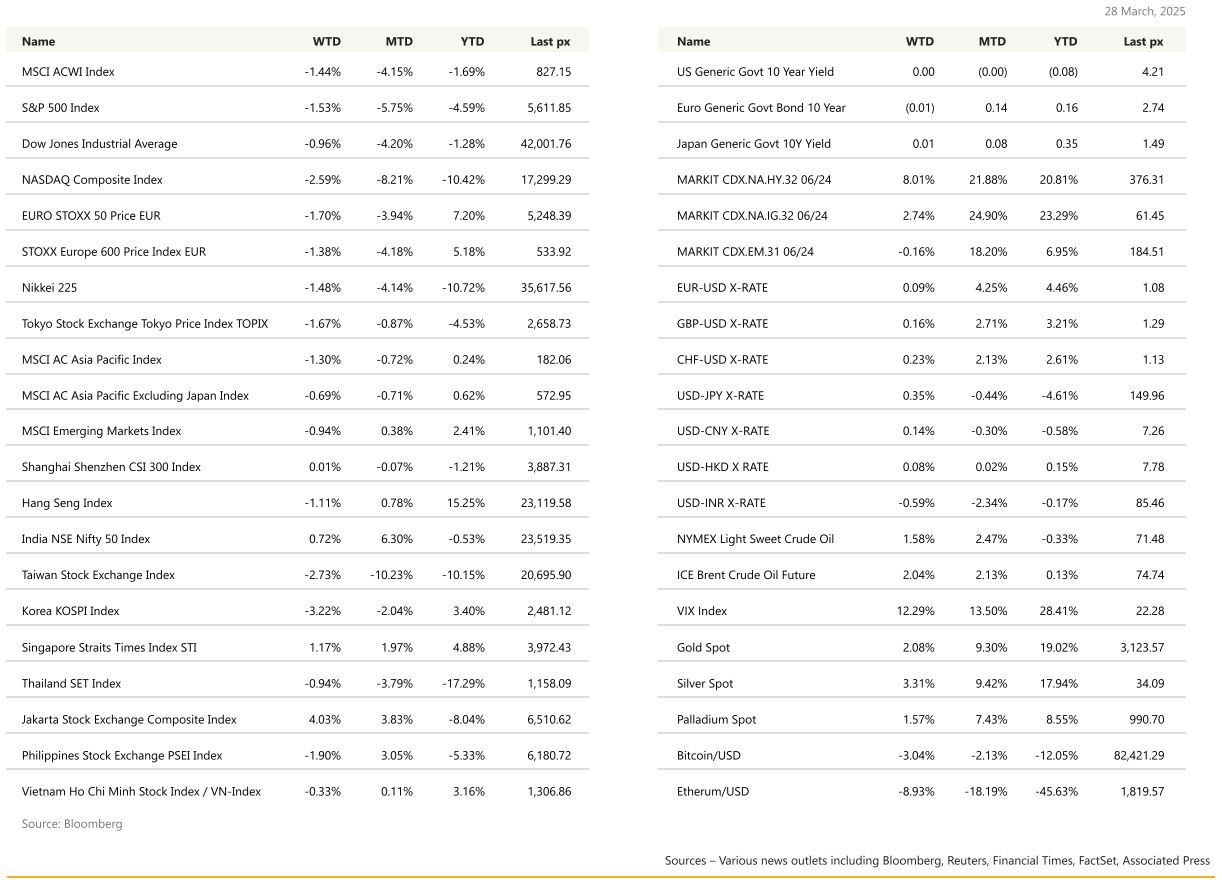

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

Markets’ anxiety over the US’ reciprocal tariffs come April the 2nd was foremost the negative driving force for the week. President Trump said he plans to start his reciprocal tariff push with “all countries,” tamping down speculation that he could limit the initial scope of levies set to be unveiled April 2. The president has said the tariffs will be “lenient,” but investors are on guard given the lack of specifics. Technology stocks have come under pressure in recent sessions, as investors question how much longer the artificial intelligence boom cycle will last ~ the Nasdaq Composite bearing the brunt falling 2.59% last week. Fears about a slowdown in growth and tariff rhetoric fired up expectations of an impending stagflation scenario. Selling was broad based with Bloomberg reporting that about 412 stocks in the S&P 500 closed lower on Friday. Core PCE Price Index rose 0.4% mom and 2.8% yoy, while the headline measures were steady at 0.3% and 2.5%, respectively, in March underpinning inflation moving against expectations. Unsurprisingly, the U. of Mich. Sentiment fell to 57 from 57.9 previously and 1 Yr and 5-10 Yr Inflation expectations rose to 5.0% and 4.1% respectively, both higher than expected. Household demand/spending was weaker than expected. Goldman’s economists, meanwhile, now forecast 3 Fed cuts this year. On the slightly surprising side was data that showed the US economy expanded at a faster pace in the fourth quarter than previously estimated amid a robust increase in corporate profits. GDP Annualised qoq came in at 2.4% versus views for 2.3%. Still, focus remains on tariff clarity before shifting to Q1 corporate results starting this week. Flight to safety saw UST10’s and 2’s decline in yields to 4.20% and 3.87% respectively flattening slightly over the last few sessions.

Meanwhile, news that the European Union is identifying concessions it’s willing to make to the Trump administration to secure the partial removal of US tariffs may help sentiment.

This week’s data release will see JOLTS on Tuesday, and PMI for manufacturing and services together with Friday’s jobs release. The unemployment rate is expected to come in unchanged at 4.1% whilst the all-volatile NFP is expected at 135k from 151k in February. Average hourly earnings mom is expected to also be unchanged at 0.3%.

Europe

