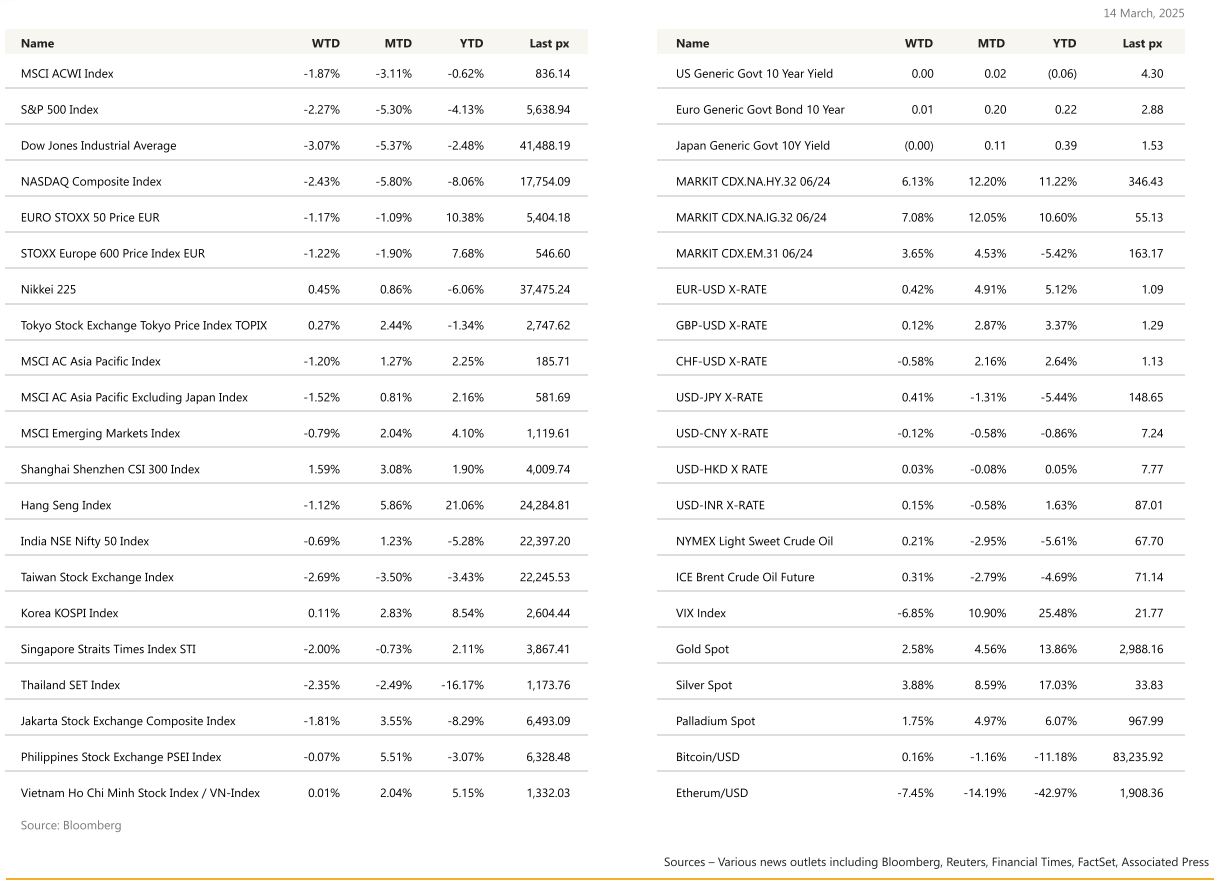

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

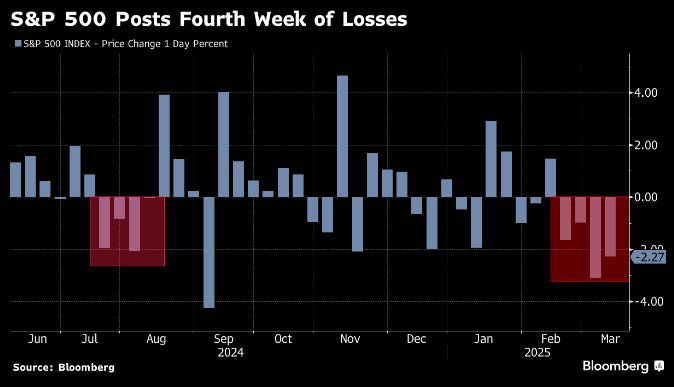

US markets closed the week down 2% plus, with the S&P 500 flirting with a “correction” before bouncing on Friday night. Contributing to the strong recovery on Friday was the risk of a US government shutdown fading following Senate Democratic leader Chuck Schumer choosing not to block a Republican spending bill. The market powered higher even as a report showed US consumer sentiment fell to a more than two-year low at 57.9 from 64.7 while long-term inflation expectations jumped to 3.9% from 3.5%, illustrating c oncerns about the economic impact from tariffs. Still, this was the 4th straight weekly decline for the S&P 500. Volatility reflected the slew of announcements from President Trump on trade, that raised concerns about the impact on the US economy. The VIX traded above the 29 level at one point which was the highest in months, before settling at 21 by the end of the week.

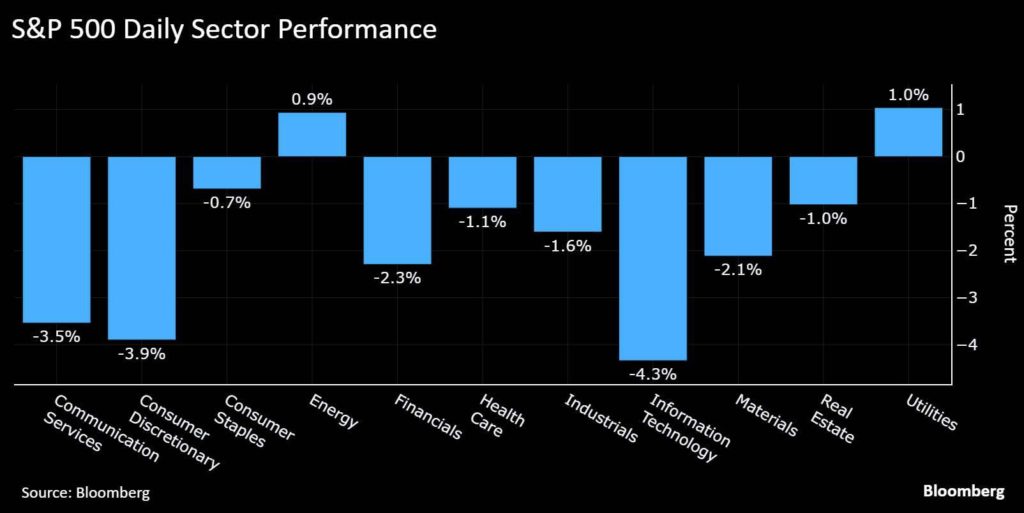

Technical analysts said market moves on Friday showed “evidence of short covering” but not necessarily aggressive equity buyers given a lack of a clear capitulatory moment. Utilities and energy emerged as havens amid economic woes:

CPI came in better than expected with an improvement on all metrics. Headline YoY CPI came in at 2.8% from 3% last month and the core MoM rate fell to 0.2% from 0.4% previously. It was also the second inflation report in as many weeks that showed progress on dis-inflation. The headline Producer Price Index (PPI for final demand) was unchanged in February (+0.0%) following an upwardly revised 0.6% in January, and below our and consensus expectation of 0.3%. The PPI excluding food, energy and trade services (core PPI) rose 0.2% and decelerated from 0.3% in January. This was also below both our and consensus expectations (0.3%). Prior months’ headline prices were revised up 17 bps combined, while core prices were revised up by just 1bp. On a 12-month basis, headline PPI inflation was 3.2%, a step down from 3.7% in January or 3.4% in December. Core PPI inflation ticked down again and was at 3.3% in February, following 3.4% in January and 3.6% in December. PPI components for airfares were below expectations but that was largely offset by stronger medical services prices. Based on today’s translation 12- month core PCE inflation should rise from 2.65% (rounding to 2.6%) in the most recent release to 2.75% (rounding to 2.7%) through February. Meanwhile 12-month headline PCE inflation is projected to remain at 2.5% (edging down from 2.51% to 2.50%).

