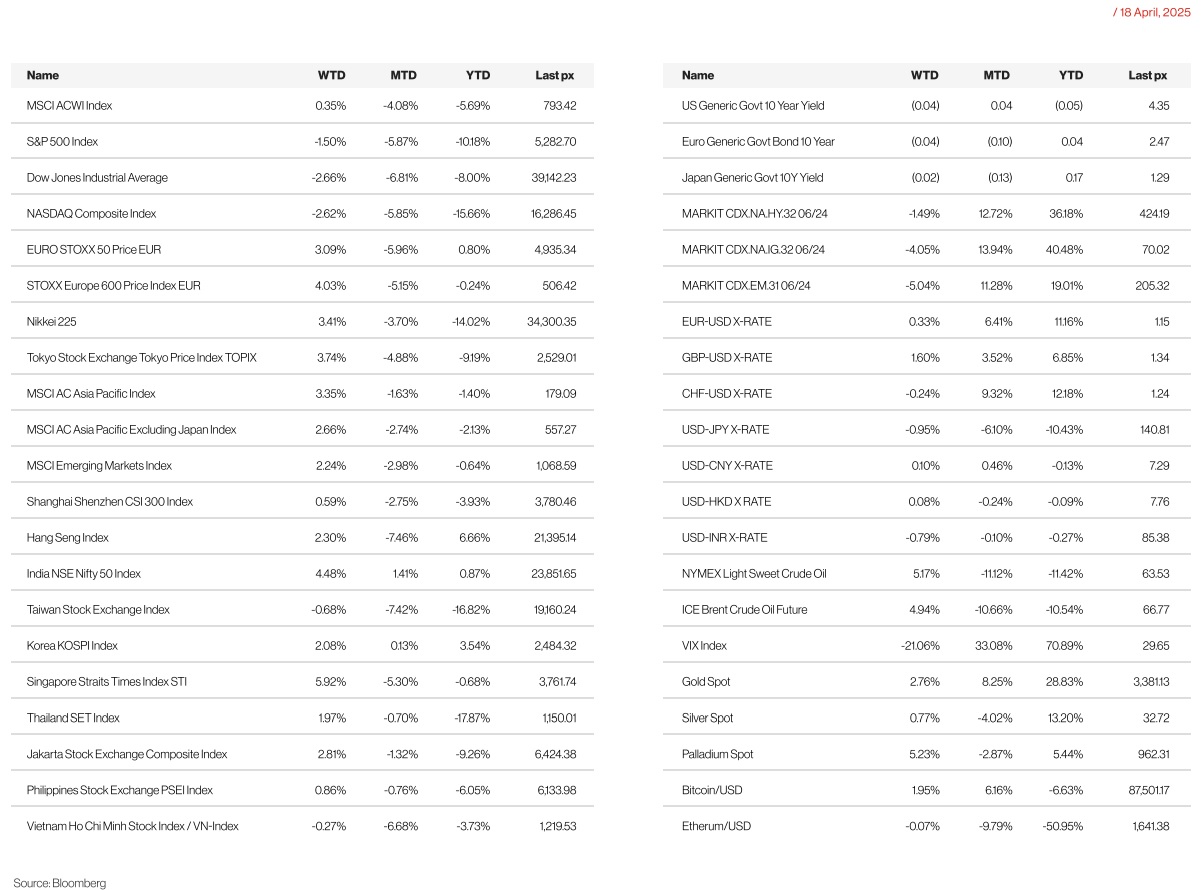

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

The shortened week brought no joy to markets as purported tariff negotiations produced nothing of substance, as yet. President Trump touted progress in trade talks and investors parsed corporate earnings to assess the impact of tariffs on firms. The S&P 500 logged its seventh down week in nine as Wall Street remains on edge about the impact of tariffs on the global economy. The Cboe VIX Index hovered around the key level of 30, signalling expectations for price swings to continue. Treasury Secretary Bessent posted on X that discussions with Japan are “progressing in a highly satisfactory direction,” and Trump said after his meeting with Italian PM Meloni he expects a to reach a trade deal with the EU, but indicated he is in no hurry to finalize an agreement to reduce tariffs. Such was the news headlines that nothing of substance was in the pipeline to sway sentiment positively. President Trump also took to social media to criticise Fed Chief Powell arguing that they should have already lowered interest rates this year and that a termination from his position “can’t come soon enough”.

