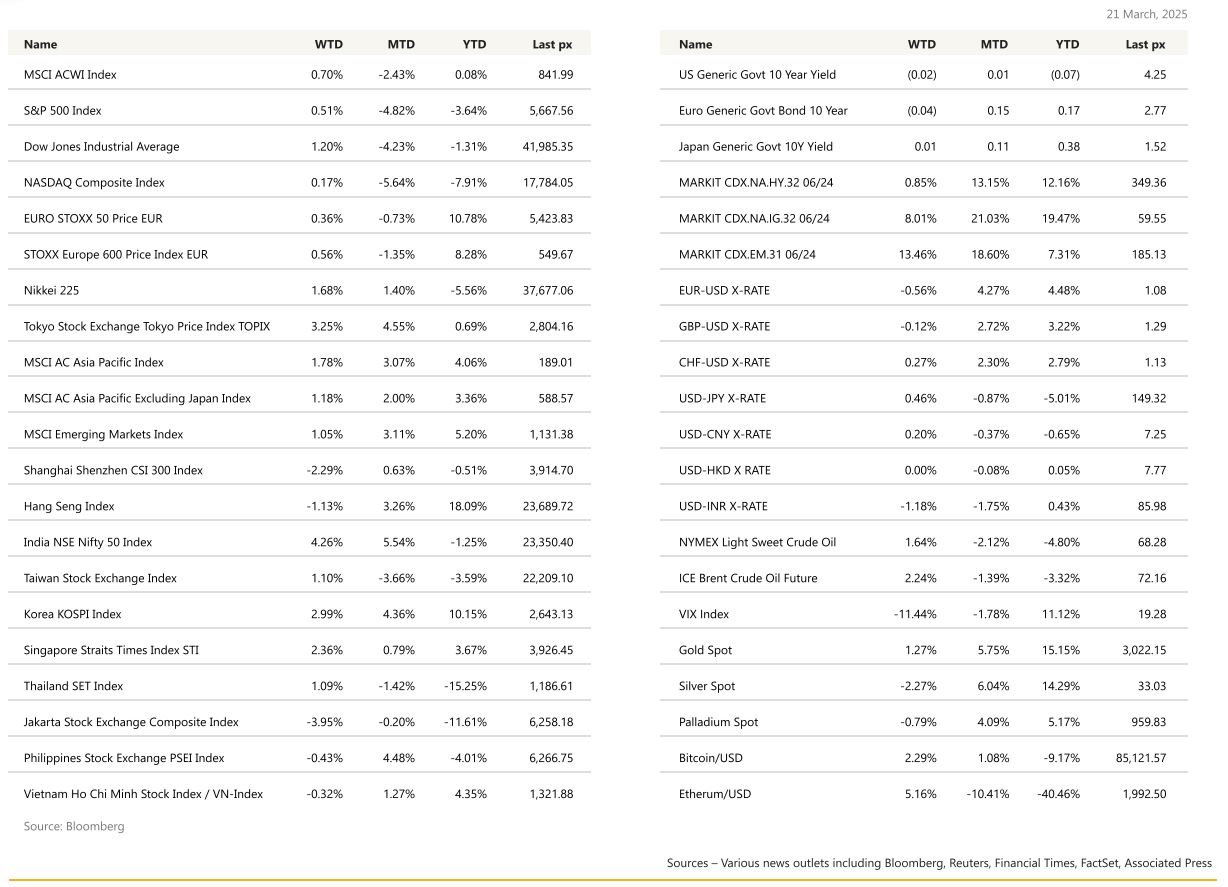

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

After a volatile week, US markets ended the week up, breaking a 4-week long selloff. The S&P 500 managed to eke out a 0.5% gain for the week, after an extra-volatile session on Friday following the “triple-witching” which saw an estimated $4.5 trillion of contracts tied to stocks, indexes and ETFs mature. US equities have mostly struggled to regain momentum from earlier this year as investors worry about slowing economic growth, President Donald Trump’s tariff policies and the prospect of fewer Federal Reserve rate cuts this year. The Fed Reserve left rates unchanged (as expected) for a 2nd straight meeting with its latest economic projections revealing expectations of slower growth and higher core inflation by yearend. This partially reflects the expected impact of recently implemented U.S. tariffs and consequential retaliation. The Fed also announced that it will further slow the pace of quantitative tightening in April, by reducing the monthly cap on U.S. Treasuries redemption to $5 billion from $25 billion. Chair Jerome Powell eased fears around tariffs pressure, saying their inflationary impact is likely to be “transitory.” Despite the threat of a fullblown trade war, Bank of America dismissed the risks that a fullfledged trade war would pose to stocks as “monster” flows of capital keep pouring into global equity markets. About $4.3 bln in inflows in the week through Wednesday amounted to the largest amount this year, according to BofA data. It remains unclear though, that we’ve seen a capitulatory type move that generally marks the bottom, analysts remarked. Not at least until tariffs take effect on the 2nd of April, the US equity selloff has further to go, Deutsche Bank commented.

US unemployment benefits were little changed showing as stillhealthy US labour market although the full brunt of DOGE cuts is still yet to be seen. Sales of previously owned homes unexpectedly bounced back in February lifting sentiment. UST yields fell for the week to 4.246% and 3.948% for the 10’s and 2’s respectively.

February Retail Sales headlines printed lower than expectations +0.20% MoM Vs 0.60% expected. The previous Month was revised down from -0.90% to -1.20%. However, the Retails Sales control group printed at +1.00% Vs +0.40% expected. Previous Month was revised down from -0.80% to -1.00%. February industrial production increased by 0.70% Vs 0.20% expected.

The Fed kept Fed Fund unchanged at 4.50% (upper bound) last week, which was very much in line with consensus. They published their revised SEP’s. For 2025, the median growth forecast came down by 40bps to 1.7%, while the current-year unemployment rate projection ticked up by a tenth to 4.4%. The median 2025 headline and core PCE inflation forecasts were revised up by 20bps and 30bps, respectively, to 2.7% and 2.8%. 