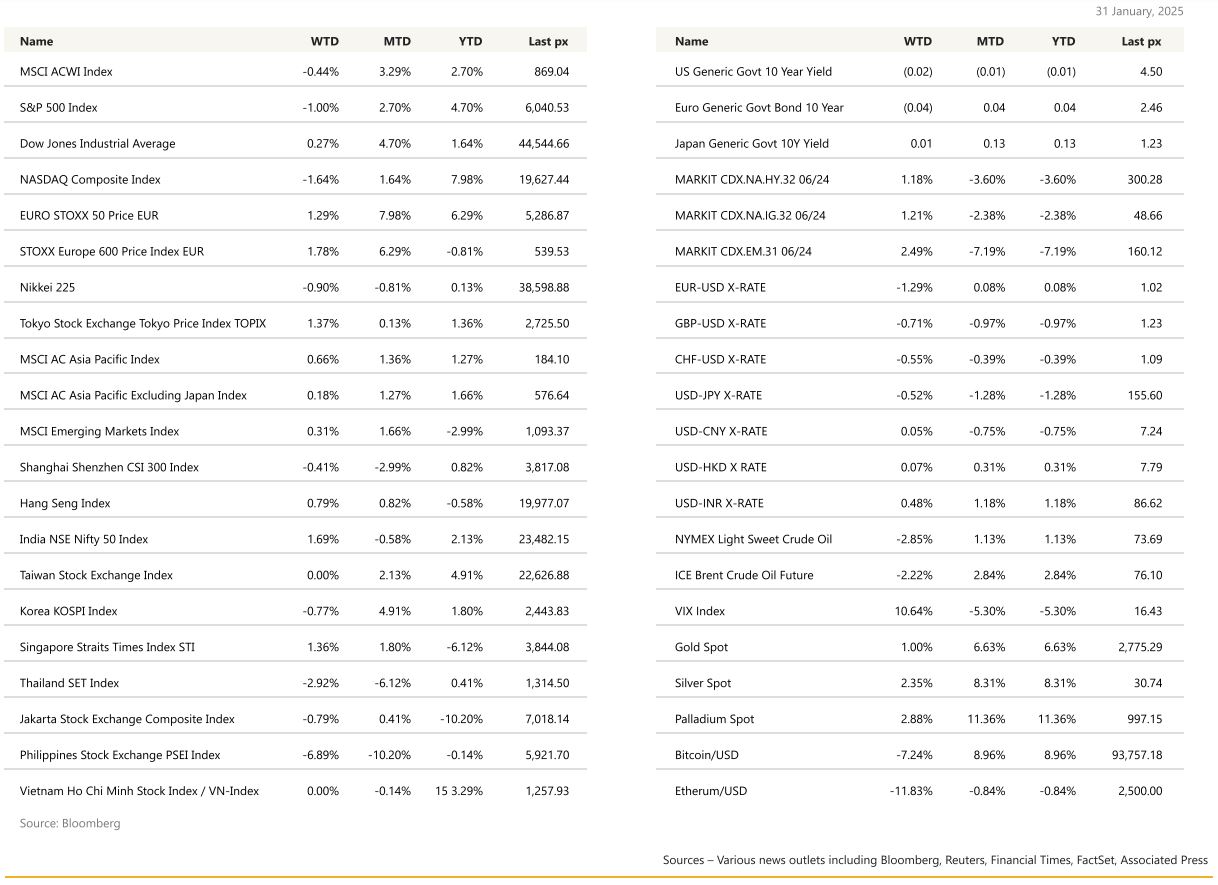

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets, except for the Dow Jones, gave up gains for the week following reports that President Trump plans to move ahead with tariffs on Canda and Mexico over the weekend, refuting an earlier report that levies would be delayed until March the 1st. Both the S&P 500 & Nasdaq were down over a percent whilst the Dow managed to eke out a 0.27% gain. The VIX closed up at 16.43. Canada and Mexico vowed to hit back at US tariffs with tit-for-tat measures, after President Donald Trump followed through on his threats of general levies of 25% and began a trade war that’s set to reshape global supply chains.

Canadian Prime Minister Justin Trudeau said the country will impose 25% tariffs against C$155 billion ($106 billion) of US goods, while Mexican President Claudia Sheinbaum pledged retaliatory tariffs. China vowed “corresponding countermeasures” to Trump’s 10% levy on Chinese exports, without announcing any new tariffs. The responses from three of America’s biggest trading partners came shortly after Trump signed orders for the US tariffs on Saturday. The measures take effect at 12:01 a.m. on Tuesday, and it’s unclear if that offers a last-chance window for a deal.

