KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

After 6 weeks of rally, the S&P 500 posted its first weekly loss, as punters grappled with mixed earnings results and rising bond yields. Mounting uncertainty surrounding the November 5th US Presidential Elections, combined with strong economic data leading investors to anticipate a less dovish stance from the Federal Reserve, has put US bonds under pressure and driven yields higher dampening risk sentiment. Markets had to digest economic data that showed a decline in new applications for unemployment benefits, an increase in new home sales and an expansion of US business activity, giving the Fed more reasons to avoid cutting rates aggressively. Initial jobless claims fell to 227k from 242k and new home sales came in higher than expected at 738k for September. We also saw improvements in consumer sentiment and a slight fall in U. of Mich. 1 Yr inflation forecast to 2.7% whilst the 5-10 Yr forecast remained unchanged at 3%. The S&P Global US manufacturing, services and composite PMI’s all came in higher than expected. The Fed’s Beige Book once again painted a picture of a sluggish economy which seemingly to be at odds with other official data where nine districts showed “flat or declining” activity and manufacturing remaining in decline. The UST10Y and 2’s rose up about 16 bps to 4.24% and 4.10% respectively with the steepness of the curve remaining unchanged for the week. The VIX closed higher at 20.33.

Attention is now turned to this week’s US payrolls report as well as big tech earnings from Meta, Apple, Microsoft, Alphabet and Amazon. Tesla which reported market earnings beat and higher growth forecast soared 22%. JOLTS Job Openings to come in on Tuesday, PCE and personal income/spending on Thursday followed by non-farm payrolls Friday where we’re expecting +110k with an unchanged unemployment rate of 4.1%.

So far, 75% of the 182 companies that reported earnings have beaten analysts’ expectations.

Several cryptocurrency-linked stocks fell after the Wall Street Journal reported that the federal government is investigating crypto firm Tether for possible violations of sanctions and antimoney-laundering rules, citing people familiar with the matter. Bitcoin fell to $67k and Ether to$2,500.

The chart below depicts the price action of the S&P 500, S&P Midcap 400 and Russell 2000 Value Indices. From the depths of 2022 till 25th of Oct. 2024, we continue to expect an outperformance particularly in the Russell against a backdrop of rate cuts:

Europe

In the Euro Area, Inflation expectations of consumers in the euro area decreased in August. The ECB’s

The Eurosotxx has shed 1% over the week, and was down another 0.04% by Friday’s close. Travel stocks led losses, down 1.5%. Corporate results have proven a mixed bag, with many banks beating expectations but other sectors keeping investor sentiment wary.

The flash composite PMI in the Euro Area rose marginally by 0.1pt to 49.7, in line with the Bloomberg consensus. The modest improvement in the composite was driven by the manufacturing sector, while services continued their downward trend (-0.2 to 51.2), reaching their lowest level since February 2024. Overall, the October PMI flash print indicates stagnating growth at the start of the fourth quarter.

According to the flash release, Euro area consumer confidence continued to increase in October. It was up 0.4%pt to -12.5%, matching the average monthly gains seen in the prior 12 months. The link between confidence and spending has been loose since Covid. The rise in consumer confidence nonetheless remains encouraging and should boost household spending in the coming months. ECB’s latest consumer survey showed continued decline in inflation expectations of +2.4% from +2.7% in August.

In the UK, banks have led the way in 3Q earnings beats, according to Morgan Stanley. Barclays shares rallied on Thursday, with better-than-expected income from its two biggest divisions. UK peer NatWest this morning reported profit that beat and improved guidance. Some of Sweden’s top banks have also posted robust profit from lending.

UK Chancellor of the Exchequer Rachel Reeves said she’ll change the fiscal rules underpinning spending plans in order to boost government investment. This is the Labour Party’s first budget in 14 years. At the budget, she’s planning to set out two fiscal rules that will set the tone for Labour’s first term in office since 2010. The first requires her to pay for day-to-day spending out of taxes. To meet that rule with sufficient headroom to give her flexibility in a crisis, Revees plans around £40 billion worth of fiscal measures, mostly from tax increases plus cuts to some public services, to meet her pledge to cover day-to-day spending without borrowing. They hope that spending more public money on power networks, transport and other infrastructure will attract private investment needed to meet their pledge to turn Britain’s sluggish economy into the faster growing in the G7. Reeves’ second rule is that debt must be falling in the fifth year of the official forecast. Compared with the existing measure of “public sector net debt excluding the Bank of England,” PSNFL will give Reeves £53 billion of additional annual borrowing headroom. Under PSNFL, she would meet her rule with three years to spare.

