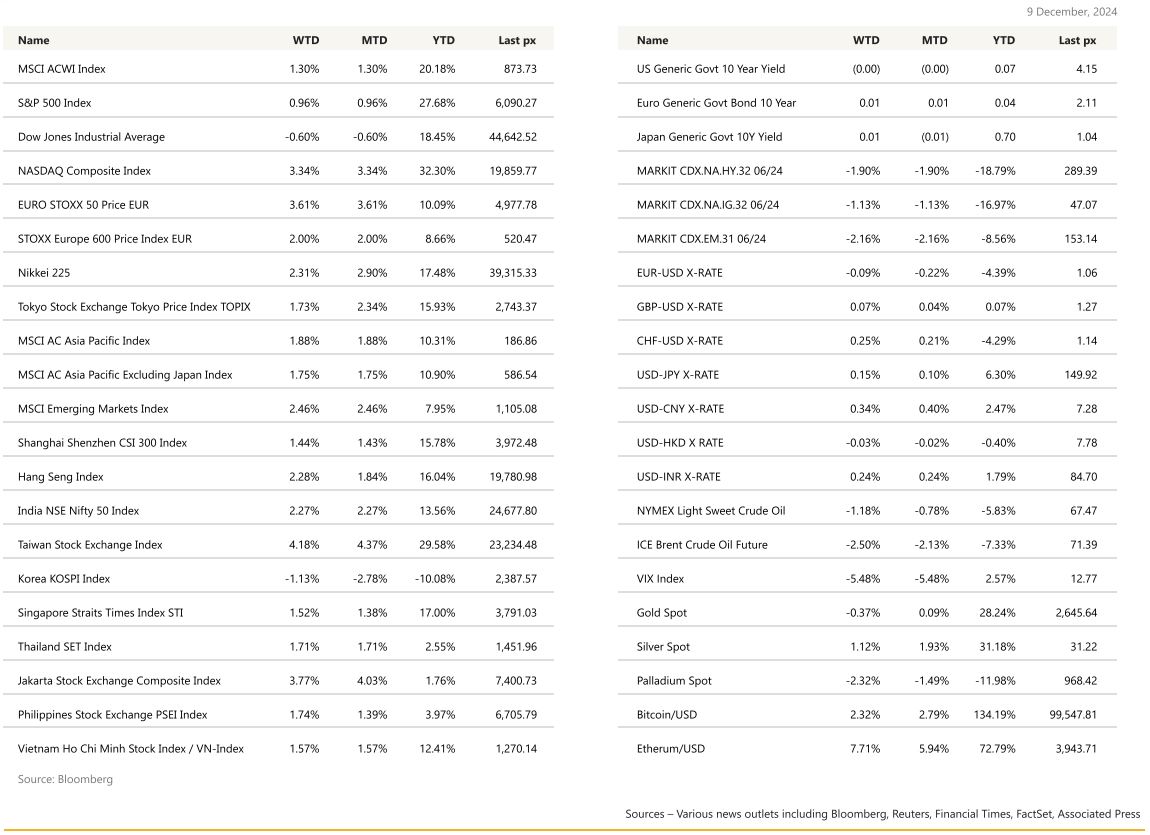

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

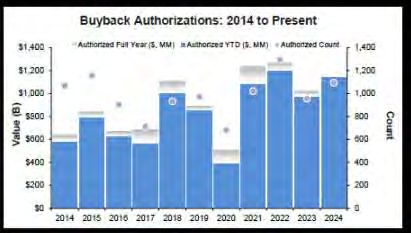

It took all week before rate cut bets favored a majority tilt again (>70%), for a 25 bps cut this month. US stocks closed at another all-time high record as jobs data indicated the labor market remains strong but not too hot, fueling bets on interest-rate cuts. The S&P 500 clocked in a 28% gain for the year so far, putting it on track for its best annual performance since 2019. The jobs report came in at 227k against expectations of 220k and October’s report was revised higher to 36k. The unemployment rate ticked up to 4.2% from 4.1%, average hourly earnings came in MoM came in slightly higher than expected at 0.4%. All in all reassuring that the economy is in good shape, and for the Fed to remain on track for lowering interest rates. Market sentiment was also boosted by corporate buyback announcements particularly, from the largest Tech companies. Apple Inc., Alphabet Inc., Microsoft Corp., Meta Platforms Inc. and Nvidia Corp. accounted for almost $350 million of announced buybacks this year, making information technology and communication services the leading sectors on a year-to-date basis. “This pace of buybacks serves as an indicator that the economy is fine and companies are flush with cash,” said Jeffrey Yale Rubin, president of Birinyi Associates.

