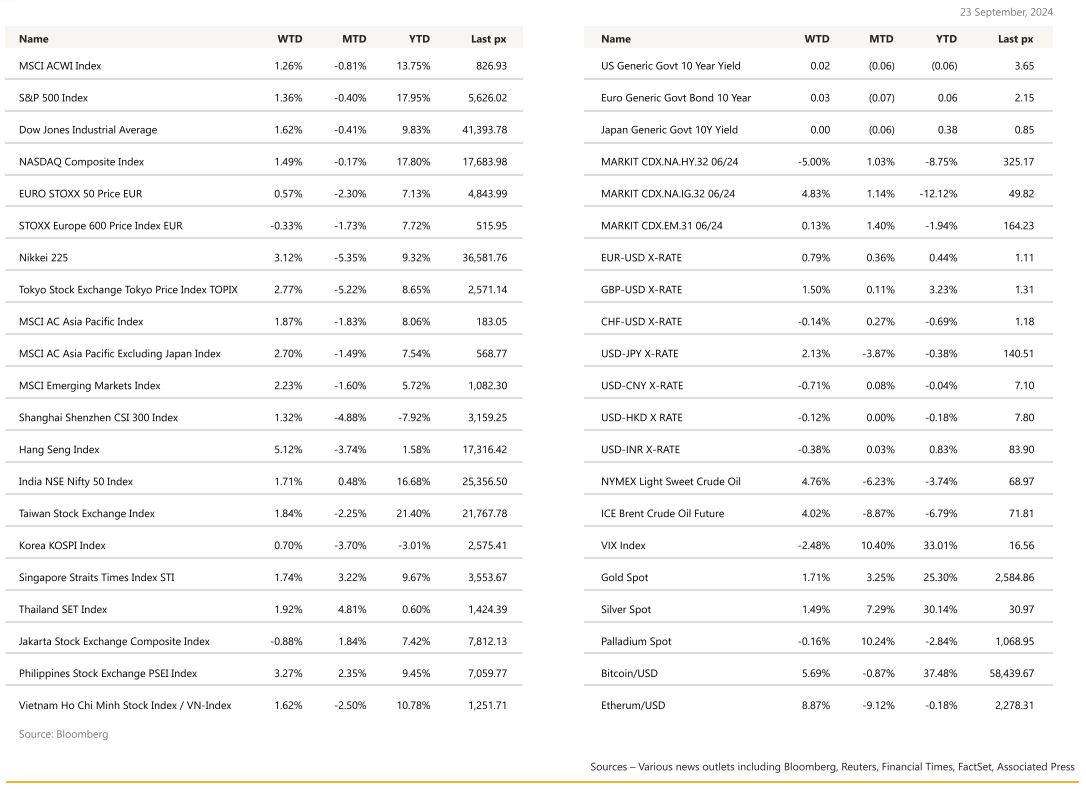

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

The long-awaited slash in rates finally happened, and in a flash a half percent was cut in the Fed Funds rate. A vote of confidence that inflation is now under control but the central bank cited risks to the labour market in its rate cut announcement, saying it was committed to the goal of full employment culled the market’s celebration Thursday. Another 50 basis points of cuts by the end of the year are expected, followed by 100 basis points in cuts next year, was enough to send all 3 major indices to close up circa 1.5%. US stocks notched its 2nd straight weekly gain despite a slight Friday night retreat. Profit taking was blamed for it, when a triple-witching options expiry and warnings of an overextended equity rally weighed on investor sentiment. Still, the S&P hit a new record on Thursday at 5713.64 and the VIX fell to 16.15. The UST2 and 10’s closed at 3.591% and 3.741% respectively, the steepest since June of 2022.

Clearly, the Fed front-loaded the rate cut cycle to address the labour market outlook as it tries to achieve the often-touted soft landing. Chair Powell further said that the market should not consider 50 bps as the new pace of reductions. Worries of a recession remain, but strategists at Barclays said current data on jobless claims, which came in lower than expected, which they see as a “reliable and timely indicator of a recession” were still holding up. Fed-speak from Fed presidents Bostic, Goolsbee and Kashkari on Monday could give us further guidance as to whether more jumbo cuts, which some on Wall Street see trouble in the labour market motivating additional outsized Fed cuts this year, could be warranted. Some are even calling the equity market rally, following the Fed’s cut, stoking the risk of a bubble, making bonds and gold an attractive hedge against any recession or renewed inflation.

