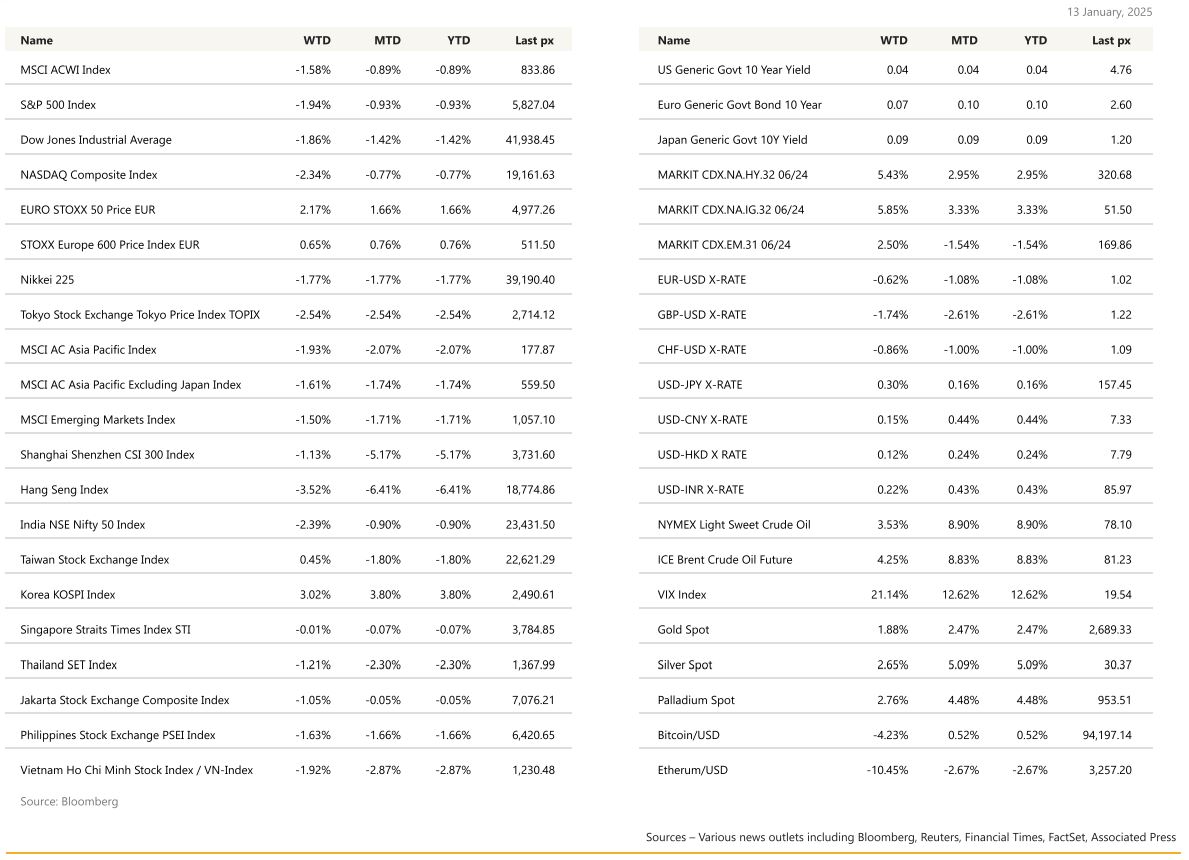

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Certainly, wasn’t a good look for major US indices last week as yields spiked and punters dialled back their rate cut outlook for the year. The nail that sealed the week’s fate came Friday when a blowout jobs report and signs of stubborn inflation may keep the Fed from lowering interest rates, pushed the S&P 500 down 1.92%. The economy added 256k jobs in December against expectations of 165k. The unemployment rate fell to 4.1% from 4.2%. U. of Mich. 1 Yr Inflation expectations rose to 3.3% against forecasts of 2.8% which was the highest since May. Average hourly earning MoM came out in line with consensus at +0.30% and YoY at +3.90% Vs 4.00% expected. Labor force participation rate came out in line with expectations and previous Month at 62.50%. University of Michigan sentiment Index came out at 73.2 Vs 74.0 expected but medium term and long-term inflation forecast came out much stronger than expected as 1year forecast came out at 3.30% Vs 2.80% expected and 5-10years came out at 3.30% Vs a consensus of 3.00%.

The VIX flirted with 20, a level that starts to raise concerns for traders. In addition, the threat of tariffs from Presidentelect Donald Trump has raised worries about possible upward pressure on inflation, which has remained above the Fed’s 2% target. Analysts from Bank of America who previously expected 2 cuts no longer expects any this year. Whilst seeming extreme to revise based off one volatile number, it was enough to dampen sentiment. UST10 year yield closed at 4.759% and the 2’s at 4.379%.