The mood music in European markets has abruptly shifted, as concerns over imminent tariffs outweigh optimism driven by Germany’s defence-driven spending package. Still, the Euro Stoxx 50 is headed for its biggest quarterly outperformance versus the US on record. The index is up 7.2% for the quarter while the S&P 500 index is down 4.59% in contrast.

Having dumped German bonds en masse earlier this month on the spending plans announced by Berlin, fund managers have been dipping back in as appetite for safe, highly rated assets grows. Investors late last week shifted money into haven assets to get ahead of Wednesday’s tariff day, pushing yields on 10- year bunds down for three days in a row. The two-year bund yield, meanwhile, has dropped back through 2%, 30 basis points below its March peak and the lowest level since December. Traders have amped up wagers on the extent of interest rate cuts expected from the European Central Bank, with swaps implying two quarter-point reductions and a more than 50% chance of a third by year-end, the most in a month.

The euro surged to a five-month peak of almost $1.10 on March 18 as Germany’s fiscal package pushed up bond yields, making it more lucrative to hold the currency. It’s already given up some of that advance, finishing last week around $1.08.

While many investors see further gains, they’re waiting until after Wednesday. That stance is borne out by volatility in options tied to the euro, which has eased over the past two weeks.

Asia

Asian markets were marginally weak in the last week of March. MSCI Asia ex Japan was lower by 0.69% while Nikkei was down almost 1.5%. As we take stock at the end of 2025’s first quarter, Hang Seng is still in the lead, up 15.25%. President Trump will announce his reciprocal tariff push on Wednesday which would feature “country-based” tariffs.

The Bank of Japan must raise interest rates if persistent increases in food costs lead to broad-based inflation, Governor Kazuo Ueda said on Wednesday. Ueda said Japan’s recent very high inflation was driven mostly by temporary factors such as rising import costs and food prices, which are likely to dissipate and thus not a reason to tighten monetary policy. But there is a chance that sustained rises in food costs could push up prices for other goods and services, he said.

Chinese President Xi held court with dozens of the world’s top executives last Friday, as he sought to bolster foreign investment during an escalating trade war with the United States. Government adviser said China should raise consumption to a level close to developed countries in the next decade, and rebalance the economy away from investment and export.