The Dow fell 2.66% for the week after its blue chip component, United Health fell some 22% after reporting a first-quarter profit that fell short of analysts’ expectations. Earlier in the week, markets sold off after Fed Chair Powell warned that trade tensions could spur inflation and emphasised that Fed is in no rush to reduce interest rates – effectively pushing back on any immediate trigger of the so-called Fed put. The one bright spark atleast for now comes from corporate insiders who are buying up their own shares in this rout, at the fastest pace in 16 months. Some 180 corporate insiders purchased their own stock in the first two weeks of the month, data compiled by the Washington Service show. This has tipped the buy/sell ratio to 0.40, keeping it near the highest level since late 2023.

Data wise, applications for US unemployment benefits fell to the lowest level in two months, reflecting a stable labour market. US retail sales rose substantially in March on a jump in car purchases and other goods such as electronics, suggesting consumers were scrambling to get ahead of tariffs.

On the war in Ukraine, The US is open to recognizing Crimea as part of Russia under a peace agreement with Ukraine, and has presented a framework that includes easing sanctions on Moscow in the event of a lasting ceasefire. The US warned that it may soon abandon efforts led by President Donald Trump to end the war in Ukraine if there isn’t meaningful progress toward a ceasefire. Russian President Vladimir Putin had earlier ordered a 30-hour pause in hostilities in Ukraine that will cover Easter Sunday.

The week ahead will see PMI data on manufacturing, services and composite, durable goods orders as well as the Fed’s Beige Book report. On Friday we’ll have the U. of Mich. sentiment and inflation expectations.

Europe

European equity markets ended the week higher with the Eurostoxx 50 up 3.09%. Energy, Real Estate, and Retail sectors outperformed, while Technology, Construction/Materials, and Banking lagged behind.

The European Central Bank (ECB) lowered interest rates by 25 basis points to 2.25%, emphasizing a meeting-by-meeting approach to future policy decisions, with no firm guidance on the path ahead.

Eurozone inflation figures were left unchanged, with headline inflation at 2.2% year-on-year (down 0.1 percentage point from February) and core inflation at 2.4% (down 0.2 percentage point). The decline in inflation was driven by a slowdown in service prices (down 0.3 points to 3.4%) and energy costs returning to negative territory (a 1.2-point drop to -1.0%). Industrial production in the Euro area grew by 1.1% month-on-month in February, following a downward revision of January’s growth to 0.6%. This increase was largely influenced by significant rebounds in Belgium (+7.4% m/m) and Ireland (+10.8% m/m). Sector analysis showed varied performance, with gains primarily stemming from higher output in the chemicals and pharmaceuticals sector (+6.2% m/m).

Despite a temporary 90-day halt on new tariffs, equity markets remain volatile as earnings season gets underway. UBS noted in a recent update that the European economic backdrop remains generally positive, though recent trade tensions have highlighted the region’s susceptibility to global shocks. While the consensus forecasts a 6% earnings per share (EPS) increase for 2025, Barclays is more cautious, projecting flat earnings and suggesting that markets may already be pricing in an economic slowdown. Following recent declines, valuations have adjusted, with the Stoxx 600 now trading around 12.5 times forward earnings.

On the trade front, EU US talks have yielded little progress. Although diplomatic efforts continue during the current negotiation window, EU Trade Commissioner Šefčovič returned from Washington without firm commitments from US officials, who pushed back on proposals like the “zero-for-zero” tariff deal on industrial goods. Meanwhile, China is attempting to strengthen ties with Europe amid ongoing US China trade tensions. EU leaders are scheduled to visit Beijing in July, which coincides with the end of the 90-day grace period before US tariffs on European goods are set to double from 10% to 20%.