US job openings beat, up ~240k to 7740k in January, hiring rates were steady at 3.4%, quits rate lifted to 2.1%, from 1.9% in December. Layoffs fell from 1.1% to 1.0%. The vacancy to unemployment ratio rose from 1.09 to 1.13. Positive tone overall but dated amid more recent worries about recession risks.

Last Wednesday, Bank of Canada delivered a 25bp rate cut in their latest policy decision, taking their overnight rate down to 2.75%, in line with expectations. Their statement acknowledged the ongoing trade war, saying that “heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada.” The statement acknowledged that they would need to assess “the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs.”

Canada retaliates against the latest US steel and aluminium tariffs, announcing tariffs on around C$30bn of US products, targeting steel and aluminium as well. And that followed on from the EU’s own announcement yesterday morning, who proposed countermeasures covering €26bn of American goods, which would come into force over April. So collectively, the fear is that this ratchet could be increasingly hard to climb down from over the months ahead. Amidst a visit to Ireland, Trump himself continued to make comments implying that tariffs would go up, saying that the US would respond to the EU countermeasures, that he wasn’t happy with the EU and that April 2 would be a very big day, when he’s planning to impose reciprocal tariffs.

Finally last Friday, the March preliminary University of Michigan sentiment index came out at 57.9 Vs 63.0 expected and 64.7 the previous Month. This is the 3rd Month in a row that the index prints lower and the last time that we tested this type of level was back at the end of 2022. Current conditions sub-categories was a touch lower (63.5 Vs 64.4 consensus) but Expectations subcategories printed at 54.2 Vs 63.0 expected. The 1years inflation forecast jumped to 4.9% Vs 4.3% expected (this number was at 2.8% 3Months ago ..) and the 5-10years inflation forecast came out at 3.90% Vs 3.40% expected.

However, given the Fed’s double mandate of full employment and price stability, the previous week’s labour data do point to some cracks and may even point to more workers struggling to secure stable and well-paying jobs. Many full-time workers have been forced into part-time positions. The payroll survey, which counts jobs rather than individuals, can inflate job numbers when workers take on multiple jobs. If a full-time worker loses their job and replaces it with two part-time positions, the payroll survey registers a net gain in jobs, despite their financial position worsening (Epic, 14/3/2025) which could also lead to weaker consumption. If the labour market is weaker than it appears, the Fed may turn more dovish, easing policy sooner than expected.

The U.S. economy faces headwinds from erratic tariff policies, weaker growth forecasts, and stretched market valuations, conditions that have significantly unnerved both markets and investors. However, while tariffs will undoubtably impact U.S. GDP, recession isn’t inevitable. Resilient consumer and corporate balance sheets, along with potential Fed support could stabilize conditions. While the odds of recession have risen, investors should not treat it as the base case, but neither should they dismiss the possibility outright.

Meanwhile, the US government shutdown has been avoided after the Senate passed a Republican-led measure last Friday to keep the government funded for the next six Months (until 30th of September). Nine Democrats and one independent allied with the party joined nearly all Republicans in the key procedural vote, overcoming a 60-vote threshold and paving the way for passage. The stopgap funding bill passed in the Senate 54-46.

We will have retail sales out this week, a measure of the US’ consumer resiliency. The main highlight will be the FOMC meeting concluding on Thursday, with no change in rates expected. We will also see an updated version of the FED Summary of Economic Projections as well as the Fed Dot Plots.

Watch this sector, which has lagged its European counterpart – US defence stocks. Lithuania’s defence minister Dovile Sakaliene said she recently met with executives from major US defence firms and sees a “need” for “at least $8 billion” more worth of business with American defence companies in “coming years,” according to a Breaking Defence report.

Europe

European markets ended the week on a downturn, with the Stoxx 600 declining by 1.22%. The index is on track for its second consecutive weekly loss as regional investors closely watch the turbulent developments in transatlantic trade policies.

Following the first parliamentary debate on 13 March, the Bundestag is expected to vote on 18 March on the set of reforms as part of their grand coalition negotiations. The Parliamentary approval requires a two-thirds majority and the support of the Greens. This week the German parliament will vote on the fiscal stimulus that was proposed two weeks ago. The vote in the Bundestag will take place on Tuesday and in the Bundesrat on Friday after the CDU/CSY, SPD and Greens reached a compromise on debt brake reform late last week. The three elements of the original proposal were slightly amended:

- Exempt defence spending over and above 1% of GDP from the debt brake, though with a broader definition of defence spending. This effectively allows for even more defence spending outside the debt brake than on the original proposal.