Historically, almost 90% of all announced share repurchase plans are completed within the next year. That means about $1 trillion will be allocated into the stock market as companies start to execute those buybacks. Gross buybacks can reach $1.07 trillion in 2025, according to Goldman Sachs data. In other data for the week, U. of Mich. Sentiment was positive at 74.0 from 71.8 previously. The Fed’s latest Beige Book survey said economic activity increased slightly in November after being little change in preceding months and US businesses grew more upbeat about demand. “The economy is in remarkably good shape,” Powell said on Wednesday. ISM services data came in weaker but was largely ignored by the market. We also had some Fed speak, from SF’s Mary Daly who said a rate cut this month isn’t certain but remains on the table for policymakers and Chicago Fed President Austan Goolsbee said the pace of rate cuts will probably slow next year. Federal Reserve Governor Christopher Waller said he’s leaning toward easing policy in December.

The week ahead will see the final CPI report for the year, with core MoM expected at an unchanged 0.3% and headline YoY at 2.7% (up from 2.6%) on Wednesday followed by Thursday’s PPI , Final Demand expected at 2.6% YoY from 2.4%. Bitcoin soared past $100,000 for the first time before paring some of those gains following President-elect Donald Trump’s pro-crypto pick for the SEC chair, Paul Atkins. Atkins SEC knowledge and expertise will put him in a strong position to unpick some of Gensler s (current SEC chairman) rules, especially short-sale regulations and climate disclosure rules already facing lawsuits, as well as cryptocurrency accounting restrictions. Ether lagged BTC but remains on track to catch up, after briefly flirting above $4k.

With buybacks announced and planned for further deployment, we remain focused on the AI theme and favor semis that offer value – Qualcomm, Applied Materials, Analog Devices.

Europe

French lawmakers held a no-confidence vote on the current government, which was approved by the parliament. The Barnier’s government collapsed, and the prime minister offered his resignation. French President Macron is expected to nominate what will be his 4th prime minister over the last 12Months. This marks the first government collapse in France since 1962, as Marine Le Pen’s National Rally (RN) joined forces with the left-wing New Popular Front to topple the government. President Macron faces calls to resign but insists on serving his term until 2027.

French bonds and the euro pared gains, reflecting unease around financial stability. ECB President Christine Lagarde emphasized the importance of financial stability but refrained from direct comments on France. Marine Le Pen, leader of the largest party inthe National Assembly, stated it is possible to deliver a budget within weeks, easing some market concerns. This led to safe-haven bids unwinding, narrowing EGB spreads, and modest EUR recovery.

German industrial production missed, down 1%mom in October, consensus at +1%. Now down 4.5% in year-ended terms

This week we are watching for the ECB meeting (25bp cut expected), SNB meeting (25bp cut expected), final Nov CPIs for Germany, France and Spain.

Asia

Asia was up last week, with positive momentum following regional manufacturing PMIs that showed a general pickup in activity following several months of contraction. MSCI Asia Ex Japan closing the week higher +1.75%. Taiwan took the lead moving up 4.18%.

Korea’s political fiasco left the index lower by 1.13%. South Korean lawmakers on Wednesday called for the impeachment of President Yoon Suk Yeol after he declared martial law only to reverse the move hours later, triggering the biggest political crisis in decades in Asia s fourth-largest economy. South Korea s finance ministry said it was prepared to deploy unlimited liquidity into financial markets if needed, with the Yonhap news agency saying the financial regulator was ready to deploy 10 trillion won ($7.07 billion) in a stock market stabilisation fund.

In Japan, BOJ Governor Ueda said rate hikes nearing with economic data on track. BOJ Governor Ueda said next rate hikes are « nearing in the sense that economic data are on track. » However, with market expectations divided on the move between December and January, Ueda has expressed caution about timing and has insisted that he would like to observe domestic wage trends and the political and economic situation in the US.

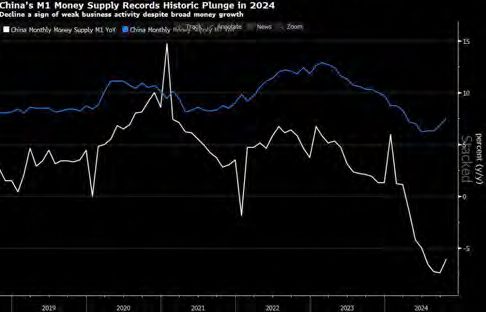

China’s central bank governor reaffirmed plans for a supportive monetary policy to promote growth next year, as the economy faces fresh challenges from a looming trade war with the US during Donald Trump’s second term. The yuan fell to the lowest level in about a year last Tuesday. Seen as an indicator of business activity and dynamism in the past, M1 growth slowed significantly since last year and began contracting early this year, even as the broad money supply M2 continued to expand.