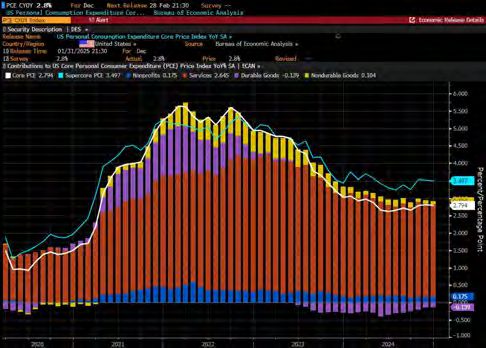

The eventful week had been buoyed earlier on economic data that signalled a buoyant US economy, including personal spending activity that was stronger than anticipated in December. At the same time, the Federal Reserve’s preferred measure of underlying inflation posted a muted advance in December. GDP Annualised QoQ came in at 2.3%, personal spending beat expectations at 0.7% and both core MoM and YoY came in as expected at 0.2% and 2.8% respectively. This gives the image of a clear slowdown, but it must be qualified because the growth figure is reduced by almost one point by the volatile item of inventory variations. This effect could be corrected at Q1 because according to various surveys, companies say they want to replenish their stocks before a possible increase in customs duties. Final domestic demand has continued to grow by more than 3.0% per year. Household consumption has accelerated from 3.7% to 4.2% pace and, as usual, amounted to about two-thirds of all activity. Residential investment rebounded (+5.4%) after two quarters of decline. All of this more than offsets the decline in spending by equipment and building companies. For the full year, GDP accelerated 2.80%, compared with 2.90% in 2023. December personal income came out in line with expectations at +0.40% while December personal spending printed at +0.70% Vs +0.50% expected.

Chicago Fed President Austan Goolsbee praised the latest inflation data, adding it’s appropriate to lower rates as price growth slows. Meanwhile, Fed Governor Michelle Bowman said Friday morning she wants to see additional progress on inflation before the central bank cuts rates further.

The Fed as widely expected, left the Fed Funds rate unchanged at 4.25% – 4.50% range after delivering 100bps of cuts over the previous three meetings. The on-hold decision was accompanied by some potentially hawkish tweaks in the press release, notably removing wording that “inflation has made progress toward the 2% objective”. However, Powell later downplayed this change, also referring to the policy stance and the economy as in a “good place”. He said that the Fed needs to see “further progress” on inflation or a labor market weakening to ease policy further but added that the Fed did not need to see inflation “all the way back to 2%” to cut rates. In terms of the immediate signal, Powell appeared to downplay the likelihood of a rate cut in March, saying that “we don’t need to be in a hurry to adjust the policy stance”, though he noted that the policy stance was still “meaningfully restrictive”.

The Fed chair largely avoided getting drawn on the potential implications of the new Trump administration, pointing to uncertainty around tariffs, immigration, fiscal and regulatory policies and saying that the Fed will have to “wait and see”. Following the meeting, Deutsche Bank US economists continue to think that the fed funds rate is likely to remain above 4% this year, with a base case of no additional cuts.

Doesn’t look too bad now, does it?

Tech markets were earlier rattled following the introduction of China’s DeepSeek which challenges the notion of US dominance in AI technology and may lead to a re-evaluation of the investment case for the entire AI supply chain. It had managed to achieve ChatGPT status at a fraction of its competitors’ costs although a lot remains unknown. The dip-buying that followed afterwards, emerged as strategists attributed Monday’s selloff in AI-related stocks as a correction rather than the start of a bear market as the macroeconomic backdrop remains supportive. On the flip-side, some companies such as Salesforce Inc., banks and major retailers — companies expected to use AI bots rather than develop them — stand to benefit from DeepSeek’s open source approach if they can deploy AI for a fraction of what it otherwise would have cost.

This week will see ISM, durable goods orders & JOLTS reports as well as the all-volatile jobs report on Friday. The consensus expects the unemployment rate to remain unchained at 4.1% whilst the NFP change is expected to fall to 170k in January from December’s blow-out 256k, followed by the February preliminary University of Michigan Sentiment Index.

Europe

European stocks were higher Friday with the Stoxx 600 reaching a record level.

LSEG Lipper data revealed a surge in global equity fund investments in the week ending 29 January, driven by strong European share rallies, easing US-China tariff concerns, and expectations of further central bank rate cuts. Investors poured $15.2B into global equity funds, marking the largest weekly net purchase since December 2024. European stocks, particularly the STOXX 600 index, which reached a new peak, boosted investor confidence. European equity funds led regional inflows with $5.66B, followed by US and Asian funds at $5.58B and $3.03B, respectively.

