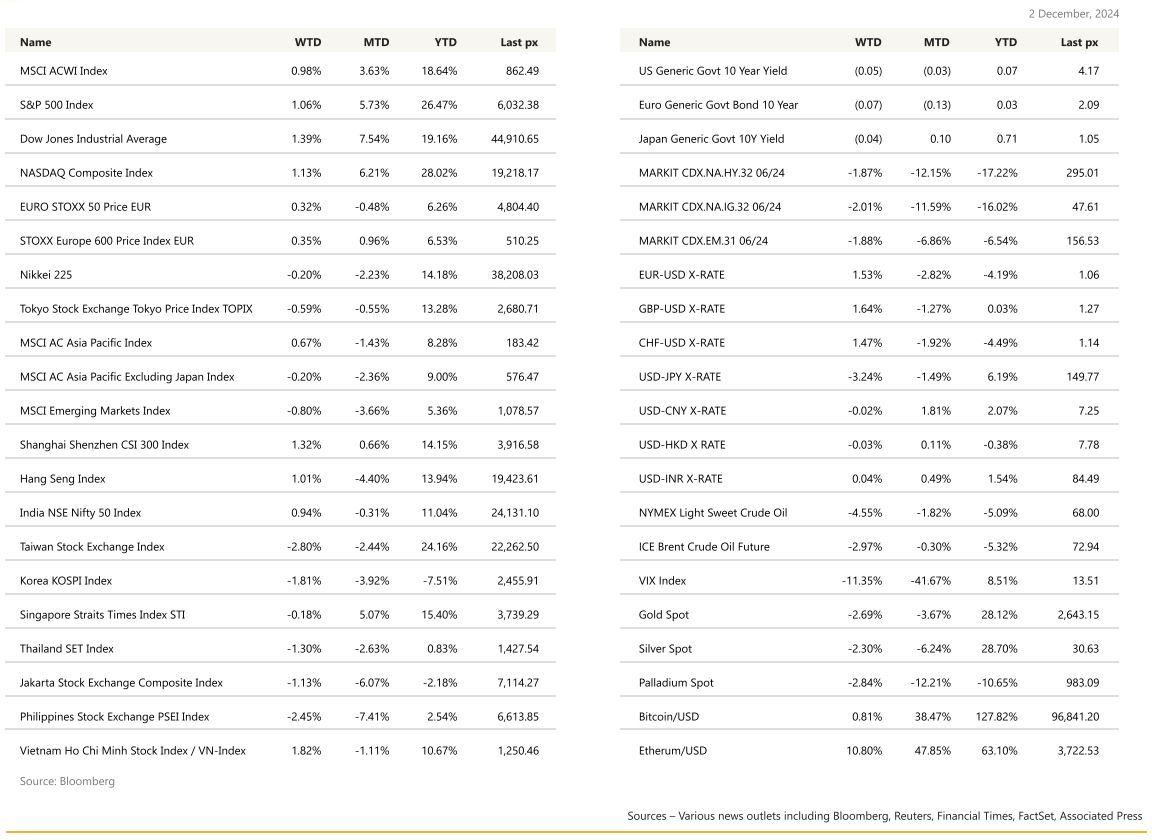

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets staged a comeback rally for the shortened week, and for the month the S&P 500 clocked in a respectable 5.87% performance whilst the Russell 2000 closed up 10.97%. Semiconductors put in a strong performance after Bloomberg reported that additional US curbs on sales of chip technology to China may stop short of some stricter measures previously considered. Trade tensions from Trump’s tariff threats eased a bit following a call between Trump and the President of Mexico. Trump has consistently vowed for trade tariffs on Mexico, Canada and China in particular.

On the inflation front, the latest PCE data fueled bets for a more measured pace of interest-rate cuts. Core PCE YoY came in at 2.8% from 2.7% previously whilst the MoM core was unchanged at 0.2%, as expected, mainly driven by service prices. The US economy expanded at a solid 2.8% annualized pace in the 3rd quarter, powered steadily by advances in consumer spending. Initial jobless claims came in lower than expected, easing concerns about a slowing labor market. The figures support recent comments by many Fed officials that there’s no rush to cut interest rates so long as the labor market remains healthy and the economy continues to power ahead. The last FOMC minutes indicated unsurprisingly, broad support for a careful approach to future interest-rate cuts as the economy remains solid and inflation slowly cools. “Participants anticipated that if the data came in about as expected, with inflation continuing to move down sustainably to 2% and the economy remaining near maximum employment, it would likely be appropriate to move gradually toward a more neutral stance of policy over time,” according to the minutes of the Federal Open Market Committee meeting ended Nov. 7. Some officials also said that the Fed could pause rate cuts if inflation remained elevated. Participants noted a lack of clarity as to where the so-called neutral rate should be.