Earlier in the week, we saw retail sales advance month on month beat expectations at 0.1% for August against expectations of -0.2%, industrial production & capacity utilisation both came in better than expected and housing starts & MBA mortgage applications also beating the street’s estimates. However, existing home sales were below expectations. This week will see S&P Global US manufacturing and services PMI’s, another GDP Annualised QoQ reading, expected at 3%. The Fed’s preferred inflation gauge, Personal Income and Spending PCE Price Index will come on Friday – headline PCE is expected at 2.3% from 2.5% previously, with the core month on month expected at an unchanged 0.2%.

With the Fed’s latest action turning from a headwind to tailwind for markets, we expect risk assets to continue its upside trajectory, with the November elections now taking centre stage as a main headwind. We prefer to remain in small to mid-caps and value sectors articulated via the Heptagon Driehaus US Small Cap Fund and the Smead US Value Fund.% for Q2.

Europe

European markets closed 1.45% lower on Friday, reversing the upbeat performance as most sectors were in red. Tech stocks in Europe lost 2.96% on Friday, while mining stocks were down 2.6%. Auto stocks shed 3.6%, led by Mercedes, which slumped over 8% after cutting its 2024 guidance considering weaker demand from China.

The Eurostat August HICP data were overall unchanged in the final release. Headline inflation declined 0.4%-pt to 2.2%oya with core broadly stable. Within the core goods basket, price pressure remains weak. Averaging the July-August price gains, it showed core prices rising at 1.2% yoy which is a little higher than historical norms and it could be due to the modest impact of freight prices. Within the services basket, the data show some limited and temporary upward impact linked to the Paris Olympics. French services inflation increased 0.5%-pt to 3.6%oya. This gives August Euro area services price gain around 3.5% annualized rate and this is smaller than the price gain see over January-May. The softer services price gain of late is a positive development. But the broader picture remains one of sticky services prices since underlying services prices at 3.5% ar are running in line with the average pace seen last year. Euro area consumer confidence increased 0.6%pt to -12.9% in September. This increase offsets the August decline and consolidates gains seen since last autumn.

Quite a few ECB Governing Council members spoke last week, following up on the rate cut on 12 September, mostly to suggest that there is still a wish to proceed gradually with rate cuts and await more data ahead of the December meeting. Natixis suggested that Fed stance is unlikely to deter ECB plans unless the European data justifies the shift.

The BoE held rates as expected at its September meeting at 5.00%, with the vote coming in at 8-1 and Dhingra dissenting. The MPC voted unanimously to continue the QT pace at £100bn, that implies a significant slowing in active sales over the forthcoming year, which probably isn’t necessary, but the BoE has placed a high weight on continuity in the overall pace. There was little new information in the statement, with the MPC noting there had been few material UK data developments since August. The BoE acknowledged that growth would likely weaken in 3Q, with a slight downgrade in its forecast from 0.4% to 0.3%q/q.

The BoE continued to set out three scenarios for inflation: one where inflation moderates steadily with time as past shocks fade, one which requires some help in the form of economic slack, and one where there are lasting structural changes keeping inflation high. Each has different implications for rates. The BoE’s baseline forecast is close to a combination of the first two, but the Bank remains open minded about the third. As such, the BoE maintained the same cautious approach in its guidance over easing at this meeting, noting that “in the absence of material developments, a gradual approach to removing policy restraint remains appropriate” and is more likely to cut rates more quickly in the coming months, with the next cut coming in November.

In data, headline CPI inflation for August remained at 2.2% over year ago, where BoE’s expectations were at 2.4%. Core inflation rose from 3.3% to 3.6%, services inflation moved back up from 5.2% to 5.6%

This week, we will see the PMIs in both the Euro Area and in the UK and the consumer sentiment in the euro area on Friday.

