weakened to a category 3 storm before the weekend. Bloomberg Intelligence analyst Charles Graham says reinsurers’ concern that Hurricane Milton could give rise to losses of over $100 billion may be appeased, with claims potentially below the $60 billion incurred from Hurricane Ian in 2022, which made landfall as a category 4 . A quieter week ahead with Columbus Day holiday Monday (the NYSE and Nasdaq will be open) and only retail sales and industrial production releases of note.

Last Friday marked the start of the Q3 earnings season with several US banks releasing results. Deutsche Bank equity strategists put out a preview of the upcoming earnings season. They expect S&P 500 earnings growth to slow from 11.8% in Q2 to 9% in Q3, driven by a narrow group of sectors such as energy and mega cap growth & tech, with growth for the others staying steady in the mid-single digits.

Cryptos staged a slight rally toward BTC$63k and ETH$2,460 as risk sentiment improved with little new news to add.

We continue to favour smaller capped companies and value-based investments.

Europe

The Eurostoxx closed 0.53% higher where the financial services led gains, up 1% while telecom stocks fell 0.42% as the lone loss. The British FTSE 100, however, fell by 0.52%, largely due to a sharp decline in mining stocks.

Last Wednesday, German Economy Minister Robert Habeck announced that the economy is expected to shrink by 0.2% this year. Germany’s economy was already the weakest among its large euro zone peers and G7 countries last year, with a 0.3% decline in GDP. As an export-oriented economy, weak global demand and geopolitical tensions took their toll on the German economy last year, when exports contracted by 0.3%.

Despite the gloomy near-term outlook, the German government predicts that the economy will return to growth in 2025, with the GDP expected to increase by 1.1%, slightly up from the earlier forecast of 1.0%. By 2026, growth could reach 1.6%, driven primarily by an upturn in private consumption and stabilizing inflation. These projections are contingent on the successful implementation of structural reforms and the stabilization of global economic conditions. Inflation is expected to fall to 2.2% in 2024 from 5.9% last year, with further reductions anticipated in the following years, stabilising at 1.9% by 2026.

German IP increased 2.9% m/m in August and this increase fully reversed July’s decline. A key driver of the increase was motor vehicle production. Which jumped 19.3% m/m in August. However, German IP still seems to be trending lower, even if payback in car production is modest, energy-intensive production is not recovering at this stage and other categories are still trending lower.

Euro area retail sales increased 0.2% m/m in August. However, this is excluding Germany, and the data could be revised substantially once this information becomes available. The Euro area July-August level stands at 0.5% below the Q2 level. From a broader perspective, retail sales remain weak overall.

The ECB has already lowered rates twice this year and a cut to the 3.5% deposit rate on Oct 17 is almost fully priced in by financial markets. Markets now think that the Oct cut will not be the last one this year, they are expecting another cut in December, bringing the rate back down to 3%.

Last Thursday, France’s government delivered its 2025 budget with plans for 60 billion euros worth of spending cuts and tax hikes on the wealthy and big companies to tackle a spiralling fiscal deficit. This budget squeeze aims to cut deficit to 5% of GDP next year. Prime Minister Barnier promises to spare middle class from tax increases and instead target big companies. The aim of this budget is to reduce deficit and contain their debt.

The UK’s GDP increased by 0.2% with manufacturing and construction retracting their declines at the start of the quarter to show gains of 1.1% and 0.4% respectively over the month.

This week, we will see the Euro area’s industrial production on Monday and the ECB rate announcement on Thursday. As for the UK, Monday we will have the unemployment rate, UK’s CPI on Wednesday, and retail sales on Friday.

Asia

China’s stock markets roared back from a week-long break early last week, hitting two-year peaks inside the first few minutes of trade, but lost steam after officials failed to inspire confidence in stimulus plans intended to turnaround a sputtering economy. HangSeng closed the week 6.5% lower, while CSI 300 was lower by 3.2%. The NDRC meeting after the Golden week disappointed. Some strategists and fund managers are retaining cautious view on equities absent the evidence of macro stabilization and meaningful additional policy steps. On Thursday, China s central bank said it would start accepting applications from financial institutions to join a newly created funding scheme, initially worth 500 billion yuan (US$70.62 billion), to aid the capital market. The People s Bank of China (PBOC) said eligible securities firms, fund companies and insurers can apply to join the swap scheme, which gives them easier access to funding to buy stocks.

Invesco said some stocks have become really overvalued after the rally, lacking a clear value proposition based on their likely earnings performance. JPMorgan AM said additional policy steps would be needed to boost economic activity and confidence, adding US elections will post further uncertainty. HSBC Global Private Banking remains concerned steps so far aren t sufficient to reverse China s long-term growth outlook. World Bank expects China s growth to drop to 4.3% in 2025 from an estimated 4.8% this year despite with temporary boost from recent stimulus measures in its semi-annual economic outlook report. Goldman however upgraded its forecasts for China’s economic growth in 2024 and 2025. The bank expects China’s gross domestic product to expand 4.9% this year, up from 4.7% previously. It also lifted its growth prediction for next year to 4.7% from 4.3%, according to a report dated Sunday.