Chinese credit is rebounding, following on from a surge in equities that was driven by fiscal and monetary stimulus. Finance Ministry of China will inject CNY500B ($69B) into four of the largest state banks — Bank of Communications (3328.HK), Bank of China (3988.HK), Postal Savings Bank of China (1658.HK), China Construction Bank (939.HK) — via share placements on mainland bourses to replenish tier-1 capital. Banks to issue new shares at a premium between 8.8% and 21.5% above Friday’s closing levels. Announcements match an earlier pledge to issue CNY500B in special sovereign bonds to replenish banking capital.

Morgan Stanely strategists have again raised their targets for China stocks, marking their second positive revision in just over a month.

Singapore’s industrial production (IP) weakened in Feb and contracted by -7.5% m/m sa, translating to a -1.3% y/y decline, against Bloomberg consensus’ median forecast of 7.0% y/y. Singapore’s export-oriented factories face rising downside risks from a more uncertain external landscape amid US-led tariff threats that might result in a global tit-for-tat trade war, said DBS Bank economist Chua Han Teng. Should tariffs and trade tensions continue to escalate, manufacturing activity could be depressed, owing to the effects of weaker global demand, said UOB associate economist Jester Koh.

South Korean appeals court reversed on Wednesday, March 26th, a lower court’s ruling and found main opposition leader Lee Jae-myung not guilty of violating the election law, removing a barrier that could have blocked him from running for president.

Other data from Asia: China official manufacturing PMI firmed in March with output and new orders strengthening while export declines narrowed. Non-manufacturing PMI also rose with construction and services logging moderate improvements. Japan industrial production rose at quickest pace in 11 months but auto segment stagnant ahead of Trump’s tariffs, while retail sales missed expectations. South Korea industrial production growth led by electronics; it also ended short-selling ban after tightening measures to crackdown on illegal transactions.

GeoPolitics

US- Russia: Geopolitical tensions seem to rise with Russia – Trump said in an interview that he may put secondary tariffs on oil.

Israel – Palestine: Hamas has reportedly accepted an unspecified new proposal from Egypt and Qatar, while Israel’s Benjamin Netanyahu has said he’s committed to reaching a deal to free the remaining hostages. Netanyahu pledged on Sunday to step up pressure on Hamas in Gaza.

US- Iran: Iran rejected direct negotiation with the US

US – Yemen: The US has been carrying out airstrikes in northern Yemen since March 15, targeting the Houthis killing at least 53 people and wounding dozens more. The US strikes are in retaliation for Houthi attacks on vessels in the Red Sea and their support for Hamas during the Israel-Gaza conflict. The Houthis have carried out more than 100 attacks on shipping since the war on Gaza began in late 2023, saying they are targeting vessels linked to Israel and its allies in an act of solidarity with Gaza’s Palestinians. Earlier this month, US President Donald Trump renewed his call for Iran to end its support for the Houthis, pledging that the Yemeni group will be defeated by Washington. It is however not clear how much the Houthis rely on Iranian support or whether Tehran can order them to stop their attacks.

US- China: China is recognized as the top military and cyber threat to the US. China’s military is fielding advanced capabilities, including hypersonic weapons, stealth aircraft, advanced submarines, stronger space and cyber warfare assets and a larger arsenal of nuclear weapons, » Director of National Intelligence Tulsi Gabbard told the committee. She labelled Beijing as Washington’s « most capable strategic competitor ». The US intelligence report also states that China has a national strategy to displace the US as the leading AI power by 2030. About a third of the 33-page report focused on China’s military and economic coercion toward Taiwan.

US – Vietnam: Vietnam has announced tariff cuts on several US products, including LNG and cars, aiming to improve its trade balance and avoid US tariffs due to a large trade surplus. Vietnam also moved forward with approving Starlink services. Despite their Comprehensive Strategic Partnership, the US and Vietnam have not signed a free-trade agreement. President Trump is expected to impose reciprocal tariffs on several countries soon.