- Establish a EUR 500 bn off-budget fund for infrastructure investment to be spent over 12 years

- Of which EUR 100bn are earmarked for the Climate and Transformation Fund

- Of which EUR 100bn go to the federal states

- Which must be in addition to a minimum 10% investment spend in the core budget

- Raise the net borrowing cap for the German states from 0% to 0.35%.

The increase in defence spending would allow for a gradual build-up in European defence spending investment in the near term, especially given existing production capacity constraints and the relatively small industrial defence base in Europe.

Early last week, the EU announced it would retaliate to Trump’s 25% tariffs on steel and aluminum with countermeasures on 26 billion euros worth of goods. The EU’s tariffs could take aim at clothing, alcohol and industrial goods imported from the US. Trump then responded to the announcement with a threat to impose further levies on EU goods, threatening on Thursday to slap 200% duties on champagne and spirits originating from the bloc, unless the European Union removes 50% tariffs on American Whiskey, effective 1 April 2025. The move sent the major European beverage companies tumbling, while US spirits makers saw a boost. The US is a key market for European alcohol producers, accounting for about 1 fifth of beverages, spirits, and vinegar products exported by the EU in 2024.

“The initiator, the retaliator, the re-retaliator, and so on and so forth—all of that is going to hurt growth at large,” ECB president Lagarde said. “Everyone will suffer; this is a constant in history of trade.” Such measures are already dampening business activity through heightened uncertainty for companies, consumers, and investors.

In terms of data, the EA industrial production rose 0.8% m/m in January, with notable rebounds in Germany and Italy. French and Spanish February headline HICP inflation were unrevised from the flash prints but German HICP was revised 20bps lower to 2.6% y/y.

Fitch ratings affirm France at AA- and maintained its negative outlook for the country, citing the government’s challenge of bringing down the swollen public deficit. Fitch forecast that French government debt will increase to more than 120% of GDP by the end of 2028, higher than the agency’s previous forecast last October.

This week will bring the EA February Final HICP on Monday, the preliminary March consumer confidence on Friday.

In the UK, the economy’s unexpectedly shrank by 0.1% m/m in January. The imposition of tariffs on steel and aluminum exports to the US are small in terms of their direct impact on the UK, with around £500mn exported in 2024, less than 0.02% of GDP. Unlike European peers, the UK does not have a defence-motivated fiscal boost to act as an offset, as the announced increase in defence spending is being done in a way so as to be fiscally neutral.

This week, we are expecting a majority of the MPC to vote the Bank Rate to hold steady at 4.5% on Thursday. We will also see the labour market data for January on Thursday and the GfK consumer confidence on Friday.

Asia

With governments around the world trying to figure out how to respond to the US president’s tariffs agenda and threats of further measures, equity markets around the world have been plunged into turmoil amid uncertainty about what is to come. MSCI Asia ex Japan was lower by 1.2% last week. Nikkei 225 edged slightly higher 0.45% while the rest of Asia was mostly down. Hang Seng still holding the lead with YTD gains of 21.06%

We have heard more good news about China in the past three weeks than probably in the previous three to four years, Citi analysts have now downgraded US stocks to neutral from overweight while upgrading China to overweight, adding to growing doubts over US exceptionalism. Amundi saying global investors are finding better value in Greater China stocks than in US. Added interest in China is slowly coming back considering Beijing’s policy clarity, in contrast with rising uncertainty in US. Goldman Sachs earlier this week slashed its year-end S&P 500 target from 6500 to 6200 while downgrading its US GDP forecast to 1.7% from 2.4% — its first below-consensus projection in two and a half years.

Over the weekend, China has introduced a plan to boost domestic consumption and drive economic growth by increasing earnings, reducing financial burdens, and improving the consumption environment. The plan focuses on wage growth, stabilizing the property and stock markets, and expanding income opportunities. It also promotes both traditional sectors like housing and automobiles, and emerging industries such as AI, smart wearables, and 3D printing. The plan includes region-specific policies for rural areas, ice and snow resource-rich regions, and urban centers. It also aims to enhance winter tourism and expand visa-free entry to boost inbound consumption. Overall, the plan links consumption growth with broader social goals, such as improving elderly care and work-life balance, to enhance quality of life in China.