The briefing on fiscal policy on Saturday by Finance Minister Lan Fo’an also disappointed. Patience has been wearing thin among investors, who have clamoured for Beijing to announce big-bang fiscal measures to help sustain the rally sparked by the stimulus blitz those authorities unleashed in late September. Hang Seng opened lower this morning and is down almost 2.5% as we write this. Chinese CPI this morning shows further entrenchment of deflation with Core CPI +0.4%, slowest in three months. The producer price index (PPI) fell at the fastest pace in six months, down 2.8% year-on-year in September, versus a 1.8% decline the previous month.

Japan’s inflation-adjusted wages fell in August while household spending also declined, but analysts say underlying trends point to a gradual recovery in pay and consumption. Real wages in the world’s fourth-largest economy fell 0.6% in August from the same month a year earlier.

Central banks :South Korea’s central bank delivered an expected rate cut on Friday morning, reducing its benchmark rate from 3.5% which was held over the last 13 months to 3.25% despite lingering concerns over high household borrowing. New Zealand’s dollar and bond yields fell after the nation’s central bank delivered a 50 basis-point cut on its benchmark rate, while the Reserve Bank of India left rates unchanged. The new monetary policy committee voted five-to-one to keep the benchmark repurchase rate at 6.5% on Wednesday.

Vietnam will strive for a economic expansion of 7.6% to 8% in the last quarter of 2024 and is maintaining its full year target of 7% growth following positive results in the third quarter, the government said on Monday. Gross domestic product grew 7.4% year-on-year in the third quarter, surpassing the second quarter’s revised 7.09% expansion, the government data showed. Strong exports and industrial production and rising foreign investment offset the effects last month of Asia’s strongest typhoon so far this year.

Thai consumer confidence dropped for a seventh consecutive month in Sept to a 14-month low, attributed to concerns over a global economic slowdown and the floods in the country.

GeoPolitics

Israel – Lebanon: Middle East tensions ratcheted up further as Iran fired missiles at Israel after Israel launched limited ground invasion into southern Lebanon. On Oct 7 – Hezbollah rockets hit Israel’s third-largest city of Haifa, in the first direct attack on the northern city that evaded the military’s usually reliable air defence systems. Israeli strikes in Lebanon have killed at least 2,083 people and wounded 9,869 others since October 8, 2023, the Lebanese Health Ministry said last week. Most of the deaths occurred since mid-September 2024 , when Israel dramatically escalated its attacks on Lebanon, first by blowing up Hezbollah pagers and walkie-talkies, then by ramping up airstrikes.

On Wednesday, Israeli PM Netanyahu spoke with US President Biden. According to Bloomberg reporting, the Biden administration is pressing Israel to limit its retaliation to military targets, while Axios reported that Netanyahu will convene Israel’s security cabinet Thursday.

Gulf states on the other hand are lobbying Washington to stop Israel from attacking Iran’s oil sites as they are concerned their own oil facilities could come under fire from Tehran’s proxies if the conflict escalates.

Australia and South Korea have started evacuating their respective citizens from Lebanon as tensions mount.

Israel – UN: Israel’s assault on Lebanon has put Irish soldiers stationed as part of the UN’s peacekeeping mission in southern Lebanon, known as UNIFIL, in a dangerous situation. Reports say fighting between Hezbollah militants and Israeli troops took place just two kilometers from the Irish peacekeepers’ outpost, known as Post 6-52. Both the UN and Ireland have rejected an Israeli request to remove the peace keepers from the area.

The United Nations said on Sunday Israeli tanks had burst through the gates of a base of its peacekeeping force in southern Lebanon, the latest accusation of Israeli violations and attacks denounced by its own allien. In its version of events, the Israeli military said militants of the Iran-backed group Hezbollah had fired anti-tank missiles at Israeli troops, wounding 25 of them. The attack was very close to a UNIFIL post and a tank helping evacuate the casualties under fire then backed into the UNIFIL post, it said.

Philippine South Korea: Philippine President Ferdinand Marcos said on Monday his country and South Korea have upgraded bilateral ties to a strategic partnership. Yoon said the two countries would strengthen their partnership on the security front, with South Korea taking part in the modernisation programme of the Philippine military.

China EU: China will impose new anti-dumping measures on EU brandy imports, escalating the trade war between Beijing and Brussels just days after the bloc slapped higher tariffs on Chinese electric vehicles. The Chinese commerce ministry said in a statement on Tuesday that it would require a security deposit from EU brandy importers. Shares in French luxury group LVMH, owner of Hennessy cognac, dropped 4.3% in early trading in Paris on Tuesday after the announcement, while Martell owner Pernod Ricard fell 2.7% and Rémy Cointreau nearly 4.8%.

Russia – Ukraine: – Russia’s Defence Ministry said on Tuesday that its forces had taken control of two settlements in eastern Ukraine, the latest gains in their drive to secure the Donbas region. A ministry report said the villages of Zolota Nyva and Zoryane Pershe had been brought under Russian control. The communities have an estimated population of a few hundred residents each.