US- Automakers: Shares in Japan’s top car companies fell after President Trump announced a 25% tariff on auto imports, set to take effect this week. Japan’s auto industry is vital to its economy, with a large portion of exports going to the US. Thailand, a major auto production hub in Southeast Asia, will also face the impact of new US tariffs on auto parts. Meanwhile, China’s BYD, the largest maker of electric vehicles, benefits from the tariffs as western automakers may fall behind due to price increases. European luxury brands like Porsche, Jaguar Land Rover, and Bentley face exposure as they have no manufacturing in the US.

US – Europe: European officials are considering stronger trade responses to the Trump administration’s action. The US had a trade surplus of €109bn with the EU in services in 2023 but faced a deficit of €157bn in goods. EU officials want to hit Big Tech’s operations, to retaliate against Donald Trump imposing 25 per cent tariffs on the car industry and promising a further round of measures this week.

Sweden: Sweden is planning $30 Billion military spending hike through 2035

Singapore – Vietnam: Singapore and Vietnam signed five agreements across sectors such as energy and financial services on Wednesday as Prime Minister Lawrence Wong and his counterpart Pham Minh Chinh reaffirmed the strong ties between both countries.

China – Chinese President Xi Jinping met with foreign executives on Friday in Beijing and emphasized that the country was a safe and stable place for companies. More than 40 people, mostly foreign executives and business officials, attended the roundtable meeting with Xi, including Bridgewater Associates Ray Dalio, Standard Chartered CEO Bill Winters and Blackstone Group CEO Steve Schwartzman.

Myanmar: Rebels declared a ceasefire as earthquake death toll nears 2,000.

Credit/Treasuries

The US Treasury curve steepened last week, with the 2 & 5years yields losing 6bps, 10years yield lost 2bps while the long bond yield gained 2bps. US IG 5years credit spreads widened by 3bps while US HY 5years credit spreads widened by 35bps. In total this Month, US HY credit spreads widened by 65bps. In term of performances, US IG gained 18bps last week while US HY lost 82bps. VIX gained about 3points and finished the week at 21.65.

Credit rating group Moody’s has warned on the US fiscal outlook, saying President Donald Trump’s trade tariffs could hamper the country’s ability to cope with a growing debt pile and higher interest rates. The rating agency said on Tuesday that America’s “fiscal strength is on course for a continued multiyear decline”, having already “deteriorated further” since it assigned a negative outlook to America’s top-notch Aaa credit rating in November 2023. “The potential negative credit impact of sustained high tariffs, unfunded tax cuts and significant tail risks to the economy have diminished prospects that these formidable strengths will continue to offset widening fiscal deficits and declining debt affordability,” Moody’s said. “In fact, fiscal weakening will likely persist even in very favourable economic and financial scenarios,” they added.

FX

DXY USD Index was relatively flat in the last week of trading but fell 3.94% for the quarter to 104.21 driven by stagflation fears amid tariffs uncertainty.

Last week, President Trump announced 25% tariffs on all autos made outside of the US to go into effect on April 2. US economic data showed signs of a weaker consumer, slower growth, and increased inflationary pressures, further dampening risk sentiment. The weak consumption dragged down GDP estimates, with the Atlanta Fed’s latest GDPNow model estimate for 1Q25 real GDP growth dropped to -2.8% from -1.81%. In addition to the soft consumer figures, the data also showed an unexpected acceleration in prices. Core PCE rose 0.365% m/m (C: 0.3%), lifting the y/y rate to 2.8% (P: 2.7%). US Michigan consumer sentiment revised down 0.9pts to 57.0 in final read for March, lowest since 2022. 1yr ahead inflation expectation revised up 0.1ppt to 5% (highest since November 2022); 5-10yr ahead revised up 0.2ppts to 4.1%, (highest since 1993). The next key event is 2nd April where US will announce its reciprocal tariff details.

GBPUSD traded flat in the last week of trading but rose 3.21% to 1.2918 for the quarter. In the UK, Chancellor Reeves provided a spring budget update, which was largely in line with expectations with regards to new spending cuts, while the OBR revised its growth forecast for UK GDP lower. In addition, GBP was buoyed by headlines that UK Chancellor Reeves had “intensive discussions” with the US administration in an attempt to avoid tariffs on April 2.