In the UK, March’s headline inflation eased to 2.6% year-on-year from 2.8% in February. Core inflation also dipped slightly to 3.4% from 3.5%. Inflation is now running below the Bank of England’s expectations across all major categories. Services inflation declined to 4.7% from 5.0%, despite businesses preparing for the April National Insurance tax increase. Next month’s inflation data will be critical in determining how much of that cost is being passed on to consumers.

Looking ahead, key indicators such as the Eurozone’s flash consumer confidence and PMI data are due next week, alongside the UK’s retail sales figures and GfK consumer sentiment results.

Asia

Stocks in Asia rose after US President Donald Trump floated a potential pause in auto tariffs, providing further relief to the market after the 90 day pause and also rollback on semiconductors and electronics was announced. India’s Nifty stands out, closing above its multi-month highs and was testing the high of January. Nifty ended the week up 4.48%. MSCI Asia closed the week higher 3.35%, and Singapore closed strong, up 5.92% for the week.

JD Vance is visiting India starting Monday. Vance’s visit includes a bilateral meeting with Prime Minister Narendra Modi, with sector-specific trade discussions taking place this week, aiming to wrap up by the end of May, and hopes are high for a quick deal to secure a reprieve from higher tariffs. The US has long sought to cultivate a deeper partnership with India, in large part as a bulwark against China.

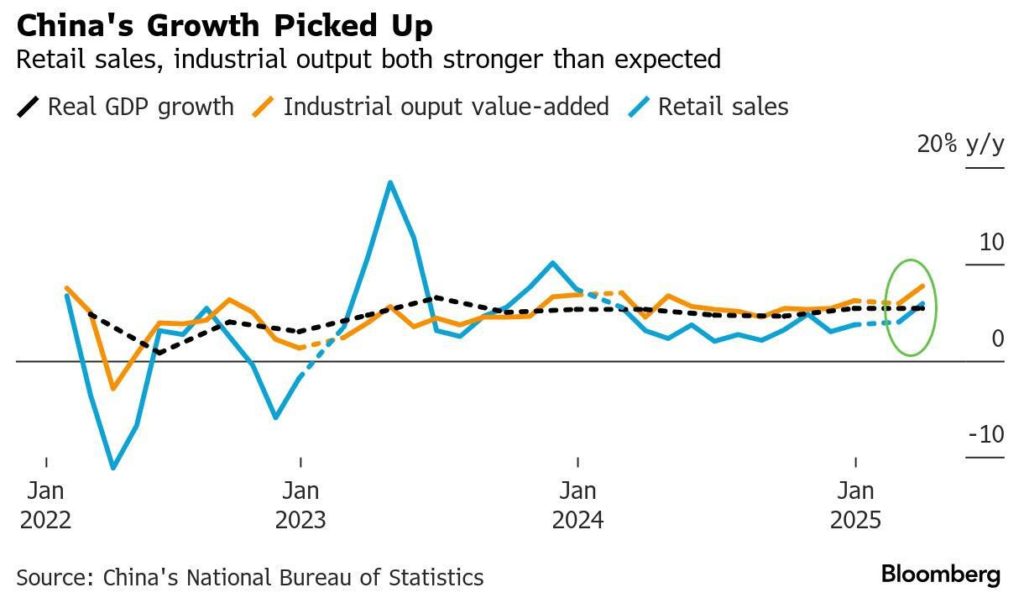

GDP in China was expected to show the economy slowing ahead of the tariffs. In reality, it didn’t.

China’s gross domestic product (GDP) grew 5.4% in the January – March quarter from a year earlier, unchanged from the fourth quarter, but beat analysts’ expectations in a Reuters poll for a rise of 5.1%.

The Trump administration has launched investigations into semiconductor and pharmaceutical imports under Section 232 of the Trade Expansion Act of 1962, citing national security concerns over America’s reliance on foreign production. The probe paves the way for sector-specific tariffs and marks a further escalation of the administration’s broad trade confrontation.

Drug manufacturers may be forced to absorb new tariffs or pass costs on to consumers in an already high-priced healthcare market. Nearly half of key antibiotic ingredients used in the US originate from China. In a further move, Washington will begin levying fees on Chinese-built ships docking in US ports, a step intended to bolster domestic shipbuilding but one that risks intensifying trade tensions with Beijing.

