KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

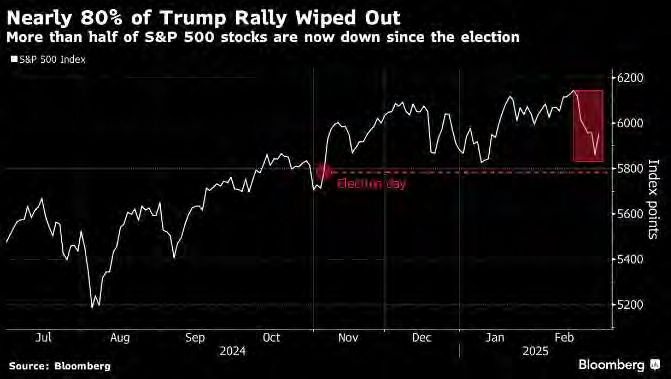

The Nasdaq took the brunt of the fall for the week, losing some 3.4% as tariff and geopolitical angst came to a peak Friday. A contentious meeting between President Trump and Ukraine’s Zelenskiy in what was to be a rare earth mineral deal turned into a testy exchange. Ukraine’s Zelenskiy following their meeting, cast doubt on the likelihood that US efforts to broker a deal with Russia would yield lasting peace. Despite the bruising week for US equities, markets rallied on Friday with traders shaking off the bad news, with the S&P 500 posting a +1.6% rally after inflation data came in tamer than expected. About half of S&P 500 members are now down since Election Day, according to data compiled by Bloomberg, while a basket of Big Tech stocks posted its worst month since December 2022.

President Trump reiterated on Thursday that he intended to move forward with the 25% tariffs on imports from Canada and Mexico, which are set to come into effect on the 4th of March.

He also said he planned to hit goods from China with a new 10% tariff. On social media, President Trump wrote that he did not think enough action had been taken to address the flow of fentanyl to the US. US Treasury Secretary Scott Bessent said Mexico has proposed matching Washington’s tariffs on China and urged Canada to do the same, signalling a potential path to avert US levies on their own exports in the coming days. The US House of Representatives has passed a budget resolution that calls for trillions of dollars in tax and spending cuts, in a significant victory for President Donald Trump as he seeks to enact sweeping changes in fiscal policy. The resolution passed by 217 votes to 215 after a campaign by House Speaker Mike Johnson to push Republican holdouts to back Trump’s “big beautiful bill”. The bill, which will kick off another round of budget talks in the Senate, proposes $4.5tn in tax cuts, about $2tn in spending cuts and allocating hundreds of billions of dollars more for the military and border security over a decade.

Meanwhile, on the inflation front, core personal consumption expenditures price index (PCE), which excludes food and energy items, rose 0.3% from December. From a year ago, it increased 2.6%, matching the smallest annual increase since early 2021. Inflation-adjusted consumer spending fell 0.5%, marking the biggest monthly decline in almost four years. The headline PCE YoY Index fell to 2.5% from December’s 2.6%. The Dallas Fed Manufacturing activity index printed at -8.3 Vs +6.4 expected and +14.1 the previous Month, a very significant drop after rising for more than 6 months. The Conference Board’s closely watched measure of consumer confidence slid 7 points in February to 98.3, the steepest decline since August 2021 and far worse than the 102.5 Wall Street anticipated. Moreover, the labour market indicators also worsened a bit, with the difference between those saying jobs were plentiful and hard to get down to a net 17.1%, which is the weakest since October. So collectively, this added to concerns that the US economy was slowing, a bit like we saw moving into last summer.