China s services activity expanded at a slower pace in November, Caixin/S&P Global services purchasing managers index (PMI), fell to 51.5 from 52.0 in October, but remaining above the 50- mark. The downbeat data in China aligns with the official PMI released on Saturday, which showed non-manufacturing activity weakened to 50.0. Last week we also saw the Chinese State media Xinhua write in a commentary that while officials have made every effort to achieve this year s growth target, coming in a little to left or right of that around 5% goal would be acceptable , an apparent attempt to manage expectations ahead of this week s Central Economic Work Conference (CEWC), in which investors hope to see stronger stimulus for 2025.

Thailand’s government and chip-maker Nvidia Corp. agreed to strengthen cooperation in artificial intelligence, as the Southeast Asian nation seeks to become a regional hub for AI and data centers.

Indonesia said that it has received an improved investment offer worth $1 billion from Apple Inc., in the tech giant’s latest bid to lift a ban on the sale of iPhone 16 devices in Southeast Asia’s largest economy. If confirmed, that would be a tenfold increase from Apple’s last offer of $100 million. Its initial bid was an even smaller $10 million for a factory making accessories and components. Indonesia prohibited the sale of Apple’s flagship iPhone 16 devices, saying it has failed to comply with domestic content requirements for smartphones and tablets.’’

Malaysia becomes the first Southeast Asian nation to sign a comprehensive strategic partnership (CSP) with Vietnam, the upgrade in diplomatic relations signals a more united stand against China’s claims in the South China Sea, say analysts

This week, Investors are readying themselves this week for a final flurry of central bank decisions across four continents, a key meeting of Chinese officials and US inflation data to pad returns for the year and help guide positions into 2025.

GeoPolitics

Syria: Syrian President Bashar al-Assad’s regime has been toppled in a lightning rebel advance, putting an end to more than half a century of his family’s rule. The Syrian president fled the country to Moscow and was granted asylum, Russian state agency TASS reported. Israel’s prime minister has announced its military has temporarily seized control of a demilitarized buffer zone in the Golan Heights, saying the 1974 disengagement agreement with Syria had « collapsed » with the rebel takeover of the country.

Benjamin Netanyahu said he had ordered the Israel Defense Forces (IDF) to enter the buffer zone and « commanding positions nearby » from the Israeli-occupied part of the Golan.

China – US: China’s commerce ministry on Tuesday said it would prohibit the export to the US of dual-use items that include gallium, germanium, antimony and superhard materials, and would impose stricter controls related to graphite. The embargoed minerals and metals are used in the production of semiconductors and batteries, as well as communications equipment components and military hardware, such as armourpiercing ammunition. China had already been strengthening export controls in response to tightening chip sanctions from the US and its allies. Existing curbs on shipments of germanium and gallium have led to an almost twofold increase in the minerals’ prices in Europe. China’s latest shipment ban to the US makes clear President Xi Jinping’s government is willing to target western economic interests to hit back against Washington’s chip restrictions.

China – Saudi: Chinese exports and investment are pouring into Saudi Arabia as the kingdom’s demand for green tech deepens a relationship once defined by oil sales and challenges business ties with its traditional western partners. China has become the kingdom’s largest source of greenfield foreign direct investment, with investments from 2021 to October this year totalling $21.6bn, about a third of which were in clean technologies such as batteries, solar and wind, according to investments tracked by fDi Markets. This compares with $12.5bn from the US, the next highest.

Georgia –Russia – EU: Mass protests light up Georgia after Georgia’s Russia-friendly government announced last week it was freezing EU accession talks for four years. The country has been in crisis since October’s elections, when the government claimed a surprise victory but opposition groups (and some Western governments) alleged fraud.

Europe: EU countries are discussing a €500bn joint fund for common defence projects and arms procurement, tapping bond markets to boost spending in anticipation of Donald Trump’s White House return. The financing model, which would be open to non-EU states such as the UK and Norway, is gaining traction among a key group of EU member states.

Credit Treasuries

The US Treasury curve bull steepened slightly over the week with the 2years yield dropping by 8bps, while 5, 10 & 30years yield lost 6bps. US IG 5years credit spread finished the week unchanged at 47bps while US HY 5years credit spread tightened by about 6bps. In term of performances, US IG & US HY gained about 35bps last week.

