KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

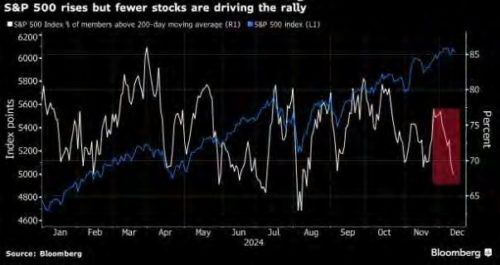

US markets closed the week lower, whilst big Tech advanced on a promising outlook in demand for AI chips. Trading remained cautious as investors looked ahead to the final FOMC meet this Thursday. Bloomberg reported that the US stock market breadth is weakening:

The cause of it all is the slight pick-up in inflation data reported during the week. CPI on Wednesday was in-line with estimates, underpinning concerns that the disinflation trend had stalled. Core CPI MoM came in at 0.3% for its 4th straight month, headline YoY CPI was at 2.7% up from October’s 2.6%. PPI accelerated in November with its final demand reading rising 0.4% versus 0.2%, the most since June.

Applications for US unemployment benefits rose to a two-month high and initial claims increased by 17,000 to242,000.

In spite of this, the data did little to dampen expectations of an interest rate cut on Thursday, by 25 bps to 4.25% – 4.50%. The outlook however, for monetary easing beyond December looks murkier. Across the pond and north of the border, their respective central banks continued to ease during the week. The question of where the neutral rate is anyone’s guess but if we were to assume that 100 bps above inflation to allow for growth is about right, then with the core PCE currently at 2.8% neutral should be circa 3.8%. The presser following the Fed’s meeting on Thursday should give us a better clue through its dot-plot forecasts. Yields ended higher with the 2’s and 10’s bear steepening at 4.24% and 4.397% respectively.

Although the S&P 500 had paused its last week, the benchmark is still up around 27% in 2024 after a 24% gain in 2023, placing it on track for back-to-back yearly gains of more than 20% for the first time this century.

Focus this week is squarely on the Fed’s fial meeting Thursday followed by PCE readings on Friday – core PCE for the year is expected to come in higher at 2.9% from 2.8% previously. We will also observe retail sales and personal income/spending before that. A busy final full week for the year.

The theme to stick to remains in AI especially US based producers & service providers.

Europe

In the euro area, the ECB delivered a 25bp rate cut bringing the deposit rate down to 3%. The statement had some dovish shifts, as it dropped the language about keeping rates “sufficiently restrictive” to get inflation back to target Lagarde also said that there were deliberations of a 50bp rate cut. The ECB now see growth in 2025 at just 1.1%, down two-tenths from last quarter, whilst the 2026 number was also revised a tenth lower to 1.4%. Meanwhile on inflation, they now expect headline inflation to fall to 2.1% in 2025, down a tenth from before, before falling to 1.9% in 2026. Markets did not take any cues from the press conference and continues to price in 125bp of rate cuts in 2025.

ECB policymakers are expected to cut interest rates by another quarter point in January and probably also in March as inflation stabilizes at the 2% target and economic growth remains sluggish.

The Swiss National Bank surprised by cutting their short-term interest rate by 50bps to bring it down to 0.50%. This decision was supported by the fact that inflation is now trading at +0.70% YoY, below the mid-point in the SNB range (0% to 2%) while growth (+0.40% during the 3rd quarter) is slowing down, negatively impacted by the weakening economic environment in Europe, and especially in Germany. Following five years of stagnation, Germany’s economy is now 5% smaller than it would have been if the prepandemic growth trend had been maintained.

Asia

Asian equities fell Friday as a lack of details from a Chinese economic conference disappointed some traders and risk appetite weakened ahead of next week’s Federal Reserve meeting. Last week MSCI Asia ex Japan closed -0.20% while the MSCI Asia index was lower by 0.70%. CSI 300 Index in China was lower by 1.01% for the week.

Chinese shares had initially jumped on Tuesday after the country’s top leaders made their strongest pledge in years to revive economic growth. The renewed optimism came after the Communist Party’s decision-making body pledged to embrace a “moderately loose” strategy for monetary policy in 2025, marking its first major shift in stance since 2011. The top leaders also said they will take a “more proactive” approach on fiscal policy, stabilizing property and stock markets, while promising to “forcefully lift consumption.”

China’s Consumer Price Index (CPI) slowed for the third consecutive month to 0.2% y/y in November. Core CPI (excluding food & energy) remained weak at 0.3% y/y from 0.2% y/y in October. Services inflation was unchanged from October at 0.4% y/y but consumer goods inflation eased to 0.0% y/y.

