KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets ended the week marginally higher but it certainly wasn’t a smooth ride. The flare-up in Israel’s attack on Lebanon’s shores followed by Iran’s missile retaliation at Israel had kept sentiment in check for the most part. Friday’s payrolls report which signaled a much stronger than expected labour market and lower unemployment rate fueled hopes of a soft landing – where the Fed Reserve indeed may be able to engineer one and avoid a recession. US nonfarm payrolls increased 254,000 in September, the most in six months, following an upwardly revised 72,000 advance over the prior two months. The unemployment rate fell to 4.1%, and hourly earnings increased 4% from a year earlier, according to Bureau of Labor Statistics. Chicago Fed President Goolsbee reacted to the report in an interview with Bloomberg Television by warning against putting too much stock in one month’s data, and adding that there are risks that inflation might undershoot the 2% target. A deeper dive into the labour market data pointed to some pockets of weakness. There were more discouraged workers in the economy last month, and the number of people unemployed for more than six months rose to the highest in almost three years. Moreover, more than half of the payroll advance was concentrated in only two sectors: leisure and hospitality, and health care.

Regardless, Reuters reports the September payrolls jump takes November’s 50 bps cut off the table. The base case is now for two 25 bps cuts by year end. On Monday, Federal Reserve Chair Jerome Powell said the central bank will lower interest rates “over time,” while again emphasizing that the overall US economy remains on solid footing. Meanwhile, the Fed’s Michelle Bowman reiterated that inflation remains “uncomfortably” above the central bank’s 2% target, supporting the case for a “measured” approach to lowering interest rates.

Elsewhere, Thursday showed applications for US unemployment benefits rose slightly to a level that is consistent with limited number of layoffs. Initial claims increased by 6,000 to 225,000 in the week ended Sept. 28, whilst the JOLTS openings came in higher than expected at 8.04 mln vs expectations of 7.693 mln. September US Services PMI printed two-tenth of one percent lower than expectations at 55.20 however the same day the ISM Services printed at 54.9, much stronger than 51.7 expected. Price paid and new orders both printed way above expectations at 59.4, only the employment component printed at 48.1, below expectations (50.0).

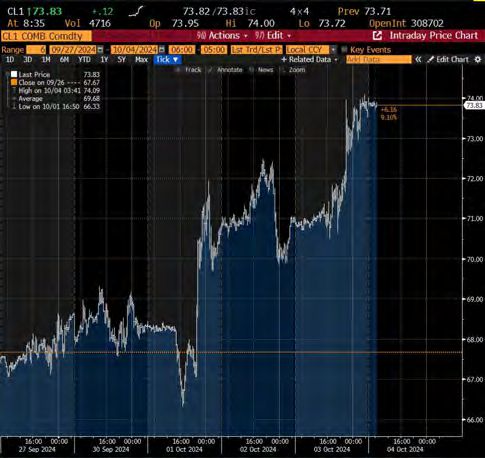

Oil and gas stocks rallied after President Joe Biden told reporters he was “discussing” if he would support Israel striking Iran’s oil facilities. We observed that mining and metals stocks got a surprise jolt in September when China’s pledge to stimulate its flagging economy electrified the performance of stocks – though strategists are still unconvinced the rally is sustainable just like previous metals rallies in the absence of additional support. Watch this space.

In politics, a sweep by Donald Trump and the Republican party in the November US elections is likely the most bullish outcome for US stocks, according to a survey of US analysts at RBC Capital Markets. A split Congress could also be slightly positive, the survey found.

This week will see if US inflation continues to reassure a labour market-focussed Fed. On Thursday, we will see September’s CPI data expected to come in at core MoM of 0.2% from 0.3% whilst YoY headline to slow to 2.3% from 2.5%. Friday will see PPI Final Demand MoM at 0.1% and YoY at 1.6%, followed by U. of Mich. Inflation expectations of 2.7% and 3% for 1 Yr and 5-10 Yr respectively. We will also see the start of Q3 earnings season.

The solid jobs report we think reiterates the rotation into smaller stocks given its solid macro outlook. We would recommend articulating this via the Small Cap Heptagon Driehaus Fund or via the iShares Core S&P Small Cap ETF.

Europe

The European Stoxx 600 index provisionally closed up 0.45%, with most sectors and major exchanges trading positively. Banks led the gains with a 1.7% rise, while oil and gas stocks gained 1.6%, extending their rally amid supply concerns after U.S. President Joe Biden suggested Israel might target Iran’s oil industry as tensions in the Middle East escalate. Automaker shares also rose by 1.5%, following the European Union’s decision on Friday to impose definitive tariffs on China-made battery electric vehicles (BEVs), despite opposition from many European carmakers concerned about potential retaliatory tariffs from one of their key markets.