In response to recent US tariffs of up to 145% on Chinese goods, Beijing extended export controls on seven rare earth elements crucial to industries such as electric vehicles, renewable energy, and defense. Supply chain disruptions are anticipated, with US stockpiles estimated by analysts to last only three to six months. The F-35 fighter jet, a cornerstone of US military capability, depends on Chinese rare-earth materials.

Vietnam, China’s largest ASEAN trading partner with bilateral trade exceeding $205 billion in 2023, is also preparing to expand aircraft imports —potentially opening doors for Chinese manufacturer Comac. Beijing and Hanoi signed 45 agreements spanning connectivity, AI, customs, agriculture, culture, and infrastructure. Among them is a $8.4 billion crossborder railway project linking northern Vietnam with key cities and ports, aimed at deepening logistical integration. Chinese President Xi Jinping urged Vietnam to jointly oppose “unilateral bullying,” calling for closer cooperation to safeguard global trade and supply chain stability.

Meanwhile, Thailand, facing a 36% US tariff, is set to meet American officials this week. Bangkok is leveraging Washington’s 90-day tariff reprieve to negotiate terms, with the US remaining its largest export market at $55 billion in 2023.

South Korea “will not fight back” against US tariffs, its acting president has said, citing the country’s historical debt to Washington ahead of trade talks with Donald Trump’s administration set to begin this week. Trump said that negotiations with Seoul would explicitly link trade and security issues, including “payment for the big time military protection we provide to South Korea” — a potential major concern for Seoul which depends on US protection from the North Korean nuclear threat.

Seoul has also announced it’ll expand its chipmaker support by 25% to $23B Trump’s tariffs and increased competition from China. The Bank of Korea’s seven-member board held its benchmark interest rate at 2.75% last week.

Singapore can no longer rely on a “working” global trading system to fit into, unlike in previous crises, and a recession, though unlikely, remains a possibility, Senior Minister Lee Hsien Loong said. On Monday, 14th April, Singapore downgraded its growth forecast for 2025 from 1 per cent to 3 per cent, to 0 per cent to 2 per cent, citing the impact of the tariffs.

GeoPolitics

US- Iran – China: The Trump administration has imposed sanctions on a Chinese refinery for buying Iranian crude oil, as Washington increasingly pushes Beijing to rein in oil purchases from the country to increase the pressure on Tehran. The Treasury department targeted Shandong Shengxing Chemical for allegedly buying more than $1bn in Iranian crude oil from sources that included a front company for Iran’s Islamic Revolutionary Guard Corps in violation of US sanctions.

Israel – Palestine:

An Israeli airstrike has hit the last fully functioning hospital in Gaza City, reportedly 20 minutes after the military issued a warning to evacuate. Hamas, which published another US-Israeli hostage proof-of-life video over the weekend, has denied Israeli allegations it was using the hospital as a command-and-control centre

Hamas said early last week that Israel has offered a 45-day ceasefire if it releases half of the remaining hostages held in Gaza, which the United Nations said is now in the grip of its worst humanitarian crisis since the start of the war. Israel has cut off all aid to the Gaza Strip since Mar 2 to pressure Hamas.

Israel – Palestine – France:

Palestinian president Mahmud Abbas and French President Emmanuel Macron called for an “urgent” ceasefire in Gaza. Macron angered Israel last week when he suggested Paris could recognise a Palestinian state during a United Nations conference in New York in June.

US- China:

Beijing warned nations against making trade agreements with Washington that hurt China, highlighting how economies around the world risk getting caught up in tensions between the two powerhouses.

The US commerce department confirmed on Tuesday it was issuing new export licensing requirements for the H20, as well as AMD’s MI308 and equivalent chips. Washington’s crackdown on H20 chips is the latest example of how the US is using tariffs and other trade barriers to increase pressure on Beijing. Nvidia said it would take a $5.5bn charge in the quarter to April 27 related to H20 chips. Its shares fell 6 per cent in after-hours trading post announcement. Huawei launched new Ascend 920 AI chip which is 30-40% faster than the previous-generation AI processors, and can perform better than the Nvidia H20 semiconductor.