We also had the last FOMC minutes released Wednesday which indicated that Federal Reserve officials adopted a new stance on rate-cutting amid elevated inflation risks, deciding to move more slowly in the months ahead. Fed Governor Wallace signalled support for additional policy easing this year and played down concerns of rising inflation from tariff policy. Atlanta Fed President Raphael Bostic said officials should be cautious with policy decisions given uneven progress on lowering inflation although he expects inflation to decline.

The November JOLTS report out earlier in the week, had mixed messages regarding the US labour market. The job opening rate (4.8% in November) rose for the second straight month to its highest level since July, while layoffs remained subdued. Q4 earnings season will kick off in full force on Jan. 15. Key releases this week will see CPI, PPI and retail sales take headlines. Bloomberg expects core MoM CPI to come in at 0.2% and headline CPI YoY to edge up to 2.9% from 2.7%.

Expect some opportunities to present itself in slightly longer term bonds with IG yields in excess of 5.25% with duration circa 6 years.

Europe

European markets ended the week higher. Eurostoxx 600 closed 0.65% higher and Eurostoxx 50 was up 2.17%. Utilities was the big decliner amid big surge in bond yields, especially the UK Glits. Insurance was also a major decliner amid worries about exposure to the Los Angeles wildfires. Autos advance, media and energy relative outperformers.

On the data front, Euro consumer confidence was confirmed at the flash print of -14.5 (-0.7 from November), and sub-indices pointed to a rapid decline in household’s assessment of economic conditions and their major purchases expectations. German retail sales contracted -0.6% m/m, France’s household goods consumption rebounded more than expected in November (+0.3% m/m), with the contraction in October less strong than previously estimated. Euro area headline inflation increased 0.2pp from November to 2.4% y/y in the flash December release. As in November, the rise was driven mostly by energy which left deflationary territory due to unfavorable base effects. Meanwhile, core inflation was unchanged at 2.7% y/y for the forth consecutive month. The final Euro area December PMIs confirmed a partial recovery in the composite index (+1.3 to 49.6). The PMI improvement was broad-based across the four major Euro area economies, but it signalled contraction at a 0.2% q/q in Germany, stagnation in Italy, modest growth of 0.4% in France and a very strong 3.6% q/q in Spain. Euro area unemployment was stable at 6.3% in November.

Last week’s ECB speakers provided no fresh views on the monetary policy front. ECB’s communication will likely remain non-committal and focus on a meeting-by-meeting approach. Furthermore, it is unlikely that a majority of Governing Council members would endorse the need to ease policy rates below neutral in advance. ECB member Cipollone argued that the ECB ‘shouldn’t try to guard excessively against possible further inflation shocks’, suggesting that protracted below potential GDP growth and wage developments lagging productivity gains reduce the ECB’s scope to react to incoming shocks.

Eurozone government bond yields climbed to fresh multi-month hights following the release of the higher-than-expected US jobs report. German 10-year bund yields initially jumped seven bp to hit their highest levels since July, before dipping slightly. Similarly, after the 30-year Glits soared to their highest rates since the late last week, the yield on the 10-year Glits hit its highest since the 2008 financial crisis last Thursday.

BoE deputy governor Breeden said last Thursday that recent evidence supports to withdraw policy restrictiveness gradually over time but highlighted that it remains tricky to gauge the right speed of easing. Most economists still expect BoE to cut rates by 25 bps at its February meeting, but there is uncertainty over pace and number of hikes thereafter.

This week in the UK, on the fiscal front, the focus would be on any speech from Chancellor Reeves. On the monetary policy side, focus is on an upcoming speech by external member Alan Taylor (15 January), where he is expected to expand on his motivation for his dovish dissent at the December meeting, where he voted for a cut. On the data front, we will see the December CPI, November GDP and December retail sales. Over in the Euro Area, we will see the 2024 German GDP release and the EA industrial production for November.

Asia

Asian markets closed the week lower. MSCI Asia ex Japan was down 1.61%, Nikkei was lower by 1.77%. Asian YTD gains to start 2025 are all in the red with the exception of South Korea (for now). Weakness dripped into Asia as FOMC minutes noted that the uncertainty surrounding how President-elect Trump’s policies will be implemented is weighing on their outlook for inflation. There was also deepening concerns over the recovery of the China economy.