On Sunday evening, Trump also threatened to enact additional tariffs on the European Union — accusing the EU of being “really out of line.” The EU, however, ‘’will respond firmly’’ if Trump decides to impose tariffs on the bloc.

The ECB reduced policy rates by 25bps to 2.75% but offered little guidance on future policy moves. As anticipated, the Governing Council (GC) reaffirmed that the disinflation process remains on track, with the current monetary stance still considered restrictive. President Lagarde emphasized the ECB’s data-dependent, meeting-by-meeting approach, allowing for maximum flexibility in future rate decisions. During the press conference, she struck a dovish tone, stating that discussions on neutral rates were “entirely premature.” Following the meeting, confidence grew that there is a strong consensus within the GC for another rate cut on 6 March, with the neutral rate estimated below 2.5%, likely around 2.0%.

Eurozone Data:

The Eurozone economy unexpectedly stagnated in Q4 2024, marking its weakest performance of the year after growing 0.4% in Q3 and missing expectations of a 0.1% expansion. Preliminary estimates confirmed signals from high-frequency indicators that pointed to slowing growth momentum toward the end of 2024. France and Germany contracted, Italy remained flat, while Spain continued to outperform expectations. Expenditure breakdowns for France and Spain showed domestic demand contributed positively, whereas external demand weighed on growth. January survey data indicated a slight pickup in activity, hinting at modest growth in early 2025.

UK Developments:

Chancellor Reeves delivered a speech outlining the government s economic growth strategy, largely reiterating previously announced measures. However, the most notable new commitment was the approval of a third runway at Heathrow Airport. Meanwhile, the Lloyds Bank UK Business Barometer declined by two points in January to 37%, the lowest level since December 2023 and marking its fifth consecutive decline.

The Nationwide House Price Index showed a slowdown in UK house price growth in January. Annualized prices rose 4.1%, below the 4.3% consensus forecast and down from 4.7% in the previous month. Monthly growth was just 0.1%, missing expectations of a 0.3% rise and down from December’s 0.7% increase. The report noted that affordability has slightly improved over the past year, though first-time buyers still face higher-than-average costs.

Upcoming Economic Releases: This week, key data releases include the flash HICP, EU/UK final Manufacturing PMI on Monday, PPI and EU/UK final Service and Composite PMI on Wednesday, and retail sales on Thursday for the Eurozone. In the UK, the Bank of England s interest rate decision is scheduled for Thursday.

Asia

Markets in Asia closed the week flat with the lunar new year seeing some markets close for holiday. MSCI Asia ex Japan closed last week +0.18%. Thailand and Philippines were the weakest markets down 2.92% and 6.89% respectively. Last week Deep Seek rattled the AI ecosystem. This week, it looks like Tariffs. Shares in Tokyo and Seoul fell more than 2% in early trade today in response to US President Donald Trump’s sweeping trade tariffs on Canada, Mexico and China. China’s yuan slumped to a record low in offshore trading on Monday.

China‘s factory activity grew at a slower pace in January, while staffing levels fell at the quickest pace in nearly five years as trade uncertainties increased, a private-sector business survey showed today. The Caixin/S&P Global manufacturing PMI slipped to 50.1 in January from 50.5 the previous month. In the face of U.S. President Donald Trump’s tariff threats, anecdotal evidence suggested exporters rushed to load cargoes at a major Chinese port before the eight-day Lunar New Year holiday and ahead of any new tariffs.

Tokyo core inflation rose to its highest since Feb-2024, +2.5% y/y vs +2.4% in prior month. Japan industrial production fell on lower auto output while retail sales growth also declined; unemployment unexpectedly fell. Japan’s corporate service inflation hits 2.9%. Service-sector inflation is being closely watched by the Bank of Japan for clues on whether prospects of sustained wage gains will prod firms to continue raising prices, and keep inflation sustainably around its 2% target. BOJ Governor Kazuo Ueda said the central bank will keep raising interest rates as wage and price increases broaden, adding that there was scope to push up borrowing costs further before they reach levels deemed neutral to the economy.

South Korea‘s retail sales declined in December by 0.6%, reflecting weak consumer spending and the fallout of impeached President Yoon Suk Yeol’s martial law declaration. South Korea’s economy barely grew in the fourth quarter with 0.1 % expansion. Factory output in December on the other hand beat market expectations and increased by the most in a year and a half thanks to a boost from chips and car production. Bank of Korea Deputy Governor Ryoo said the bank is closely monitoring domestic spillovers from US tech sector volatility.