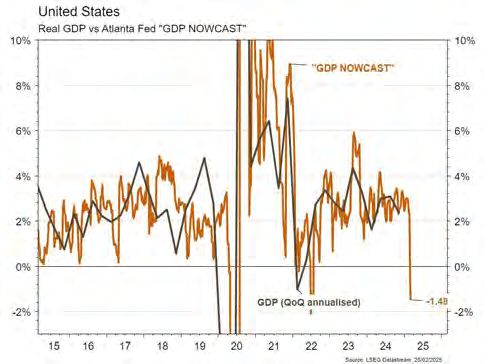

The weekly applications for US unemployment benefits rose to 242,000, matching the highest level since October, according to Labor Department data released Thursday. The increase comes amid job-cut announcements at companies and federal agencies. The big number out this week is BLS’ unemployment data. Nonfarm payrolls are expected to come in at 160k with an unemployment rate of 4%. We will also have ISM and PMI data before that, and factory orders on Wednesday. The latest iteration of GDP annualised QoQ came in as expected at 2.3%. As we stand today, there remains a lot of optimism around tax cuts and deregulation, but there are more concerns about tariffs and trade wars, which could upend the penchant of dip buyers.

Nvidia Corp, whose earnings are now the centre stage for US equities, reported earnings that were good, but not that great as it fell short of the company’s typical blowout numbers and came alongside a mixed outlook.

This week s economic calendar is packed with important events, including potential US tariff actions as the White House weighs tariff actions on its largest trade partners. Recall that President Trump signaled that the US Administration would implement 25% tariffs on Canada and Mexico as well as another 10ppts on China on Tuesday in response to those countries’ failure to stem the flow of illegal drugs into the US. Based on some estimates, 25% tariffs on Canada and Mexico, If sustained, could present a 0.4-0.7ppts drag on the baseline 2025 real GDP forecast of 2.5% (Q4/Q4) and 0.3-0.7ppts to core PCE inflation this year, leaving it in a 2.8-3.2% (Q4/Q4) range.

Europe

European markets closed mixed on Friday, recording their tenth consecutive week of gains despite the uncertainty surrounding US President Donald Trump’s tariff threats, with the EuroStoxx 600 increased over 3% in February. The Stoxx Technology Index was the worst performer, dropping 1.5% due to the ripple effects from Thursday’s sell-off of chipmaking giant Nvidia. However, the global tech bellwether bounced back on Friday as investors continued to analyze its quarterly earnings report.

Consumer confidence for February was confirmed at -13.6, remaining well below its long-term average. On a positive note, expectations for major household purchases showed some recovery, though savings intentions stayed notably high. In January, retail sales in Germany grew, but less than anticipated (0.2% m/m vs. Bloomberg’s 0.5% m/m forecast), while in France, household consumption of goods reversed much of the December increase, contracting by 0.5% m/m. The final Q4 real GDP figures for Germany and France were released, confirming a -0.2% q/q decline in Germany and a -0.1% q/q drop in France. German flash HICP inflation came in stronger than expected at 2.8% y/y (BBG consensus 2.7% y/y, Barclays forecast 2.7% y/y, January 2.8% y/y), while French flash HICP inflation printed at 0.9% y/y (BBG consensus 1.1% y/y, Barclays forecast 1.1% y/y, January 1.8% y/y). The ECB’s consumer inflation expectations also fell in January by -0.2pp to 2.6%, but remained unchanged at 2.4% for the three-year horizon.

This week, at the 6 March meeting, we expect the ECB to cut all three policy rates by 25 basis points, leaving the deposit rate at 2.5%. On 6 March, EU leaders will meet to discuss options to boost defence spending and in Germany, various options to ease fiscal policy are also on the table. We will be watching the EA final February PMIs (Mon and Wed), the EA January unemployment rate (Tue), EA retail sales (Thu). On the fiscal front, critical to the ECB’s assessment, next week will finally bring the fourth quarter’s final GDP and employment figures for the EA (Fri).

In term of economic data, the February ISM Manufacturing & Services index will be release and on Friday, as usual on the first Friday of each Month, all the job’s data will be announced.