GeoPolitics

US – China: South China Morning Post citing sources reported US and China are making plans for an in-person meeting between President Trump and Xi as early as April. Both hope the other side to visit to present it as a diplomatic triumph while early talks have been around Trump visiting Beijing, which he previously said he wanted to travel to China during first 100 days in office. Meanwhile Trump expressed hope for Xi to visit Mar-aLago in Florida but China wanted a more formal setting in Washington or have Trump in China.

China – Iran – Russia: Beijing played host to Russia and Iran – both key diplomatic partners – on Friday for trilateral talks on Tehran’s nuclear program. China and Russia welcomed Iran’s reiteration that its nuclear program is exclusively for peaceful purposes and not for the development of nuclear weapons, and that Iran’s right to peaceful use of nuclear energy needs to be respected. The pledge was made by ViceForeign Minister Ma Zhaoxu, Russian Deputy Foreign Minister Ryabkov Sergey Alexeevich and Iranian Deputy Foreign Minister Kazem Gharibabadi in Beijing.

US- Ukraine- Russia: On March 11, the United States agreed to resume weapons supplies and intelligence sharing with Ukraine following Kyiv’s indication that it was open to supporting a ceasefire proposal. U.S. and Ukrainian delegations held a meeting in Saudi Arabia, where they discussed a proposal for a 30-day ceasefire covering land, sea, and air. The two sides also agreed to begin negotiations aimed at establishing a lasting peace that ensures Ukraine’s long-term security.

European Union foreign policy chief Kaja Kallas expressed her belief on March 13 that Russia is likely to agree to a ceasefire, but with conditions. Additionally, Saudi Crown Prince Mohammed bin Salman spoke with Russian President Vladimir Putin by phone, reaffirming Saudi Arabia’s commitment to supporting a political resolution to the conflict in Ukraine.

Ukrainian President Volodymyr Zelensky said Mr Putin was preparing to reject the ceasefire proposal but was afraid to tell Mr Trump.

US – Iran: U.S. President Donald Trump sent a letter to Iran’s Supreme Leader in an effort to initiate talks regarding Tehran’s advancing nuclear program. Although the letter’s contents have not been disclosed, its delivery coincides with the imposition of new sanctions on Iran as part of Trump’s “maximum pressure” campaign. Trump also hinted at the possibility of military action against Iran.

Iran has long maintained that its nuclear program is for peaceful purposes but has increasingly threatened to pursue nuclear weapons. The country now enriches uranium to 60% purity, a level near weapons-grade. This is a significant deviation from the 2015 nuclear deal, which permitted Iran to enrich uranium only up to 3.67% purity and restricts its stockpile to 300 kilograms. As of the latest International Atomic Energy Agency report, Iran’s stockpile has grown to over 8,200 kilograms, with a portion enriched to 60%. U.S. intelligence agencies have assessed that while Iran has not yet begun a weapons program, its actions place it in a position to develop one if it chooses.

The Supreme Leader of Iran emphasized that the country does not seek war, but warned that any wrong action by the U.S. or its allies would lead to decisive retaliation, with the U.S. bearing the brunt of the damage. He also reiterated that Iran is not interested in nuclear weapons.

Credit/Treasuries

The shape of the US Treasury curve last week almost did not change at all, with all the points (2years à 30years yield) up by around 6bps. US IG 5years credits spreads widened by 2.5bps while US HY 5years credit spreads widened by 14ps.

FX

DXY USD Index fell 0.12% to close the week at 103.72 (9 consecutive weekly loss) driven by growing recession fears in the US.

Trade tensions remain high as US tariffs on steel and aluminium were quickly met with retaliatory measures from Canada and EU. On US macro data, US CPI and PPI both comes in softer than expected. However, components that feed into PCE remain firm. The preliminary March University of Michigan Consumer Sentiment survey deteriorated further, with both current conditions and expectations falling amid the ongoing policy uncertainty. 1y inflation expectations rose further, the highest level since November 2022. US government averted a shutdown, as the spending deadline is extended until 30-Sep. Support level at 103, while resistance level at 104.50.