Asia

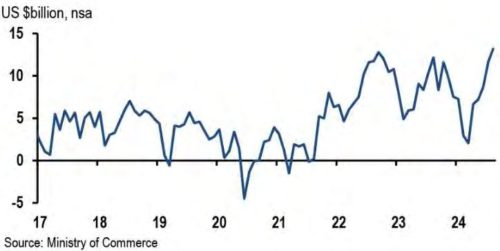

The People’s Bank of China today lowered the 14-day reverse repurchase rate to 1.85% from 1.95% previously. The central bank also injected 74.5 billion yuan ($10.6 billion) of liquidity into the banking system via the tool, it said in a statement. The move came ahead of the National Day Holiday that will last seven days from Oct 1. Bloomberg reported President Xi called on government officials at all levels to achieve this year’s annual growth target, as analysts have cast doubt over momentum in Chinese economy with many global banks cutting their forecasts. ING Bank economist said Xi’s comments will bring about more urgency in policy support with a larger boost likely to come soon.

Chinese yuan rises to the highest level in about 16 months as the central bank set a stronger currency fixing after the dollar weakened following the Federal Reserve’s interest-rate cut.

Singapore’s electronics shipments gained the most since 2010, exports rose 35.1% in August from a year earlier, following a revised increase of 16.8% the previous month. Singapore and the broader Southeast Asia region are benefiting as companies diversify their tech supply chains beyond China and Taiwan to reduce risks related to tensions between Beijing and Washington.

The Taiwanese central bank decided to keep its key policy rate on hold at the 3Q monetary policy meeting. The BoJ kept the policy rate unchanged at 0.25%, as widely expected. The policy statement was broadly unchanged, with most sentences remaining the same as those in the July outlook report. However, the BoJ modestly upgraded its assessment of domestic consumption from “resilient” to “on a moderate increasing trend.” Bank Indonesia front runed the Fed cutting its interest rate by 25 basis points to 6%.

Vietnam’s regulatory body has announced the removal of the requirement for overseas investors to fully pre-fund equity trades, a significant step in the country’s bid to secure reclassification as an emerging market. Analysts anticipate that FTSE could announce Vietnam’s upgrade to Emerging Market status during its semi-annual market review in Sep 2025, leading to more than US$500mn of passive inflows, and a likely revision from MSCI, according to JPMorgan analyst estimates.

India – Consumer Price Index (CPI) inflation unexpectedly rose, primarily due to a smaller-than-anticipated decline in food prices. August trade deficit widened to the second highest level on record, though it appears to be driven by several one-offs. The surge in gold imports was due to reduced gold import duties and upcoming festival season demand. Imports ex oil and gold also appear to be driven by stocking in anticipation of strong festive season demand. The core deficit (excluding oil and gold) gives a cleaner reading on underlying trends. This rose to $13.2bn in August from $11.6bn in July.

GeoPolitics

US is increasingly concerned about risk of an all-out war between Israel and Lebanon.

Hezbollah’s deputy secretary-general Naim Qassem has said that the Lebanese militant group had entered a new phase of its conflict with Israel which he described as an “open-ended battle of reckoning”. Hezbollah says Israel crossed a “red line” with explosive attacks on its communications devices and vowed to keep up the missile strikes.

Lebanon’s Hezbollah launched over 100 rockets early on Sunday across a wide and deep area of northern Israel, with some landing near the city of Haifa. The barrage came after an Israeli airstrike in Beirut on Friday killed at least 45 people, including one of Hezbollah’s top leaders, as well as women and children.

Israeli defence minister, Yoav Gallant, said Israeli strikes on Lebanon would continue until it was safe for evacuated people in the north of Israel to return. Israeli prime minister Benjamin Netanyahu said Israel has in recent days dealt Hezbollah “a series of blows it could not have imagined”.

Taiwan’s crucial tech industry has been unwittingly drawn into Middle East politics after revelations that thousands of exploding pagers used to kill members of Lebanon’s Hezbollah group were manufactured using the branding of a Taiwanese firm. Taiwanese tech company Gold Apollo on Wednesday denied that it had manufactured the AR-924 model pagers that exploded en masse in Lebanon, saying they had been made by a European company named BAC through a licensing deal. Taiwan’s Ministry of Economic Affairs said it had no record of direct exports of the devices to Lebanon and that the pagers may have been modified after manufacturing.

credit treasuries

US Treasury curve bear steepened last week with the 2years yield up 4bps, 5years yield up 8bps, 10 & 30years yield up 10bps. 5years US IG credit spread widened by 2bps but HY credit spread tightened by around 15bps. VIX went down 1 point to finish the week at 16. In term of performance, US IG lost 75bps and US HY gained 55bps.