One highlight here is that owning the S&P 500 Index would mean an over-exposure to growth stocks which have done well. Constructively, this would mean being underweight in value stocks. Value stocks, by contrast trade at relatively attractive levels today. Estimates show that value stocks would need to rise by some 40% just to get back to its historical valuation.

UK Prime Minister Starmer announced plans to increase defense spending to 2.5% of GDP by 2027, on the eve of a crucial visit to meet US President Donald Trump. This will result in an additional £6bn commitment for FY27-28 compared to previous projections. But he will fund the rise by cutting Britain’s already depleted foreign aid budget, which will now fall to just 0.3% of the country’s GDP.

Meeting between UK PM Starmer and Trump did not lead to concrete guarantees on Ukraine. Said it is too early to discuss peacekeeping troops until a deal is agreed. President Trump also explicitly mentioned the possibility of a US-UK bilateral trade deal where tariffs wouldn’t be necessary. However, briefings following the press conference suggested that the deal is likely to be narrowly focused, meaning its direct economic impact may be limited.

In other news, Ofgem (the UK’s independent energy regulator) revealed the energy price cap for Q2 2025, which will see a 6.4% increase compared to Q1. The new cap will raise the average annual household energy bill to £1,849 ($2,334.18) – up £111 from the previous cap.

This week there will be data on money and credit from the Bank of England covering January (3 March) which will include the latest on mortgage approvals. We also get the BoE’s Decision Makers Panel (DMP) survey for February (6 March).

Asia

It was a sea of red in Asia last week as investors grappled with risk posed by the U.S. intensifying its technology war with China in areas as varied as artificial intelligence, quantum computing and aerospace. MSCI Asia ex Japan closed the week lower by 4.15%. Asian chip stocks in the region including SK Hynix, Samsung Electronics and Japan’s Advantest fell Friday following Nvidia’s earnings and market’s reaction to its report; North Asia indices. Kospi and Nikkei were down 4.59% and 4.18% respectively last week. Taiwanese market was shut for holiday on Friday, we are seeing weakness play out this morning as TSMC catches up with the drop.

Chinese President Xi Jinping urged officials to stay composed amid domestic and global challenges, signalling Beijing will take a measured approach to the Trump administration’s new trade and investment restrictions. Washington has ramped up pressure by restricting Chinese spending in US strategic sectors like tech and energy, urging Mexico to impose its own tariffs on Chinese imports, and pushing for fees on commercial ships made in China to counter its dominance in shipbuilding.

We have the National People’s Congress (NPC) starting 5th March in China. Many economists are expecting leaders to focus on consumer support and the fiscal deficit, which will reveal how much Beijing is willing to spend to reach an expected GDP growth target of ‘around 5%’. It may also lower its inflation goal to 2.0% from 3.0% in a signal policymakers are acknowledging lingering deflation. China’s factory activity returned to expansion in February, easing pressure on officials to speed up stimulus.

Singapore’s core inflation fell to 0.8% year-on-year in January, from a revised 1.7% in December last year. The drop was due to lower inflation across all broad consumer price index categories, the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) said. The Department of Statistics also said that the consumer price index for general households has been rebased from a base year of 2019 to 2024.

Australia CPI inflation unchanged at RBA’s 2.5% target midpoint in January although underlying inflation ticked higher. Singapore industrial output rose 9.1% in January y/y with its key electronics sector expanding 18.9%. The Bank of Thailand unexpectedly trimmed its base interest rate by 25 bps to support the economy and aid the weak baht. Japan‘s factory output fell 1.1% in January from the previous month, roughly in line with a median market forecast for a 1.2% decline. Data on Friday showed India’s economy expanded by 6.2% in the October-December quarter, picking up on increased government and consumer spending. Vietnam’s central bank will aim to keep interest rates stable this year in a bid to help businesses and boost the economy, as the Southeast Asian nation targets an ambitious growth goal of at least 8% this year. Bank of Korea cuts benchmark rate by 25 bp as expected.

