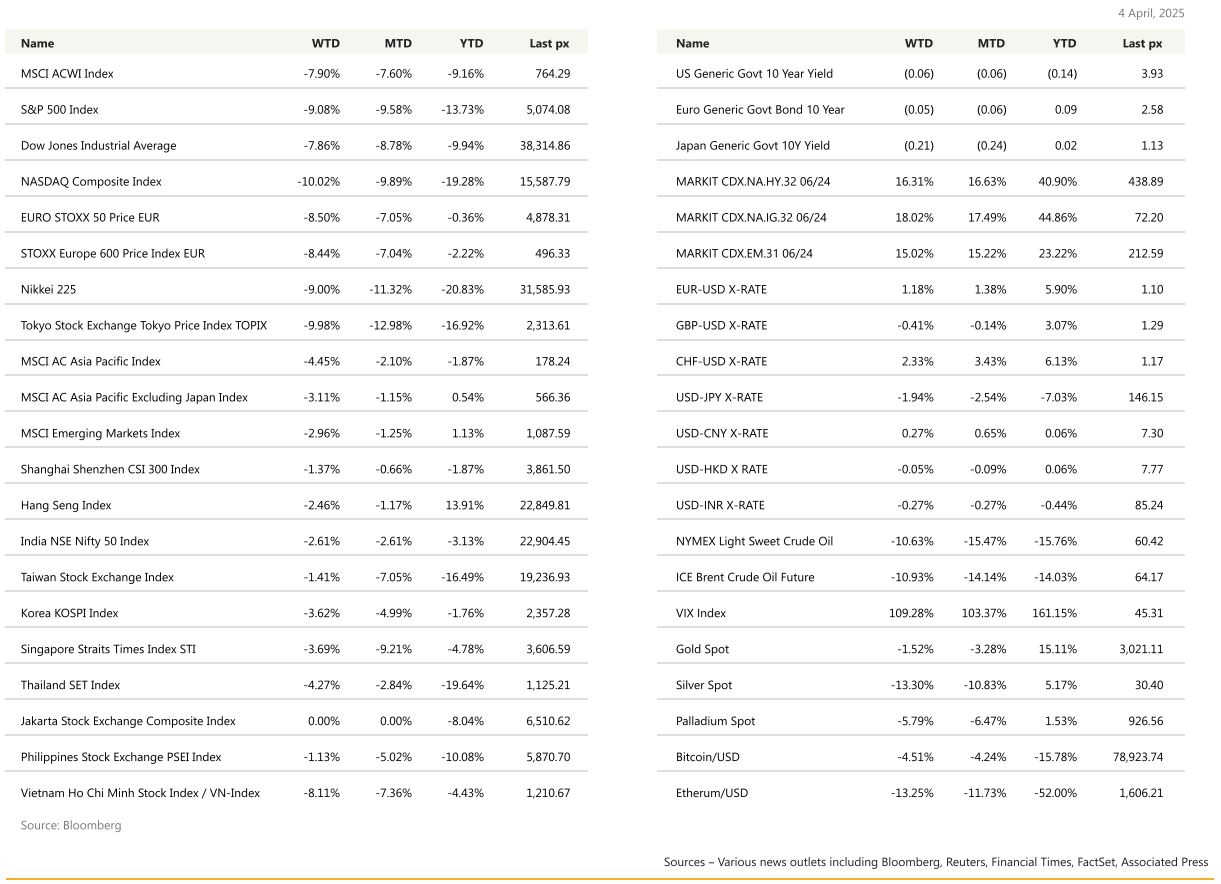

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Carnage Everywhere. US equities ended the week sharply down with the S&P 500 declining to its lowest level in 11 months, losing some $5.4 trillion in market value in just 2 sessions. The tariffs announced on Wednesday’s “US Liberation Day” far exceeded expectations. While the scale of the tariffs is a concern, the bigger issue is the absence of a clear strategy to reverse course. The administration aims to reduce the US trade deficit by imposing tariffs based on the size of a country’s trade balance relative to total imports. That formula won’t change significantly unless there is a substantial shift in the relative competitiveness of the two nations. Traders hoping for some conciliatory tone from Fed Chair Powell were disappointed after Powell said the trade-policy shift is likely to slow growth and spur inflation — a vexing combination that could prevent the central bank from cutting interest rates deeply enough to offset the toll. He further said the Trump administration’s tariffs « could have a persistent impact on inflation » and stressed the need to keep inflation expectations anchored. Earlier, Trump had pressured Powell to cut rates now. Friday’s NFP added 228k jobs beating expectations, with a 4.2% unemployment rate that ticked up from 4.1%. Average hourly earnings MoM came in as expected.