Markets also sighed some relief after Trump nominated Scott Bessent, a hedge-fund veteran, as Treasury Secretary – where he may temper some of Trump’s trade policies. Treasury 10- year yields declined, suggesting that the nomination eased worries about persistent inflation under Trump’s protectionist policies. UST2’s and UST10’s closed at 4.15% and 1.468% respectively. The VIX closed lower at 13.51. WTI crude eased to $68 a barrel following the 60-day ceasefire agreement between Israel and Hezbollah. BTC has yet to take out $100k with little to trigger another upmove, at least for now.

This week will see ISM Manufacturing & Services data, JOLTS, Durable Goods Orders and BLS’ Employment Data. The unemployment rate is expected to remain unchanged at 4.1% with a 200k Nonfarm payroll from a hurricane-struck 12k addition in October.

We continue to favor small caps, financials and utilities (electricity-generation).

Europe

European equity markets finished higher on Friday. Basic Resources, Financial Services and Auto/Parts the best performers, while Telecom, Food/Beverage and Utilities lag.

On the macro data, despite last week s significant fall in euro area flash PMIs, last week s EC sentiment survey was stable at 95.8 (+0.1pt). Eurozone November CPI reached 2.3%, exceeding ECB’s target of 2% and climbing from October s 2% mark. However, Core inflation remained stable at 2.7%, defying expectations of an increase. Services sector inflation at 3.9%, also showed marginal improvement from 4% prior.

Germany’s November headline inflation came in at 2.2%, slightly below forecasts, with a notable 0.2% monthly drop pointing toward disinflation trends. However, core inflation rose to 3.0%, the highest since May 2024. The GfK Consumer Climate Indicator revealed a worsening outlook, dropping by 4.9 points to -23.3 for December, far below expectations of -18.6, highlighting increasing consumer pessimism.

Swedish battery maker Northvolt AB filed for bankruptcy protection under the U.S. Chapter 11 procedure, citing dwindling cash reserves of just $30 million (€28.81m). This setback underscores challenges faced by European industries in competing with cheaper Chinese and South Korean rivals. Any financial shortfall could become a burden on the EU budget, potentially creating further tension among member states.

In France, Marine Le Pen s Rassemblement National (RN) party signalled its intention to back a no-confidence motion against PM Michel Barnier s government, accusing it of ignoring RN’s fiscal priorities. Le Pen s party is pressuring the government for further budget changes, even after the administration dropped plans to raise electricity taxes. This political manoeuvring raises the stakes for Barnier’s government, as further concessions could weaken its broader fiscal agenda.

In addition, a recent Ifop-Fiducial poll for Sud Radio, conducted with 1,006 people on November 26 and 27, reveals that around 53% of the French population wants Prime Minister Michel Barnier’s government to collapse in response to anger over his proposed budget. The poll shows that 67% oppose Barnier’s budget, which aims to reduce France’s growing public deficit by implementing 60 billion euros ($63 billion) in tax increases and spending cuts, while 33% support it. If these sentiments persist, Barnier’s government could fall before Christmas, potentially as soon as next week, if far-right and left-wing opponents manage to force a no-confidence motion, which he is likely to lose.

In the UK, business confidence in the services sector is plummeting at its fastest pace in two years, partly due to tax increases. The sharpest decline is being felt in the consumer services sector, where major employers will face the brunt of a 25 billion-pound ($32 billion) rise in payroll taxes. A survey conducted on Thursday revealed that optimism among consumer services businesses dropped to its lowest level since August 2022, reaching -55 in November, down from -19 in August. Meanwhile, sentiment in the business and professional services sector fell from +9 to -29.

This week, we will see the final EU and the UK manufacturing PMI figures on Monday, the final services composite figures on Wednesday, EU retail sales on Thursday and the GDP figures in the EU on Friday.

Asia

Markets in Asia were mixed last week. The MSCI Asia ex Japan Index closed lower by 0.2%, the MSCI Asia was up +0.67%. Vietnam and China’s CSI 300 took the lead up 1.82% and 1.32% respectively. Taiwan was the weakest market, lower by 2.8% last week.