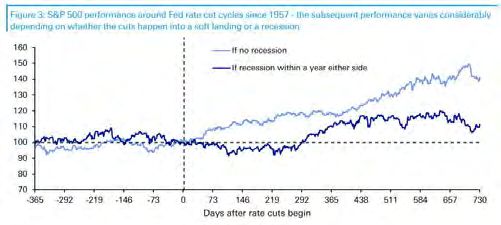

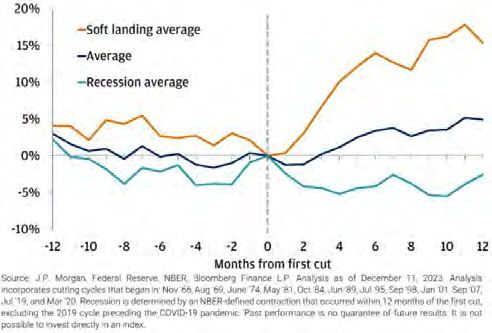

S&P 500 performance around Fed rate cut cycles since 1957 – the subsequent performance varies considerably depending on whether the cuts happen into a soft landing or a recession

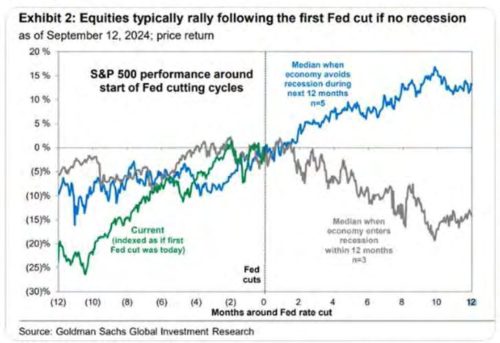

Equities typically rally following the first Fed cut if no recession as of September 12, 2024; price return

10Y yields & USD 1yly rates moved higher after 50 cut in 2007.

The pace of easing monetary policy would be, firstly quick, with 100bps of cut over the next 3Months or by the end of 2024, and then would slow with another 100bps of easing over the next 8 FOMC meetings that will happen in 2025. On top of the normalization of monetary policy, Powell indicated that quantitative tightening could continue alongside rate cuts. The Fed continues to see no fundamental tension between normalizing their two tools. Fyi, financial markets still expect about 70bps of cut for the remaining of 2024 & 125bps of cut in 2025. This seems excessive outside of a recession scenario. It is important to highlight that the Fed has increased the Long Run neutral rate to 2.90% compared to 2.50% 12Months ago. That could possibly implied that the Fed will tolerate higher inflation moving forward, some might argue that higher inflation might be one of the tools needed to fight ever increasing sovereign debt level.

Initial intraday reaction of risky assets to the FOMC decisions were bullish (S&P500 up 1%, US HY credit spread tighter by 10bps). S&P500 finished marginally lower when US HY Credit spread still managed to end the day 3bps tighter than previous day.

Moving forward, further deterioration of the job market will mean more easing than previously forecasted (lower 2Years yield and mild steepening of the curve). Deteriorating Consumer figures (retail sales, consumer confidence, ISM Services, etc..) will mean lower growth which mean more easing than previously forecasted (lower yields across the curve). Unexpected rebound of inflation will mean return of inversion of the curve. FED easing monetary policy coupled with an easing of financial conditions in a growing economy means that risky assets should continue to perform well. We might observe more volatility on equity rather than on interest rate moving forward (at least couple for a couple of Months/quarters) if no big changes in economic data happen. Big question mark remain the US Election, the composition of the house of representative, the smooth and peaceful transition of power, and geopolitical risks in the background (escalation in the Middle-East to a global confrontation is not unthinkable, and if the UK government manage to convince other NATO allied to provide long range missiles to Ukraine and allow them to strike into the Russian territory, a big red line for Putin government, retaliation, direct or through proxies, against NATO assets is also not unthinkable). USD behavior in Months to come is not to clear Vs DM ccy. If markets remain risk on (i.e. lower rates with growth in line with Fed forecast), interest rate differential & growth differential, both in favor of the US (at least against Europe), might not be enough for the dollar not to depreciate. Of course, ECB forecast growth for next year is quite ambitious and if deterioration of economic environment in Europe continues, that would be supportive of the USD. Elsewhere, lower US interest rates coupled with lower USD, but with the US economy still growing around target (2%), that could be supportive for EM markets and currencies.