Thailand industrial production fell by more than expected. The manufacturing production index (MPI) fell 2.11% last month vs a year earlier. The Southeast Asian country’s auto production tumbled 22.79 % year on year in December as domestic sales of pickup trucks and passenger cars slowed on the back of high household debt and tightening credit conditions, the ministry said in a statement.

Indonesia FDI rose to a fresh record high – foreign direct investment last year was 900.2 trillion rupiah ($55.33 billion), up 21% on a yearly basis. Singapore, China and Hong Kong were the biggest sources of FDI in the fourth quarter of 2024.

India’s Budget was presented on Saturday. It was a prudent one, focused on consumption, capital expenditure (capex), and consolidation. Key areas of interest was reforms to be initiated in urban development, mining, the financial sector, power and regulatory frameworks. As per the 2025-26 Budget Estimates, the fiscal deficit is expected to be 4.4% of GDP. The projected reduction in debt-to-GDP (gross domestic product) ratio, which is expected to fall to just over 50% by 2030-2031, signals macroeconomic stability. This is likely to be well received by investors and credit rating agencies. Despite repeatedly criticising India’s tariff structure, Trump’s first executive order to impose trade tariffs did not mention India, signalling that bilateral trade negotiations may be on the cards later this month when Prime Minister Narendra Modi is scheduled to visit the US.

GeoPolitics

China – US: Donald Trump said advances in artificial intelligence by Chinese start-up DeepSeek were a wake-up call for US industries. Trump said he wanted to unleash US tech companies and dominate the future like never before. FBI are now investigating whether DeepSeek received advanced Nvidia chips through Singapore-based firms. If confirmed, it would mean the company had circumnavigated sales restrictions that banned the sale of certain chips to China. Online analysts Graphika said social media accounts associated with the Chinese state amplified the narratives of DeepSeek as an AI disruptor in the days leading up to this week’s US technology stock rout. It said the accounts on X, Facebook and Instagram all promoted the idea that DeepSeek challenged the US dominance in AI.

US- Mexico- Canada- China: Tariff headlines remain volatile with press sources noting Trump advisers exploring ways to dial back or avert tariffs on Mexico and Canada after president earlier said 25% tariffs would be going ahead on 1- Feb. Options discussed include targeting tariffs towards sectors such as steel and aluminium while sparing oil (Trump said he would likely decide Thursday night whether to subject oil to tariffs). Canada and Mexico immediately vowed retaliatory measures, and China said it would challenge Trump’s levies at the World Trade Organization. Goldman Sachs had estimated previously that a long-term 25% tariff on imports from Canada and Mexico would raise core personal consumption expenditure prices by 0.7 %. Morningstar had said the 10% tariffs on China would most affect home appliances, home furnishings, lithium batteries and electric vehicles in China. But it added many companies would likely see an impact of less than 5% of their respective total revenue and that they may not be as bad as feared for some industries .

China: China appears to be building a large laser-ignited fusion research center in Mianyang, Sichuan that could aid weapons design and power generation. IT said the facility appeared to be of a similar design to the National Ignition Facility in California but could up to 50% larger.

Israel – US: Israel’s Prime Minister Benjamin Netanyahu left on Sunday (Feb 2nd ) for the United States where he will become the first foreign leader to meet Donald Trump since the US president returned to office. His visit comes as a fragile truce holds between Israel and Hamas in Gaza, and between Israel and Hezbollah in Lebanon.

US- Ukraine- Russia: The United States wants Ukraine to hold elections, potentially by the end of the year, especially if Kyiv can agree a truce with Russia in the coming months, President Donald Trump’s top Ukraine official told Reuters. If presidential elections were to take place in Ukraine, the winner could be responsible for negotiating a longer-term pact with Moscow. If Trump pressures Zelenskiy to agree to elections, Washington would be playing into Putin’s recent statements questioning the Ukrainian leader’s legitimacy, the former Western official said.

European officials are debating whether Russian pipeline gas sales to the EU should be restarted as part of a potential settlement to end the war against Ukraine, according to people familiar with discussions. Advocates of buying Russian gas argue it would bring down high energy prices in Europe, encourage Moscow to the negotiating table, and give both sides a reason to implement and maintain a ceasefire.

Credit / Treasuries

The shape of the US Treasury curve did not significantly change last week with the US Treasury 2, 5 & 10years yields dropping 6bps, while the long bond (30Y) yield went down by 4bps. 5years US IG Corporate bond spread tightened by 1bps while the same tenor in HY tightened by 7bps.