GeoPolitics

US Tariff updates: Trump has announced an additional 10% tariff on imports from China from March 4th, and said he would press ahead with levies on Mexico and Canada to take effect from April 2nd. The Chinese embassy in Washington criticised the new tariffs, saying there were “no winners” in a trade war. Canada said it would immediately impose levies on $30bn worth of goods imported from the US in response.

US announces new round of sanctions on Iranian oil entities linked to illicit shipments of Iranian crude.

US- Russia: President Donald Trump deepened Washington’s split with allies over Ukraine, withdrawing US condemnation of Russia’s 2022 invasion at the United Nations and among Group of Seven countries as he aims to end the war on terms agreeable to Moscow. The deal came together after US dropped the demand for Kyiv to commit to paying $500 billion from resource extraction to a fund as a form of repayment for US aid, one person said. The framework agreement would create a joint USUkraine fund to manage future revenues from the country’s natural resources, according to the person.

US- Ukraine: Ukraine had agreed with the US on a deal to jointly develop its natural resources. However, the meeting of Zelenskiy and Trump did not go as planned over the weekend. After Friday’s public clash between President Donald Trump and Ukrainian President Volodymyr Zelenskyy, U.S. officials say the path to a peace deal to end the war in Ukraine is deeply uncertain. Trump administration officials have also discussed whether to pause U.S. military aid to Ukraine, according to two administration officials, though it’s unclear whether or when the president would take such a step. Ending the war in Ukraine was one of Trump’s signature campaign promises, and he said during the 2024 race that he would do it within 24 hours of taking office. Friday’s developments left the president further away from achieving that goal.

China – Taiwan: Taiwan detained a Chinese-crewed cargo ship on Tuesday (Feb 25) after a subsea telecoms cable was severed off the island. The Togolese-registered ship Hongtai was « escorted » back to Taiwan and the case was being « handled in accordance with national security-level principles », the coast guard said in a statement. Taiwan’s Chunghwa Telecom reported the cable between Penghu, a strategic island group in the sensitive Taiwan Strait, and Taiwan was disconnected early on Tuesday, the Ministry of Digital Affairs said. « Whether the cause of the undersea cable breakage was intentional sabotage or a simple accident remains to be clarified by further investigation, » the coast guard said. The ship was using a flag of convenience, was crewed by eight Chinese nationals and had Chinese funding, it said.

US- China: White House officials are considering toughening US semiconductor sales restrictions to China, and may pressure key allies to escalate their own curbs in a sweeping expansion of President Biden’s program. Officials are also mulling new shipment restrictions to SMIC of high-end chips.

China – Russia: President Xi told Putin that Beijing welcomes positive efforts made by Russia and relevant parties to resolve Ukraine crisis in a video call on Monday. Added China-Russia ties have strong internal driving force and unique strategic value, signalling Moscow’s détente with Washington wouldn’t deter relations. Both leaders have signalled plans to visit each other’s countries in 2025.

Iran: Iran’s stockpiles of near-nuclear-grade uranium have expanded since it announced a ramp-up in December, with the UN nuclear watchdog now describing the situation as a “serious concern”, and warning the window to contain Iran’s nuclear activity is closing.

Credit/Treasuries

Huge volatility on interest rate last week. The US Treasury Curve bull flattened slightly last week with the 2years yield dropping 22bps. The 2years yield is now trading below 4% for the first time since October last year. The 5years yield lost 27bps, 10years yield lost 23bps and the 30years yield dropped by 18bps. The 10years yield has now dropped by around 40bps over the last two weeks. US IG 5years credit spreads widened last week by 1bps while US HY 5years credit spreads widened by almost 10bps. VIX traded during the week slightly above the 20 marks.

FX

DXY USD Index rose 0.94% to 107.61 driven by escalatory tariff concerns, as President Trump said Canada and Mexico tariffs are still set to go into effect on 4-Mar, where he will also hit China with an additional 10% tariff.