2026 forecast changes were less dramatic with growth revised down by 20bps to 1.8%, the unemployment rate forecast unchanged at 4.3%, headline PCE inflation revised up a tenth to 2.2% but core PCE inflation unchanged at 2.2%. For 2027, the only change was a one-tenth decrease in the median growth forecast to 1.8%. There were no changes to the longer-run variables. The Fed median Dot Plots is still showing two cuts for the remaining of this year but the consensus within the Fed seems less strong than 3Months ago (8 voters now believe that Fed fund should remain unchanged or believe that only 1 cut will happen this year, see chart below, compared to only 4 3Months ago).

Headwinds picked up as geopolitical risks re-emerged following recent developments in the Middle East after Israel launched airstrikes across Gaza, breaking an almost-two-month ceasefire. Meanwhile, Russian President Putin is demanding a suspension of all weapons deliveries to Ukraine during a ceasefire proposed by US counterpart Donald Trump.

This week’s main highlight will be the PCE Index, expected at 0.3% core MoM and 2.5% on headline YoY. GDP Annualised, U. of Mich. Inflation expectations and the March Conference Board Consumer Confidence Index, February Personal Income & Personal Spending are also on the cards for the week.

Europe

European markets ended lower on Friday, primarily driven by a 1.6% decline in the travel sector following the closure of Heathrow Airport.

Airline stocks slipped after the sudden shutdown of the London airport due to a major power outage, which affected at least 1,351 flights. British Airways, one of the most impacted airlines, saw its parent company, International Consolidated Airlines Group S.A. (IAG), experience a 3% drop in the morning and a 1.5% dip in the early afternoon in London. Other sectors also saw declines. German leisure and tourism company TUI, which owns five airlines, including one servicing the UK market, fell 1.8%. Intercontinental Hotels Group recorded a significant loss, dropping by 3.7%. Although flights resumed the day after the power failure, disruptions are expected to persist for days as various systems require rebooting and checks to ensure their stability.

The German parliament approved constitutional changes to the debt brake, securing passage through the Bundestag after the Greens negotiated a deal that allocated a fifth of the €500bn Special Fund to climate-related projects through the Climate and Transformation Fund. This will ensure that infrastructure spending remains at current levels, supporting the goal of climate neutrality by 2045. The fund will have a lifespan of 12 years, two years longer than originally planned. However, this large fiscal envelope can only be accessed after the formation of a new government and the approval of the 2025 budget, which may take until April due to ongoing coalition talks. There are also potential interactions with EU fiscal rules, which still require a debt sustainability analysis even when national escape clauses are invoked.