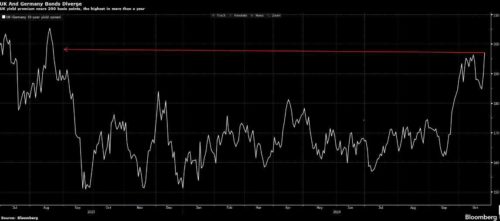

However, markets wobbled at news of the scale of the potential borrowing, with the spread between gilt yields and German bunds widening after a report in the Guardian newspaper late Wednesday. The yield on 10-year gilts rose as much as seven basis points to 4.27% on Thursday, widening the spread over equivalent German notes to 199 basis points, the highest in a year.

In terms of data, the UK flash composite slowed to 51.7 in October, down 0.9pt from September. This was below the Bloomberg consensus’ expectation. The downtick was driven by both services (-0.5pt to 51.8) and manufacturing output (-2.7pt to 50.9). The details show a decline concentrated in manufacturing, but with services also a little softer. Sentiment took a hit, with year ahead expectations down from 72.1 to 69.3.

This week, we will have the Euro area consumer confidence and GDP on Wednesday, Eurozone CPI and unemployment on Thursday and finally the S&P Global UK Manufacturing PMI on Friday.

Asia

Asian markets closed lower last week, MSCI Asia ex Japan was lower by 1.87%. The Nikkei and Nifty were the worst performers last week, down 2.74% and 2.71%, respectively.

Japan’s ruling coalition is set to lose its parliamentary majority, exit polls for Sunday’s (Oct 27) general election showed, raising uncertainty over the make-up of the government of the world’s fourth-largest economy. The biggest winner of the night, the main opposition Constitutional Democratic Party of Japan (CDPJ), was predicted to win 157, as voters punished Ishiba’s party over a funding scandal and inflation.

Share buybacks on mainland China’s biggest exchanges have soared to a record high this year. There have been Rmb235bn ($33bn) in buybacks across mainland-listed shares so far in 2024, more than double last year’s total and far surpassing the previous record of Rmb133bn in 2022. The NPC Standing Committee will hold its meeting on 4-8 November as investors wait for more details on fiscal policy agenda likely to emerge from this meeting as top legislature’s approval is needed for such measures

Bank Indonesia intervened in currency markets to support the rupiah as traders price in greater prospects of a Donald Trump victory

Thailand’s central bank chief signalled policymakers won’t be rushing to follow up on last week’s interest-rate cut and defended the current inflation target amid government calls to ease policy further.

Other data from Asia: Japan flash PMIs showed manufacturing contracted at an accelerated pace to 49 and services POMI drop to 49. India flash PMIs ticked higher to 58.6 in October. Singapore’s September core CPI (excluding private road transport and accommodation) rose 2.8%yoy (August: 2.7% yoy) South Korea’s economy barely grew in the third quarter, Gross domestic product (GDP) increased 0.1% quarter on quarter in the July-September quarter, after shrinking 0.2 per cent in the second quarter, the Bank of Korea said on Thursday. The Bank of Korea expects the country’s economic growth this year to fall short of its latest forecast of 2.4%.

GeoPolitics

Europe – Russia: London Times reported ministers have announced plans to use the profits from frozen Russian assets to bankroll the Ukrainian war effort for the first time, with an immediate loan of £2.26B to Kyiv expected.

Israel – Lebanon: The Israeli army said on Monday (Oct 21) that the latest commander responsible for funding the Lebanese Hezbollah group was “eliminated” in Syria. On Wednesday, Israel confirmed death of heir apparent to slain Hezbollah leader . The Military said Hashem Safieddine was killed in a strike carried out three weeks ago in Beirut’s southern suburbs, its first confirmation of his death. Lebanon state media reported 17 Israeli raids on Beirut’s southern suburbs, with six buildings levelled and the vacated offices of a pro-Iran broadcaster hit on Wednesday, 23rd Oct.