China’s exports rose 6.7% year-on-year in November, official data showed, while imports declined by 3.9 per cent, the most since February. Both metrics missed analyst forecasts

China’s November Industrial output rose 5.4% y/y matching expectations. However, retail sales missed at +3.0% y/y vs estimates of 5.0%, and Jan to Nov fixed investments rose 3.3% y/y vs estimates of 3.5%.

Over in Korea, the Korean won fell amid ongoing political uncertainties. The country’s opposition filed a second impeachment motion against President Yoon Suk Yeol on Thursday. South Korean President Yoon Suk Yeol has now been suspended from his duties, and Prime Minister Han Duck-soo has stepped in as interim leader until the Constitutional Court rules on the impeachment motion within 180 days. Should Yoon be removed, early presidential elections will be held in 60 days.

GeoPolitics

US – China: President-elect Donald Trump has invited Chinese President Xi Jinping to attend his inauguration next month.

China – Europe: China’s recent implementation of a visa-free travel policy has been warmly received by European nations, heralding a new era of enhanced connectivity and collaboration between China and Europe. The new visa-free framework removes a significant barrier, making travel seamless for millions of tourists on both sides. With the policy set to take full effect in the coming months, stakeholders across Europe are preparing for a surge of Chinese visitors.

Syria: Geopolitics abhors a vacuum, and yet that s exactly what Syria s neighbours and others will have seen once Assad fled to Moscow. Making things more complex is Syria s bewildering ethno-religious demography, and its strategic geography (a pipeline for Iraqi and Egyptian oil, and a transit route for Iranian weapons to its proxies like Hezbollah). So with that high stakes and low trust atmosphere, every player with means has already made a move: Turkey has (again) hit various rival Kurdish groups; Israel has seized more land along the Golan Heights; and the US has launched airstrikes on ISIS strongholds.

China – US: China has opened a probe into Nvidia Corp. over suspicions that the US chipmaker broke anti-monopoly laws around a 2020 deal. The State Administration for Market Regulation opened an investigation into the company’s recent behavior as well as the circumstances surrounding the acquisition of Mellanox Technologies Ltd., the government said in a statement on Monday. Beijing gave approval for the deal four years ago, on condition that Nvidia not discriminate against Chinese companies. The move against Nvidia is Beijing’s latest riposte to escalating US technology curbs, coming just a week after the Chinese government banned exports of several materials with tech and military applications. China had approved Nvidia’s $7 billion acquisition of Mellanox in 2020, but stipulated that the Israeli computer networking equipment maker provide information about new products to rivals within 90 days of making them available to Nvidia. Nvidia gets about 15% of its revenue from customers in China, according to its most recent financial report.

China – US – Ukraine: China’s escalating conflict with the US over trade is now extending to the drones that have become a vital part of Ukraine’s defense. Western nations are pushing to build and assemble drones outside of China to secure their supply chains. Yet the country remains the hub for producing cheap equipment for the devices. China controls nearly 80% of the commercial drone market, according to a report from the Center for Strategic and International Studies. Many producers of UAVs in Ukraine rely on Chinese parts to make the cheap and effective weapons that have helped define the war with Russia. China in July announced a ban on exports of drones for military use, and Beijing says it doesn’t provide weapons to any of the parties in the conflict.

Syria: The international community needs to establish « several red lines » in any talks with the new Syrian leadership and consider sanctions to ensure a peaceful future for the country, Spanish Foreign Minister Jose Luis Albares said on Wednesday.

Israel – Syria: Israel has shown itself to be adept at creating, and exploiting, events in the Middle East to secure its interests. After the fall of Bashar al-Assad’s regime, the IDF wasted no time. It launched hundreds of air strikes, which wiped out the Syrian navy, levelled missile and other ammunition storage facilities, and reduced fighter jets, tanks, and other weapons to twisted metal. The past few months have shown, Israel is virtually unchallenged now. The United States has kept its foot off the brakes, and groups and countries in the region that could make life difficult for Israel have chosen to keep their powder dry and restrict their actions to pointless rhetoric. The United Nations’ Special Envoy for Syria, Geir Pedersen, warned Israel that its air strikes and ground invasion must stop, and it should not interfere with the transition of power in Syria. But what Israel is doing is no different from what the US and Turkey are also attempting: Securing their own interests.

Credit Treasuries

The US Treasury curve bear steepened last week with the 2years yield up 15bps, 5years +22bps, 10 & 30years +24bps. US IG 5years credit spreads finished the week unchanged while US HY 5years credit spreads widened by 8bps. In term of performances, US IG lost about 1.55% last week, US HY lost about half a percent, but leverage loans gained 5bps.

