The race for AI supremacy

The biggest U.S. tech companies have had monopoly access to AI largely because the entry ticket price was in the billions of dollars.

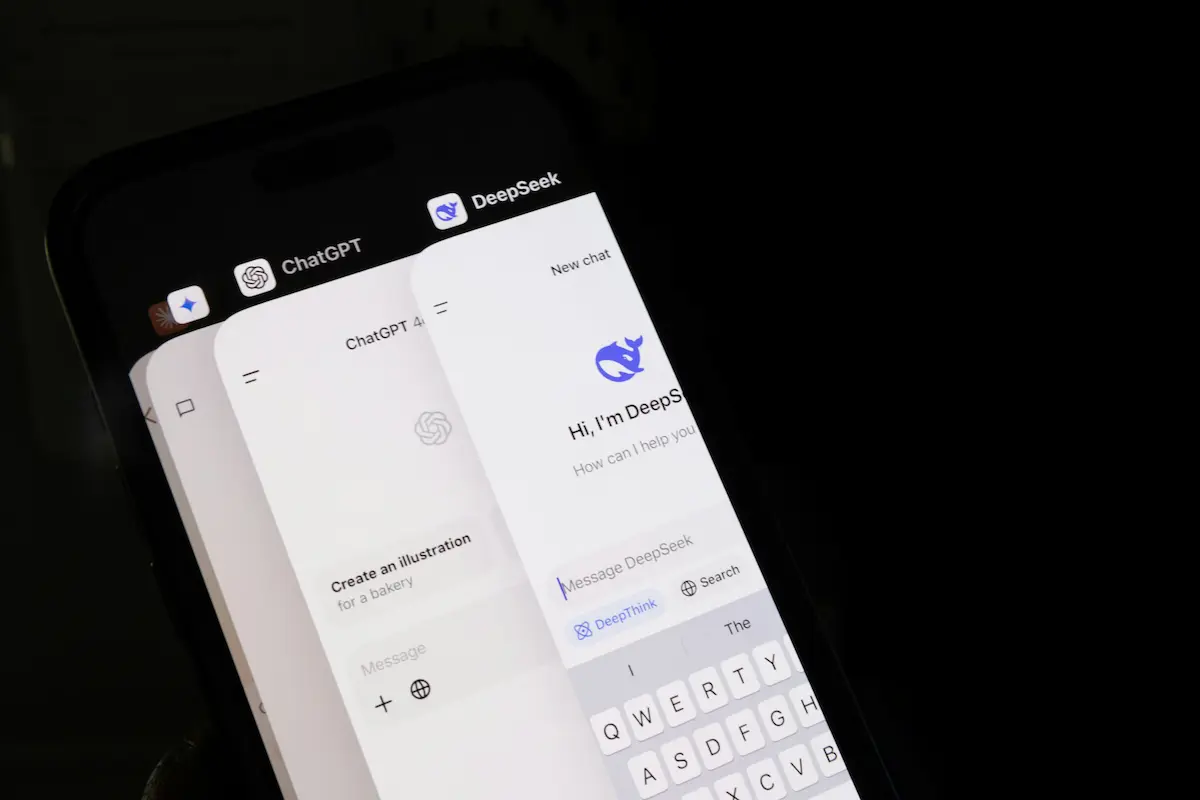

The industry assumption however got challenged in early 2025. Enter DeepSeek, a company that has levelled the playing field in the sector demonstrating a new rule – “Anyone can play”.

In recent weeks, China has made significant breakthroughs in AI, challenging the notion of U.S. dominance in the field. This is despite the Various. restrictions that the U.S. had placed on Chinese companies to fend any AI advances.

DeepSeek, originally focused on quantitative trading, has rapidly emerged as a major player by developing a near state-of-the-art model at jU.S.t 1/50th of previous. training costs. This achievement places it on par with American AI giants like OpenAI, Google, and Anthropic, both in terms of performance and innovation. A couple weeks later, DeepSeek followed up with a competitive alternative to OpenAI’s o1, called R1. Soon after, ByteDance (parent company of TikTok) dropped a third bombshell, a new model that is even cheaper. Then, a Hong Kong lab added yet a fourth advance, making a passable though less powerful version of r1 with even less training data.

Credit is due to China for making significant advancements without hundreds of thousands of Nvidia’s high tech H100 chips. If we look at DeepSeek’s R1 reasoning model, it took jU.S.t about two months, highlighting how quickly competition is intensifying in the AI landscape. A rapid pace of development, at a fraction of the cost and yet, quality was not compromised market impact depends on the sequence of policies and the severity. Trade, immigration, taxes, and deregulation are the fourprimary channels which will be influenced by US policy changes. Looking at President Trump’s campaign promises, and previous policies, tariffs and immigration curbs are expected to be announced and implemented quickly. Deliberations on how to extend the provisions of the Tax Cut and Jobs Act (TCJA) expiring at the end of 2025 could drag on for much of 2025. Regulation rewriting tends to move slowly, but changes in regulatory posture and enforcement could quickly change how companies are planning their investments, such as a potential pickup in M&A activities. Tariffs are growth negative, while tax cuts are pro-growth. A combination of faster policy implementation and fewer limiting factors drives more significant impacts. In addition, factors such as legal and procedural constraints, and/or appointees who support a gradualist approach could lead to lags and less severe policy implications for markets and the economy.