Chinese airlines have been ordered not to accept any more deliveries from Boeing. The Chinese government also asked its airlines to halt purchases of aircraft-related equipment and parts manufactured by U.S. companies.

Credit/Treasuries

Global yields fell last week following better risk sentiment as US announced a temporary tariff exemption for electronics, Trump highlighted “big progress” in trade talks with Japan, said he was confident about a deal with EU and mentioned possibility of some exemptions for auto industry, while report noted China open to trade talks with US under certain conditions. UST yields fell with 2yr (-16 bps), 10yr (-16 bps) and 30 yr (-7 bps). The outperformance of Treasuries was supported by comments from Deputy Treasury Secretary Michael Faulkender that officials were investigating potential changes to the Supplementary Leverage Ratio regulation, which could allow banks to buy more Treasuries. In the meantime, US credit spreads also tightened, with HY spreads down -6bps to 424bps, whilst IG spreads came down -3bp to 70bps. Despite denials from Bessent, since the 1960’s, similar “bear steepening” patterns in the yield curve, following an inversion, typically occurred when the U.S. economy was in a recession or headed for one soon. The 2-10’s were inverted for 2 years previously.

In Europe, the sovereign bond rally also gathered pace, with 10yr bund yields coming down -9.8bps to 2.47%. So remarkably, the tariff developments have seen yields unwind nearly all of their rise after the German fiscal shift, as it was only just over a month ago (March 5) that 10yr bund yields saw their biggest daily jump (+29.8bps) since German reunification in 1990. Italian government bonds outperform (10y -16.6bp) following S&P Global s upgrade of Italy s rating to BBB+.

FX

DXY USD Index closed below its key support level (100) to 99.23 (-0.87% for the week), a level last seen in July 2023. The fourth weekly DXY decline was driven by stagflation fears amid tariff uncertainty. On monetary policy, Fed Chair Powell continues to emphasize that rates are well positioned to wait for greater clarity while flagging the Fed may face a challenging scenario where the dualmandate goals are in tension , indicating Fed put is being pushed back. On macro data, NY Fed s 1-yr ahead inflation expectations index rose in March, above consensus and now at its highest level since September 2023, but also a much more moderate increase in expectations than in the Michigan survey. March retail sales data were strong, with upward revisions in previous two months. However, Strong auto sales likely due to pulled forward demand ahead of tariffs supported headline retail sales. Fed independence back in the headlines after President Trump posted today “Powell s termination cannot come fast enough!” (Powell s term as Fed chair ends in May 2026). On tariffs, renewed optimism around the potential for trade negotiations following successful trade talks with various US key partners such as Mexico and Japan.

European Currencies performed mixed against USD with EUR (+0.33% to 1.1393), GBP (+1.60% to 1.3296) and CHF (-0.25% to 0.8168). Even though anecdotal evidence of some market participants looking to diversify away from the US continued to build, CHF strength was muted against the USD as some market participants seemingly continued to debate the potential for SNB intervention or emergency cuts in light of recent CHF strength. In addition, renewed optimism around potential trade deals supports risk sentiment and as a result, safe-haven currency (CHF) underperform. In the eurozone, the ECB cuts rates by 25bp to 2.25%, as expected. The statement removes the explicit reference to rates being “restrictive,” and emphasizes a deterioration in the growth outlook due to “rising trade tensions” which pose the risk of having “a tightening impact on financing conditions.” On UK macro data, UK headline headline CPI slowed to 2.6% y/y in March (C: 2.7%; P: 2.8%) due to lower-than-expected food inflation. Core CPI slowed to 3.4% y/y (C: 3.4%; P: 3.5%) as Services CPI slowed to 4.7% y/y (C: 4.8%; P: 5.0%). RPI came in at 3.2% y/y (C: 3.2%; P: 3.4%). UK employment beat: +206k in three months to February (C: 170k). Unemployment rate steady at 4.4%, earnings missed: +5.9% y/y (C: 6.0%)