The UK-German 10yr spread up to 216bps, which is close to the widest it’s been since September 2022 when Liz Truss was still PM. Bear in mind that the closing peak in the spread was 228bps under Liz Truss, and that hasn’t been exceeded in Bloomberg’s data series back to 1992. So, we’re now pretty close to a multidecade record, and the widening interest differential also meant that sterling closed at its strongest level against the Euro since June 2016, the month of the Brexit referendum.

France’s 10-year note futures fall to a three-week low as a credit downgrade by Moody’s Ratings adds to concern over the nation’s finances. Moody’s cut France’s rating to Aa3 from Aa2 on Saturday.

In Asia IG, markets closed Friday in the doldrums with spreads across the region largely unchanged. Investors were progressively squaring positions with some selling in the frontend Australian corporates, while financials across Australian and Japan continued to see demand.

FX

DXY USD Index rose 0.89% to close the week at 107, moving in tandem with higher UST yields. US CPI in-line with consensus, with headline and core both +0.3% mom in Nov, +2.7% yoy and +3.3% yoy respectively. Details of inflation highlighting an upside surprise in core goods and normalizing rents and OER, suggesting core PCE inflation is likely to remain above levels consistent with the Fed’s target. Strong rise in US NFIB small business optimism index, up 8pts to 101.7, above consensus and now at highest level since 2021. US producer prices beat at the headline, up 0.4% mom in November, consensus at 0.2%mom. Market pricing over 90% probability of a Fed cut later this Wednesday, but only less than 2 cuts in 2025.

European Currencies fell against USD, with EURUSD -1.63% to 1.0501, GBPUSD -0.98% to 1.2619 and USDCHF +1.58% to 0.8927. SNB cuts rates by 50 bps to 0.50%, bigger cut than consensus of 25 bps. SNB’s inflation projections were revised down substantially and flagged that uncertainty about the economic outlook had intensified. ECB cut rates by 25 bps to 3%, in line with consensus, and removed the reference to the need for restrictive policy from its statement. This implies that there is now an implicit easing bias on ECB.

Antipodean Currencies fell against USD, with AUDUSD -0.45% to 0.6362 and NZDUSD -1.15% to 0.5764. RBA left its OCR unchanged at 4.35%, but post-meeting statement and press conference were more dovish than expected. In other AU macro data, Australia labour force survey beat, employment up 35.6k in November, consensus at 25k, unemployment rate dropped 0.2ppts to 3.9%. As a result, AUDNZD rose 0.75% to close the week at 1.1042.

USDJPY rose 2.43% to 153.65, driven by widening US-JP rate differential. In addition, weak yen was supported by a local media report that the BoJ is considering skipping a rate hike this Thursday.

USDCAD rose 0.54% to 1.4234. BoC cut rates by 50bps, in line with consensus, but post-meeting statement introduces a slightly hawkish tilt, where it stated that upcoming « decisions will be guided by incoming information », anticipating a « more gradual approach to monetary policy ». This suggests a very high bar for a further 50bp cut.

Oil & Commodities

Oil Futures rose last week, with WTI +6.09% to 71.29 and Brent +4.74% to 74.49, driven by the possibility of tighter sanctions on Russian crude from the outgoing Biden administration. OPEC again cuts its forecast for 2024 oil demand, slashing projections by 27% since July. However, EIA reversed its prediction for a surplus and now calls for a small deficit in 2025.

Gold rose 0.56% to close the week at 2648.23. It rose to an intra-week high of 2726, before paring back its gain as Fed rate cut remains in focus this week.

Economic News This Week

-

Monday – JP Core Machine Orders, CH Indust. Pdtn/Retail Sales, JP/EU/UK/US Mfg/Svc/Comps PMI Dec Prelim, US Empire Mfg

-

Tuesday – AU Westpac Cons. Confid., UK Labor Data, EU ZEW, CA CPI, US Retail Sales/Indust. Pdtn

-

Wednesday – NZ Westpac Cons. Confid., JP Trade Balance, UK CPI/RPI, EU CPI, US Mortg. App./Housing Starts/FOMC

-

Thursday – NZ GDP/Biz Confid., JP BoJ Policy Rate, SW Riksbank Policy Rate, UK BoE Policy Rate, US GDP/Personal Cons./Initial Jobless Claims/Leading Index/Existing Home Sales

-

Friday – JP Natl CPI, CH LPR, UK Retail Sales, EU Cons. Confid., CA Retail Sales, US Personal Income/Personal Spending/Core PCE/UMich

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.