In China, we saw the PBOC add more gold for second straight month in December. It now holds 73.29M fine troy ounces by end-December from 72.96M in November. Purchase indicates PBOC is still keen to diversify reverses despite the precious metal is at historically high levels.

Other data points in Asia: Japan’s service PMIs revised lower, China Caixin composite PMI fell to three-month low but services index rose to seven-month high; India’s Services PMI also revised lower. Vietnam’s FY 2024 GDP grew 7.1% y/y while separate data showed industrial output at five-month high. Philippine annual inflation quickened to 2.9% in December. Leaders of Malaysia and Singapore formalized an agreement establishing the JohorSingapore special economic zone (JS-SEZ), with the aim of attracting 50 projects in the first five years of establishment.

Emerging ASEAN continues to emerge as manufacturing hub for Chinese companies as they relocate mid-to-upstream supply chain there, and the region’s share of China’s intermediate goods exports has risen sharply from 13% in 2013 to nearly 18% in 2023.

Vietnam has announced that, in the “spirit of independence and self-reliance”, it will not use foreign loans to fund the US$67 billion project by 2035. Instead, it will use the state budget, lowinterest loans and government bonds. Hanoi will continue shielding itself from Chinese influence and potential debt traps, while building a pathway to greater autonomy and selfsustainability. Chinese-funded projects invoke wider security considerations for Vietnam. Hanoi is wary of providing Beijing with greater clout over sensitive issues, such as territorial disputes in the South China Sea, and eroding its political and economic autonomy.

Key events this week:

- China trade, Monday

- India CPI, Monday

- China GDP, property prices, retail sales, industrial production, Friday

GeoPolitics

BRICs: Brazil’s government said in a statement on Monday that Indonesia is formally joining BRICS as a full member, further expanding the group of major emerging economies that also includes Russia, India, China and South Africa. Indonesia, the world’s fourth most-populous nation, had previously expressed its desire to join the group as a means of strengthening emerging countries and furthering the interests of the so-called Global South.

US- China:

US Defense Department has blacklisted Tencent (700.HK) and CATL(300750.CH) for alleged links to Chinese military in a surprise move just before Trump takes office. Blacklisting carries no specific sanctions but tends to discourage US firms from dealing with named entities

CCP’s most significant move so far is its December 2024 ban on refined mineral exports to the United States. Particularly gallium. China produces about 98% of the world’s gallium. The mineral is critical for making semiconductors, optoelectronics, weaponry, and much more. So, China is also escalating on its end, having added 28 U.S. companies, primarily defence contractors, to its own sanction list.

US- Asia: The US secured ties with key Asian allies Japan and the Philippines ahead of Donald Trump’s return to the White House, with President Joe Biden expressing optimism that a trilateral alliance will continue. Biden on Monday held a virtual meeting with Japan Prime Minister Ishiba Shigeru and Philippine President Ferdinand Marcos Jr., where they pledged to sustain economic, maritime and technology cooperation. “I’m optimistic that my successor will also see the value of continuing this partnership, and that it is framed the right way,” Biden was quoted as saying by a statement from Marcos’ communications office. The US under Biden has bolstered ties with Tokyo and Manila, seeking to counter an increasingly assertive China.

US- Russia: US Treasury on Friday 10 January imposed sanctions on Russian oil producers Gazprom Neft and Surgutneftegas, as well as 183 vessels that have shipped Russian oil, targeting the revenues Moscow has used to fund its war against Ukraine. Russian oil exports will be hurt severely by the new sanctions, which will force Chinese independent refiners to cut refining output going forward. Among the newly sanctioned ships, 143 are oil tankers that handled more than 530 million barrels of Russian crude last year, about 42% of the country’s total seaborne crude exports. Of these, about 300 million barrels was shipped to China while the bulk of the remainder went to India. Chinese and Indian refiners will look to now source more oil from the Middle East, Africa and the Americas, boosting prices and freight costs.

Iran: Iran is set to receive a new warship and a fleet of advanced drones in the coming days, the state-run Islamic Republic News Agency reported, citing the Army’s coordinating deputy, Rear Admiral Habibollah Sayyari. The roughly 1,000 drones will come equipped with “stealth capabilities, high explosive power, long range, and precision targeting,” Sayyari said.

Credit Treasuries

Following the strong ISM Services, the FOMC meeting minutes and especially after the December employment data, the US Treasury curve bear steepened last week. 2years yield finished the week up 9bps, 5 & 10years yield gained 15bps and the long bond yield gained 11bps, supported by a decent 30years auction earlier during the week. The 2s10s yield curve finished the week up to 42bps, its highest level since May 2022. US IG 5years credit spreads widened by 3.5bps & US HY 5years credit spread widened by 20bps. US IG corporates lost about 0.90% last week while US HY lost about 70bps. Leverage loans finished the week unchanged.