China’s factory activity showed continued expansion in November, with the official manufacturing PMI rising to 50.3, indicating marginal growth driven by a broad stimulus package. However, the non-manufacturing PMI slightly declined to 50 from 50.2, reflecting stagnation in the services and construction sectors. The Politburo meeting is expected to take place in December as a precursor to the annual Central Economic Work Conference (CEWC), although the exact dates have not yet been announced.

Japan’s Tokyo headline CPI for November exceeded expectations, rising by 2.6% year-on-year (consensus: 2.2%), with core CPI also stronger at 2.2% (consensus: 2.0%), while core-core CPI was in line at 1.9%. On the other hand, activity data showed weaker-than-expected performance. Retail spending grew by only 0.1% month-on-month in October (consensus: 0.4%), and industrial production rose by 3% month-on-month, falling short of the 4% consensus estimate. This mixed data highlights ongoing challenges in Japan’s economic recovery.

The Bank of Korea made a surprise rate cut, lowering the interest rate to 3% from 3.25%, signalling the need for accommodative monetary policy despite concerns over FX stability. The central bank also revised its GDP growth forecasts downward, projecting 2.2% for 2024 (down from 2.4%) and 1.9% for 2025 (down from 2.1%) due to weakening global trade. Additionally, the government plans to enhance fiscal support for domestic chipmakers in 2024 to boost the economy.

Vietnam plans to buy more aircraft, liquefied natural gas and other products from the US, as it braces for a new era of tariffs from the incoming Trump administration. Vietnam is among the world’s most trade-dependent nations, with exports accounting for about 85% of its economy and had a trade surplus of around US$100bn with the US last year. Vietnam PM Aims for About 8% Economic Growth in 2025.

GeoPolitics

Geopolitical backdrop still unsettled with progress in the Mideast somewhat offset by fears of escalation in the Russia/Ukraine conflict.

Israel – Lebanon: Agreement of 60 days ceasefire.

Ukraine – US – Russia: Escalation in Ukraine/Russia (additional ATACMS strike on Russia territory on Tuesday, the strike destroyed an S-400 air-defence missile system, there are casualties following this strike. So far, Russia has not retaliated against this strike yet.

The US has pressed Ukraine to lower its military recruitment age to 18 to address a severe shortage of manpower that has weakened its position on the battlefield and led to the fastest Russian gains in two years. “The simple truth is that Ukraine is not currently mobilising or training enough soldiers to replace their battlefield losses while keeping pace with Russia’s growing military,” the senior official said.

Zelenskiy said last weekend that he is open to Cease-Fire If NATO Protects Unoccupied Areas: He suggested that he’d accept a cease-fire with Russia that left parts of his country occupied in return for NATO security guarantees over the rest, the strongest signal yet that the Ukrainian leader is open to ending the war without regaining all territory.

US- BRICS: US President-elect Donald Trump warned the socalled BRICS nations that he would require commitments that they would not move to create a new currency as an alternative to using the US dollar and repeated threats to levy a 100% tariff. “The idea that the BRICS Countries are trying to move away from the dollar while we stand by and watch is OVER,” Trump said in a post to his Truth Social network on Saturday. Trump has long stressed that he wants the US dollar to remain the world’s reserve currency, saying in a March interview with CNBC that he “would not allow countries to go off the dollar” because it would be “a hit to our country.”

US President-elect Trump announced he intends to levy a 25% tariff on all imports from Mexico and Canada and an additional 10% tariff on imports from China. China’s share of U.S. imports has fallen from 21% in 2016 to 14%. Crucial consumer products, like smartphones, laptops, and toys, remain tariff-exempt, with China producing 81% of US. smartphone imports. Chinese equities have remained resilient in the face of tariff threats, buoyed by stimulus measures.

Credit Treasuries

US Treasury curve was very volatile last week and especially last Friday, for no specific reason (there was no economic data in the US last Friday). The curve bull flattened with the 2 & 5years yield down 15bps, 10 & 30years yield were down 17bps (down 10bps last Friday). Interest rates are retracing about ½ of what they lost last Friday. US IG 5years credit spread finished the week 1bps tighter while US HY 5years credit spread finished the week 3bps tighter, even though last Friday was also very volatile on credit, with HY spreads navigating through the day by an amplitude of 20bps, again for no specific reason. In term of performances, US IG gained 75pbs last week while US HY gained 30bps. Leverage loans were unchanged.