FX

DXY USD Index rose 0.86% to 108.37 last week and a further 1.15% to reach 109.60 at the point of writing this morning, driven by the weekend announcement that President Trump issued executive orders directing US to impose new tariffs on Canada, Mexico and China, to take effect on February 4. On the FOMC, The Fed kept the policy rate on hold at 4.25-4.5%, as expected. The post-meeting statement leaned slightly hawkish, removing a previous statement that inflation has made progress toward the Committee’s 2% objective . On US Macro data, US 4Q24 GDP rises at a 2.3% annualized rate, driven by unexpected strength in personal consumption (+4.2%), which rises at its fastest pace since 1Q23. US Conference Board s consumer confidence indicator fell by more than expected in January, moving down to a four-month low of 104.1 (C: 105.7). Core PCE deflator in line at 2.5%, while Core PCE Price index in line at 2.8%.

European Currencies fell against USD, with EUR (-1.29%), GBP (-0.71%) and CHF (-0.55%) closing the week at 1.036, 1.2395 and 0.9109 respectively. EURUSD fell another 1.3% to 1.023 this morning after President Trump said tariffs on EU goods would definitely happen over the weekend. GBPUSSD and USDCHF fell another 1% and 0.60% respectively at the point of writing. On Eurozone, The ECB cuts rates by 25bp to 2.75%, as expected, and maintained the view that rates remain restrictive, signalling more cuts to come. In the Euro Area, 4Q24 GDP was flat (0.0% q/q; C: 0.1%; 0.4%).

USDJPY rose 0.52% to close the week at 155.19. On Japan Macro data, retail sales in Japan surged at its fastest pace since June 2024 (A: +3.4%; C: 3.2%; P: 2.8%). Japan’s Tokyo CPI beat consensus (A: 3.4%; C: 3.0%). Core core in line, +1.9% yoy.

AUDUSD fell 1.52% to close the week at 0.6218 driven by the below consensus CPI, which strengthened expectations for RBA easing in February. Headline inflation below consensus (A: 0.2% qoq and 2.4% yoy; C: 0.3% qoq and 2.5% yoy). Trimmed mean CPI below consensus as well, (A: 0.5% qoq and 3.2% yoy; C: 0.6% qoq and 3.3% yoy. Market pricing implies ~95% probability of a cut.

USDCAD rose 1.39% last week and another 1.6% to 1.4780 at the point of writing this morning. In response to US tariff implementation, Canadian PM unveiled a 25% counter tariff. As a result, CAD sank to its weakness against USD since 2003. The BoC lowered its policy rate by 25bp to 3.00% at its January meeting as widely expected. In addition, it is formally ending its QT program early and anticipates it will resume asset purchases in March. On forward guidance, it removed its rate guidance in the statement as the possibility of tariffs continues. The central bank noted that the cumulative reduction in the policy rate since last June is substantial, while highlighting the downside risks to growth from potential tariffs.

USDSEK rose 1.57% to 11.0972 last week. Riksbank cut rates by 25bps to 2.25%, as expected, but post-meeting statement signal a pause, with no further cuts over the first half of 2025. In Sweden, 4Q24 GDP grew 0.2% qoq (C: 0.3%; P: 0.3%). On a monthly basis, GDP rose 0.7% mom in December (P: 1.4%).

Oil & Commodity

Oil Futures fell last week, with WTI and Brent falling 2.85% and 2.22% to 72.53 and 76.76. The technology sell-off spurred fears around the potential for a slowdown in AI-related power demand, which dragged down oil futures. However, The tariff announcement over the weekend sparked a surge in the price of oil this morning as levies on imports from Canada and Mexico threaten to disrupt North America’s tightly integrated oil market and push up gasoline prices for American motorist. At the point of writing, WTI and Brent were up 1.39% and 0.41% respectively.

Gold rose to a record high of 2817.18 last week, before closing the week at 2798 (+1%), as demand for the safe-haven asset continues to grow amid ongoing policy uncertainty. However, gold fell to 2777 at the point of writing this morning, driven by USD strength due to the implementation of US tariffs.

Economic News This Week

- Monday – AU Melbourne Inflation/ Retail Sales, JP/CH/SW/ SZ/EU/UK/CA/US Mfg PMI Jan Final, EU CPI, US ISM Mfg

- Tuesday – US JOLTS/ Factory Orders/ Durable Goods Orders

- Wednesday – NZ Employ., AU/JP/CH/EU/UK/US Svc/Comps PMI Jan Final, EU PPI, US ADP/ ISM Svc

- Thursday – AU Trade Balance, SZ Employ., SW CPI, UK Construction PMI, EU Retail Sales, US Initial Jobless Claims

- Friday – SZ Foreign Curr. Reserves, CA Employ., US Employ./ UMich/ Wholesale Inv. S – CH CPI/PPI

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.