The European Commission published its defense white paper, “Readiness 2030.” In addition to urging countries to increase defense spending and improve coordination, the EC outlined its roadmap to support member states and the European defense industry. The paper also provided more clarity on the activation of ‘national escape clauses’ in EU fiscal rules and introduced the €150bn loan facility, known as SAFE. This strategy aims to gradually increase total defense spending across the EU.

As for the economic data in Europe, the preliminary consumer confidence reading for March dropped by 0.9 points to -14.5, reversing the year-to-date gains. Eurozone inflation was revised down by 0.1 percentage point to 2.3% year-on-year in the final February release, while core inflation remained unchanged at 2.6% year-on-year. Services inflation fell 0.2 percentage points to 3.7% year-on-year, and core goods inflation rose 0.1 percentage point to 0.6% year-on-year.

In the UK, the Monetary Policy Committee (MPC) voted 8-1 to maintain the Bank Rate at 4.5%. The vote split was more hawkish than market consensus. The minutes from the meeting revealed that Mann had dropped her dissent for a 50bp rate cut, while Dhingra shifted from supporting a 50bp cut to favoring a 25bp reduction. The committee reaffirmed its stance on a gradual and careful approach to easing policy. UK inflation rose to a 10-month high of 3% in January, well above the Bank s target of 2%.

Meanwhile, the Swiss National Bank lowered its rate by 25 basis points last Thursday, while Sweden’s Riksbank held its rate steady.

This week, we can expect PMI figures from the Euro Area on Monday, followed by the March consumer confidence report on Friday. UK CPI on Wednesday, UK GDP and retail sales on Friday.

Asia

Economic worries and a shifting geopolitical landscape kept risk appetite in check. MSCI Asis ex Japan closed the week 1.18%.

The MSCI China Index has soared almost 20% so far in 2025 while the S&P 500 Index has shed about 4%. That is on course to be the biggest quarterly outperformance since 2007.

Franklin Templeton Institute sees the emergence of a “Xi put” — akin to the so-called “Fed put” — a view that authorities will deploy market-friendly measures and more stimulus to achieve the about 5% economic growth target set this month. Xi’s ambitious goal comes as Donald Trump’s chaotic rollout of tariffs has raised the odds of a US recession and sent American megacaps into a tailspin.

Indonesia’s trade surplus was $3.1bn in Feb 2025, above Bloomberg consensus but below our estimate. Exports grew 14.1% yoy, led by CPO and iron & steel, while coal declined. Imports rose 2.3% yoy, but consumer goods imports fell 21% yoy due to early rice imports and government budget cuts. The trade surplus remains strong at a 58-month average of $3.2bn, though risks persist. The current account deficit is expected to widen to 1% in 2025F due to higher dividend repatriation and services demand.

Other data points from Asia:

Japan exports were at their strongest in nearly a year as stockpiling ahead of tariffs set it but was a tad below expectations; machine orders missed estimates and final industrial output data confirmed a preliminary decline.

Bank Indonesia kept its base interest rate unchanged as expected by a slim majority of economists just as its stock market recovered from yesterday’s sharp selloff. Taiwan’s central bank (CBC) left its main policy rate on hold today (at 2.0%), and is likely to leave rates unchanged throughout 2025.

Japan’s core inflation hit 3.0% in February; BOJ policymakers have signaled their readiness to keep raising interest rates if they become convinced that Japan will see inflation sustained around 2 per cent backed by solid wage gains. Yen was slightly weaker after the Bank of Japan held rates as expected. The BOJ board voted unanimously to maintain the bank’s short-term policy rate at 0.5%.

GeoPolitics

Israel – Palestine: The recent Israel-Gaza ceasefire ended with a literal bang when Israel launched extensive strikes . Israel is saying it was hitting Hamas targets in what appeared to be the most intense assault on the enclave since a ceasefire took effect in January. Israel had only returned to the negotiating table last week, dispatching a team to Doha for the first talks since US President Donald Trump took office, after direct talks between Washington and Hamas stalled. Talks are being mediated by the US, Qatar and Egypt. Israel’s military action also comes after Netanyahu removed Ronen Bar, the head of domestic intelligence agency Shin Bet, and David Barnea, the director of foreign spy agency Mossad, from his country’s negotiating team. The prime minister claimed the intelligence chiefs were negotiating too softly.