Antipodean Currencies rose against USD with AUD (+1.40% to 0.6377) and NZD (+1.92% to 0.5937), supported by positive risk sentiment at the end of the week. In Australia, employment added 32k jobs in March (C: 40k; P: -58k). The Labor Force Participation increased to 66.8% (C: 66.9%; P: 66.7%), and the Unemployment Rate rose to 4.1% (C: 4.2%) from a downwardly revised 4.0% in February. RBA minutes signal an openness to future easing highlighting May as an “opportune time” to revisit policy, while emphasizing that the outcome of the decision “was not predetermined.” In New Zealand, Headline CPI rose 0.9% q/q in 1Q24 (C: 0.8%; P: 0.5%).

USDCNH rose 0.26% to 7.3061 driven by high US-China trade war tension, as the US restricts sales of semiconductor chips to China. CNH fell despite reports that China is open to trade negotiation talks with the US if certain conditions are met and above consensus China macro data. Trade Surplus widened to $102.6bn in March (C: $75.2bn; P: $31.7bn), as Exports rose by 12.4% y/y (C: 4.6%; P: -3.0%) reflecting normalization from residual LNY seasonality, while Imports contracted by 4.3% y/y (C: -21.%; P: 1.5%) amid steel production cuts. 1Q25 GDP growth beat consensus expectations, coming in at 5.4% y/y (C: 5.2%; P: 5.4%), led by policy frontloading on infrastructure, tech and consumption. Sequentially, GDP was up 1.2% q/q in 1Q25 (C: 1.4%; P: 1.6%). Retail Sales rose by 5.9% y/y in March (C: 4.3%; P: 4.0%). Industrial Production rose by 7.7% y/y in March (C: 5.9%; P: 5.9%). Meanwhile, Fixed Assets Investment YTD edged up to 4.2% y/y in March (C: 4.1%: P: 4.1%).

USDCAD fell 0.21% to 1.3847. On macro, big miss on Canada headline CPI, +0.3%m/m in March (C: +0.7%). Trimmed mean measure of core also missed, up 2.8% y/y (C: 3.0%). The BoC maintained its policy rate at 2.75% at its April meeting. The decision to hold comes as the Bank decided to “gain more information about both the path forward for US tariffs and their impacts.” Regarding future decisions, the Bank reiterated that it will “proceed carefully” as it pays attention to “the risks and uncertainties” facing Canada. The Bank is also prepared to act “decisively” if incoming information points in one direction. The neutral rate remains unchanged at 2.25-3.25%. Forecasts included two scenarios as opposed to one outlook: “Scenario 1” lays out a more optimistic path in a situation where tariffs are negotiated away, while “Scenario 2” lays out a more dire situation where uncertainty and limited tariffs persists, and other US tariffs are added.

Oil & Commodity

WTI crude and Brent crude oil futures closed the week at 64.68 (+5.17%) and 67.96 (+4.94%) respectively. The rise was initially supported by news of China’s openness to talks and then was further boosted by news of additional US sanctions on Iranian oil, with Treasury Secretary Bessent posting that “we will apply maximum pressure on Iran and disrupt the regimes oil supply chain and exports”.

Gold continued its upward trend, breaking its previous record high (+2.76%) to 3326.85 last Thursday. Gold continued to trade at new high (currently trading at 3384 at the point of writing) after National Economic Council Director Kevin Hassett said last Friday that President Trump is still exploring ways to remove Fed Chairman Jerome Powell.

Economic News This Week

- Monday – CH LPR, US Leading Index

- Tuesday – NZ Trade Balance, SW Unemploy., EU Cons. Confid., US Richmond Fed Mfg Index

- Wednesday – AU/JP/EU/UK/US Mfg/Svc/Comps PMI April Prelim., US MBA Mortg. App./ New Home Sales

- Thursday – NZ Cons. Confid.,US Durable Goods Orders/ Initial Jobless Claims/ Existing Home Sales

- Friday – JP Tokyo CPI, UK Retail Sales, CA Retail Sales, US UMich

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.