February’s JOLTS report earlier in the week revealed a larger-thananticipated drop in job openings, falling to 7.568 million from January’s revised 7.762 million indicating hires & job openings have stabilised. However, a good jobs report won’t be enough to quell recession fears because its backward looking. An ounce of caution is warranted though – March Challenger US Job cut announcements printed at 275K. This type of level was only reached 4 times over the last 25years.

Trump’s absence of signs in backing down from his punitive tariffs are threatening to set off a worldwide recession. The US was hit the hardest. China retaliated less than 48 hours after with what looks like a negative-feedback loop. China imposed a 34% tariff on all American imports starting April 10, in addition to targeted actions against poultry producers and weapons makers, according to the official Xinhua News Agency. Oil tumbled on speculation demand will slow. The cost to protect investmentgrade debt against default surged by the most since the regional banking crisis of 2023. And government bonds rallied as investors rushed in. UST10’s and 2’s closed at 3.99% and 3.65% respectively.

Now, traders are boosting their expectations for the Fed to cut interest rates this year. Money markets are fully pricing four quarter-point reductions by year-end, with a more than 50% chance of a fifth — up from just three cuts priced in before the levies were announced. In expectations, of a growth slowdown, possibly leading to a global recession.

All eyes remain on negotiations and de-escalation if any, to reverse some of this “carnage”. Key data releases for the week are CPI and PPI with consensus for core CPI MoM at 0.3% and headline CPI YoY at 2.6% and, core PPI MoM also at 0.3%.

Europe

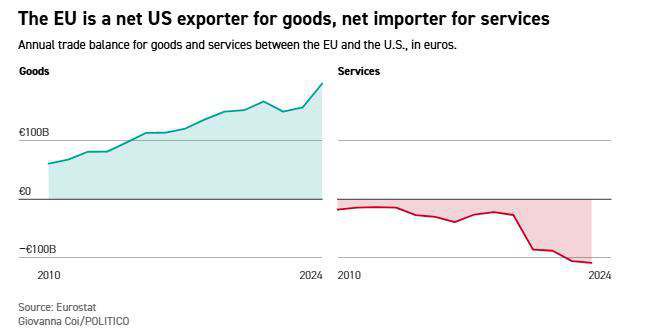

President Donald Trump dumped the European Union in the worst category of America’s trade partners Wednesday, hitting the bloc with a 20 percent tariff on all imports. The Trump administration estimates the tariffs charged by the European Union to the United States at 39 percent, and cuts this figure by half to come up with the 20 percent, in what Trump labelled “kind reciprocal” tariffs. In fact, over 70 percent of imports to the EU are duty-free. And, on a trade-weighted basis, EU tariffs average just 2.7 percent, according to the World Trade Organization.

European Union countries will seek to present a united front in the coming days against U.S. President Donald Trump’s tariffs, likely approving a first set of targeted countermeasures on up to $28 billion of U.S. imports from dental floss to diamonds. Such a move would mean the EU joining China and Canada in imposing retaliatory tariffs on the United States in an early escalation of what some fear will become a global trade war, making goods more expensive for billions of consumers and pushing economies around the world into recession.

However, Economy ministers from Italy and Spain are calling for European governments to avoid confrontation with the U.S. over President Donald Trump’s tariffs. France and Germany on the other hand, want to see a tougher response to Trump’s tariffs. » Emmanuel Macron, in the meantime, wants EU businesses to stop investing in America in response to Trump’s tariffs. “It is important that future investments, the investments announced over the last few weeks, should be put on hold for some time until we have clarified things with the United States of America,” Macron said on April 3.

Asia

Japan’s Nikkei share average slumped to an eight-month low on Thursday – Liberation day. US President Donald Trump’s tariffs on Japanese goods are a « national crisis », Prime Minister Shigeru Ishiba said on Friday. Japanese firms are the biggest investors into the United States but Trump on Thursday announced a hefty 24 percent levy on imports.