The Palestinian civil emergency service said there were at least 35 airstrikes on Gaza. The strike on Tuesday 18th March killed more than 400 people, shattering nearly two months of relative calm since a ceasefire began, unnerving investors.

Israel – Yemen – Iran – US: Israel’s military said it intercepted a missile launched from Yemen early on Thursday as hostilities with the Houthis intensified. Trump has threatened to punish Iran over its perceived support for the Yemeni militant group.

Trump told Iran’s Supreme Leader Ali Khamenei his nation has a two-month deadline to reach a new nuclear accord.

US- Russia -Ukraine:

Putin declined the 30-day ceasefire in Ukraine, instead agreeing to limit attacks on the country’s energy infrastructure.

Washington wants Kyiv to agree to detailed provisions about who owns and controls a joint investment fund, and to a broader scope, potentially covering US ownership of other economic assets such as Ukraine’s nuclear power plants, two Ukrainian officials said. Trump said the US was looking to sign deals on rare earths and minerals across the world, but that Ukraine was a special focus.

US: Donald Trump invoked emergency powers to order the expansion of US production of critical minerals and potentially coal. The president also said he’d sign a rare-earths deal with Ukraine. The US is a major importer of metals, including copper and aluminium, which have a broad range of uses, from construction to energy and technology, as well as lesser-known ones such as rare earths, which are used in the defence and automotive sectors. By invoking the Defense Production Act, passed in 1950 after the outbreak of the Korean war, the president can mobilise domestic industry to supply materials deemed critical for national defence.

China – G7: China has lashed out at accusations it is endangering maritime safety made by top diplomats from the Group of 7 industrialised democracies in a joint statement, saying on Saturday (Mar 15) the G7 members are “filled with arrogance, prejudice and malicious intentions”. The G7 had said in a statement, “We condemn China’s illicit, provocative, coercive and dangerous actions that seek unilaterally to alter the status quo in such a way as to risk undermining the stability of regions, including through land reclaimations, and building of outposts, as well as their use for military purpose.”

Germany / EU: The German parliament has approved Friedrich Merz’s plans to inject up to EUR 1tn into military and infrastructure projects. The proposal includes a EUR 500bn fund for modernising public facilities, potentially reviving Europe’s largest economy.

Credit/Treasuries

The shape of the US Treasury curve did not really change last week with all the points on the curve ending the week down by 2-3bps. Both IG & HY 5years credit spreads widened by around 5bps last week.

FX

DXY USD Index rose 0.36% to 104.09 last week as the April 2nd Tariff deadline approached. This was despite the dovish FOMC, where no change to fed funds target range of 4.25-4.50% as expected. The SEP maintained the baseline projection of two 25bp cuts in 2025, while revising down growth expectations and raising inflation forecasts. The Fed statement highlights that uncertainty around the economic outlook has increased and Chair Powell downplayed the rise in inflation expectations, while noting that tariff inflationary impacts may be transitory. Chair Powell also talked up resilience of hard data and said economy strong overall and recession risk not high. Hard>soft data trend continued with control group retail sales, industrial production, housing starts and existing home sales all surprising to the upside.

European Currencies were mixed against USD, with EUR -0.56% to 1.0818, GBP -0.12% to 1.2919, SEK -0.03% to 10.1419 and CHF +0.26% to 0.8828. In Eurozone, German parliament approved meaningful fiscal expansion focused on defence and infrastructure spending, while ECB President Lagarde says that US tariffs and an EU response could lower euro area growth by 0.5pp and push near-term inflation up by ~50bp. BoE maintains its policy rate, as expected; gilts sell off (2y: +3bp) in response to the 8-1 vote split, which was seemingly more hawkish than expected as only one member favored a 25bp cut. The vote split was more hawkish than market consensus, with External Members Mann and Dhingra voting for a 50bp cut and Taylor for a 25bp cut. The Riksbank maintained its policy rate at 2.25% at its March meeting, as widely expected, and continued to assess that the rate will remain at that level for the duration of the forecast period. The bank also cited uncertainty coming from trade policy and defence spending in Europe and revised its GDP projections up to 1.9% for 2025 and down to 2.4% for 2026. The SNB lowered its policy rate by 25bp to 0.25% at its March meeting, as expected. It also revised its conditional inflation forecast slightly higher, however, while flagging downside inflationary risks and that, if the policy rate had not been cut, the conditional inflation forecast would have had to be revised lower.