AUDUSD fell 0.41% in the last week of the quarter and rose 0.95% for the quarter to 0.6247. Last week, headline CPI slowed to 2.4% y/y in February (C: 2.5%; P: 2.5%), and Core CPI slowed to 2.7% y/y (P: 2.8%). In addition, heightened level of tariff uncertainty supported AUD weakness. However, RBA is widely expected to maintain its cash rate at 4.10% on the 1st April. Throughout the 1st quarter, AUDUSD has been largely trading in a tight range of 0.62-0.64.

USDJPY closed the quarter (-4.61%) to 149.96, supported by tightening rate differentials and the risk sentiment backdrop. Minutes from the January BoJ meeting showed the Board reiterating its view that the BoJ would continue to raise the policy rate if its outlook for economic activity and prices was realized. Accordingly, markets appeared to position for a higher terminal rate scenario. Tokyo CPI report for March, which came in stronger than expected at +2.9% (vs. +2.7% expected). In addition, the measure excluding fresh food and energy moved up to +2.2% (vs. +1.9% expected), the strongest in a year.

USDNOK closed the quarter (+7.70%) to 10.50. The Norges Bank maintained its policy rate at 4.50% at its March meeting, as expected. The decision was driven mainly by the recent acceleration in inflation, higher wage growth in 2024, and prevailing uncertainty. The press release noted that « restrictive monetary policy » is still needed and the policy rate path was revised upwards.

Oil & Commodity

Oil: The current administration’s policies are creating instability in the shale oil sector, with producers warning that further drops in oil prices, currently around $70 per barrel, could severely harm the industry. Shale producers, who need consistent capital to sustain output, argue that Trump’s tariff policies and the « drill, baby, drill » rhetoric are unrealistic, especially if prices fall to $50 per barrel. Experts caution that this uncertainty is slowing production, with many producers reducing their capital expenditures and threatening to halt operations if prices continue to decline. The Dallas Fed report notes that shale producers need at least $65 per barrel to remain profitable.

Gold: The yellow metal soared to record high and closed the quarter at 3123.57 (+19.02% YTD) driven by stagflation concerns in the US as tariff uncertainty ramped up.

China’s largest insurance companies to invest in gold, four major firms—PICC Property and Casualty, China Life Insurance, Ping An Life, and China Pacific Life—joined the Shanghai Gold Exchange (SGE) as members yesterday. These companies represent 74% of the 2023 year-end investment assets. If they allocate 1% of these assets to gold, it would total USD 25 billion in potential gold purchases. Deutsche Bank previously estimated that such a deployment could raise gold prices by USD 120 per ounce, based on past ETF inflows. The fact that these companies have just become SGE members suggests these gold flows have not yet materialized

Technically, next resistance level is at 3200, while immediate support at 3075.

Economic News This Week

- Monday – JP Indust. Pdtn/ Retail Sales, NZ Biz Confid., AU Melbourne Ins. Inflat.. CH PMI, UK Mortg. App., US Chicago PMI/ Dallas Fed Mfg Act.

- Tuesday – AU/JP/CH/SW/SZ/NO/EU/UK/CA/US Mfg PMI March Final, JP Jobless Rate/ Tankan Index, AU Retail Sales/ RBA OCR, UK Nationwide Hse Px, SZ Retail Sales, EU CPI, US ISM Mfg/ ISM Price Paid

- Wednesday – NZ Building Permits, AU Building App., US Mortg. App./ ADP/ Factory Orders/ Durable Goods Orders

- Thursday – AU/JP/CH/SW/EU/UK/US Svc/Comps PMI March Final, SZ CPI, EU PPI, US Initial Jobless Claims, US ISM Svc

- Friday – SZ Unemploy. Rate, SW CPI, UK Construction PMI, CA Unemploy. Rate, US NFP, Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2024 Bordier Group and/or its affiliates.