Israel – Iran: Israel’s airstrikes “hit hard” Iran’s defences and missile production, Prime Minister Benjamin Netanyahu said on Sunday. The Islamic Republic has not signalled how it will respond to Saturday’s long-anticipated strikes, which involved scores of fighter jets bombing targets near the capital Tehran and in the western provinces of Ilam and Khuzestan. The U.N. Security Council will likely convene to discuss the attack on Monday. Iranian President Masoud Pezeshkian said Iran was not looking for war but would give an “appropriate response”.

BRICs: The BRICS summit, attended by more than 20 leaders including Chinese President Xi Jinping, Indian Prime Minister Narendra Modi and Turkey’s Tayyip Erdogan, has shown the depth of Russia’s relations beyond the Western world. A 43-page final communique from the summit ranged from geopolitics and narcotics to artificial intelligence and even the preservation of big cats. It mentioned Ukraine just once.

Russian President Vladimir Putin told BRICS leaders on Thursday that the Middle East was on the brink of a full-scale war after a sharp rise in tension between Israel and Iran, though the Kremlin chief also faced calls to end the war in Ukraine. Xi, speaking after Putin, said that China wanted a political settlement in Ukraine, and suggested joint efforts by Beijing and Brasil offered the best chance of peace. “We need to work for an early de-escalation of the situation and pave the way for a political settlement,” Xi said. On the Middle East, Xi said that there should be a comprehensive ceasefire Gaza, a halt to the spread of war in Lebanon and a return to the two-state solution under which states for both Israel and Palestine would be established.

Four Southeast Asian countries – Malaysia, Indonesia, Vietnam and Thailand – have become partner countries of BRICS, a group of emerging economies that is seen as a counterweight to the West.

China – India: Wednesday’s meeting between Modi and Xi saw their first formal talks since October 2019. The meeting came two days after Beijing and New Delhi reached an agreement to end border standoff between the two armies in eastern Ladakh. India’s policy that aims at decoupling from China has failed to attract meaningful support from the US-led West to help ‘Made in India’ and the country’s modernization and industrialization. India’s concerns are caused by the unhappy memories between India and the West in recent years. The Modi administration has found that the US and its allies cannot offer India much meaningful support, so now that India has tension with Canada, Washington will not side with New Delhi. This means that Modi may finally realize that it is unwise for India to completely side with the US in this game of great powers.

Australia & Allies – China: Australia, United States and 13 other countries criticized China at the United Nations on Tuesday over alleged human rights abuses in Xinjiang and Tibet, prompting China to denounce them for ignoring the “living hell” in the Gaza Strip. China’s U.N. Ambassador Fu Cong on Tuesday accused the group of Western states of resorting “to lies to provoke confrontations.” Fu said if the Gaza death toll was not enough to “awake the conscience of a few Western countries … then their socalled protection of human rights of Muslims is nothing but the biggest lie.”

South Korea – Ukraine: South Korean officials suggested this week that the North Korean troop deployment to Russia could convince Seoul to supply direct lethal military aid to Ukraine for the first time. A presidential official told South Korean state media that Seoul would consider sending Kyiv defensive weapons, “and if a threshold is exceeded, we could ultimately consider offensive weapons as well”.

US – China: China solar sector saw strong rally last week on news that US Department of Commerce is considering partially reversing the anti-dumping and countervailing duties (AD/CVD) on China’s crystalline silicon photovoltaic (PV) cells.

credit treasuries

US Treasury Curve bear flattened last week, with 2 years (+15.6 bps), 5 years (+18.5 bps), 10 years (+15.7 bps) and 30 years (+10.7 bps). Factors behind the move was mainly due to rising concern about debts and deficits, particularly ahead of the US election, where Trump/GOP sweep polling momentum seems to be getting heightened attention. In addition, we continued to see strong US economic data. IMF pointed out in their recent.

Fiscal Monitor that global public debt is forecast to exceed $100 trillion this year, and rise further in the medium term. Both US IG and HY credit spreads widen last week, with IG and HY rising 1.6 and 9.8 basis points. In comparison, Eurozone curve bear steepened, with 2 years yield flat, 5 years (+9.6 bps) and 10 years (+10.8 bps).

FX

DXY USD Index rose 0.74% to close the week at 104.257 following higher UST yields and strong economic US data.