Upcoming meeting

The Prime Minister plans to deliver his policy speech on January 14 when the parliamentary session resumes. Should follow the presentation of a new finance bill, based in part on that of his predecessor Michel Barnier, with the ambition of having it adopted around mid-February. Mr. Bayrou was evasive on the deficit target for 2025 and on adjustments affecting taxes and spending. No one anymore believes that the deficit will be reduced to 5% of GDP in 2025. To ensure the neutrality of certain opposition parties, the Prime Minister also intends to re-examine the pension reform and promises to modify the voting method. by introducing a large dose of proportionality

What does it mean for the existing CHIPs act?

Many in Washington appeared to see the export controls as an urgently needed delaying tactic, perhaps guessing that it would buy the U.S. a few critical years and somehow secure a permanent advantage in the AI race. The most obvious. risk when the CHIPs Act was enacted was that it would encourage China to build its own chips. Policymakers in Washington anticipated China to invest heavily in self-sufficiency. As expected, China has already committed billions to advancing its semiconductor capabilities, intensifying the global competition in chip manufacturing and AI hardware. We have seen strong gains for Semiconductor Manufacturing International Corporation (SMIC), Alibaba and Lenovo in recent days.

However, with what has now conspired, the CHIPS Act, which was designed to slow China in the AI race, may turn out to be one of the worst backfires in history. Silicon Valley’s initial advantage in large language models evaporated quickly, despite export controls.

Deep seek circumvented the hurdles of the CHIPs Act by utilizing multiple specialized models working together to enable slower chips to analyse data more efficiently. DeepSeek stated it used Nvidia’s H800 chips, which could have been legally purchased in 2023. Moreover, the Chinese company seems to have used Nvidia’s less powerful H20s that can still be lawfully shipped to China.

For the U.S. government, DeepSeek’s arrival on the scene raises questions about its strategy of trying to contain China’s AI advances. Still, it’s not a lost cause with the CHIPs Act. Researchers have pointed out that there are still data centers operating in China running on tens of thousands of prerestriction chips. They also note that the real impact of the restrictions on China’s ability to develop frontier models will show up in a couple of years when it comes time for upgrading. Or it may show up after Nvidia’s next-generation Blackwell architecture has been more fully integrated into the U.S. AI ecosystem.

What does all this mean for OpenAI?

Sam Altman, one of the founders of Open AI seems undaunted by the recent developments. Altman said that it was “invigorating to have a new competitor,” but added that OpenAI’s product would still be better.

Better or not, we think the model has somewhat changed from what Open AI envisioned it to be. OpenAI’s best model is not free. On the contrary, DeepSeek released its model in a relatively open-source way, allowing anyone with a laptop and an internet connection to download it for free. And end users are now considering alternatives; there is no longer a sense that OpenAI is the only provider customers can turn to. There is no obvious. moat whatsoever. This is precisely what has thrown doubt into the assumptions about business models for AI companies and led to the turmoil in U.S. stock markets.

What does all this mean for Nvidia?

Nvidia, a company that makes high-end H100 graphics chips presumed essential for AI training, lost $589 billion in valuation in the biggest one-day market loss in U.S. history. DeepSeek, after all, said it trained its AI model without them — though it did use less-powerful Nvidia chips. Nvidia could soon face significant challenges on two fronts. Drop in demand for high performance chips, and competition in new generation chips.

First, DeepSeek’s advancements suggest that large language models may be trained far more efficiently in the future, potentially reducing the demand for Nvidia’s high-performance GPU.S.. The company has thrived by selling cutting-edge computing power during the AI boom, but if breakthroughs like DeepSeek prove that sophisticated AI can be developed with fewer resources, the need for Nvidia’s hardware could diminish. This shift would mark a major turning point in the AI industry, challenging Nvidia’s dominance and potentially reshaping the competitive landscape for AI infrastructure providers.

Secondly, while chip supply will still matter, the game has now clearly changed with more players entering as technology needs and use changes. For instance, differing Chips that might be better suited to AI based off reasoning models.

CEO of next-gen chip company Cerebras (still a private company) for example is celebrating. Their chips are designed specifically to make it more efficient to use AI. This process is called “inference” — basically, the act of running an AI model and allowing it to “think” and reason like a human, as opposed to the work of feeding data into the model to teach it how to do that thinking to begin with. When it comes to inference, Nvidia’s stranglehold is less severe, which has allowed several smaller startups to sprout.

Is the race for “AI Supremacy” over?

Well, over for at least for now. Or perhaps, the race has jU.S.t started, with a levelled playing field for all.

DeepSeek’s approach and an open-source model is likely a net positive for the industry, bringing exorbitant resource costs down and lowering the barrier to entry for researchers and firms. As mentioned above, it could also create space for more chipmakers than Nvidia to enter the race. Unlike technology in previous. decades, any advantage in the AI world will be a shortlived one, with the beneficiaries being consumers, for now.

Despite the U.S. restrictions, China’s achievements in efficiency are no accident. They directly respond to the escalating export restrictions imposed by the U.S. and its allies. By limiting China’s access to advanced AI chips, the U.S. has inadvertently spurred its innovation.

Deep Seek has demonstrated that the next big race toward Artificial General Intelligence (AGI) will not be won by the country with the most computing power but by the one that fosters true innovation. While the U.S. and China remain dominant players, the future of AGI may be shaped by a nation or organization willing to break free from traditional large language model approaches and invest in groundbreaking ideas. This shift underscores the growing importance of ingenuity over sheer computational scale in the next phase of AI development.

Disclaimer The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that: (i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings. (ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and (iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only. In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility. © 2020 Bordier Group and/or its affiliates.