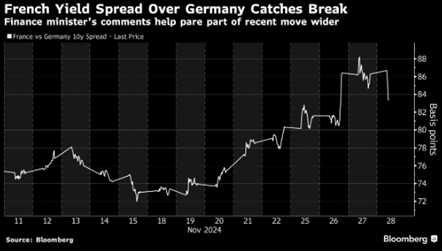

France’s 10-year yield premium over Germany — a closely watched gauge of risk — fell four basis points on Thursday, which would be its largest decline since July.

FX

DXY USD Index fell 1.69% to close the week at 105.737. Factors driving the pullback are (1) consolidation after extended movement (after nine straight weeks higher), (2) Month-end USD selling flows, (3) Scott Bessent nomination as Treasury Secretary (potential of a smaller than feared increase in the deficit). The Fed minutes showed broad support for gradually lowering rates, risks to achieving Fed target remained roughly in balance. But many participants noted uncertainty around r-star. On US macro data: GDP (3Q) confirmed at 2.8% saar in 2nd estimate; Personal income (Oct) +0.6% mom, above market; PCE price index (Oct) +0.2% mom/2.3% yoy, at market; Durable goods orders (Oct) +0.2% mom, below market; Pending home sales (Oct) +Up 2.0% mom, above market; Initial jobless claims (Nov 23) at 213k, below market. Based on OIS, market pricing a 65% chance of a Dec rate cut.

European Currencies rose against USD, driven by USD weakness, with EURUSD +1.53% to 1.0577, GBPUSD +1.64% to 1.2735 and USDCHF -1.44% to 0.881. Hawkish remarks from ECB members, with Chief Economist Lane arguing for a “careful, step-by-step” approach, Governing Council Member Nagel stating that the ECB must not “rush rate cuts”; ECB’s Schnabel: “only limited room” for further rate cuts, ECB “may not be so far” from neutral, which is somewhere between 2-3%.

On Eurozone macro data: Europe core CPI +2.7% yoy, below market; Headline CPI +2.3% yoy, in-line. Based on OIS, market pricing a 32.7 bps ECB rate in Dec.

AUDNZD fell 1.30% to close the week at 1.10. RBNZ cut its OCR by 50 bps to 4.25% as expected, the second straight cut of 50 bps. In addition, RBNZ governor indicated that another 50bps cut is coming in February if the economy evolves as expected. On Australia macro data: AU CPI +2.1% yoy, below market, remained well within the RBA’s target band in October. However, trimmed mean inflation +3.5% yoy (P: +3.2%).

USDJPY fell 3.24% to close the week at 149.77, driven by USD weakness and above market Tokyo CPI. Headline CPI +2.6% (C: 2.5%, P: 1.8%); Core CPI +2.2% (C: 2.0%, P: 1.8%). Core-core CPI +1.9% (C: 1.9%, P: 1.8%).

USDCAD rose 0.20% to close the week at 1.4006, with CAD weakness offsetting USD weakness. This is due to increased CAD risks following Trump’s announcement that on his first day in office the US would enact a 25% across-the-board tariff on both Canada and Mexico.

Oil & Commodities

Oil futures and Gold fell last week, driven by reduced safe haven appetite following a US brokered cease-fire deal between Israel and Hezbollah that came into effect. Gold price fell 2.69% to close the week at 2643.15. WTI and Brent fell 4.55% and 2.97% to close the week at 68 and 72.94 respectively. We have the OPEC+ meeting this Thursday, where the group is expected to delay a slight increase of production for a third time. Oil has been trading in a range of less than USD 6 since mid-October

Economic News This Week

-

Monday – NZ Building Permits, JP Capital Spending, AU Melbourne Inflation/Building App./Retail Sales, JP/CH/SW/ SZ/EU/NO/UK/CA/US Mfg PMI Nov Final, UK Nationwide House Px, US ISM Mfg

-

Tuesday – SZ CPI, US JOLTS

-

Wednesday – NZ ANZ Commodity Price, JP/CH/SW/EU/UK/ US Svc/Comps PMI Nov Final, AU GDP, EU PPI, US Mortg. App./ADP/Factory Orders/ISM Svc/Durable Goods Orders

-

Thursday – AU Trade Balance, SZ Unemploy. Rate, SW CPI, UK Construction PMI, EU Retail Sales, US Trade Balance/Initial Jobless Claims

-

Friday – EU GDP, CA Unemploy. Rate, US NFP/UMich

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.