In addition, heightened geopolitical tensions results in the strengthening of the USD. Data wise, initial jobless claims was below consensus, an upside surprise in October services and manufacturing PMIs, and strong new home sales. Manufacturing and services were above consensus, with composite PMI rising to 54.3 (C: 53.8). US Michigan consumer confidence revised up 1.6pts to 70.5 in final read for October. 5-10yr inflation expectation steady at 3%. Based on OIS, market is pricing 40 bps cut for 2024.

European Currencies fell against USD, with EURUSD down 0.65% to 1.0796 and GBPUSD down 0.69% to 1.2962, with both EUR and GBP breaking strong support level of 1.08 and 1.30 respectively, driven by widening interest rate differentials. In Euro. there has been growing expectations for additional ECB cuts after ECB commentary continues to express confidence on disinflation, while a report cites unnamed sources saying the ECB is starting to debate cutting rates below neutral. Eurozone flash PMI was mixed with manufacturing at 45.9 (C: 45.1), services at 51.2 (C: 51.5) and composite at 49.7 (C: 49.7, P: 49.6). Details leant on the dovish side with Euro Area composite output prices down to their lowest since early 2021. Based on OIS, market is pricing a 34.3% chance of a 50 bps cut in December. In UK, flash PMIs surprised on the downside, with manufacturing at 50.3 (C: 51.5), services at 51.8 (C: 52.4) and composite at 51.7 (C: 52.5), all below consensus.

USDJPY rose 0.74% to close the week at 104.257 as UST yields rose with the whole curve moving up by more than 10 basis points. However, yen extended its losses following the election over the weekend, with USDJPY rising 0.91% to 153.70 this morning at the time of writing. The ruling LDP coalition failed to win a majority in parliament for the first since 2009, which may complicate the outlook for Bank of Japan, where the bank is trying to seek the right timing for another rate hike. Data wise, Tokyo CPI data was stronger than expected, with core-core CPI picking up to 1.8% (C: 1.6%).

USDCAD rose 0.67% to close the week at 1.3892 as Bank of Canada cut rates by 50bps, in line with consensus, to 3.75% and down 125bps since the middle of the year from policy peak of 5%. The Bank reiterated that “the timing and pace” of future rate decisions will be based on incoming data related to its inflation outlook. However, Governor Macklem noted a “clear consensus” for a more aggressive cut and “if the economy continues to evolve in line with our forecast, we will be cutting rates further”. Data wise, Headline Retail Sales rose 0.4% m/m (C: 0.5%; P: 0.9%) in August. Retail Sales ex Auto fell -0.7% m/m (C: 0.4%; P: 0.3%).

Oil & Commodities

Oil futures closed the week up, with WTI and Brent gaining 3.70% and 4.09% to 71.78 and 76.05 respectively, following the drone strike on the private home of Israeli PM last Monday. However, oil futures are down more than 4% this morning, following the limited damage on Iran by Israel strikes and the report where no oil or nuclear sites are targeted. Data wise, EIA report for the week ending October 18, showed an unexpected 5.5mn barrel increase in crude oil inventories. Psychological support level on WTI and Brent at 65 and 70 respectively.

Gold rose to a record high of USD 2758 last week and eventually closed the week at USD 2748 (+0.96%) as demand for the safe haven is boosted amid the US election uncertainty and geopolitical tensions in the Middle East. This was despite the rise in global yields. Over the weekend, Israel strikes Iranian military targets in retaliation for Iranian missile barrage. Iran said that the strike caused limited damage and no oil or nuclear sites are targeted. This raised prospect of regional deal being made to avoid escalation. As such, Gold price opened the week down to 2730 (-0.62%) at the time of writing this morning.

Economic News This Week

-

Monday – US Dallas Fed Mfg Act.

-

Tuesday – JP Jobless Rate, UK Mortg. App., US Wholesale Inv., Cons. Confid.

-

Wednesday – AU CPI, EU Cons./Svc/Indust./Econ. Confid. / GDP, US Mortg.App./ ADP/ GDP/ Core PCE

-

Thursday – JP Retail Sales/ Indust. Pdtn/ BoJ Rate Decision, NZ ANZ Biz Confid., AU Retail Sales, CH PMI, EU CPI, CA GDP, US Personal Income/ Personal Spending/ Initial Jobless Claims/ MNI Chic. PMI

-

Friday – NZ Building Permits, JP/CH/SZ/UK/US/CA Mfg PMI Oct Final, UK Nationwide Hse Px, SZ CPI/ Retail Sales, US Nfp/ ISM Mfg

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.