Antipodean Currencies fell against USD; AUD fell 0.81% to 0.627 and NZD fell 0.24% to 0.574. This was despite positive China economic activity data and the announcement from PBoC announcement on guidelines aimed at boosting consumption. AUDNZD fell 0.59% to 1.094, as Australia labor data was below consensus, with employment falling 53k (C: +30k) in February, after nearly a year of sustained upside surprises.

USDJPY rose 0.46% to 149.32 driven by broad based USD strength, despite heightened expectations for near term BoJ hikes after BoJ Governor Ueda’s press conference and an upside surprise in February core CPI. The BoJ kept the policy rate unchanged at 0.50% at its March meeting, as widely expected. The statement was largely unchanged from the January statement with regards to the assessment of the economy and inflation. That said, the BoJ added “the evolving situation regarding trade and other policies in each jurisdiction” in its statement as a risk to their outlook. At the press conference, Governor Ueda mentioned 1) uncertainty around US policy and that its impact on the US and Japan economies has increased but highlighted that the impact would likely become clearer by the next BoJ meeting in April, when outlook report will be released, and 2) preliminary spring wage negotiation result was slightly stronger than the Board’s expectation.

USDCAD fell 0.12% to 1.435 as Canada CPI rises 2.6% (C: 2.2%; P: 1.9%) alongside an acceleration in the BoC’s underlying core inflation measures (CPI-Trim and CPI-Median). CAD is little impacted by a downside surprise in January Canadian Retail Sales, as headline Retail Sales fell -0.6% m/m (C: -0.4%; P: 2.6%) in January as payback after a surge of holiday spending. Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle parts dealers, fell 0.2% m/m reversing December’s rise and then some. In volume terms, retail sales were down 1.1% m/m.

Oil & Commodity

WTI crude and Brent crude oil futures rose last week, with WTI (+1.64%) to 68.28 and Brent (+2.24%) to 72.16. The rise in oil prices was driven by renewed tensions in the Middle East and new Iran-related sanctions issued by the US. Israeli military strikes in Gaza signalled a potential breakdown of the almost two-month ceasefire with Hamas, while US for the first time sanctioned a Chinese refinery for allegedly buying Iranian oil, raising the prospect of stricter US sanctions enforcement against Iran. In addition, a better-than-feared outcome from the FOMC supported higher oil price. Elsewhere, OPEC+ issued a new schedule for seven member nations including Russia, Kazakhstan, and Iraq to make further oil output cuts to compensate for pumping above agreed levels, while the EIA report for the week ending March 14 showed a 1.7mn barrel increase in crude oil inventories.

Gold touched a record high of 3057.49 following a dovish FOMC. In addition, Gold was supported by safe-haven demand on the back of headlines on Israel striking Gaza, tariff, and growth uncertainty. However, Gold pared some of the recent gains last Friday, touching 3000 before closing the week at 3023.81 (+1.27% for the week).

Economic News This Week

- Monday – AU/JP/EU/UK/US Mfg/Svc/Comps PMI Prelim Mar, SG CPI

- Tuesday – CH 1Yr LFR, US New Home Sales/ Cons. Confid./ Richmond Fed Mfg

- Wednesday – AU CPI, UK CPI/ RPI, US MBA Mortg. App./ Durable Goods Orders

- Thursday – US GDP/ Wholesale Inv./ Personal Cons./ Core PCE Index/ Initial Jobless Claims/ Pending Home Sales

- Friday – JP Tokyo CPI, UK GDP, Norway Employ., UK Retail Sales/ Trade Balance, EU ECB CPI Exp., CA GDP, US Personal Spending/ PCE Deflator/ UMich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.