France – Romania – Ukraine: The French Army is planning to test its ability to fight a high-intensity conflict with Russia during drills in Romania set to take place next year. Earlier in the year, French President Emmanuel Macron repeatedly called for NATO troops to be deployed to Ukraine and said he was finalizing a plan to send French soldiers to the country to train Ukrainian troops. Macron appeared to back down on the plan following repeated warnings from Russia that any French troops would be considered legitimate targets.

Vietnam – France: The countries have officially upgraded their relations to a comprehensive strategic partnership , Vietnam s highest level, during a visit by Vietnamese President To Lam to Paris. The move underlined Vietnam s increasingly strategic role as an important link in global supply chains and is the latest success for its flexible foreign policy known as bamboo diplomacy . Vietnam s other seven top partners now include the United States, China, India, South Korea, Japan, Russia and Australia.

credit treasuries

The US Treasury curve bear flattened last week, the 2years yield end the week unchanged, but the 5years yield gained 8bps, 10years yield gained 12bps and the 30years yield gained 15bps. The 10years yield has rebounded by roughly 50bps over the last Month. Credit spreads were a bit tighter last week with US 5years IG tighter by 2bps and US 5years HY tighter by 4bps. US IG lost about 15bps last week while US HY gained about 40bps. Leverage loans gained 15bps.

FX

DXY USD Index continued its rebound last week, rising 0.36% to 102.89 following the beat in CPI and strong underlying components in PPI.

Headline CPI rose 0.18% (C: +0.1%), while core CPI rose 0.31% (C: 0.2%). This meant that the 3-month annualised rate for core CPI rose to 3.1%, having been at +2.1% in August. Headline PPI came in below expectation, but components that feed into PCE, particularly airfares, came in stronger than expected. Preliminary University of Michigan Consumer data showed that sentiment unexpectedly fell to 68.9 (C: 71.0; P: 70.1). Based on OIS, market is now pricing a 82.8% chance of a 25 bps cut in November. The Fed minutes showed divide among participants over the 50-bps cut and affirmed the view that the Fed’s 50bp cut in September was a recalibration to not get behind the curve, rather for the standard for cuts to come.

GBPUSD fell 0.42% to 1.3067 as monthly UK GDP data meets consensus expectations, but details are less strong with weakness in consumer-facing sectors. UK GDP grew 0.2% m/m in August (C: 0.2%; P: 0.0%). Consumer-facing sectors were weak, with a drag from hospitality, arts, and entertainment.

NZDUSD fell 0.80% to 0.611, as RBNZ lowered rates by 50bps to 4.75%, in line with expectations. Forward guidance was limited, but the post-meeting statement concludes that New Zealand is « now in a position of excess capacity », while the policy stance is described as « still restrictive ».

USDJPY rose 0.29% to 149.13 as US-JP interest rate differential widens with the rise in US treasury yields across the curve. 2 years UST yield rose 3.37 bps to 3.95, while 10 years yield rose 13.31 bps to 4.10%, a level last seen in July 2024.

USDCAD rose 1.37% to 1.3762 despite strong Canadian labor data. The labor market report beat expectations, with +46.7k net change in employment (C: 27.0k) and unemployment rate fell to 6.5% (C: 6.7%, P: 6.6%).

Oil & Commodities

Oil futures rose last week, with WTI rising 4.76% to 71.92 and Brent rising 4.02% to 74.49. The rebound on oil prices was driven by positive risk sentiment following the 50 bps cuts on Fed Fund rate. In addition, worsening Middle East conflict supported oil prices, as Hezbollah launched rockets, missiles and drones toward Israel over the weekend. The escalation and fears it would drag in OPEC producer Iran, has led to the return of a risk premium in oil. OPEC+ will publish its annual World Oil Outlook on Tuesday.

Gold rose 1.71% to 2621.88, breaking the key resistance level of 2600, as the Fed cuts 50 bps. This was despite the 2 years US treasury yield moving in the opposite direction, where it rose 1 bps. However, OIS is pricing 71.3 bps of cuts in 2024, at odds with the median dots showing only 50 bps of cuts for the rest of the year. The appreciation in Gold price has now brought it to overbought territory based on RSI indicator.

Economic News This Week

-

Monday – SI GDP, CH Trade Balance

-

Tuesday – NZ Hse Sales, JP Indust. Pdtn, SW/CA CPI, UK Employ., EU Zew, US Empire Mfg/NY Fed 1 Yr Infl. Exp

-

Wednesday – NZ CPI, JP Core Machine Orders, UK CPI/RPI, CA Housing Starts/Mfg Sales

-

Thursday – JP Trade Balance, AU Employ., JP Tertiary Indust. Index, EU CPI/ECB Rate Decision, US Retail Sales/Initial Jobless Claims/Indust. Pdtn

-

Friday – JP Natl CPI, CH GDP/Retail Sales/Indust. Pdtn, UK Retail Sales, US Housing Starts

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.