European Currencies performed mixed against USD; EURUSD rose 0.42% to 1.0879; GBPUSD rose 0.12% to 1.2935; SEK and CHF both fell against USD, with USDSEK +0.43% and USDCHF +0.59%. EUR was supported, as Germany reached a compromise on debt brake reform with only slight amendments to the original proposal, one of which allows for even more defence spending outside the debt brake. In UK, GDP contracted 0.1% m/m in January (C: 0.1%; P: 0.4%) as a correction after the strong December release. The Index of Services rose 0.1% m/m (C: 0.1%; P: 0.4%), while Industrial Production fell 0.9% (C: -0.1%; P: 0.5%). In Sweden, GDP fell 0.5% m/m in January (P: 0.5%), pointing toward a weak start to 1Q25.

Antipodean Currencies rose against USD; AUDUSD rose 0.30% to 0.6324, while NZDUSD rose 0.67% to 0.5748. Both AUD and NZD were supported by media reports that China state Council scheduled press conference on potentially stimulating consumption. In Australia, Consumer Confidence rose to 95.9 in March (P: 92.2), reaching a new three-year high. Meanwhile, Business Confidence weakened to -1 in March (P: 5.0) , but conditions indices improved across most measures. Australia Melbourne institute inflation expectations dropped 1ppt to 3.6% in March, lowest since 2021. Leans dovish for the RBA, with headline inflation on the monthly measure back in the 2-3% target band for the past 6 months, suggests consumers haven’t attached a permanent covid ‘premium’ to price expectations.

USDJPY rose 0.41% to 148.64 following reports around the US avoiding a government shutdown likely increased confidence. In addition, after Japan’s GPIF reportedly decides it would keep its current portfolio allocation weights unchanged against some expectations for a higher weight for Japanese assets, supporting USDJPY. In Japan, 4Q24 Real GDP was revised down to 2.2% SAAR (Preliminary: 2.8%; C: 2.8%; 3Q24: 1.4%). The largest labor union association Rengo released the first tabulation of 2025 wage hike negotiations. The Average Overall Wage Hike came in at +5.46% (2024: 5.28%). The wages report was in line with BoJ expectation, and BoJ is expected to keep its rate unchanged on Wednesday.

USDCAD was relatively unchanged (-0.04%) last week. BoC lowered its policy rate by 25bp to 2.75% at its March meeting, in line with consensus expectations. The statement highlighted that continued trade uncertainty was one of the drivers behind the decision, and monetary policy may not be able to offset the macroeconomic impact of trade tensions

Oil & Commodity

WTI crude and Brent crude oil futures rose last week, with WTI (+0.21%) to 67.18 and Brent (+0.31%) to 70.58. The Energy Information Administration slashed its prediction for a surplus for this year and halved its outlook for a glut in 2026, citing the prospect of diminished flows from Iran and Venezuela. Despite the price rise, overall sentiment remains fragile due to tariff developments and concerns over US growth, with geopolitical concerns also remaining a key factor. Effectiveness of sanctions against Russia have been receiving some scrutiny after crude flows from all Russian ports in the four weeks to Mar-9 saw biggest jump since the beginning of 2023, a sign of sanctions evasion. The rise comes despite soft energy CPI and a 1.4mn barrel increase in crude oil inventories.

Gold rose to a record high of 3004.94 last Friday, before closing the week (+2.58%) at 2984.16. Gold prices were supported by haven demand amidst the ongoing trade tensions.

Economic News This Week

- Monday – CH Indust. Pdtn/ Retail Sales, US Empire Mfg/ Retail Sales

- Tuesday – JP Tertiary Industry Index, EU Zew, CA CPI, US Housing Starts/ Building Permits/ Indust. Pdtn

- Wednesday – JP Core Machine Orders/ Indust. Pdtn/ BoJ Rate Decision, EU CPI, US MBA Mortg. App./ FOMC Rate Decision

- Thursday – NZ GDP, AU Employ., CH LPR, UK Employ., SZ SNB Rate Decision, SW Riksbank Rate Decision, UK BoE Rate Decision, US Initial Jobless Claims/ Leading Index/ Existing Home Sales

- Friday – JP Natl CPI, UK GfK Cons. Confid., EU Cons. Confid.

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.