Last week’s final Euro area composite PMI saw an unusually large upward revision of 0.8 points from the flash estimate. Despite this, the composite output index still fell by 1.4 points in September, landing at 49.6, indicating weak GDP growth at an annualized rate of just 0.6%. The PMI also highlighted other trends, including a modest widening of the gap between the services and manufacturing sectors. Additionally, the composite output price index continued to decline. On the inflation front, last week’s flash HICP report for September came in noticeably below staff forecasts, while the PMI composite output price index continued to normalize. Headline inflation dropped to 1.8% yearon-year, down from 2.2% in August, with core inflation easing by 0.1 percentage points to 2.7%. The main driver of this slowdown has been energy inflation, despite a recent rise in oil prices.

With respect to the ECB, the third-quarter HICP data came in weaker than expected. ECB staff had projected core inflation to average 2.9% year-over-year in Q3, but the actual figure was slightly lower at 2.8%. We anticipate core inflation will remain at 2.8% in Q4, below the ECB’s forecast of 2.9%.

In August, the number of unemployed in the Euro area decreased by 94,000, keeping the unemployment rate steady at 6.4%, a record low for the region. However, this tight labor market is more reflective of weak productivity than of a strong economy. Recent declines in unemployment have been concentrated in Italy and Spain, while Germany has seen an increase in the number of unemployed this year, and France’s unemployment figures have remained relatively stable.

With updated growth and inflation forecasts, including lower energy price assumptions, weaker-than-expected 3Q inflation and worryingly weak business confidence, we think the ECB will cut rates again on 17 October to avoid falling behind the curve and keep optionality for the December meeting.

In response to weaker inflation and activity data, and ECBspeak, markets now price 24bp of cuts for October, relative to only 6bp priced as of two weeks’ ago. As for the terminal rate, markets price approximately 226bp of cuts peak-to-trough (i.e. a terminal rate of 1.74%), in line with where we expect the ECB to cut rates.

Swiss CPI +0.80% YoY, two-tenth of one percent below expectations and MoM printed at -0.30% Vs -0.10% expected. ZIRP for CHF, or even negative interest rate policy, might be coming back in the next few quarters.

In the UK, second-quarter GDP growth was revised down from 0.6% to 0.5% quarter-on-quarter (1.8% annualized). This growth rate appeared high relative to business survey data. However, consumer spending continued to show weakness, with an unchanged increase of just 0.2% quarter-on-quarter, despite strong real disposable income growth of 1.3%. This led to a rise in the savings ratio from 8.9% to 10%. Consumer services and durable goods both saw solid growth (0.7% quarter-on-quarter), but net tourism dragged consumption growth down by 0.2 percentage points. On the corporate front, business confidence remains high, as reflected in the Lloyds business barometer, which dipped slightly from 50 to 47 in September but remains robust. Business investment has now seen growth for three consecutive quarters.

On the data front this week, in the euro area, the focus turns to industrial production figures for August for most of the euro area countries. France is expected to present its 2025 draft budget on Thursday. Over in the UK, we will see the monthly GDP figures, industrial production, and trade balance on Friday.

Asia

The star performer in Asia was Hong Kong last week, with the HSI index up 10.2%, taking YTD gains to 23.95%, the highest in Asia! Chinese authorities have announced several stimulus measures over the past two weeks. China has been closed for a week; we await China market to reopen tomorrow. Officials from the National Development and Reform Commission said on the weekend will hold a briefing tomorrow (8th Oct) . While Chinese shares have skyrocketed since late-September, firms such as Invesco Ltd., JPMorgan Asset Management, HSBC Global Private Banking and Wealth, and Nomura Holdings Inc. are among those viewing the rebound with scepticism. Goldman Sachs, however, has upgraded Chinese stocks to overweight, expecting the benchmark indexes to rise further on improved valuations.

There was a slew of property market related news from China – Guangzhou became first top-tier city to lift all restrictions on home purchases while Shanghai and Shenzhen said they would ease curbs on housing purchases by non-local buyers and lower minimum downpayment ratio for maiden homebuyers to no less than 15%. PBOC said in a statement on Sunday that homeowners will be able to renegotiate with current banks effective 1-Nov. Those who chose fixed mortgage rates can also renegotiate new loans based on latest loan prime rate. This is a follow-up from what PBOC Governor Pan Gongsheng said at the press conference on 24-Sep. Moves will slash outstanding rates for individual borrowers by an average of 50 bp, and reduce

Real estate showrooms appeared just as crowded as some tourist haunts in Shanghai over golden week holiday, as loosened buying rules triggered a rebound in home sales interest.

Data out of Asia last week: China, NBS manufacturing PMI rose while Caixin manufacturing PMI fell in September, and both Caixin and NBS services PMI fell.

Korean Manufacturing PMI declined sharply in September; the index plunged 3.6pt to 48.3 which is the lowest level since June 2023. Korea’s consumer price index rose 1.6%oya in September from 2.0% print in August. The slowdown of the inflation was as expected. Australia composite PMI fell back into contraction, Singapore PMI fell from two-year high but remained expansive, and final Japan September PMI was revised lower. Thailand’s manufacturing production index (MPI) fell 1.9%oya in August (July: +1.6%oya), missing expectations. Indonesia’s September headline CPI rose 1.8% y/y and and 0.1%m/m

This week, the Bank of Korea and Reserve bank of India are due to hold a rate decision this week. We are also expecting Thailand & Taiwan CPI, China reserves, Japan household spend, Singapore GDP data all this week. The ASEAN Summit and the East Asia Summit is also taking place in Laos through Oct 11th.