Trump has set a baseline of 10% across all imports and higher duties on some of the U.S.’s biggest trading partners. The China plus one model may be shaky and affect Asian economies like Vietnam, Indonesia, Thailand, Malaysia etc which were often touted as plus one partners of Chinese manufacturing for Global corporates. The big unknown now is how trading partners will react.

US tariffs on China, the world’s biggest exporter of goods, will rise to 54 per cent after Trump imposes a further 34 per cent duty on top of 20 per cent levies he placed on the Asian nation earlier this year.

China – Three new buzzwords: silver, ice and snow, and debut. The first refers to China’s silver economy, products and services catering to the rapidly ageing population. The second is the ice and snow economy, the country’s burgeoning winter sports and tourism industry that is expected to surpass 1.2 trillion yuan (US$165 billion) this year. There is also the debut economy, the launch of new products, services and flagship stores to influence consumer trends and boost spending.

China’s president has abruptly swapped the roles of two elite Politburo members — the heads of the Party’s personnel and propaganda departments. Speculation around the why includes to potentially prevent either official amassing too much influence.

In February, official forecasts put Singapore’s growth for 2025 at 1 to 3 per cent but this will now need to be relooked, said Mr Gan. « We are at the moment reassessing our economic forecast, and we may need to make adjustments in time to come, » he told a media conference. Mr Gan said Singapore will have to double down on its efforts to continue to keep its economy open and uphold open, fair and free trade among like-minded countries. The US had a goods trade surplus of US$2.8 billion (S$3.74 billion) with Singapore last year, an 84.8 per cent increase over 2023, according to the United States Trade Representative website. Senior Minister Lee Hsien Loong reiterated that Singapore will not respond with tariffs of its own, although many countries may do so.

GeoPolitics

Israel – Palestine: Defense Minister Israel Katz has announced plans to clear Hamas infrastructure and incorporate more of Gaza into a border security zone, displacing more Gazans.

China – Taiwan: China’s military on Tuesday (Apr 1) said it had begun joint army, navy and rocket force exercises around Taiwan to « serve as a stern warning and powerful deterrent against Taiwanese independence », calling Taiwan’s President Lai Ching-Te a « parasite ». The exercises around the democratically governed island, which China views as its own territory and has never renounced the use of force to bring under its control, come after Lai had called Beijing a « foreign hostile force » last month.

US – India: Agriculture is a key battleground in US President Donald Trump’s escalating trade war. For years, Washington has pushed for greater access to India’s farm sector, seeing it as a major untapped market. But India has fiercely protected it, citing food security, livelihoods and interests of millions of small farmers. To be sure, India’s transformation from a food-deficient nation to a food-surplus powerhouse is one of its biggest success stories. Today, India is not just feeding its 1.4 billion people but, as the world’s eighth-largest agri-produce exporter, also shipping grains, fruits and dairy worldwide. The weighted average tariff – the average duty rate per imported product – in India on US farm products is 37.7%, compared to 5.3% on Indian agricultural goods in the US, according to the Delhi-based think tank Global Trade Research Initiative (GTRI).

Xi Jinping has argued regional rivals China and India should work more closely together in what he’s dubbed a « DragonElephant tango » on their 75th anniversary of diplomatic ties. The two neighbours have gradually managed to stabilise ties since a 2020 border clash left dozens of soldiers dead.

Turkey – Syria – Israel: There are local reports Turkey is moving to take control of Syria’s Tiyas air base, arguing it’s to deter Israeli airstrikes and hit ISIS operations. Syria and Turkey have been negotiating a defence pact since December that’d potentially see Turkey fill the local void left by Russia and Iran.

Credit/Treasuries

ISM Manufacturing Index declined: to 49.0 in March from 50.3 in February (Nomura: 49.2, Consensus: 49.5). The details were stagflationary, as new orders, production, backlog orders, supplier delivery, and employment all deteriorated, while the prices paid index jumped sharply to 69.4 in March, the highest since June 2022, posing some upside risk to core goods inflation. Comments from survey respondents stressed tariffs and heightened economic uncertainty that weighed on manufacturing activity, in line with other manufacturing surveys.

March ISM Services printed at 50.8 Vs 52.9 expected. Employment component dropped massively to 46.2 Vs a consensus at 53.0.