FX

DXY USD Index fell 0.39% to 100.72, as the Fed delivered a 50 bps cut last week, lowering the fed funds target to the 4.75-5.00% range. The larger cut came amid a dovish shift to the Fed’s inflation and unemployment projections compared to June, with 2025 PCE inflation lowered to 2.1% and unemployment raised two tenths to 4.4%. However, the larger cut was followed by more hawkish guidance in the SEP and Powell’s measured press conference which cautioned against expecting the 50bp pace to continue. Data wise, Jobless claims were down to 219k (C: 230k), Atlanta Fed’s GDPNow forecast is currently at an annualised +2.9% for Q3, almost in line with the +3.0% number in Q2. US retail sales beat, headline up 0.1%mom in August, consensus looked for a 0.2%mom decline.

GBPUSD rose 1.5% to a year to date high of 1.3321, while EURGBP fell 0.71% to 0.8379. BoE kept rate unchanged as expected with an 8-1 vote split, but the statement leans hawkish with an emphasis on a gradual approach to policy easing. Governor Bailey warned that “we need to be careful not to cut too fast or by too much”. Data wise, UK CPI for August was inline with consensus, while retail sale came in above consensus. Based on OIS, market is now pricing a full 25 bps cut in Nov and 40 bps of cut in 2024. Next resistance level at 1.34, while support level at 1.327/1.32.

USDNOK fell 1.64% last week after the Norges Bank maintains its policy rate as expected. Forward guidance remains hawkish with the policy rate path still indicating the first cut in 1Q25.

AUD rose 1.54% against USD and 0.24% against NZD after Australia employment growth beats expectations for the fifth consecutive month. Australia’s unemployment rate remained steady in August at 4.2% while the number of employed people grew by 47,500 (vs 26,000 expected). Meanwhile, the participation rate remained at its record level of 67.1%.

USDJPY rose 2.13% to 143.85 as BoJ left their policy rate unchanged as expected, but their statement leaned on the dovish side, as it warned of “high uncertainties surrounding Japan’s economic activity and prices” and said that “it is necessary to pay due attention to developments in financial and foreign exchange markets”. Gov. Ueda’s communications at the press conference were more cautious than in the previous one, with his somewhat less hawkish tone. Data wise, Japanese inflation picked up as expected, with headline inflation up to a 10-month high of +3.0% in August (P: 2.8%).

Commodity

Oil future rose last week, with WTI rising 4.76% to 71.92 and Brent rising 4.02% to 74.49. The rebound on oil prices was driven by positive risk sentiment following the 50 bps cuts on Fed Fund rate. In addition, worsening Middle East conflict supported oil prices, as Hezbollah launched rockets, missiles and drones toward Israel over the weekend. The escalation and fears it would drag in OPEC producer Iran, has led to the return of a risk premium in oil. OPEC+ will publish its annual World Oil Outlook on Tuesday.

Gold rose 1.71% to 2621.88, breaking the key resistance level of 2600, as the Fed cuts 50 bps. This was despite the 2 years US treasury yield moving in the opposite direction, where it rose 1 bps. However, OIS is pricing 71.3 bps of cuts in 2024, at odds with the median dots showing only 50 bps of cuts for the rest of the year. The appreciation in Gold price has now brought it to overbought territory based on RSI indicator.

Economic News This Week

-

Monday – NZ Trade Balance, AU/EU/U=/US Mfg/Svc/Comps PMI Sep Prelim., SG CPI, US Chicago Fed Nat Act. Index

-

Tuesday – JP Mfg/Svc/Comps PMI Sep Prelim., AU RBA Rate Decision, US Cons. Confid. / Richmond Fed Mfg Index

-

Wednesday – CH LFR, AU CPI, SW Riksbank Rate Decision, US MBA Mortg. App. / New Home Sales

-

Thursday – JP Machine Tool Orders, US GDP / Core PCE / Durable Goods Orders / Initial Jobless Claims / Pending Home Sales

-

Friday – NZ Cons. Confid., JP Tokyo CPI, EU Cons./Svc/ Indust./Econ Confid., CA GDP, US Personal Income / Personal Spending / Core PCE Price Index / Michigan Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.