GeoPolitics

Israel – Lebanon:

Today is the 7th of October and it is sadly the 1year anniversary of renewed tensions in the Middle East, tensions that for most commentators in the mainstream media stated 1year ago, when in fact, those tensions started probably about 77years ago. With its decapitation of Hezbollah in Lebanon, the Israeli government hopes that it has finally seized the initiative in the battle with its regional enemies. Many now want to press home the advantage, in the hope of striking a decisive blow against not just Hezbollah but Iran – and the “axis of resistance” that it leads, which includes Hamas, Hezbollah, militias in Iraq and Syria and the Houthis in Yemen. Israeli Prime Minister Benjamin Netanyahu promised that arch foe Iran would pay for its missile attack against Israel. Tehran said any retaliation would be met with vast destruction, raising fears of a wider war.

World leaders have urged Iran and Israel to step back from the brink after Tehran fired a barrage of rockets at its archrival. The attack was retaliation for killings including Hezbollah chief Hassan Nasrallah in Beirut and Hamas leader Ismail Haniyeh in Tehran.

Israel’s air force struck at least 4,600 targets in Lebanon between September 20 and October 2 — sometimes more than 1,000 in a single day. The bombing campaign is part of what the IDF says is a “new phase” of the war, which it says forms part of efforts to ensure northern Israel is safe enough to allow 60,000 people displaced by Hizbollah rocket fire to return home. The strikes came as Hizbollah sent barrages of rocket fire at Israel and fired a ballistic missile towards Tel Aviv.

On 4th Oct – Israel’s military conducted multiple air strikes on Beirut’s southern suburbs overnight in one of its heaviest bombardments on the Lebanese capital in an intensifying campaign against armed group Hizbollah. Israel continued to pound Lebanon with a fierce wave of air strikes overnight in the heaviest 24 hours of bombing over the weekend. In an indication that it was preparing for an expansion of the fighting, Israel on Sunday evening declared a third closed military zone on its border with Lebanon, banning civilians from entering the area of Manara, Yiftah and Malkia.

Israel’s defence minister Yoav Gallant is due to visit Washington on Wednesday to discuss the security situation with his US counterpart, the Pentagon announced on Sunday.

As time of writing, it is important to highlight that as situation might evolve at almost any hour, it remains to be seen, what the Israel government response to the latest ballistic missiles strike from Iran middle of last week, will be. The fog of war has been getting thicker recently and the posture of the US government is really unclear as what would be their support to Israel if direct strikes on Iran territory are approved and which kind of targets, oil facilities, nuclear facilities or others, might be agreed on. Based on a Financial Times article last week, the IDF strikes on Lebanon over the last two weeks have probably destroyed more than 3’000 houses. The US army has now moved around 43’000 military personnel in the region and two aircraft carriers. Israel Defence Forces and its allied are currently conducting some kind of military operations in 5 countries/territories, Gaza & the Westbank, Lebanon, Syria, Yemen and Iraq. Iran might be next on this list soon.

Russia – Ukraine: Ukrainian forces have retreated from Vuhledar after Russian troops threatened to encircle the coalmining hub. Vuhledar (now mostly destroyed) has tactical value because it’s perched atop a hill and is also close to major railways that are key for supply lines.

US: U.S. dock workers and port operators reached a tentative deal that will immediately end a crippling three-day strike that has shut down shipping on the U.S. East Coast and Gulf Coast, the two sides said Thursday. The tentative agreement is for a wage hike of around 62% over six years, two sources familiar with the matter told Reuters, including a worker on the picket line who heard the announcement. That would raise average wages to about $63 an hour from $39 an hour over the life of the contract.

credit treasuries

The US Treasury curve bear flattened dramatically last week, but especially last Friday after the US job data, with the 2years yield up 36bps over the week, 5years yield gained 30bps, 10years yield gained 21bps and 30years yield gained 15bps. US 5years IG & HY credit spread finished the week unchanged. In term of performances, US lost about 1.50% last week, while US HY lost about 0.80% and leverage loans finished the week unchanged. Fed funds futures tempered rate cut expectations, with the amount of easing priced by December falling to 53bps, down from 77bps at the start of the week. 2 and 10 Year yields rose to 3.92% and 3.97% respectively, flattening from 22.5 bps on the 25th of Sept to merely 4.5 bps Friday

Economic News This Week

-

Monday – U Sentix Investor Conf, EU Retail Sales, Thailand CPI

-

Tuesday – Trade Bal, Germany Industrial Production, France Trade Bal

-

Wednesday – Taiwan CPI/PPI

-

Thursday – FOMC Meeting Mins, US CPI, Ag Hourly Earnings, Initial Jobless Claims, Japan PPI

-

Friday – PPI, U.Mich.Sentiment, UK Monthly GDP, UK Industrial Production, UK Manufacturing Production

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.