In Asia IG, Korea moved wider Friday morning due to back-andforth political headlines. Sovereigns ex-Korea were -2 to 3bps tighter on the week. Korea had a short pop wider Friday morning following martial law headlines, which later were assured would not happen.

FX

European Currencies closed the week relatively unchanged against USD, with EURUSD (-0.09%) to 1.0568, GBPUSD (+0.07%) to 1.2744 and USDCHF (-0.25%) to 0.8788.

EURUSD intraweek movement was volatile, touching a low of 1.046 before rebounding to touch a high of 1.063. French PM Michel Barnier resigned last week after losing a vote of confidence. EUR benefited towards the end of the week from reduced political uncertainty, with National Rally leader Le Pen saying France should be able to pass a budget over the coming weeks. In terms of Eurozone Macro data, Eurozone unemployment remained at 6.3%, Retail Sales fell -0.5% m/m in October (C: -0.3%; P: 0.5%) and the final 3Q24 GDP reading confirmed the preliminary release of 0.4% q/q growth (2Q24: 0.2%). We have the ECB and SNB rate decision on Dec 12, where market consensus is for 25 bps for both.

Antipodean Currencies performed the worst within the G10 currencies, with AUDUSD (-1.86%) to 0.639 and NZDUSD (-1.44%) to 0.583. Australia Q3 GDP rose 0.3% q/q, missing consensus of 0.5%, while retail sales rose 0.6% m/m in October (C: 0.4%; P: 0.1%). A full rate cut by RBA is now priced in April, compared to May in the previous week. We have the RBA OCR decision on Dec 10.

USDJPY closed the week relatively unchanged at 150 (+0.15%), trading in a range between 149 and 151. A clean break on either side therefore signals a reversal in trend. BoJ Governor Ueda, in an interview released on November 30 but conducted on November 28 before the solid Tokyo CPI release, said rate hikes are “nearing in the sense that economic data are on track.” That said, he emphasized that the uncertainty around the US economic outlook remains, especially due to the potential of new tariff policies. Regarding wage inflation, Ueda said the BoJ needs a bit more time to confirm 2025’s Shunto wage hike trends, but that it is not necessary to wait for that information, in order to decide the monetary policy path. He said the BoJ is carefully monitoring service inflation along with wage growth.

USDCAD rose 1.08% to 1.4157, driven by a larger-than-expected rise in the Canadian unemployment rate. Jobs grew by 50.5k in November (C: 25.0k; P: 14.5k), but the increase is below labor force and population growth in November. The Unemployment Rate ticked up to 6.8% (C: 6.6%; P: 6.5%) while participation rate increased to 65.1% (P: 64.8%). The Average Hourly Wage rate fell sharply to 3.9% y/y (C: 4.7%; P: 4.9%). We have the BOC rate decision on Wednesday, where market consensus is for a 50 bps cut.

Oil & Commodities

Oil futures declined last week, with WTI down 1.18% to $67.20 and Brent down 2.50% to $71.12, despite OPEC+ deciding to delay its planned output increases until April 2025. The cartel’s decision to extend production cuts reflects ongoing headwinds from weak Chinese demand and surging U.S. supply. U.S. commercial stockpiles fell by more than 5 million barrels—the biggest weekly drop since August. Nationwide oil production hit a record high of over 13.5 million barrels per day, significantly outpacing Saudi Arabia s output of about 9 million barrels per day. The surge in U.S. production underscores the resilience of non-OPEC+ supply, which continues to weigh on prices. Sentiment among analysts remains bearish, with a Bloomberg survey suggesting crude prices could fall below $60 per barrel by 2027, driven by a combination of growing non-OPEC+ output and potential structural shifts in global demand

Gold fell 0.37% to 2633.37 last week, with a new trading range of 2600-2700. Immediate support level at 2600/2530, while resistance level at 2675/2700.

Economic News This Week

-

Monday – JP GDP, CH CPI/PPI, EU Sentix Inv. Confid., US Wholesale Inv.

-

Tuesday – AU NAB Biz Confid./RBA OCR, NO CPI, US Small Biz. Optim.

-

Wednesday – JP PPI, US MBA Mortg. App./CPI, CA BOC Rate Decision

-

Thursday – AU Employ., SW CPI, EU ECB Rate Decision, US PPI/Initial Jobless Claims

-

Friday – NZ Biz Mfg PMI, JP Tankan Index/Indust. Pdtn, UK Indust. Pdtn/Mfg Pdtn/Trade Balance, EU Indust. Pdtn

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.