The current concerns are that they echo what we saw around September-October 2023, when the S&P 500 experienced a technical correction as the 10yr Treasury briefly moved above 5% intraday. To be fair, we’re still some way from that point (10years yield is now trading at 4.75%), but the 20yr Treasury yield move above 5% by the end of last week for the first time since November 2023, so part of the curve has already briefly breached that milestone.

FX

DXY USD Index rose 0.64% to close the week at 109.65 driven by resilient US labor market and Macro data.

In addition, a combination of higher US yields and deterioration in global risk demand lifted USD demand amid media reports of President-elect Trump considering a national economic emergency declaration to provide legal grounds for universal tariffs. Nonfarm payrolls rose 256k (C: 165k; P: 212k) the most in 9 months, following a slight downward revision to the prior two months. Unemployment Rate fell to 4.1% (C: 4.2%; P: 4.2%), amid a steady labor force participation ratio of 62.5%. Average Hourly Earnings grew 0.3% m/m in December (C: 0.3%; P: 0.4%). Michigan sentiment was relatively unchanged as it edged down to 73.2 (P: 74.0). Inflation Expectations rose to 3.3% y/y (C: 2.8%; P: 2.8%), and 5-10y Inflation Expectations rose to 3.3% y/y (C: 3.0%; P: 3.0%), the highest level since 2008. ISM Services rose to 54.1 (C: 53.5; P: 52.1), the 10th time the composite index was in expansion territory in 2024, while ISM services prices paid indicator surged to its highest in almost two years, at 64.4. FOMC minutes revealed that many participants see the need for a for careful approach to monetary policy decisions over coming quarters amid elevated inflation risks. Based on OIS, market is now pricing 28 bps of Fed fund rate cuts compared to 39 bps cut a week ago. Immediate resistance level at 110, while support level at 108.70/107.70.

European Currencies sold off against USD; EURUSD fell 0.62% to 1.0244, a level last seen in Nov 2022; GBPUSD fell 1.74% to 1.2207; USDCHF rose 0.87% to 0.9085. In the Euro Area, both headline and core CPI were in line with expectations, at 2.4% and 2.7% respectively. Services PMI was revised up to 51.6 (Preliminary: 51.4; November: 49.5), while the Composite PMI was revised to 49.6 (Preliminary: 49.5; November: 48.3). Consumer Confidence worsened to -14.5 (C: -11.6; P: -13.7) while Economic Confidence deteriorated to 93.7 (C: 95.6; P: 95.6) as geopolitical and domestic uncertainties kept consumer and business sentiment at a low level. GBP was the worst performing G10 currency, driven by fiscal concerns and fears over persistent inflation.

Antipodean Currencies sold off against USD; AUDUSD fell 1.11% to 0.6147; NZDUSD fell 1% to 0.5557. Australia headline CPI accelerated to 2.3% y/y in November (C: 2.2%; P: 2.1%), while Core inflation was softer, with services inflation easing to 4.2% y/ y (P: 4.8%).

USDJPY rose 0.30% to close the week at 157.73. Negative risk sentiment weighed on USDJPY, while media reports speculated that Bank of Japan officials are likely to discuss raising their inflation outlook given higher rice prices in the next rate meeting.

Oil & Commodities

Oil Futures rose last week amid reports of new US sanctions on Russia’s oil industry and weather-related factors. Russia pumps around 10% of global oil supply. WTI rose 3.53% to 76.57; Brent rose 4.25% to 79.76.

Gold rose 1.88% to 2689.76 as traders sought safety in the precious metal amid concerns over tariffs and inflation, even as a strong US jobs report supported the case for a pause in US interest-rate cuts.

Economic News This Week

-

Monday – AU Melbourne Inflation, CH Trade Balance, US NY Fed 1Yr Inflat. Exp.

-

Tuesday – AU Westpac Cons. Confid., JP BoP Balance, US PPI

-

Wednesday – SW CPI, UK CPI/RPI, CA Mfg Sales, US Mortg. App./ Empire Mfg/ CPI

-

Thursday – NZ Food Prices, JP PPI, AU Employ., UK GDP/ Indust. Pdtn/ Mfg Pdtn, CA Housing Starts, US Retail Sales/ Initial Jobless Claims

-

Friday – NZ Biz Mfg PMI, CH GDP/ Indust. Pdtn/ Retail Sales, UK Retail Sales, EU CPI, US Housing Starts/ Building Permits/ Indust. Pdtn

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.