The shape of US Treasury curve did not drastically change last week, the 2years yield dropped by 21bps closing the week at 3.65% even though it briefly touched 3.46% intraday last Friday. 5years & 10years yield lost 23bps, and the long bond lost 19bps. US IG 5years credit spreads widened by 11bps & US HY 5years credit spreads widened by 54bps. The VIX index started the week at 23% and closed last Friday at 45.3%.

FX

DXY USD Index fell 0.98% to 103.02 as safe-haven currencies and EUR led the move upwards against USD. Market fear was at its extreme with the escalation in trade wars.

President Trump announced a 10% baseline tariff effective April 5 with additional reciprocal tariffs on select countries effective April 9 in addition to incremental tariffs on a country-by-country basis. In response, China imposed a 34% tariff on US imports, matching US reciprocal tariffs. In addition, Fed Chair Powell emphasizing patience and push back against immediate rate cut bets. US macro data was mixed: Strong US employment data with the March nonfarm payrolls rising 228k (C: 140k). The Unemployment Rate edged up to 4.15% (P: 4.14%) alongside a rise in the labor force participation rate Average Hourly Earnings grew 0.3% m/m (C: 0.3%; P: 0.3%). ISM services Index dropped to 50.8 in March (C: 52.9; P: 53.5) with the employment index unexpectedly falling 7.7 points to 46.2, the largest decline in nearly five years. US ISM Manufacturing declined to 49.0 (C: 49.5; P: 50.9) with the new orders and employment indices falling further into contraction, while the prices paid index rises further, reaching the highest level since June 2022. Market is currently pricing 109 bps cut in the US this year.

European Currencies was mixed last week with EUR (+1.18%) to 1.0956, GBP (-0.41%) to 1.2887, CHF (+2.27%) to 0.8608. EUR was supported by reports suggesting that the EU was preparing a package of emergency measures to support sectors that will be hit hardest by the US tariffs. In addition, EU-US yield differentials tightened as market participants may see more downside risks to US growth than EA growth following the trade developments, supporting EUR. GBP, being a risk sensitive currency, weakened among the European currencies. CHF strengthened as a safe-haven currency, driven by extreme market fears.

Antipodean Currencies fell last week, with AUD (-3.93%) to 0.604 and NZD (-2.10%) to 0.5596, weighed down by heightened risk of higher tariffs on China. Trade war escalated with China announcing 34% tariffs on all US imports. The RBA left the Official Cash Rate (OCR) unchanged at 4.1% In an accompanying statement the central bank sounded cautious about the outlook and reiterated that returning inflation sustainably to target remains the highest priority, thus failing to give clarity on when the next rate cut might arrive. However, the latest tariff development led market to price a 28 bps cut in May.

USDJPY fell 1.94% to 147.93, breaking 147.00 for the first time since October 2024. Expectations for a near-term BoJ rate hike fade amid the heightened uncertainty and as the global risk-off sentiment supports flight-to-quality bids with JPY appreciating.

Oil & Commodity

Tariff developments also led to sharp declines across commodities. Bloomberg commodity index fell 5.78% last week, with Copper futures (-14.19%) and Aluminium future (-7.42%).

WTI crude and Brent crude oil futures fell significantly last week, with WTI (-10.63%) to 61.99 and Brent (-10.93%) to 65.58. OPEC+ unexpectedly announced it will accelerate the unwind of its production quota, agreeing to a larger-than-expected oil supply hike in May. The group led by Saudi Arabia and Russia will add 411,000 barrels a day to the market next month, the equivalent of three monthly tranches from its previous plan to revive output, according to a statement posted on the OPEC website. In addition, oil prices were further weighed down by demand concerns after the trade war escalations.

Gold fell 1.52% to 3038.24, displaying positive correlation with risk assets despite weakness in DXY USD index. Silver, on the other hand, fell 13.30% to 29.59, with majority of the downfall happening last Friday.

Economic News This Week

- Monday – SZ Foreign Currency Reserves, EU Retail Sales

- Tuesday – JP BoP Current Acc, AU Westpac Cons. Confid./ Biz Confid., US Small Biz Optim.

- Wednesday – NZ RBNZ OCR, JP Machine Tool Orders, US MBA Mortg. App./ Wholesale Inv.

- Thursday – JP PPI, CH CPI/PPI, Norway CPI, US CPI/ Initial Jobless Claims

- Friday – NZ Mfg PMI, SW CPI, UK Indust. Pdtn/ Mfg Pdtn, US PPI/ UMich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2024 Bordier Group and/or its affiliates.