Trump also defended planned tariffs on autos, talked about 25% tariffs on EU imports and said 2-Apr reciprocal tariff date remains in full force and effect. USD strengthen was despite the fall in UST yields. US economic data was mixed with the US Conference Board Consumer Sentiment seeing its largest monthly decline since 2021, confirming downbeat consumer expectations. Inflation expectations in the Conference Board survey also ticked up with average 12m inflation expectations surging to 6% in February (P: 5.2%). US 4Q24 GDP revisions came in at a 2.3% annualized rate (Preliminary: 2.3%; C: 2.3%; 3Q24: 3.1%), Personal Consumption at 4.2% (Preliminary: 4.2%; C: 4.1%; 3Q24: 3.7%), and Core PCE at 2.7% q/q SAAR for 4Q24 (Preliminary: 2.5%; C: 2.5%; 3Q24: 2.2%). US core PCE deflator in line, up 0.3%mom in January, year-ended at 2.6%. December month revised up to 2.9%yoy from 2.8%yoy (in line with signal from upward revision to Q4). Three-months annualized core PCE at 2.39% but year-ended close to rounding up to 2.7% after revisions; so, leans very slightly hawkish for the Fed.

European Currencies fell against USD, with EURUSD -0.79% to 1.0375, GBPUSD -0.44% to 1.2577 and USDCHF +0.53% to 0.8994, driven by broad USD strength. EUR fell after potential 25% tariffs on the EU were one of the several tariffs mentioned during President Trump’s first cabinet meeting. EUR strengthen as the results of the German election indicated that the CDU/ CSU will likely become the largest in the German Bundestag, while the AfD did not outperform relative to polls. However, gains were pared back amid skepticism over how quickly the new government can achieve meaningful fiscal policy changes.

Antipodean Currencies fell against USD, with AUDUSD -2.33% to 0.6209 and NZDUSD -2.51% to 0.5598. Commodity currencies such as AUD and NZD underperformed the most within G10 currencies as potential tariffs and soft economic data in the US drove global growth concerns. In addition, reports that the US administration is considering tightening restrictions on China’s semiconductor industry may have weighed on AUD.

USDJPY rose 0.91% to 150.63 driven by broad based USD strength. In addition, Japan Tokyo CPI came in below consensus, driving JPY weakness. Tokyo CPI yoy came in at 2.9% (C: 3.2%, P: 3.4%), core CPI at 2.2% (C: 2.3%, P: 2.5%), and Core-core CPI at 1.9% (C: 2.0%, P: 1.9%).

Oil & Commodity

WTI crude and Brent crude oil futures fell 0.91% and 1.68% to 70.59 and 74.39 respectively amid the deteriorating global sentiment, even as the EIA report for the week ending February 21 showed a 2.3mn barrel decrease in crude oil inventories, the biggest weekly drawdown in two months.

Gold fell 2.66% to 2857.83 driven by broad based USD strength. This was despite significant fall in US Treasury yields, implying that the fall in gold price was most likely driven by profit taking and/or overbought technical level. Immediate support level at 2800.

Economic News This Week

- Monday – AU Melbourne Inflat., JP/CH/SW/SZ/EU/UK/CA/US Mfg PMI Feb Final, UK Mortg. App., EU CPI, US ISM Mfg

- Tuesday – JP Jobless Rate, AU Retail Sales, EU Unemploy. Rate

- Wednesday – AU GDP, AU/JP/CH/SW/EU/UK/CA/US Svc/ Comps PMI Feb Final, SZ CPI, EU PPI, US ADP/ Factory Orders/ Durable Goods/ ISM Svc

- Thursday – AU Building App., SW CPI, UK Construction PMI, EU Retail Sales/ ECB Rate Decision, US Initial Jobless Claims/ Wholesale Inv

- Friday – EU GDP, CA Unemploy. Rate, US NFP

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.